|

市場調查報告書

商品編碼

1644513

美國排水溝蓋:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)United States Gutter Guards - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

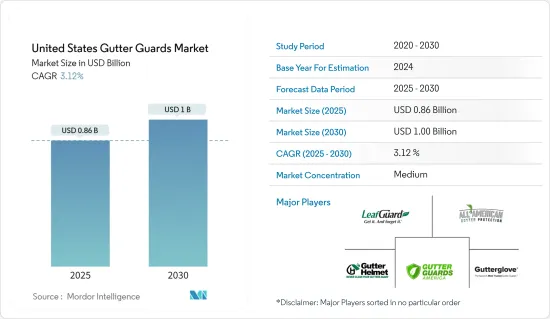

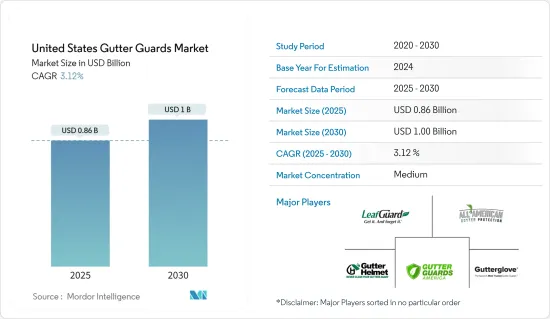

預計 2025 年美國排水溝蓋板市場規模將達到 8.6 億美元,到 2030 年將達到 10 億美元,預測期內(2025-2030 年)的複合年成長率為 3.12%。

隨著消費者對環保、永續、先進和外觀美觀的產品的需求不斷成長,排水溝行業正在經歷重大的轉型和進步。人們越來越意識到排水溝保護的重要性,這刺激了住宅和商業領域對排水溝蓋的需求。住宅市場是排水溝蓋的主要銷售目的地,因為有大量老住宅的排水溝系統已經達到或接近其預期使用壽命,最終需要更換。然而,大部分銷售是在國內市場,在那裡更昂貴的商品可以增加價值。然而,由於許多此類機器是在新冠肺炎疫情期間住宅裝修激增期間安裝的,未來的安裝量將受到限制。

透過使用再生材料和雨水收集技術,該行業正在朝著更永續的實踐方向發展。隨著人們越來越傾向於使用環保解決方案,世界各地的排水溝業務正在轉變。這項技術與技術整合一起,推動了可自主清潔和監控的智慧排水溝系統的誕生,為效率和簡便性樹立了新的行業標準。

美國排水溝蓋板市場趨勢

在美國,由於對維護資產的興趣日益濃厚,住宅開始使用排水溝蓋

在美國,住宅住宅引領排水溝蓋市場,因為屋主優先考慮房產的維護、便利性和長期安全。排水溝蓋已成為住宅維修的必備選項,尤其是在降雨量大、降雪量大、樹木茂密的地區。住宅意識到排水溝堵塞的潛在威脅,包括洪水、地基侵蝕和屋頂損壞。安裝排水溝蓋可以減少排水溝清潔的頻率,並降低昂貴維修的可能性,從而增強其對住宅的吸引力。

DIY文化的興起正在加速排水溝蓋在住宅中的普及。由於零售店和網路平台隨處可見易於安裝的產品,許多住宅開始採用 DIY 方式進行住宅維修。這項運動受到大量線上資源的推動,從教程到評論,讓住宅可以選擇和安裝自己的排水溝蓋。這種 DIY 趨勢引起了注重預算的消費者的共鳴,為他們提供了按照自己的步調進行安裝的便利。

美國排水溝蓋板需求的區域差異

在美國,氣候、地理和住宅特徵的區域差異顯著影響排水溝蓋的需求。例如,在經常發生大雨的太平洋西北地區,住宅優先考慮使用排水溝防護裝置,以防止排水溝堵塞造成的水損害。由於該地區降水量較大,排水溝溢出的風險很高,凸顯了可靠的排水溝保護的必要性。同樣,東南部的熱帶風暴和颶風也推動了對排水溝蓋的需求,以保護房屋免受隨之而來的強降雨的侵襲。

相反,在東北部和中西部等較冷的地區,秋季和冬季對排水溝蓋的需求激增。秋天的落葉和冬天的積雪會增加排水溝和冰壩的堵塞風險,從而可能對您的房屋造成損壞。這些地區的排水溝蓋通常是為了應對這些季節的挑戰而製造的,確保樹葉留在原處並防止冰堆積。因此,住宅可能會投資更堅固或更專業的排水溝蓋系統來滿足這些需求。

區域層面的經濟因素也在塑造需求方面發揮關鍵作用。房產價值較高的富裕地區往往傾向採用優質的排水溝蓋系統。相比之下,對價格敏感的地區往往傾向於更實惠的選擇。此外,住宅繁榮的地區正在經歷住宅建設的激增,其中許多新房屋都標配了排水溝蓋,進一步增加了需求。

美國排水溝蓋板產業概況

美國排水溝蓋市場比較分散,各家公司都在爭取較大的市場佔有率。公司透過提供無縫系統來最大限度地減少洩漏並確保最佳排水性能,從而獲得競爭優勢。報告也分析了市場的競爭格局。主要企業包括 LeafGuard、All American Gutter Protection、GutterGlove、Gutter Guard America 和 Gutter Helmet。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 住宅和商業基礎設施的快速投資正在推動市場擴張

- 政府推動節約用水的舉措

- 市場限制

- 替代品對排水溝蓋板市場構成挑戰

- 市場機會

- 將排水溝覆蓋範圍擴大到尚未開發的商業和工業領域

- 投資研發與產品創新

- 價值鏈/供應鏈分析

- 產業吸引力波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 深入了解美國建築和改造產業

- 洞察科技趨勢與消費者偏好

- 新冠肺炎疫情對市場的影響

第5章 市場區隔

- 按產品

- 網格和篩網

- 護罩和蓋子

- 泡沫和頭髮

- 依材料類型

- 金屬

- 塑膠

- 其他材料

- 按最終用戶

- 住宅

- 商業的

第6章 競爭格局

- 市場競爭概況

- 公司簡介

- Leaf Guard

- All American Gutter Protection

- Gutter Guards America

- Gutterglove

- Gutter Pro USA

- Amerimax

- Homecraft Gutter Protection

- Raptor

- GutterCraft

- Gutterstuff

第7章 未來趨勢

第8章 免責聲明及發布者

The United States Gutter Guards Market size is estimated at USD 0.86 billion in 2025, and is expected to reach USD 1.00 billion by 2030, at a CAGR of 3.12% during the forecast period (2025-2030).

The gutter sector is undergoing notable transformations and progress due to increasing consumer demand for environmentally sustainable, cutting-edge, and visually appealing goods. The growing awareness of the importance of gutter protection has fueled the demand for gutter guards across residential and commercial sectors. Residential markets are the primary outlets for gutter guards as the large stock of older residences with gutter systems at or near the end of their expected product lifestyle will eventually require replacement. However, the vast majority of sales occur in the domestic market, where using higher-value items will increase value gains. However, future installations will be limited due to the enormous number of units installed during the COVID-19 pandemic era's surge in house renovation activity.

Utilizing recycled materials and rainwater-gathering technologies, the sector is moving toward more sustainable methods. The gutter business is undergoing a global transformation due to the increasing trend toward eco-friendly solutions. This, together with technological integration, has led to intelligent gutter systems that can autonomously clean and monitor, setting a new industry standard for efficiency and ease.

United States Gutter Guards Market Trends

In the United States, Homeowners are Focusing on the Adoption of Gutter Guards due to the Rising Focus on Property Maintenance

In the United States, the residential segment leads the gutter guards market, fueled by homeowners prioritizing property upkeep, convenience, and long-term safeguarding. Especially in areas with heavy rainfall, snowfall, or dense tree cover, gutter guards have emerged as essential in home improvement endeavors. Homeowners recognize the potential threats of clogged gutters, including water overflow, foundation erosion, and roof damage. Installing gutter guards reduces the frequency of gutter cleaning and lessens the chances of costly repairs, solidifying its appeal among residential property owners.

The growing DIY culture has further accelerated the uptake of gutter guards in homes. With easy-to-install products readily available in retail stores and online platforms, many homeowners are embracing the DIY approach to home improvements. This movement is bolstered by abundant online resources, from tutorials to reviews, enabling homeowners to choose and fit gutter guards independently. This DIY trend resonates with budget-conscious consumers and offers the added convenience of self-timed installations.

Regional Variations in Demand for Gutter Guards Across the United States

In the United States, regional differences in climate, geography, and housing characteristics significantly influence the demand for gutter guards. For instance, in the Pacific Northwest, where heavy rainfall is common, homeowners prioritize gutter guards to prevent water damage from clogged gutters. The region's frequent precipitation heightens the risk of gutter overflow, underscoring the need for reliable gutter protection. Similarly, in the Southeast, tropical storms and hurricanes drive the demand for gutter guards, safeguarding homes from the accompanying intense rainfall.

Conversely, colder regions like the Northeast and Midwest see a surge in gutter guard demand during fall and winter. With leaves accumulating in the fall and snow in winter, the risk of clogged gutters and ice dams rises, potentially damaging homes. Gutter guards in these areas are often tailored to address these seasonal challenges, ensuring leaves are kept out and preventing ice buildup. As a result, homeowners might invest in more robust or specialized gutter guard systems to meet these demands.

Economic factors at the regional level also play a pivotal role in shaping demand. Wealthier neighborhoods boasting higher property values tend to gravitate toward premium gutter guard systems. In contrast, regions more sensitive to pricing often lean toward budget-friendly options. Furthermore, areas witnessing housing booms are seeing a surge in new home constructions, many of which are incorporating gutter guards as standard features, further amplifying demand.

United States Gutter Guards Industry Overview

The US gutter guards market is semi-fragmented, with players competing for higher market share. Companies gain a competitive advantage by providing leak-minimizing, seamless systems that ensure optimal water drainage performance. The competitive landscape of the market has also been analyzed in the report. Some of the major players include Leaf Guard, All American Gutter Protection, Gutterglove, Gutter Guards America, and Gutter Helmet.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Investments in Residential and Commercial Infrastructure Fueling the Market's Expansion

- 4.2.2 Government Initiatives are Propelling Water Conservation

- 4.3 Market Restraints

- 4.3.1 Substitute Products are Challenging the Gutter Guards Market

- 4.4 Market Opportunities

- 4.4.1 Expansion of Gutter Guards into Untapped Commercial and Industrial Sector

- 4.4.2 Investments on R&D and Product Innovations

- 4.5 Value Chain/Supply Chain Analyisis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Construction and Renovation Industry in the United States

- 4.8 Insights on Technological Trends and Consumer Preferences

- 4.9 Impact of the COVID-19 Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Meshes and Screens

- 5.1.2 Hoods and Covers

- 5.1.3 Foams and Bristles

- 5.2 By Material Type

- 5.2.1 Metal

- 5.2.2 Plastic

- 5.2.3 Other Material Types

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

6 COMPETITIVE LANDSCAPE

- 6.1 Market Competition Overview

- 6.2 Company Profiles

- 6.2.1 Leaf Guard

- 6.2.2 All American Gutter Protection

- 6.2.3 Gutter Guards America

- 6.2.4 Gutterglove

- 6.2.5 Gutter Pro USA

- 6.2.6 Amerimax

- 6.2.7 Homecraft Gutter Protection

- 6.2.8 Raptor

- 6.2.9 GutterCraft

- 6.2.10 Gutterstuff*