|

市場調查報告書

商品編碼

1644631

中國翻新智慧型手機市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)China Refurbished Smartphone - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

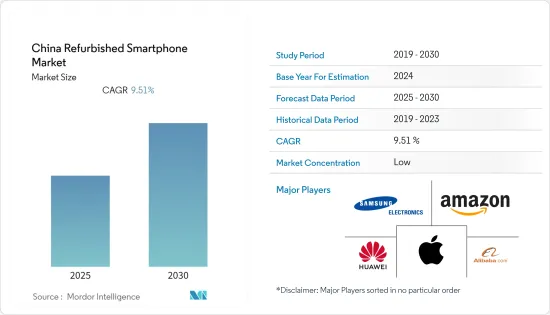

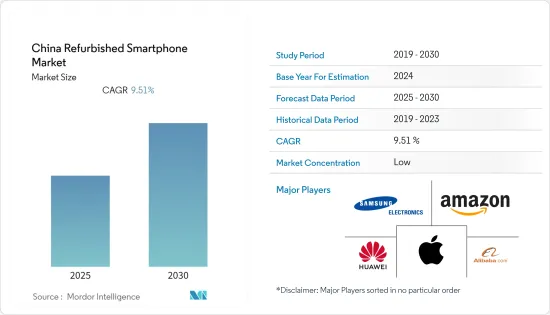

預測期內,中國翻新智慧型手機市場的複合年成長率預計將達到 9.51%

關鍵亮點

- 升級成本的上升是推動市場成長的主要因素之一。高階智慧型手機價格上漲導致一些消費者保留現有行動電話的時間比預期的要長。但同時,這項因素也推高了二手設備的平均售價。

- 根據轉轉集團2021年7月發布的報告,蘋果是中國二手智慧型手機類別的主要市場參與企業之一,控制約36.53%的次市場。此外,小米等區域巨頭緊隨其後,市場佔有率約為 13.88%,其次是 Vivo,市佔率約 12.7%,三者並列第一。

- 此外,出售的翻新設備中帶有保固的比例更高。這些行動電話附有購買證明和保修,這在很大程度上克服了消費者對購買翻新設備的猶豫。例如,三星以大幅折扣提供經過認證的二手設備。直接從三星購買的一個主要好處是消費者可以獲得新產品的一年全保固。

- 未來幾年可能影響市場的一個因素是5G網路的發展。大多數智慧型手機的最短許可期限為 24 個月,最長可達 5 年。然而,一旦 5G 網路進入市場,大多數可以使用 3G 和 4G 服務的設備將會變得過時。這可能會導致大量翻新的二手智慧型手機上市,但這在新興市場不太可能發生,因為很大一部分人都希望跟上當前的技術趨勢。例如,根據轉轉集團的報告,2021年第二季二手榮耀設備銷售量成長了88.34%。總體而言,中國智慧型手機市場較 2021 年第一季成長了 10.76%,因為消費者特別熱衷於購買與第五代網路相容的裝置。

- 由於幾乎所有國家都實施了全國封鎖,COVID-19 疫情嚴重阻礙了全球產業的發展。受疫情影響,智慧型手機產業也正在經歷經濟變化。由於中國是大多數此類設備和零件的全球製造地,且需求方面也呈現類似的趨勢,智慧型手機製造業正受到出貨延遲和下一代產品開發減弱的不利影響。該地區在供應商、工人和物流網路方面也面臨困難。

中國翻新智慧型手機市場趨勢

電子商務通路採用率提高

- 專業的舊行動電話翻新方法涉及多項品質和性能檢查,因此在大多數情況下,用戶可以獲得優質的設備,或至少可以獲得承諾的優質設備。問題在於,目前翻新產業主要由實體門市經營,這些商店往往提供低價且不可靠的行動電話。因此,保養產品的形像很差。然而,隨著時代的變化以及電子商務和專業翻新業務的興起,翻新智慧型手機市場預計將進一步成長。亞馬遜和 Cashify 等專注於翻新和製造優質產品的大型參與者的參與預計將進一步加強市場並為用戶提供對翻新智慧型手機的必要信心。

- 通訊業者在電子商務經濟中佔據最佳地位。這些公司具有獨特的優勢,可以創造二手智慧型手機的供應和需求。目前,人們的抽屜裡擺著數百萬部智慧型手機,而且作為 5G 技術轉型的一部分,預計會有數百萬部 3G 和 4G行動電話被交易,通訊業者可以利用這個不斷擴大的供應池來推動新用戶成長和消費者承受能力。為了抓住這個機會,這些業者需要一個明確的轉售策略,該策略可以在推出後的任何時間增加和利用設備的剩餘價值和二手智慧型手機的市場價值,為他們的業務帶來巨大的利益。

- 翻新產品在亞馬遜、本地商店和網路商店都有自己的專區。客戶可以在亞馬遜上用舊智慧型手機以舊換新,並獲得折扣。該公司將檢查您的手機,進行必要的維修,並使其再次像新手機一樣運作。這些設備隨後被轉售到翻新市場。它還附帶零售商和製造商提供的有限保固。

- 對供應鏈和晶片短缺的擔憂正在推動維修業向前發展。為了滿足這種需求,企業正在轉向翻新電子產品供應商,這有望推動翻新電子產品市場,尤其是智慧型手機。

- 還有一個名為「製造商翻新」的類別,這與當地維修公司進行的維修不同。這意味著製造商(如OEM一樣)使用原廠零件進行維修、驗證其功能並將其更新到「像新的一樣」的狀態。這是許多人想要的,而且顧客更喜歡翻新的智慧型手機。

5G 將如何影響翻新智慧型手機

- 在目前的市場上,5G技術是全球幾大公司投入最多的技術之一。 5G連接也擴展了應用範圍,從而可提高許多領域的效率。隨著行動電話技術變得越來越普及,消費者對數位參與和個人化體驗的要求也越來越高。此外,政府機構採用和商業化 5G 技術的意願日益增強,預計也將使所研究的行業受益。就市場上的眾多價格層級和作業系統而言,5G 設備生態系統正在不斷擴大。

- 根據GSMA《中國移動經濟2021》報告預測,到2025年,中國將新增約3.4億個智慧型手機連接,其中中國當地為15億個,香港為1230萬個,澳門為190萬個,台灣為2570萬個,佔每10個連接中的9個。在中國,消費者對5G的興趣很高。從中國當地5G設備銷售佔有率的不斷成長就可以看出這一點。根據GSMA的《2021年行動經濟》預測,2020年5G智慧型手機銷量將達到1.63億部,佔智慧型手機總出貨量的近53%。

- 此外,對於預算有限的買家來說,全新的頂級旗艦智慧型手機並不總是一個選擇。高昂的價格以及機型之間巨大的更新換代壓力導致許多消費者放棄了傳統的智慧型手機升級週期。

- 雖然 5G 智慧型手機出現在翻新機市場還需要一段時間,但以舊換新已開始對市場格局產生影響。目前,翻新5G智慧型手機市場正式起步的時間有限。此外,5G等新技術的廣泛應用預計將導致以舊換新數量的增加,從而導致二手市場上的產品數量增加。

- 5G技術對二手產業的主要影響將是大量處理舊款3G和4G智慧型手機。隨著越來越多的消費者為了獲得更好的連接和網路速度而轉向 5G 技術,他們將拋棄舊的 3G 和 4G 智慧型手機。這可能會給銷售舊款行動電話的維修店帶來問題,尤其是在通訊業關閉 2G 和 3G 頻譜的情況下。

中國成熟智慧型手機產業概況

中國的翻新智慧型手機市場適度細分。為了滿足保險業不斷變化的需求,參與企業傾向於投資創新其產品。此外,參與企業也採取夥伴關係、合併和收購等策略活動來擴大其影響力。近期市場發展趨勢如下:

- 2022 年 3 月-iPhone 12 和 iPhone 12 Pro 機型在 Apple 官方認證翻新店推出。從 Apple 認證翻新店購買的產品包括新電池、新外觀、需要時更換的 Apple 原廠零件以及一年保固。

- 2021 年 11 月-華為中國官方網路商店已開始銷售經過認證的翻新高階行動電話。您可以以折扣價購買華為產品。行動電話是100%原廠的,配備新電池和HarmonyOS 2.0作業系統。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析(生態系統、通路、相關人員分析)

- COVID-19 對市場的影響

第5章 市場動態

- 市場促進因素

- 透過電子商務通路增加採用

- 來自市場領先供應商的有競爭力的定價和附加價值服務

- 市場問題

- 與新冠疫情相關的供應鏈中斷和智慧型手機需求整體下降所造成的短期影響;

- 近期中美貿易戰導致的進出口限制

第6章 競爭格局

- 公司簡介

- Samsung Electronics Co. Ltd.

- Apple Inc.

- Huawei

- Alibaba

- Amazon.com Inc.

- Verizon Communications Inc.

- AT & T

- Flipkart Internet Private Limited(Walmart Inc.)

- AliExpress

- Aukte Limited

第7章 市場展望市場展望

簡介目錄

Product Code: 90989

The China Refurbished Smartphone Market is expected to register a CAGR of 9.51% during the forecast period.

Key Highlights

- An increase in the upgrade cost has been one of the prominent reasons for the market's growth. An increase in the prices of premium smartphones has led to multiple consumers holding on to their phones much longer than expected. However, at the same time, this factor has also raised the average selling price of a pre-owned device.

- According to a report published in July 2021 by Zhuanzhuan Group, Apple is one of the prominent market players in the used smartphones category in China, which controls approximately 36.53% of the secondary market for smartphones. Further, the company was followed by regional giants such as Xiaomi with a market share of around 13.88% and closed the top three with Vivo, around 12.7%.

- Moreover, a higher percentage of refurbished devices are being sold with warranties. These phones can be insured with proof of purchase, which is significantly helping in overcoming consumer hesitancy towards the purchase of refurbished devices. For instance, Samsung offers certified pre-owned devices at heavy discounts. The main advantage of directly buying from Samsung is that consumers get a full one-year warranty, which is offered on a new product.

- The factor that may affect the market in the coming years is the evolution of the 5G network. Most smartphones have a minimum life of 24 months and can be used up to 5 years. However, with the emergence of the 5G network in the market, most of the 3G and 4G enables refurbished devices would be obsolete. It may, in turn, give rise to a huge pile of refurbished and used smartphones, which will be irrelevant in the developed nations as most of the population would be willing to follow the present technological trend of the market. For instance, according to a report by Zhuanzhuan Group, sales of used Honor devices increased by 88.34% in the Q2 of 2021. In general, the smartphone market grew by 10.76% in China compared to Q1 of 2021 since consumers are especially eager to buy devices with support for fifth-generation networks.

- The Covid-19 pandemic has severely disrupted the growth of industries worldwide due to nationwide lockdowns imposed in almost all the countries. The smartphone industry has also experienced economic changes due to the pandemic. As China is the global manufacturing center for most of these devices and components, and with similar trends on the demand side, the smartphone manufacturing industry has been adversely hit by delayed shipments and weakened development of next-generation products. Also, the region has been choked off by suppliers, workers, and logistics networks.

China Refurbished Smartphone Market Trends

Increased Adoption Through E-Commerce Channels

- The professional way of refurbishing where an old phone goes, several quality and performance check-ups means that the users, in most cases, are getting a quality device or at least what they are promised. The problem is that the refurbished industry is currently handled largely by offline stores, which tend to offer lower quality phones at higher prices and low reliability. This gives a bad name to refurbishing. However, with changing times and the rise of e-commerce and professional refurbishing, it is anticipated that the refurbished smartphone market will grow additionally with the involvement of major companies like Amazon, Cashify, and others that are dedicated to refurbishing and producing quality products will further strengthen the market and will bring the much-needed confidence in users for refurbished smartphones.

- The telecom operators are best positioned to play in the e-commerce economy. These companies are uniquely capable of generating both the used-phone supply and demand. With millions of available smartphones sitting idle in people's drawers and millions of 3G and 4G phones that are expected to be traded in as part of the 5G technology migration, operators can capitalize on this expanding supply pool to drive new subscriber growth and consumer affordability. To seize this opportunity, these companies require a well-defined re-commerce strategy that boosts and leverages a device's residual value and market price for a used smartphone at any point after its launch to potentially drive significant benefits in the business.

- Refurbished products have their area on Amazon, the regions, and the online store. Customers can trade their old smartphones for a discount on a new device at Amazon. The company inspects them and makes any necessary repairs to make them appear and work like new. After that, these devices are resold in the refurbished market. They're even covered by a limited guarantee from the merchant or manufacturer.

- Concerns about supply chains and chip shortages prop propel the refurbishing industry forward. To address this demand, businesses are turning to refurbished electronics suppliers, expected to drive the refurbished electronics market, particularly Smartphones.

- There's also a category called "manufacturer reconditioned," which distinguishes itself from fixes performed by local repair companies. This means that the manufacturer, like original equipment makers, repairs the phone with original components, confirms its functionality, and renews it in a "like new" state. This is what most people look for, and customers prefer refurbished smartphones.

Impact of 5G on Refurbished Smartphones

- In the current market, 5G technology is one of the most heavily invested technologies by several major corporations worldwide. 5G connectivity is also expanding the range of applications to enhance numerous sectors' efficiency. Consumers increasingly demand digital involvement and personalized experiences as technology in cellphones becomes more prevalent. Furthermore, the increased willingness of government bodies to adopt and commercialize 5G technology is expected to benefit the industry under study. The 5G device ecosystem is expanding in terms of the many device pricing tiers and operating systems available on the market.

- According to GSMA's Mobile Economy China 2021, China will be adding around 340 million smartphone connections by 2025, with adoption rising to 9 in 10 connections with 1.5 billion in Mainland China, 12.3 million in Hong Kong, 1.9 million in Macao, and 25.7 million in Taiwan. The consumer willingness for 5G adoption is high in China. This is evident in mainland China's growing share of 5G device sales. According to GSMA's Mobile Economy 2021, 163 million 5G smartphones were sold in 2020, accounting for nearly 53% of total smartphone shipments.

- Additionally, the brand new, top-of-the-line flagship smartphones are not always an option for buyers on a budget. The hefty price tags and underwhelming advancements between the models have seen multiple consumers turning their back on the conventional smartphone upgrade cycle.

- Although 5G smartphones will take a while to hit the refurbished segment, trade-ups are starting to impact the market landscape. For now, the time has been limited for the refurbished market for 5G phones itself to properly get going. Also, any large uptake of new technology such as 5G is anticipated to drive increased trade-in volumes and, consequently, more products entering the secondary market.

- A major impact of 5G technology on the refurbished industry can be huge dumps of older technology 3G and 4G compatible smartphones. As more and more consumers move to 5G technology with respect to better connectivity and internet speed, they will discard their older 3G and 4G smartphones. This can be problematic for refurbishers to sell obsolete technology phones, especially when telecom industries shut down their 2G and 3G spectrums.

China Refurbished Smartphone Industry Overview

The China Refurbished Smartphone market is moderately fragmented. Players tend to invest in innovating their product offerings to cater to the insurance industry's changing demands. Moreover, players adopt strategic activities like partnerships, mergers, and acquisitions to expand their presence. Some of the recent developments in the market are:

- March 2022 - The iPhone 12 and iPhone 12 Pro models have been introduced to Apple's official Certified Refurbished store. A new battery, a new outer shell, authentic Apple part replacements (if necessary), and a one-year warranty are included with products purchased from Apple's Certified Refurbished store.

- November 2021 - Huawei's official online store in China has begun selling certified reconditioned premium cellphones. Huawei products are available at discounted pricing for purchasers. The phones are 100% original, with new batteries and the HarmonyOS 2.0 operating system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis (ecosystem, distribution channel, and stakeholder analysis)

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased adoption through e-commerce channels

- 5.1.2 Competitive pricing and value-added services from major vendors in the market

- 5.2 Market Challenges

- 5.2.1 Short terms of impact of the COVID related supply chain disruptions and general decline in demand for smart phones

- 5.2.2 China-US Trade war leading to considerable import-export constraints in the recent years.

6 Competitive Landscape

- 6.1 Company Profiles

- 6.1.1 Samsung Electronics Co. Ltd.

- 6.1.2 Apple Inc.

- 6.1.3 Huawei

- 6.1.4 Alibaba

- 6.1.5 Amazon.com Inc.

- 6.1.6 Verizon Communications Inc.

- 6.1.7 AT & T

- 6.1.8 Flipkart Internet Private Limited (Walmart Inc.)

- 6.1.9 AliExpress

- 6.1.10 Aukte Limited

7 MARKET OUTLOOK

02-2729-4219

+886-2-2729-4219