|

市場調查報告書

商品編碼

1644652

編碼和標記解決方案:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Coding And Marking Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

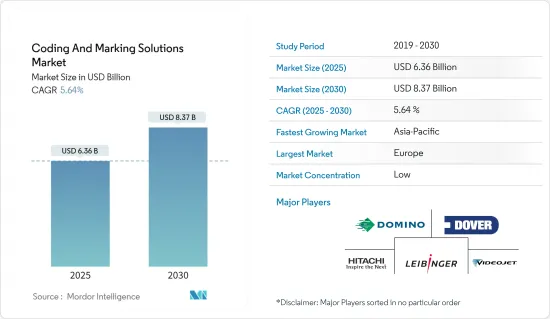

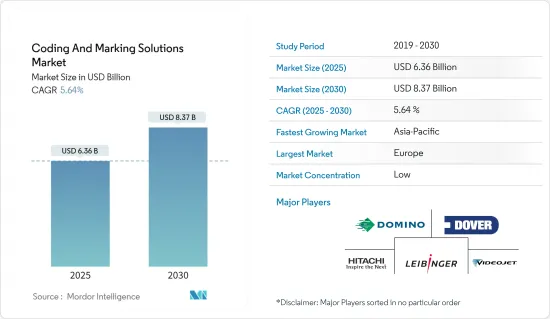

編碼和標記解決方案市場規模預計在 2025 年為 63.6 億美元,預計到 2030 年將達到 83.7 億美元,預測期內(2025-2030 年)的複合年成長率為 5.64%。

主要亮點

- 編碼和標記是包裝消費品和工業生產和物流過程的重要組成部分。使用編碼和標記技術將製造日期、批號、有效期限等產品相關資訊列印在包裝上。零售業的良好前景以及食品和飲料、化妝品、化學品、藥品以及建築材料等主要終端行業的需求正在影響市場需求。

- 在汽車、醫療保健、化學、建築、半導體和電子、食品和飲料等行業中,編碼和標記系統用於列印批號、政府識別碼以及在初級和二級包裝材料上的標籤的使用越來越廣泛,這為它們提供了巨大的成長機會。

- 編碼和標記設備用於將膠囊、粉末、液體和軟膏等各種物品包裝到瓶子、管子、紙箱和其他包裝類型中,以用於醫療保健和製藥行業。由於嚴格的法規和品牌保護,醫療保健和製藥領域對編碼和標記設備的使用正在增加,為市場擴張提供了潛力。

- 可在多種基材上進行連續印刷,包括瓦楞紙板、軟性薄膜、罐頭、玻璃、塑膠、木材、金屬、PET和聚丙烯(PP)。此技術的最大優點是,較高的墨滴速度使得列印頭和基板之間能夠有較大的距離,而較高的墨滴噴射頻率使得列印速度較高。這一市場是由工業界採用連續噴墨技術所推動的,該技術具有速度快、多功能且易於使用等特點。

- 編碼和標記設備的價格取決於技術整合、應用、尺寸和耗材類型。因此,編碼和標記設備的價格差異很大。因此,編碼和標記設備的高成本限制了新興國家對價格敏感的工業用戶的採用。因此,高價是市場成長的一大障礙。

編碼和標記解決方案市場趨勢

食品和飲料行業預計將佔據最大的市場佔有率

- 食品包裝擴大使用編碼和標記技術來標記產品。隨著全球對食品品質和安全的要求不斷提高,食品製造商正在轉向高解析度編碼和標記來識別包裝食品上的必要資訊。

- 食品和飲料行業的資訊顯示和標籤的監管要求為編碼和標記系統製造商提供了寶貴的機會。對此類高品質代碼和標記的接受,以及對其能夠快速有效地列印食品友善資訊的認可,正在推動市場成長。

- 高速、高功率飲料產業的製造商正在應對影響業務效率的客戶行為變化。寶特瓶正在逐步淘汰,由可回收鋁等不同材料製成的容器正變得越來越普遍。飲料公司正透過對其包裝流程以及編碼和標籤系統進行現代化改造來應對這一問題。

- 根據美國人口普查局估計,2023年美國零售食品和飲料銷售額約為836.91億美元。為了確保消費者安全和產品資訊的透明度,食品和飲料行業受到多項法規和標籤要求的約束。

- 不斷成長的銷售額導致製造商需要編碼和標記解決方案,以使製造商能夠遵守這些法規並滿足所需的標準。

亞太地區可望創下最快成長

- 亞洲是世界上變化最快的食品市場之一,因此食品創新,特別是包裝和安全的創新至關重要。由於消費者需求的快速變化、氣候變遷帶來的挑戰以及人口的不斷成長,該地區的食品產業各個方面(包括包裝)都在不斷發展。

- 智慧包裝,包括2D碼和 RFID 標籤,將使消費者和企業能夠追蹤食品的來源、品質和新鮮度。這對先進的編碼和標記解決方案的需求日益成長,以跟上這些新興技術。

- 歐洲是編碼和標記系統的重要市場,因為它擁有世界上最嚴格的食品和飲料行業監管機構,並且是世界上一些最大的製藥公司的所在地。此外,由於對編碼和標記系統的需求不斷增加,預計亞太地區將在預測期內實現最快的成長。

- 亞太地區在編碼和標記系統市場佔據主導地位,中國在研發支出和高科技系統採用方面處於領先地位。

- 中國食品藥物監督(SFDA)法規的主要目的是保護人們免受假藥和中藥的侵害。法規還要求為不同的包裝單元分配唯一的產品標識符,即“電子代碼”,必須透過藥品電子監督系統進行匹配和檢驗。

- 「e-Code」需要高解析度列印,以確保程式碼清晰可讀,以供檢驗。這對具有卓越列印解析度和耐用性的高品質印表機和標記解決方案的需求不斷增加。

- 據韓國海關總署 (KCS) 稱,韓國還要求對某些產品進行標籤和標記,包括藥品、有機食品、機能性食品和透過生物技術生產的食品。由於食品和飲料行業對包裝食品的消費量不斷增加,編碼和標記解決方案市場也隨之成長。

- 根據中國國家統計局的報告,2023年12月中國醫藥零售交易金額為96.4億美元,較2023年4月的74.1億美元大幅增加。隨著藥品銷售量的增加,需要加強產品可追溯性以確保藥品的真實性和安全性。編碼和標記解決方案提供了透過供應鏈追蹤產品、防止假冒和確保符合監管標準所需的技術。

編碼和標記解決方案行業概覽

編碼和標記解決方案市場由以下主要參與者細分: Videojet Technologies Inc.、Hitachi Ltd、REA Electronik GmbH、Dover Corporation、Keyence Corporation 和 Koenig & Bauer Coding GmbH。

- 2024 年 6 月,全球知名編碼和標記技術公司 LEIBINGER 及其老牌合作夥伴 Qualijet 將進軍 Fispal Tecnologia。 IQJET 亮相並將在巴西首次亮相。智慧編碼和標記系統 IQJET 將與 LEIBINGER 成熟的解決方案一起成為巴西最負盛名的食品和飲料行業盛會的焦點。

- 2024 年 1 月:MarkemImaje 推出標記觸發器,提高了其 Direct Coder 機器的靈活性。雖然某些應用允許直接在輸送機上直接印刷,但某些產品和物體的尺寸、形狀和性質使得編碼更加複雜,特別是在航空和汽車等領域。

- 2023 年 5 月 Markemimag 是 Dover 旗下一家公司,也是端到端噴墨供應鏈解決方案以及工業和編碼和標記系統的全球供應商,宣布推出 9750 E 連續列印系列,為市場帶來擠出領域的行業首創創新。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場動態

- 市場促進因素

- 生產包裝產業的擴張和創新包裝技術的採用增加

- 各產業供應鏈對產品追溯解決方案的需求日益增加

- 市場限制

- 安裝編碼和製造設備的初始成本和持續成本高昂

- 應用見解(各種應用中編碼和標記效用的指示性佔有率(%)、趨勢等)

- 零件識別

- 品牌認知與識別

- 可追溯性和防偽

第6章 市場細分

- 按解決方案

- 裝置

- 液體和絲帶

- 空閒的

- 按設備

- 熱感噴墨 (TIJ) 印表機

- 連續噴墨 (CIJ) 印表機

- 雷射印表機

- 其他設備

- 按最終用戶產業

- 藥品

- 建造

- 飲食

- 化妝品

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Videojet Technologies Inc.

- Hitachi Ltd

- REA Elektronik GmbH

- Dover Corporation

- Domino Printing Sciences PLC

- Control Print Ltd

- Keyence Corporation

- Matthews International Corporation

- Leibinger Group

- Koenig & Bauer Coding GmbH

第8章投資分析

第 9 章:未來趨勢

簡介目錄

Product Code: 91022

The Coding And Marking Solutions Market size is estimated at USD 6.36 billion in 2025, and is expected to reach USD 8.37 billion by 2030, at a CAGR of 5.64% during the forecast period (2025-2030).

Key Highlights

- Coding and marking are critical components of the production and intralogistics processes for packaged consumer and industrial goods. Product-related information, such as the manufacturing date, batch number, and expiration date, is printed on the packaging using coding and marking techniques. The promising outlook for the retail sector and the demand in important end-use industries such as food and beverage, cosmetics, chemicals, pharmaceuticals, and construction and building materials influence the demand in the market.

- The growing use of coding and marking systems for printing batch numbers, government identification codes, and printing labels on primary and secondary packaging materials in industries such as automotive, healthcare, chemical, construction, semiconductor and electronics, and food and beverage presents significant growth opportunities.

- Coding and marking equipment are used in packaging various items such as capsules, powders, liquids, and ointments in bottles, tubes, cartons, and other packaging types in the healthcare and pharmaceutical industries. Due to stringent regulations and brand protection, the use of coding and marking equipment in the healthcare and pharmaceutical sectors is increasing, providing potential for market expansion.

- Continuous printing can be implemented on various substrates, including cardboard, flexible films, cans, glass, plastic, wood, metal, PET, and polypropylene (PP). The high velocity of the ink droplets, which allows for a substantial distance between the printhead and the substrate, and the high drop ejection frequency, which enables high-speed printing, are significant advantages of this technique. The market is driven by the deployment of continuous inkjet technology in industries, which offers high speed, versatility, and ease of use.

- The pricing of coding and marking devices is determined by technological integration, applications, size, and the type of consumables utilized. As a result, there is a substantial variation in the pricing of coding and marking machines. Therefore, the high price of coding and marking devices restricts their adoption by price-sensitive industrial users from emerging nations. As a result, high prices have been cited as a significant barrier to the market's growth.

Coding And Marking Solutions Market Trends

The Food and Beverage Segment is Expected to Hold the Highest Share in the Market

- Food packaging is increasingly using coding and marking methods to label the products. Food manufacturers are utilizing high-resolution coding and marking to identify the necessary information on packaged food goods as the demand for food quality and safety has risen across the world.

- Regulatory requirements regarding information display and labeling in the food and beverage industry present a valuable potential for coding and marking system manufacturers. The acceptance and awareness of such high-quality codes and marks to quickly and efficiently print food-good information propels the market's growth.

- Manufacturers in the high-speed and high-output beverage business deal with changing customer behavior, which influences operational efficiency. PET bottles are being phased out in favor of containers made of different materials, such as recyclable aluminum. Beverage companies respond by modernizing their packaging processes and coding and labeling systems.

- In 2023, retail food and beverage stores in the United States raked in sales of around USD 83,691 million, as per the US Census Bureau's estimates. To ensure consumers' safety and product information transparency, the food and beverage sector is governed by several rules and labeling requirements.

- The growth in sales is leading to a need for coding and marking solutions that can meet the required standards, driven by manufacturers' compliance with these regulations.

Asia-Pacific is Expected to Register the Fastest Growth Rate

- Innovations in food, particularly in terms of packaging and safety, are crucial in Asia because it has one of the fastest-changing food markets in the world. Every aspect of the food industry in the area, including packaging, is constantly evolving because of the rapidly shifting consumer demands, the challenges posed by climate change, and the region's continually growing population.

- Smart packaging, including QR codes and RFID tags, allows consumers and businesses to track the origin, quality, and freshness of food products. This increases the demand for sophisticated coding and marking solutions for these advanced technologies.

- Europe is one of the significant markets for coding and marking systems due to the existence of some of the world's stringent regulatory agencies for the food and beverage industry and the presence of some of the world's largest pharmaceutical firms. Additionally, Asia-Pacific is expected to register the fastest growth during the forecast period due to the region's rising need for coding and marking systems.

- Asia-Pacific dominates the coding and marking systems market, with China leading the way in terms of R&D spending and adoption of high-technology systems.

- The primary objective of the Chinese State Food and Drug Administration's (SFDA) regulations is to safeguard people from counterfeit pharmaceuticals and traditional Chinese medicines. This regulation also mandates the assignment of unique product identifiers known as 'eCodes' at various packaging units and a level of combination and verification through the drug electronic supervision system.

- 'eCodes' require high-resolution printing to ensure the codes are clear and readable for verification purposes. This pushes the need for high-quality printers and marking solutions that offer superior print resolution and durability.

- South Korea has also mandated labeling and marking requirements for certain products, such as pharmaceuticals, organic food, functional food, and food produced through biotechnology, according to the Korean Customs Service (KCS). The coding and marking solutions market expanded by increasing the consumption of packaged meals in food and beverage.

- In December 2023, China's retail trade in medicine generated USD 9.64 billion, marking a significant increase from USD 7.41 billion recorded in April 2023, as reported by the National Bureau of Statistics of China. With the rise in pharmaceutical sales, there is a corresponding need for enhanced product traceability to ensure the authenticity and safety of medications. Coding and marking solutions provide the necessary technology to track products through the supply chain, preventing counterfeiting and ensuring compliance with regulatory standards.

Coding And Marking Solutions Industry Overview

The coding and marking solutions market is fragmented due to significant players such as Videojet Technologies Inc., Hitachi Ltd, REA Electronik GmbH, Dover Corporation, Keyence Corporation, and Koenig & Bauer Coding GmbH.

- June 2024: LEIBINGER, a prominent global coding and marking technology entity, and its established partner Qualijet are set to make a notable entry at Fispal Tecnologia. They are set to announce the IQJET, marking its debut in Brazil. Positioned in intelligent coding and marking systems, IQJET will take center stage alongside LEIBINGER's array of proven solutions at Brazil's premier food and beverage industry event.

- January 2024: MarkemImaje introduced a marking trigger that will increase the flexibility of its Direct Coder equipment on a broad range of surfaces and sizes, e.g., objects as large as an airplane's wings. While some applications can be printed directly on a conveyor, specific products or objects are more complex to code due to their size, shape, and nature, especially in sectors such as aeronautics and automobiles.

- May 2023: MarkemImaje, part of Dover and a global provider of end-to-end inkjet supply chain solutions and industrial and marking coding systems, announced the launch of the 9750 E continuous printing range, bringing to the market industry's first innovations in the extrusion sector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Expansion of the Production and Packaging Industry and Increasing Adoption of Creative Packaging Techniques

- 5.1.2 Increasing Demand for Product Traceability Solutions Across the Supply Chain of Various Industries

- 5.2 Market Restraints

- 5.2.1 High Upfront and Operational Costs for Deploying Coding and Making Equipment

- 5.3 Application Insights (Indicative share (%) of Utility of Coding and Marking in Various Applications, Trends, etc.)

- 5.3.1 Component Identification

- 5.3.2 Brand Recognition and Identification

- 5.3.3 Traceability and Counterfeiting

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 Equipment

- 6.1.2 Fluids and Ribbons

- 6.1.3 Spares

- 6.2 By Equipment

- 6.2.1 Thermal Inkjet (TIJ) Printer

- 6.2.2 Continuous Inkjet (CIJ) Printer

- 6.2.3 Laser Printer

- 6.2.4 Other Equipment

- 6.3 By End-user Industry

- 6.3.1 Pharmaceutical

- 6.3.2 Construction

- 6.3.3 Food and Beverage

- 6.3.4 Cosmetics

- 6.3.5 Other End-user Industry

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Videojet Technologies Inc.

- 7.1.2 Hitachi Ltd

- 7.1.3 REA Elektronik GmbH

- 7.1.4 Dover Corporation

- 7.1.5 Domino Printing Sciences PLC

- 7.1.6 Control Print Ltd

- 7.1.7 Keyence Corporation

- 7.1.8 Matthews International Corporation

- 7.1.9 Leibinger Group

- 7.1.10 Koenig & Bauer Coding GmbH

8 INVESTMENTS ANALYSIS

9 FUTURE TRENDS

02-2729-4219

+886-2-2729-4219