|

市場調查報告書

商品編碼

1644626

通訊電纜:全球市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Global Telecom Cable - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

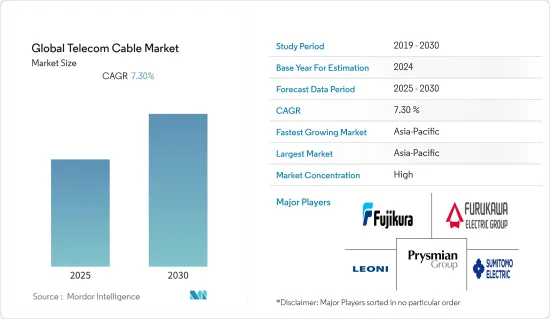

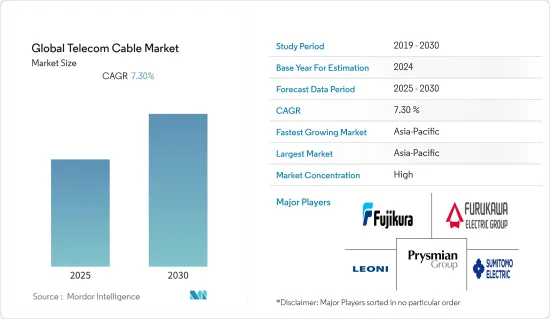

預計預測期內全球通訊電纜市場複合年成長率為 7.3%。

主要亮點

- 智慧型手機、平板電腦等網路設備已成為全球不可或缺的通訊、資訊和娛樂工具。智慧型手機的普及、網路在全球的興起是影響通訊設備市場成長的主要因素,進而帶動通訊電纜市場的發展。

- 物聯網技術利用通訊服務進行資產管理和系統的遠端監控。使用 Kaa 這樣的物聯網平台,通訊公司可以將各種實體資產連接到雲端,進行遠端營運管理、故障調查、韌體升級和庫存管理,這將有助於推動市場成長。

- 最近,政府對寬頻基礎設施的資助出現了更加分散的趨勢。例如,美國於2021年11月通過了1兆美元的基礎設施投資和就業法案(IIJA),撥款650億美元用於寬頻接入、清潔水、電網更新、交通和道路提案。旨在擴大和改善通訊基礎設施和服務的政府計劃預計將推動市場成長。

- 通訊電纜營運維護成本的增加是阻礙市場成長的主要因素之一。此外,地下光纖更加可靠,維護需求更少。因此,光纖光纜在當前和未來的市場中都蘊藏著巨大的商機。

- COVID-19 疫情的爆發和疫情對通訊業構成了重大挑戰,該行業嚴重依賴大型客服中心來協助客戶、繼續營運甚至為在家工作的代理商提供支援。然而,隨著在家工作的增加,對網路連線的需求很高,這有助於市場成長。

通訊電纜市場趨勢

網路普及率不斷提高以及智慧型手機的普及

- 預計在預測期內,智慧型手機等行動裝置中通訊電纜的廣泛使用以及網路普及率的提高將推動市場成長。住友電工、萊尼、Nike森是主要企業,競爭非常激烈。

- 各個新興國家引進4G LTE技術和5G服務,將帶動市場成長,同時無線市場的通訊業者以及即將到來的5G和高速網路升級也將推動市場成長。為了實現廣泛的網路體驗,這種轉變是必要的。預計通訊電纜市場將隨著高速網際網路的需求而成長。

- 人們對多接取邊緣運算和私人行動網路的興趣日益濃厚。私人行動網路和邊緣運算的企業市場正在蓬勃發展。市場仍在成長,許多參與者預計將爭奪市場佔有率。網路營運商必須與其他可能成為提供解決方案的重要合作夥伴的參與者競爭。未來幾年,其他新參與企業可能會進入這個新興但快速發展的市場並確定自己的角色。這些因素也影響通訊電纜市場的成長。

- 各公司正專注於創新和擴大有線電視業務以提高網路速度。例如,通訊業者巴帝電信(Bharti Airtel)於2022年2月宣布,將加入SEA-ME-W-E6海底電纜聯盟,以擴大其全球網路容量,服務印度日益成長的數位經濟。 SEA-ME-WE-6 是世界上最大的海底電纜系統之一,連接新加坡和法國。

- 2020年8月,印度總理啟動了清奈-安達曼和尼科巴群島海底電纜登陸計劃。這導致了通訊電纜市場的擴大。

- 在當今不斷發展數位化的世界中,文字訊息、電子郵件和視訊串流似乎可以帶來更多的收入。行動資料服務已取代電話通話成為通訊業最大的收益來源,網路連線用戶數量正穩定成長。此外,在家工作文化正在推動全球通訊電纜市場的發展。

亞太地區預計將佔據主要市場佔有率

- 亞太地區新興大都市對連接和網路存取的需求不斷成長,積極推動了市場成長。最後,對更快的網際網路速度和更好的連接性的日益成長的需求需要採用通訊電纜內光學技術的堅固而高效的光纖測試設備,從而推動市場成長。

- 此外,2021 年 3 月,先進電視系統委員會 (ATSC) 和印度電信標準發展協會 (TSDSI) 簽署了一項協議,推動印度採用 ATSC 標準,以便在行動裝置上提供廣播服務。這使得 TSDSI 能夠符合 ATSC 標準,有助於協調全球數位廣播標準。該協定允許行動電話營運商考慮從 ATSC 3.0 繼承的基於標準的傳輸技術。這將有助於其進一步開拓印度通訊電纜市場。

- 2020 年 6 月,數位生態系統推動者塔塔通訊 (Tata Communications) 宣布,其所屬的亞洲直達電纜 (ADC) 聯盟正在建造一條連接中國、日本、菲律賓、新加坡、泰國和越南的高性能海底電纜。該財團選擇 NEC 來建造長達 9,400 公里的 ADC 電纜,目標是於 2022年終完工。

- 近來,亞洲公司已成為重要參與者。中國和日本引領了這一潮流,使亞太國家在地圖上佔據了牢固的地位。澳洲、韓國、台灣、印度和越南擁有亞太地區重要的電訊營運商,增強了該地區在電訊業的地位,並利用了該地區的電訊電纜市場。

- 此外,由於對具有高連接速度的基於雲端基礎的技術的需求增加以及對IT基礎設施的投資增加,預計亞太地區的通訊電纜市場將成為預測期內最大的市場之一併見證最高的成長。

通訊電纜產業概況

電訊電纜市場競爭激烈,主要由以下現有參與者主導:住友電氣工業株式會社、古河電工、萊尼和耐吉森。 透過研發,這些參與者能夠創新產品,從而獲得競爭優勢。

- 2021 年 9 月 - 萊尼(Leoni)是一家為汽車行業和其他行業提供能源和資料管理產品和解決方案的供應商,在塞爾維亞克拉列沃正式開設了第四家工廠。該工廠不僅是萊尼在塞爾維亞最大的工廠。它還按總生產能力僱用了大量員工(到 2023年終將達到 5,000 人),使該公司成為塞爾維亞重要的私人工業雇主。萊尼已投資超過 5000 萬歐元用於新生產設施的建造和設備。

- 2022 年 5 月—One energy 和 Prysmian Group 宣布將與 Telstra 合作建造澳洲最先進的首都光纖網路。國家光纖網路計劃將是一項多年的努力,Telstra 將建造新的“最先進的城際雙光纖路徑”,增加長達 20,000 公里的新光纖地面電纜,並提升區域間的首都容量。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 價值鏈/供應鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 網路使用率提高和智慧型手機普及

- 物聯網 (IoT) 需求不斷成長

- 市場限制

- 通訊電纜運作維護成本高

第6章 市場細分

- 按類型

- 同軸電纜

- 光纖電纜

- 資料中心電纜

- 行動網路

- 雙絞線電纜

- LAN 電纜

- 按應用

- 通訊應用

- 資料中心

- CATV

- 電腦網路

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 日本

- 中國

- 印度

- 其他亞太地區

- 世界其他地區

- 北美洲

第7章 競爭格局

- 公司簡介

- Commscope Inc.

- Sumitomo Electric Industries, Ltd.

- Prysmian Group

- Fujikura Ltd.

- Furukawa Electric Co. Ltd

- Leoni AG

- Belden Inc.

- Hitachi Cable America Inc.

- LS Cable & System

- Hengtong Group Co. Ltd.

第8章投資分析

第 9 章:未來趨勢

簡介目錄

Product Code: 90982

The Global Telecom Cable Market is expected to register a CAGR of 7.3% during the forecast period.

Key Highlights

- Internet-enabled devices such as smartphones and tablets have become indispensable tools for communication, information, and entertainment worldwide. The increasing adoption of smartphones and the widespread use of the internet worldwide is a key factors influencing the growth of the telecommunications equipment market, which is responsible for developing the telecommunications cable market.

- IoT technology uses telecom services for asset management and remote system monitoring. By using an IoT platform like Kaa, telecom companies can connect their diverse physical assets to the cloud and remotely manage their operations, investigate malfunctions, run firmware upgrades, and keep track of inventory, leading to market growth.

- Recently, the shift to more decentralized government funding for broadband infrastructure has been observed. For instance, in November 2021, the USD 1 trillion Infrastructure Investment and Employment Act (IIJA) was passed in the United States, which allocates USD 65 billion for broadband access, clean water, electric grid renewal, transportation, and road proposals. Government programs dedicated to expanding and improving telecommunications infrastructure and services are expected to boost the market's growth.

- The increased operating and maintenance cost of telecom cables is one of the major factors likely to hamper the market growth. Moreover, underground fiber provides more reliability and requires fewer maintenance efforts. Hence, there is a huge opportunity for optical fiber cables in the market in the current and future.

- The outbreak of Covid-19 and the pandemic has become a huge challenge to continue operating and providing support even with agents working from home, as the telecom industry heavily relies on huge contact centers to assist their customers. However, due to the increased work-from-home trend, there is high demand for internet connectivity, positively boosting the market's growth.

Telecom Cable Market Trends

Rising Internet Penetration and Adoption of Smartphones

- The growing applications of telecom cables in mobile devices such as smartphones and the rise of internet penetration are expected to augment the market's growth for the forecast period. Sumitomo Electonic, Leoni, and Nexans are key players who are intensely competing for space.

- The introduction of 4G LTE technology and 5G services across various developing countries lead to the market's growth, telecom operators in wireless markets, and the imminent 5G and high-speed internet upgrades to be an offering to the market. This migration is necessary to enable expansive network experiences. The telecom cable market is expected to grow with the demand for high-speed internet.

- The growing interest in multi-access edge computing and private mobile networks. The enterprise market for private mobile networks and edge computing is gaining momentum. The market is still growing, but it is promised to compete with many players competing for market share. Network operators must compete with other players who can be critical partners in providing solutions. In the next few years, other new entrants may begin to bet and define their role in this emerging but rapidly evolving market. These factors leverage the growth of the telecom cables market as well.

- Companies focus on innovating and expanding their cable business to improve internet speeds. For instance, in February 2022, telecommunications operator Bharti Airtel announced that it would join the SEA-ME-W-E6 Submarine Cable Consortium to expand its global network capacity to serve India's growing digital economy. SEA-ME-WE-6 connects Singapore and France, making it one of the largest submarine cable systems in the world.

- In August 2020, The Prime Minister of India inaugurated the Chennai-Andaman Nicobar Island Submarine cable landing project that can offer better internet and mobile connectivity in the islands, raising the submarine cable communications. Therefore, increasing the market for telecom cables.

- In today's growing and digitalized world, text messaging, emailing, and video streaming seem to be forging more income. Mobile data services have substituted telephone calls, developing the telecommunications industry's maximum revenue and exhibiting consistent increases in the number of subscriptions for internet connections. Moreover, the work-from-home culture has leveraged the global telecom cable market.

Asia Pacific Region is Expected to Hold a Significant Market Share

- Increasing demand for connectivity and internet access in emerging metropolitan cities in the Asia Pacific region is actively driving the market growth. Finally, the growing need for faster internet speeds and better connectivity requires robust and efficient fiber optic test equipment filled with optical technology within the telecom cables, driving the market growth.

- Moreover, in March 2021, Advanced Television Systems Committee (ATSC) and Telecommunications Standards Development Society, India (TSDSI) signed a deal to boost the adoption of ATSC standards in India to make broadcast services available on mobile devices. This allows the TSDSI to follow ATSC standards, harmonizing global digital broadcasting standards. The agreement allows mobile operators to consider standards-based transmission technologies inherited from ATSC 3.0. This can further leverage the telecom cable market in India.

- In June 2020, Tata Communications, a digital ecosystem enabler, announced that the Asia Direct Cable (ADC) Consortium, of which it is a member, is making a high-performance submarine cable connecting China, Japan, the Philippines, Singapore, Thailand, and Vietnam. The consortium has selected NEC Corporation to construct the 9,400-kilometer-long ADC cable, which is anticipated to be finished by the end of 2022.

- In recent times, Asian companies have emerged as significant players. China and Japan have set precedents, firmly setting the Asia-Pacific countries on the map. Australia, South Korea, Taiwan, India, and Vietnam boast significant telecom operators in the Asia-Pacific region, bolstering the position of the Asia-Pacific region within the telecom industry and leveraging the telecom cables market in the region.

- Moreover, the Asia Pacific telecom cable market is expected to remain one of the largest markets and witness the highest growth over the forecast period due to growing demand for technologies such as cloud-based technology with high connectivity speed and increasing investment in IT infrastructure.

Telecom Cable Industry Overview

The telecom cable market is highly competitive, dominated by established players such as Sumitomo Electric Industries, Ltd., Furukawa Electric Co. Ltd, Leoni, and Nexans. Through research and development, these players have been able to innovate the offerings that have enabled them to achieve a competitive advantage. With strategic partnerships and mergers & acquisitions, these players have gained a stronger foothold over the market.

- September 2021 - Leoni, a provider of products and solutions for energy and data management in the automotive sector and other industries, marks the official opening of its fourth plant in Serbia, Kraljevo. The site is not only a giant Leoni plant in Serbia. It also employs a significant number of people at total capacity (up to 5,000 by the end of 2023), making the company a significant private industrial employer in Serbia. Leoni has invested over 50 million EUR in building and equipment for its new production facility.

- May 2022 - One energy and Prysmian Group announced collaborating with Telstra to build a new state-of-the-art inter-capital fiber network in Australia. The national fiber network project is a multi-year project that will see Telstra build a new 'state-of-the-art inter-city dual fiber path' that adds up to 20,000 route km of new fiber optic terrestrial cable, boosting inter-capital capacity as a capacity for regional areas.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in the use of Internet and increasing acceptance of smartphones

- 5.1.2 Increased demand for Internet of Things (IoT)

- 5.2 Market Restraints

- 5.2.1 High cost of operation and maintenance of Telecom Cable

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Coaxial Cable

- 6.1.2 Fiber Optic

- 6.1.3 Data Center Cables

- 6.1.4 Mobile Networks

- 6.1.5 Twisted Pair Cable

- 6.1.6 LAN Cables

- 6.2 By Application

- 6.2.1 Telecommunication applications

- 6.2.2 Data Centers

- 6.2.3 CATV

- 6.2.4 Computer Network

- 6.2.5 Others

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.1.3 Mexico

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 France

- 6.3.2.3 Uk

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 Japan

- 6.3.3.2 China

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Rest of the World

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Commscope Inc.

- 7.1.2 Sumitomo Electric Industries, Ltd.

- 7.1.3 Prysmian Group

- 7.1.4 Fujikura Ltd.

- 7.1.5 Furukawa Electric Co. Ltd

- 7.1.6 Leoni AG

- 7.1.7 Belden Inc.

- 7.1.8 Hitachi Cable America Inc.

- 7.1.9 LS Cable & System

- 7.1.10 Hengtong Group Co. Ltd.

8 INVESTMENTS ANALYSIS

9 FUTURE TRENDS

02-2729-4219

+886-2-2729-4219