|

市場調查報告書

商品編碼

1644526

法國設施管理:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)France Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

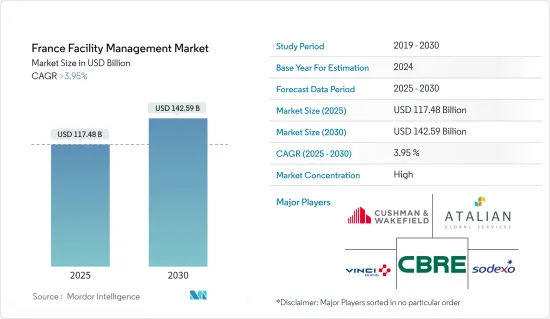

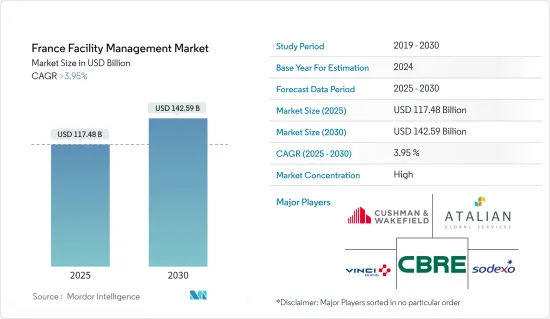

法國設施管理市場規模預計在 2025 年為 1,174.8 億美元,預計到 2030 年將達到 1,425.9 億美元,預測期內(2025-2030 年)的複合年成長率將超過 3.95%。

推動市場發展的是清潔業政府合約的增加以及零售業服務合約續約數量的增加。不過,近幾個月來該市場一直在緩慢復甦,被認為是日本的一個有前景的市場。

關鍵亮點

- 法國是繼英國和德國之後歐洲主要的FM市場之一。該國大型私營和公共部門營業單位也在推動 FM 市場的成長。它還為現有供應商和國際參與者提供了在法國建立 FM 業務的機會。此外,隨著人們對 FM 認知的提高以及外包越來越被普遍接受,情況正在改變。這就是我們預計法國 FM 市場將會成長的原因,尤其是綜合設施管理 (IFM) 交付模式。

- 在設施管理服務領域,許多公司將數位解決方案融入其服務中,以提高服務效率並提高客戶滿意度,從而為其市場採用創造需求。例如,像 Watts 這樣的新興企業已經在該國推出了一款名為 DIGISCO 的新型設施管理應用程式。此雲端基礎的解決方案簡化並管理了設施管理中所有回流防止裝置的檢查和管理的整個工作流程。該應用程式基於對客戶和服務經理需求的持續關注。

- 此外,2023 年 6 月,全球領先的行動解決方案供應商 Valeo 與全球能源、設施管理和服務的領導者 Equance 簽署了夥伴關係,共同打造安全、低碳的未來城市。 Equans 和 Valeo 將共同開發一系列解決方案和服務,以滿足城市的需求。尤其是重點將放在為行人和騎自行車的人提供更安全、更互聯的城市空間上,包括在 VivaTech 上 Bouygues 展位上展示的智慧桿、資料中心和能源儲存設施的最佳化運行、以及透過充電和 V2G 解決方案發展電動車。

- 此外,該國政府機構進行的大量外包活動導致公共部門飽和狀態。上市公司致力於透過延長合約來與設施管理承包商保持長期關係。

- COVID-19 疫情對設施管理公司的業務產生了多種影響。對人員行動的限制已導致我們許多客戶所在地的計劃工作減少和活動水準降低。世邦魏理仕集團和索迪斯集團等大型國內公司都受到了疫情相關關閉的負面影響。此外,對清潔服務的需求不斷成長,推動了軟設施管理服務的發展。因此,由於多種因素,疫情對市場成長產生了各種影響。

- 許多企業正在採用混合模式,這意味著員工將減少去辦公室的次數,其餘時間都在遠距工作。這意味著企業將需要更少的辦公空間,並能夠以更少的員工運作更小的職場環境。

法國設施管理市場趨勢

商業建築保持最大市場佔有率

- 商業房地產涵蓋由商業服務(例如 IT 和通訊、製造業和其他服務供應商)建造或占用的辦公大樓。對提供、裝飾和管理必要的設備、配件和商業建築的日益重視正在推動該國零售業市場的發展。

- 法國設施管理市場已經出現了政府、供應商和商業實體之間的多項夥伴關係活動。例如,2022 年 3 月,埃迪納市一家基礎設施開發商申請對西 70 街和法國大道減稅 2,200 萬美元,其中包括一個 24 層樓的豪華綜合用途開發項目,內設辦公和零售空間。新興國家此類商業計劃的發展預計將增加對法國調頻服務的需求。

- 該國許多計劃的基礎設施包括變電站、帶有裝卸區的內部道路、飲用水、消防系統、灌溉、雨水和廢水網路以及相應的水箱。這些因素導致該國對防災、電氣維護、技術支援和維護、清潔、空調和其他設施管理服務的需求增加。

- 日本的資料中心設施數量正在增加,隨著DC區域數量的增加,對DC FM硬體和軟體服務的需求正在為FM服務供應商創造商機。例如,2022年3月,法國國家資料中心計劃在法國建造一個約3,000平方公尺的資料中心。

- 此外,歐盟統計局估計,到 2025 年,該國建築業的收益可能超過 932.4 億美元。因此,所研究的市場很可能存在巨大的成長機會。

綜合設施管理可望實現最高成長

- 隨著多個行業從使用單一設施管理外包模式轉向能夠大規模滿足所有客戶核心需求的綜合服務模式,市場模式轉移。隨著新技術改變組織的工作方式,綜合設施管理成為全國智慧建築和職場環境的關鍵。

- 它將組織的辦公室和房地產相關的服務和流程整合到一個合約和管理團隊之下。它是滿足您組織的所有 FM 需求的一站式商店。公司可以放棄多個雜亂無章的供應商契約,而選擇單一的服務協議。它還將先前由不同團隊分別處理的多項職責納入到一個整體之下。

- 法國市場趨勢正從單一服務轉向配套服務,並轉向綜合設施管理方式。透過提供更廣泛的服務和更長期的契約,這將增加附加價值,提高品質和規模經濟。對於需要專業知識的外包服務的需求也不斷增加。

- 綜合設施服務可以幫助您的公司提高盈利、效率和競爭力,同時讓您更專注於核心業務。許多全球性公司已與該國的 FM服務供應商合作,引發了該國對 FM 服務的需求。

- 例如,2022年12月,法國FM服務供應商索迪斯與食品加工和包裝解決方案生產商利樂簽署了一份為期五年的續約契約,繼續提供全球綜合設施管理服務。索迪斯和利樂目前已在包括法國在內的歐洲 65 個地點簽訂了協議。該協議涵蓋了各種地點的需求,包括辦公室、總部和生產設施。

法國設施管理產業概況

法國的設施管理市場較為集中,少數幾家主要企業佔據著全國最大的市場佔有率。這些主要企業正在採用各種成長策略,如併購、新產品發布、業務擴張、合資和夥伴關係,以鞏固其在該市場的地位。市場的主要企業包括 CBRE Group Inc、Cushman &Wakefield、Sodexo Group、VINCI Facilities 和 Atalian Group。

- 2023 年 7 月 - CBRE 已被任命為 M&G Real Estate 在歐洲大陸七個國家的物業管理業務。 CBRE負責管理M&G房地產持有50處物業(總面積超過80萬平方公尺),包括辦公室、工業、購物中心、零售和酒店等物業,並提供物業管理、技術管理和會計服務。

- 2022 年 12 月 - Elior Group 和 Derichebourg Group 是專門從事清潔、衛生和軟設施管理的法國公司,兩家公司簽署了一份合作備忘錄,根據備忘錄,Elior Group 將出售 Derichebourg Group,以換取 Derichebourg SA 收購 Elior Group 的額外股份。 Elior 集團鞏固了其在合約餐飲領域的地位,而對 DMS 的收購則擴大了其在法國的安全、技術和設施管理以及軟體和設施管理方面的服務範圍。

- 2022年5月-威立雅與Seche Environnement簽署單邊出售協議,根據該協議,Seche Environnement將收購威立雅在法國的部分工業水處理服務業務,並接管設施管理,包括廢棄物管理和維護業務,為工業公司提供工業水循環管理領域的高附加價值服務。

- 2022 年 2 月 - ATALIAN 與法國 Gustave Roussy 續約設施管理合約。 ATALIAN 在過去 5 年一直與該客戶合作,提供清潔和相關服務(生物清潔、消隱、患者食物發行等)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 對供應鏈效率的需求不斷增加

- 由於對工業 4.0 的日益關注,製造設施不斷增加

- 市場限制

- 管理人員缺乏意識

第6章 市場細分

- 按類型

- 內部設施管理

- 設施管理外包

- 單調頻

- 捆綁 FM

- 整合調頻

- 依產品類型

- 硬體維修

- 軟調頻

- 按最終用戶

- 商業的

- 設施

- 公共/基礎設施

- 工業的

- 其他

第7章 競爭格局

- 公司簡介

- CBRE Group Inc

- Cushman & Wakefield

- VINCI Facilities

- Sodexo Group

- Atalian Group

- ONET SA

- Elis SA

- L'Agence du Panier

- AItenders

- Veolia Environnement SA

- ISS World Services A/S

- DEF network

第8章投資分析

第9章:市場的未來

The France Facility Management Market size is estimated at USD 117.48 billion in 2025, and is expected to reach USD 142.59 billion by 2030, at a CAGR of greater than 3.95% during the forecast period (2025-2030).

The market is driven by rising government contracts in the cleaning sector, with increasing service contracts being renewed in the retail industry. However, the market has witnessed slow rejuvenation over the last few months and seems promising for the country.

Key Highlights

- France is one of the major FM markets in Europe, after the United Kingdom and Germany. The country's large private and public sector business entities also pave the FM market's growth. The market also provides opportunities for existing suppliers and entrants from other countries to set up FM businesses in France. Further, the situation is changing as FM awareness grows and outsourcing is becoming more commonly accepted. This is expected to provide growth in France's FM market, particularly for integrated facility management (IFM) delivery models.

- Many companies in the field of Facility management services have been integrating digital solutions in their services to increase the efficiency of their services to increase customer satisfaction, which is creating a demand for market adoption. For instance, emerging players, such as Watts, have launched a new facility management app called DIGISCO in the country. This cloud-based solution simplifies and manages the entire test and control of backflow preventers workflow for all Backflow testers in facility management. The app is based on constant attention to customer and service managers' needs.

- Furthermore, in June 2023, Valeo, one of the global leaders in mobility solutions, and Equans, a global leader in the energy, facility management, and services sector, signed a partnership to work together to prepare a safe and low-carbon city of the future. Equans and Valeo would work together to develop various solutions and services to meet the needs of cities, focusing on a connected urban space, safer for pedestrians and cyclists, with in particular the Smart Pole, presented at VivaTech on Bouygues stand, optimized operation of data centers and energy storage facilities, development of electric mobility with charging and V2G solutions.

- Moreover, the extensive outsourcing activities done by government entities in the country have led to saturation in the public sector. The public sector companies have focused on maintaining long-term relationships with facility management players through contract extensions.

- The outbreak of COVID-19 had a mixed business impact on facilities management firms. The restrictions on the movement of people resulted in a decline in project work and a decreased level of activity across many customer sites. Significant players in the country, such as CBRE Group, Sodexo Group, and others, were adversely affected due to the pandemic lockdown. In addition, the increasing demand for cleaning services has fuelled soft facility management services. Thus, due to the combination, the pandemic has a mixed impact on market growth.

- The future of work is hybrid, and due to many companies adopting the hybrid model, employees would come into the office at a lesser frequency, and the rest of the time, they would work remotely. Due to this, businesses would not need as much office space because fewer people would be accomodated in a smaller working environment, which is a challenge to the market growth because lesser facility areas would decrease the demand for FM services in the country.

France Facility Management Market Trends

Commercial Buildings to Remain the Largest Market Shareholder

- The commercial entities cover office buildings constructed or occupied by business services, such as corporate offices of IT and communication, manufacturers, and other service providers. Due to the provision of necessary fitments, interiors, and commercial buildings, decoration, and management have gained significant importance, thereby driving the country's retail sector market.

- The Facility Management market in France is witnessing multiple partnership activities between the government, vendors, and commercial entities. For instance, in March 2022, Infrastructure developers in Edina asked for a USD 22 million tax break for W. 70th Street and France Avenue, which includes a 24-story luxury complex with office and retail space. This development of commercial projects in the country would increase France's demand for FM services.

- The infrastructure of many projects in the country consists of electrical substations, internal roads with loading and unloading areas, networks for potable water, firefighting systems, irrigation, stormwater, and foul water, and their respective tanks. These have led to the increased demand for fire safety, electrical maintenance, technical support and maintenance, cleaning, HVAC, and other facility management services in the country.

- The data center facilities are increasing in the country, and with an increase in the number of DC areas, it is creating an opportunity for the FM service providers due to the DCs' requirements for FM hard and soft services. For instance, in March 2022, the French company Nation Data Center planned to build a data center in France that would be approximately 3,000 square meters in size.

- Moreover, Eurostat estimates that the revenue generated from the construction of buildings in the country could surpass USD 93.24 Billion by 2025. Thus, it would create significant opportunities for the studied market growth.

Integrated Facility Management is expected to witness the highest growth rate

- There is a paradigm shift in the market as multiple industries are transforming from utilizing a single facility management outsourcing model to an integrated services model that can meet all customers' core needs on a large scale. In addition, with newer technology transforming how organizations work, integrated facility management has become the key to smart buildings and work environments in the country.

- It consolidates the organization's office and property-related services and processes under a single contract and management team. It is a one-stop shop for all the FM needs of an organization. A company could forego multiple, confusing vendor contracts favoring just one service agreement. It would also involve placing multiple responsibilities handled individually by different teams under a single umbrella.

- The trends in the French market are for a progression from single services to bundled services and further toward the integrated facilities management approach. It offers a broad scope of services and longer-term contracts, which adds value and drives better quality and economies of scale. Also, this is increasing the demand for outsourced services, where specialist expertise is required.

- Integrated facility services can help companies to become more profitable, more efficient, and more competitive while making them more focused on the core business. Many global companies in the country have been partnering with FM service providers, which is creating a demand for FM services in the country.

- For instance, in December 2022, Sodexo, a French FM service provider, and Tetra Pak, a producer of food processing cum packaging solutions, have extended their 5-year agreement to continue offering global integrated facilities management services. Currently, 65 locations in Europe, including France, have been part of the contract between Sodexo and Tetra Pak. The agreement would cover a wide range of places' needs, including offices, corporate headquarters, and production facilities.

France Facility Management Industry Overview

The France Facility Management Market is consolidated because a few key players have contributed the maximum market share in the country. These major players have adopted various growth strategies, such as mergers and acquisitions, new product launches, expansions, joint ventures, partnerships, and others, to strengthen their positions in this market. The major players in the market are CBRE Group Inc, Cushman & Wakefield, Sodexo Group, VINCI Facilities, and Atalian Group, among others.

- July 2023 - CBRE has been appointed to provide property management services for M&G Real Estate in seven countries in Continental Europe. CBRE will manage 50 of M&G Real Estate's assets, including office, industrial, shopping center, retail, and hotel, totaling over 800,000 square meters, where CBRE will provide property and technical management, together with accounting services.

- December 2022 - Elior Group, a French company specializing in cleaning, sanitation, and soft facility management, and Derichebourg Group signed an MOU in which Elior Group agreed to sell Derichebourg Multiservices in exchange for Derichebourg SA receiving extra Elior Group shares. Elior Group's position in contract catering would be strengthened, and the acquisition of DMS would increase the company's service offerings in France's security, technical facility management, and soft facility management.

- May 2022 - Veolia and Seche Environnement signed a unilateral put agreement in which Seche Environnement agreed to purchase a section of Veolia's industrial water treatment services business in France to provide industrial enterprises with high-value-added services in the area of delegated water cycle management because the contract includes facility management with waste management and maintenance operations.

- February 2022 - ATALIAN renewed its facilities management contract with the Institut Gustave Roussy in France. ATALIAN has been associated with this client for the past five years with its cleaning and related services (bio-cleaning, blanking, distribution of patient meals, etc.).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Efficiency in Supply Chain

- 5.1.2 Increasing Focus on Industry 4.0, Leading to More Manufacturing Facilities

- 5.2 Market Restraints

- 5.2.1 Lack of Managerial Awareness

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Inhouse Facility Management

- 6.1.2 Outsourced Facility Management

- 6.1.2.1 Single FM

- 6.1.2.2 Bundled FM

- 6.1.2.3 Integrated FM

- 6.2 By Offering Type

- 6.2.1 Hard FM

- 6.2.2 Soft FM

- 6.3 By End-User

- 6.3.1 Commercial

- 6.3.2 Institutional

- 6.3.3 Public/Infrastructure

- 6.3.4 Industrial

- 6.3.5 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 CBRE Group Inc

- 7.1.2 Cushman & Wakefield

- 7.1.3 VINCI Facilities

- 7.1.4 Sodexo Group

- 7.1.5 Atalian Group

- 7.1.6 ONET S.A.

- 7.1.7 Elis S.A.

- 7.1.8 L'Agence du Panier

- 7.1.9 AItenders

- 7.1.10 Veolia Environnement S.A.

- 7.1.11 ISS World Services A/S

- 7.1.12 DEF network