|

市場調查報告書

商品編碼

1644622

VR 內容創作服務:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)VR Content Creation Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

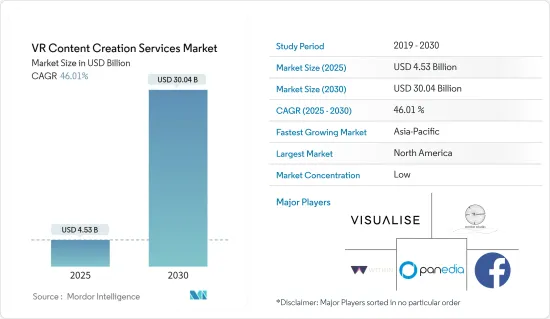

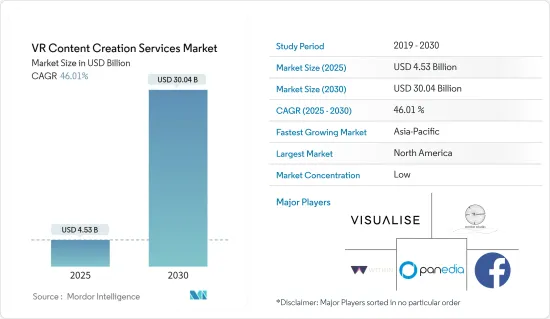

預計 2025 年 VR 內容創作服務市場規模為 45.3 億美元,到 2030 年將達到 300.4 億美元,預測期內(2025-2030 年)的複合年成長率為 46.01%。

由於虛擬實境技術在媒體和娛樂、工業、醫療保健和教育領域的應用日益廣泛,市場正在不斷成長。

主要亮點

- 企業擴大採用 VR 技術進行培訓、教育等,包括在職培訓、遠距團隊的虛擬辦公室和虛擬會議,正在推動虛擬實境內容創作市場的成長。

- 虛擬實境 (VR) 技術的引入是一項突破,使個人能夠比以往更有效地傳達他們的 3D 想法和設計。創造更具吸引力和互動性的內容的目的是利用VR內容製作技術讓目標消費者沉浸在虛擬娛樂中。這將導致虛擬實境內容開發的使用不斷成長,預計將在整個預測期內推動市場發展。

- 隨著創新和尖端技術越來越受到認可,加速虛擬實境內容創作市場的擴張,預計市場將受益匪淺,尤其是來自新興經濟體。 VR 內容製作的一個主要終端用戶是媒體和娛樂產業。這是因為 VR 技術能夠提供使用者逼真、身臨其境的體驗。

- 供應商正在夥伴關係開發尖端的 VR 內容創作平台和服務。例如,2022年5月,大朋VR與FXG視訊科技達成合作,結合兩家公司的技術與資源,打造更便利的VR內容系統。電視、電腦等系統不斷升級,這是市場擴大的驅動力。 VR內容因其強大的訪問周圍環境顯示系統和支援改進的虛擬模擬的能力而變得越來越受歡迎。此類活動和透過各種夥伴關係的策略性投資預計將在各個領域創造機會並推動市場成長。

- 在政府資金的推動下,亞洲的VR市場正快速擴張。日本的gumi等亞洲創業投資在支持亞洲市場成長的同時,也對全球VR人才感興趣,尤其是歐洲的人才。由於文化和語言原因,我們主要關注亞洲市場,但亞洲在內容創作方面也很活躍。

- 虛擬實境依賴運算技術、雲端處理和網際網路服務來運行,因此容易受到網路攻擊,損害資料完整性並增加資料外洩的風險。適當的安全和隱私被低估,並對虛擬實境市場構成了重大挑戰。

- 虛擬實境(VR)技術因其能夠緩解疫情帶來的許多挑戰而得到越來越廣泛的應用。然而,整體採用率相對較低且軟體有限仍限制了 VR 有效應對 COVID-19 挑戰的能力。

VR內容製作市場趨勢

VR 在遊戲領域的應用日益廣泛

- 虛擬實境正變得越來越受歡迎,遊戲產業也受益於這種身臨其境型技術。許多大型遊戲開發商都已加入虛擬實境 (VR)機芯,認為該運動將徹底改變使用者體驗。隨著時間的推移,越來越多的開發者對 VR 遊戲表現出興趣。隨著現有VR內容的添加和修改,遊戲的圖像近年來發生了顯著的變化。

- 由於虛擬實境遊戲採用了令人興奮的概念和內容,VR 遊戲產業的市場規模正在快速擴大。這樣,虛擬實境就有可能為遊戲產業帶來新事物。

- 遊戲是虛擬實境最受歡迎的應用程式之一。它能為各個年齡層的人們提供身臨其境、引人入勝的體驗,因此深受人們的喜愛。遊戲是一種數位媒體,參與者透過社交互動和虛擬環境來完成任務。此外,該行業採用 VR 內容創作與消費者對逼真體驗日益成長的需求有關。預測期內,VR 技術在遊戲產業的應用預計將大幅成長。

- 2022 年 1 月,微軟宣布有意收購遊戲開發先驅和互動娛樂內容發行商動視暴雪。此次收購預計將加速微軟遊戲公司在行動、PC、主機和雲端平台的擴張,並作為元宇宙的基礎。透過此次收購,微軟預計在收入方面超越騰訊和SONY,成為全球第三大遊戲營運商。

- 此外,Virtex 還宣布計劃推出“Virtex Stadium”,這是一個虛擬實境體育場,球迷可以和朋友們一起在球場中心觀看比賽。此次發布正值電子競技日益成長的普及以及 VR 消費設備價格和性能的提升。遊戲產業主要供應商利用虛擬實境的技術創新和發展正刺激對遊戲和相關服務的新內容創作的需求,預計將推動市場成長。

- 此外,遊戲產業正在快速發展,根據遊戲開發者大會的報導,虛擬和替代現實遊戲已不再是遙遠的未來。根據 2023 年的一項調查,全球 36% 的參與遊戲開發商表示他們當時正在為 Meta Quest虛擬境頭戴裝置開發遊戲。因此,隨著消費者對身臨其境型媒體體驗的需求不斷成長以及遊戲產業公司擴大採用 VR 技術,市場預計將會成長。

預計北美將佔據主要佔有率

- 美國在虛擬實境市場佔有主導地位。硬體和軟體研發中心位於矽谷,這裡是Google、蘋果、Facebook 等主要 IT 公司的所在地。內容製作主要集中在洛杉磯,主要有遊戲和製作工作室。

- 美國為虛擬實境新興企業提供了有利的條件,其中以 VR 和 AR 創投(VC)基金最為活躍,願意投資早期科技新興企業。預計此類投資將在未來持續下去,並有望成為市場成長的驅動力。

- 遊戲和娛樂產業對 HMD 的需求不斷增加,預計將推動該地區市場的發展。此外,虛擬實境 (VR) 技術在航太和國防、建築和規劃領域的日益普及也可以成為推動市場成長的重要機會。

- 技術進步和眾多軟體工具及硬體套件的開發可望為該地區創造商機,使其相對於其他地區獲得競爭優勢。因此,北美虛擬實境內容創作產業預計在未來幾年將會成長。

- 據 PlayStation 稱,2022 年玩得最多的 PlayStation VR 遊戲是虛擬實境節奏遊戲《Beat Saber》。與美國、加拿大和其他地區一樣,歐盟下載次數最多的 PS VR 遊戲都是評價很高的 VR 電玩遊戲。 《Job Simulator》僅次於《Beat Saber》排名第二,《SUPERHOT VR》僅次於《SUPERHOT VR》排名第三。

VR內容製作產業概況

由於許多參與者透過合作、併購和產品創新擴大在該地區的影響力,VR 內容創作服務市場變得越來越具有競爭力和分散化。參與者包括 Visualise Creative Limited、Panedia Pty Ltd、Fiebak Medien、Facebook 等。

- 2023 年 4 月-虛擬實境 (VR) 遊戲開發公司 Vinci Games 在由 Makers Fund主導的種子輪資金籌措中籌集了 510 萬美元,Y Combinator、Soma Capital、Pioneer Fund、Anorak Ventures、BonAngels 和 Twitch 聯合創始人 Kevin Lin 也參與其中。這筆資金將用於支持該工作室的首款遊戲《Blacktop Hoops》的開發,這是一款具有競爭性和社交主導的虛擬實境籃球體驗。遊戲將投籃、扣籃和運球等籃球技巧帶入虛擬實境,讓使用者沉浸在街球的動作中。

- 2023 年 6 月-BinaryX 透露其進軍虛擬實境 (VR) 和人工智慧遊戲內容 (AIGC) 市場的意圖。 BinaryX 已與 VR 和 AIGC 合作夥伴 AiGC Labs 簽署協議,打造 GameFi,這是一種具有突破性的基於 AI 的全新 VR 遊戲類型。該團隊聲稱,BinaryX 已與 AiGC Labs 合作,並準備發布其首款專注於 VR 和 AIGC 的 VR 遊戲。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 產業影響評估

第5章 市場動態

- 市場促進因素

- 基於 VR 的內容在客戶中越來越受歡迎,這主要得益於基於位置的 VR 體驗。

- 受需要內容創建和渲染的企業用例推動,VR 解決方案的市場活動顯著增加

- 市場挑戰

- 基礎設施挑戰和相對較長的開發週期導致預算超支

- 市場機會

- 生態系分析

- 目前 VR 電影製作的進入門檻

- VR 電影製作領域的當前活動和發展

- 目前 VR 格局概述,包括硬體、軟體和內容/服務

第6章 市場細分

- 按最終用戶

- 媒體與娛樂

- 商業/工業

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Visualise Creative Limited

- VREI

- Panedia Pty Ltd.

- Within

- Fieback Medien

- Evolve Studio

- FirebirdVR

- FXGear Inc.

第 8 章 主要相關人員

第9章投資分析

The VR Content Creation Services Market size is estimated at USD 4.53 billion in 2025, and is expected to reach USD 30.04 billion by 2030, at a CAGR of 46.01% during the forecast period (2025-2030).

The market is growing due to the increasing usage of virtual reality technology by the media and entertainment, industrial, healthcare, and education sectors.

Key Highlights

- The increased use of VR technology by enterprises for applications such as on-the-job training, virtual offices for remote teams, training such as virtual meetings, and education fuels the growth of the virtual reality content creation market.

- Introducing virtual reality (VR) technologies is a breakthrough, allowing individuals to communicate 3D ideas and designs more effectively than ever before. The goal of creating more intriguing and interactive content is to leverage VR content production technologies to immerse target consumers in virtual entertainment. As a result, the growing use of virtual reality content development is expected to boost the market throughout the forecast period.

- The marketplace is expected to benefit greatly from the increasing acceptance of innovative and cutting-edge technologies, particularly in developing economies, which will accelerate the expansion of the virtual reality content creation market. A significant end-user of VR content generation is the media and entertainment industry. This is due to VR technology's capacity to give users a realistic and immersive experience.

- The vendors are developing advanced VR content creation platforms and services by forming partnerships. For instance, in May 2022, DPVR and FXG Video Science and Technology partnered to create more convenient VR content systems by combining their technology and resources. systems like televisions, PCs, and others continue to be upgraded, which drives the market expansion, demand for VR content is rising due to its strong ability to access surrounding environment displaying systems and support improved virtual simulations. Such activities and strategic investments through various partnerships are expected to drive the market's growth creating possible opportunities across various sectors.

- Due to government funding support, the Asian VR market has rapidly expanded. Asian venture capital firms, such as the Japanese business Gumi, support Asian growth while also being interested in global VR talent, especially in Europe. Asia is also active in content creation, although it mainly focuses on the Asian market for cultural and linguistic reasons.

- Virtual reality relies on computing technologies, cloud computing, and internet services to function, making it vulnerable to cyberattacks, jeopardizing data integrity, and raising the risk of data leakage. Proper security and privacy are undervalued, presenting a significant challenge to the virtual reality market.

- Virtual reality (VR) technology had the potential to mitigate many of the challenges brought about by the pandemic, which spurred increased adoption. However, relatively low adoption overall and limited software still restricted the power of VR to address COVID-19 difficulties effectively.

VR Content Creation Market Trends

Growing Adoption of VR in Gaming

- Virtual reality is becoming popular in gaming, which has benefited from this immersive technology. Many large-scale game development companies have jumped on the VR movement to transform the user experience. As time passed, many developers showed interest in VR games. The addition and modification of existing VR content have changed the image of the games in recent years.

- The VR gaming industry's market size is expanding at a rapid pace as the concepts and contents used in virtual reality games are exciting. Thus, virtual reality has the potential to introduce new things to the gaming industry.

- Games are one of the most popular applications of virtual reality. People of all ages can appreciate the immersive, engaging experience that they offer. Games are characterised as digital medium in which participants engage in social interaction and/or virtual environment to accomplish a task. Additionally, the utilisation of VR content creation in this industry can be linked to consumers' rising demand for experiences that are realistic and lifelike. During the projected period, there is expected to be significant growth in the application of VR technology in the gaming industry.

- Microsoft Corp. announced in January 2022 that it intended to acquire Activision Blizzard Inc., a pioneer in game development and a publisher of interactive entertainment content. This purchase is expected to speed up the expansion of Microsoft's gaming company across mobile, PC, console, and cloud platforms and will serve as a foundation for the metaverse. By revenue, Microsoft is anticipated to overtake Tencent and Sony to become the third-largest gaming business in the world after this transaction.

- Further, Virtex announced that it was planning to launch a virtual reality stadium, "Virtex Stadium," that lets fans watch the game with their friends from the center of the field. The launch is in line with the growing popularity of e-sports and the growing affordability and performance of VR consumer devices. Such innovations and developments by key vendors in the gaming industry using virtual reality are adding to the demand for new content creation in games and related services, which is expected to propel market growth.

- Additionally, the gaming industry is fast evolving, and virtual reality and alternate reality games are no longer in the distant future, according to Game Developers Conference. According to a 2023 study, 36% of participating game developers worldwide said they were working on titles for the Meta Quest virtual reality headset at the time. As a result, the market is anticipated to increase as a result of rising consumer demand for immersive media experiences and expanding VR technology adoption by companies in the gaming sector.

North America is Expected to Hold Major Share

- The United States has a leading position in the virtual reality market. R&D for hardware and software is centered around Silicon Valley, home to IT giants such as Google, Apple, and Facebook. The content production is concentrated around big gaming studios and production studios in Los Angeles.

- The United States offers favorable conditions for virtual reality start-ups, has the most active VR and AR venture capital (VC) funds, and is willing to invest in early technology start-ups; hence, commercial VR and AR companies started in the US earlier than elsewhere. Such investments are expected to continue and are estimated to drive market growth.

- The increased demand for HMDs in the gaming and entertainment industries is expected to push the regional market. Also, the increased deployment of VR technology in aerospace and defense and the architecture and planning sectors may act as a major opportunity that helps in the growth of the market.

- Technological advancements and the development of numerous software tools and hardware suits are expected to create tremendous opportunities for businesses to gain a competitive advantage over other regions. As a result, the North American virtual reality content creation industry is expected to grow in the coming years.

- The most played PlayStation VR game in 2022, according to Playstation, was the virtual reality rhythm game Beat Sabre. The most downloaded PS VR game in the EU, as well as in the US, Canada, and other regions, was the critically acclaimed VR videogame. Job Simulator and SUPERHOT VR came in second and third, respectively, in both stores, after Beat Sabre.

VR Content Creation Industry Overview

VR content creation services market is moving toward a fragmented market as the competition in the market is intensifying owing to a large number of players increasing their presence in the region through collaboration, merger & acquisition, and product innovation. Players include Visualise Creative Limited, Panedia Pty Ltd, Fiebak Medien,Facebook and others.

- April 2023 - Virtual reality (VR) game developer Vinci Games has secured USD 5.1 million in a seed fundraising round, which was headed by Makers Fund and included participation from Y Combinator, Soma Capital, Pioneer Fund, Anorak Ventures, BonAngels, and Kevin Lin, the co-founder of Twitch. The funds raised will go towards the production of the studio's debut game, Blacktop Hoops, a competitive, socially driven VR basketball experience. It has the most simple-to-use shooting, dunking, and dribbling basketball mechanics created particularly for virtual reality, letting users immerse themselves in the action of streetball.

- June 2023 - BinaryX revealed their intentions to enter the Virtual Reality (VR) and Artificial Intelligence Game Content (AIGC) markets. In order to create a ground-breaking new GameFi genre of AI-based VR games, BinaryX has apparently signed into agreements with their VR and AIGC partners, AiGC Labs. The team claims that BinaryX, in partnership with AiGC Labs, is getting ready to release the first VR game with a focus on both VR and AIGC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assesment of Impact of COVID -19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 VR-Based Content is BeningIncreasingly Received by Customers, Mostly Driven by Location-Based VR Experiences

- 5.1.2 Marked Increase in the Market Activity for VR Solutions Driven by Enterprise Use-CasesWhich Require Content Creation & Rendering

- 5.2 Market Challenges

- 5.2.1 Infrastructural Challenges Remain a Concern. Moreover, the Relatively Long Development Cycles Require Considerable Budget Overlay

- 5.3 Market Opportunities

- 5.4 Industry Ecosystem Analysis

- 5.5 Current Entry Barriers to VR Film Production

- 5.6 Current Activities and Developments in the VR Filmmaking Sector

- 5.7 Overview of Current VR Landscape - Hardware, Software and Content Services

6 MARKET SEGMENTATION

- 6.1 By End-user

- 6.1.1 Media & Entertainment

- 6.1.2 Enterprise & Industrial

- 6.1.3 Other End-Users

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Visualise Creative Limited

- 7.1.2 VREI

- 7.1.3 Panedia Pty Ltd.

- 7.1.4 Within

- 7.1.5 Fieback Medien

- 7.1.6 Evolve Studio

- 7.1.7 FirebirdVR

- 7.1.8 FXGear Inc.