|

市場調查報告書

商品編碼

1644612

汽車共享遠端資訊處理:全球市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Global Car Sharing Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

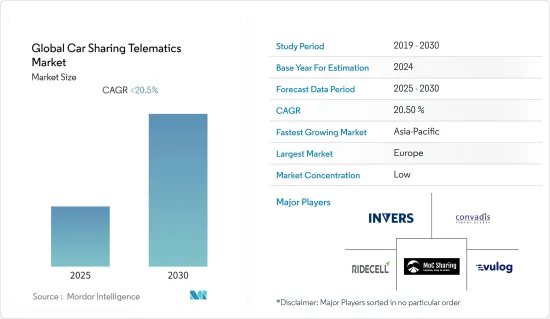

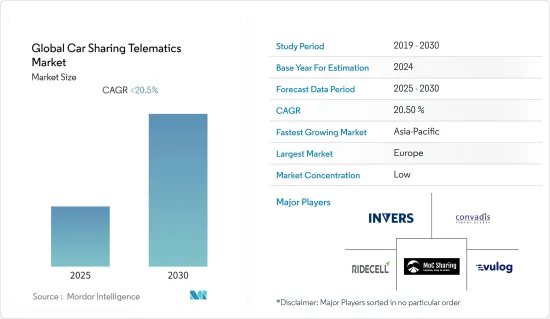

預計預測期內全球汽車共享遠端資訊處理市場複合年成長率將低於 20.5%。

汽車共享是一種以站點為基礎提供和管理的服務,主要用作企業解決方案。這使得員工能夠透過租用所需時長的車輛提前預訂商務旅行,從而推動市場成長。另外,營運公共交通服務並希望滿足不同客戶需求(例如在需要時提供車輛)的地方政府和多功能公共事業公司可以在前者的基礎上提供自由浮動模式。

對於汽車共享,燃料費通常包含在價格中,因此用戶無需支付燃料費用。因此,降低汽油成本的挑戰對於汽車共享營運商來說尤其重要,而遠端資訊處理可以監控影響燃料消耗的幾個因素,包括怠速、駕駛行為(激進駕駛會增加燃料消耗)、天氣(寒冷氣溫會促進燃料消耗)和配件的使用(如空調)。這些因素將推動市場成長。

此外,視訊遠端資訊處理為企業提供了一個平台,可以做出資料驅動的決策、執行預測分析並大規模解決問題。此外,遠端資訊處理允許公司為車隊車輛配備廣泛的功能,幫助車隊減少物流麻煩。車輛遠端資訊處理的使用可望擴大市場機會。

在汽車共享遠端資訊處理領域,高昂的實施成本是一大障礙。這是因為遠端資訊處理系統不僅需要初始設定的成本,還需要持續的維護成本。此外,燃料成本可能會給該組織帶來進一步的壓力。因此,汽車共享遠端資訊處理的高成本可能會限制市場的成長。

汽車共享遠端資訊處理市場趨勢

人工智慧、物聯網、雲端汽車共享和遠端資訊處理解決方案有望推動市場佔有率

為了確保駕駛員和乘客的安全,市場上的視訊遠端資訊處理解決方案結合了機器視覺和人工智慧。傳統的遠端資訊處理解決方案只能捕捉事故發生的時間和地點,以及事故發生的一些機械原因,例如突然煞車或轉向,而視訊遠端資訊處理解決方案可以捕捉車輛內部和外部的整體情況,真實地顯示事故發生的原因。

支援TCU部署的核心技術之一是5G。該技術的低延遲、高密度、超快下載速度和設備感知功能解鎖了對汽車共享駕駛系統至關重要的新功能和體驗。此外,市場正在尋求利用與智慧型手機功能相關的機會,以實現即服務時代的到來。

事實證明,遠端資訊處理是汽車行業的重要組成部分。遠端資訊處理增強了標準的車載導航和引導系統,使車輛和車主能夠在車輛內和車輛之間更有效地通訊。雲端基礎的車隊管理系統也為汽車共享供應商提供了許多新的選擇和駕駛機會。

總體而言,汽車共享公司旨在最佳化業務並改進系統,利用物聯網、人工智慧和雲端基礎的解決方案來追蹤和監控車輛、控制路線並診斷可能出現的問題。

預計歐洲將佔據主要市場佔有率

新的行動服務和經營模式正在改變城市交通,主要影響市場的供應方和需求方。網際網路的興起和公共交通價格的上漲也在改變交通運輸行業,基於應用程式的行動服務(例如透過行動應用程式共享汽車)為擴展和補充現有服務提供了新的可能性,可以平衡該地區的公共和私人交通。

該地區的行動服務供應商旨在透過提供直覺、快速的用戶介面來改善用戶的旅行體驗。這一因素減少了道路上的車輛數量,促進了向電動車的過渡,從而減少了二氧化碳排放和環境影響。

例如,2021年11月,專門從事遠端資訊處理、智慧運輸和出行物聯網平台領域數位解決方案創建的科技公司Targa Telematics推出了Targa Smart Mobility,該解決方案將所有類型的共用出行整合到一個平台上,從而可以減少二氧化碳排放並降低對環境的影響。 Targa Smart Mobility 還融合了市場上越來越受歡迎的共乘服務,允許多個用戶(尤其是企業客戶)共用一輛車。

此外,2022 年 1 月,永續及互聯行動技術與服務供應商大陸集團擴大了與 Share Now Denmark 的合作夥伴關係。此前,兩家公司成功完成了汽車共享服務車輛進入監控先導計畫。此次夥伴關係將確保 Share Now Denmark 的汽車共享車隊保持智慧輪胎管理。

因此,該地區的各種汽車共享遠端資訊處理供應商都在透過新產品發布、合作夥伴關係和產品改進來進行創新和投資,以此作為獲得靈活性、增強安全性、提高性能、提高效率和最大化市場佔有率的有利途徑。

汽車共享遠端資訊處理產業概況

全球汽車共享遠端資訊處理市場競爭激烈,有許多地區和全球參與者。創新正在推動產品市場的發展,供應商也正在對創新進行投資。主要參與者包括 INVERS GmbH、Convadis AG、MoC Sharing、Ridecell Inc. 和 Vulog。

2022 年 3 月 - 自動駕駛汽車共享公司 Invers 正在擴大與 Europcar Mobility Group 旗下汽車共享品牌之一 Ubeeqo 的合作夥伴關係,將其專門針對共享的遠端資訊處理部門 CloudBoxx 添加到 Ubeeqo 的車輛中。

2022 年 2 月-OCTO Telematics 和福特馬達公司宣布達成一項新協議,以擴大整個歐洲的資料流。 OCTO 將利用福特的連網汽車資料為其在英國、義大利、德國、法國和西班牙的保險和分析服務市場提供遠端資訊處理服務。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 對汽車共享遠端資訊處理市場的影響評估

第5章 市場動態

- 市場促進因素

- 基於物聯網、人工智慧和機器學習的汽車共享遠端資訊處理解決方案的興起

- 自動駕駛汽車的興起預計將徹底改變汽車共享遠端資訊處理格局

- 市場挑戰

- 實施成本高

第6章 市場細分

- 按頻道

- OEM製造商

- 售後市場

- 按類型

- 嵌入式

- Tether

- 融合的

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- INVERS GmbH

- Convadis AG

- Continental Aftermarket & Services

- Octo Group SpA

- Vulog

- Ridecell, Inc

- Mobility Tech Green

- Targa Telematic

- OpenFleet

- WeGo BV

- Fleetster

- MoC Sharing

第8章投資分析

第9章:市場的未來

The Global Car Sharing Telematics Market is expected to register a CAGR of less than 20.5% during the forecast period.

Car sharing is one of the services given and managed in a station-based mode, primarily used for corporate solutions. It allows employees to arrange business trips by renting a vehicle in advance and for the required length, driving the market growth. Alternatively, local governments or multi-utilities that operate the public mobility service and seek to meet the varied requirements of customers, such as the ability to use the vehicle when needed, can provide a free-floating mode in addition to the former.

Fuel is usually included in the price of car-sharing, meaning a user does not have to pay for it. As a result, the issue of reducing gasoline expenses for car-sharing business owners is particularly significant, and telematics allows to monitor several factors that affect fuel consumption, including Idling, driving behavior (aggressive driving increases fuel consumption), weather (low temperatures promote higher fuel consumption), and use of accessories (air conditioning, etc.). Such factors will drive market growth.

Furthermore, organizations can use video telematics to create a platform to make decisions based on data, give predictive analytics, and help enterprises solve large-scale challenges. Furthermore, with telematics, businesses will have the widespread capability in fleet vehicles, which will help fleets eliminate logistical hassles. As a result of the use of fleet telematics, the market opportunities are projected to grow.

The high installation cost is a significant obstacle for the car-sharing telematics sector. Because the initial configuration of telematics systems, as well as its ongoing maintenance, can be costly. Furthermore, the cost of fuel may further strain the organization. As a result, the high cost of car-sharing telematics may limit the market's growth.

Car Sharing Telematics Market Trends

AI, IoT and Cloud Car Sharing Telematics Solutions Expected to Drive the Market Share

To keep drivers and passengers safe, video telematics solutions in the market are combining machine vision and artificial intelligence. Unlike traditional telematics solutions, which only capture the time and location of an incident and possibly some of the mechanical reasons for the incident, such as hard braking or swerving, video telematics solutions capture the entire picture inside and outside the car to truly demonstrate why an incident occurred.

One of the cores enabling technology responsible for the deployment of TCU is 5G. The technology's low latency, massive density, super-fast download speeds, and device awareness, among others, draw new capabilities and experiences critical for car-sharing driving systems. Additionally, the market seeks to leverage opportunities in line with smartphone features that enable an era of mobility-as-a-service.

Telematics has proven to be an essential component of vehicle industries. It has increased the capabilities of standard onboard vehicle navigation and guidance systems and made it possible for vehicle and fleet owners to communicate more effectively within and amongst the vehicles. A cloud-based vehicle management system also opens up many new options and driving opportunities for car-sharing vendors.

Overall, Car-sharing companies aim to optimize their operations and better their systems for tracking and monitoring vehicles, controlling routes and diagnosing possible issues using IoT, AI, and cloud-based solutions.

Europe Expected to Witness Significant Market Share

The newer mobility services and business models have been changing urban transport, primarily affecting the supply and demand sides of the market. Internet penetration and high public transportation prices have also changed the transportation sector, and app-based mobility services, such as car-sharing via mobile applications, have offered new possibilities to expand and complement the existing services that could balance public and private transport in the region.

Mobility providers in the region aim to improve users' travel experiences by delivering an intuitive and fast user interface. This factor reduces the number of vehicles on the road and makes the transition to electric vehicles easier, resulting in lower CO2 emissions and environmental impact.

For instance, in November 2021, Targa Telematics, a technology firm specializing in the creation of digital solutions in the telematics, smart mobility, and mobility IoT platform fields, introduced Targa Smart Mobility, a solution that unifies all types of shared mobility on a single platform and the solution allows lower CO2 emissions and lower environmental impact. Targa Smart Mobility also incorporates the carpooling service, which is gaining traction in the market and allows numerous users, primarily corporate clients, to share a single ride.

Moreover, in January 2022, Continental, a technologies and services company for sustainable and connected mobility, expanded its partnership with SHARE NOW Denmark. The decision came after the two firms successfully worked on a tread-depth monitoring pilot project for the car-sharing service's fleet. The partnership will keep SHARE NOW Denmark's car-sharing fleet with intelligent tire management

Hence, various car-sharing telematics providers in the region view innovation and investments through new product launches, partnerships, and product improvisation as a lucrative path toward gaining agility, enhanced security, improved performance, increased efficiency, and maximizing market share.

Car Sharing Telematics Industry Overview

The Global Car Sharing Telematics Market is highly competitive, with many regional and global players. Innovation drives the market in the product offerings, and each vendor invests in innovation. Key players include INVERS GmbH, Convadis AG, MoC Sharing, Ridecell Inc., and Vulog

March 2022 - Invers, the automated vehicle sharing firm, partnered with Ubeeqo, one of Europcar Mobility Group's vehicle sharing brands, and is expanding the partnership by fitting additional vehicles in Ubeeqo's fleet with CloudBoxx, the company specialized sharing telematics unit.

February 2022 - OCTO Telematics and Ford Motor Company announced a new agreement to expand data streaming across Europe. OCTO will enhance its market-telematics services in insurance and analytical services in the UK, Italy, Germany, France, and Spain by leveraging Ford's linked car data.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Car Sharing Telematics Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing IoT, AI, and Machine Learning based solutions for Carsharing Telematics

- 5.1.2 Increasing Autonomous vehicles are Anticipated to Transform the Carsharing Telematics Landscape

- 5.2 Market Challenges

- 5.2.1 High Installation Cost

6 MARKET SEGMENTATION

- 6.1 By Channel

- 6.1.1 Orginal Equipment Manufacturers (OEM)

- 6.1.2 Aftermarket

- 6.2 By Form

- 6.2.1 Embedded

- 6.2.2 Tethered

- 6.2.3 Integrated

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 INVERS GmbH

- 7.1.2 Convadis AG

- 7.1.3 Continental Aftermarket & Services

- 7.1.4 Octo Group S.p.A

- 7.1.5 Vulog

- 7.1.6 Ridecell, Inc

- 7.1.7 Mobility Tech Green

- 7.1.8 Targa Telematic

- 7.1.9 OpenFleet

- 7.1.10 WeGo B.V.

- 7.1.11 Fleetster

- 7.1.12 MoC Sharing