|

市場調查報告書

商品編碼

1644655

支援 GNSS 的消費性設備:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)GNSS-Enabled Consumer Device - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

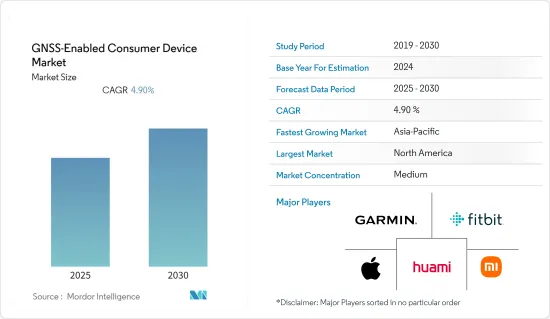

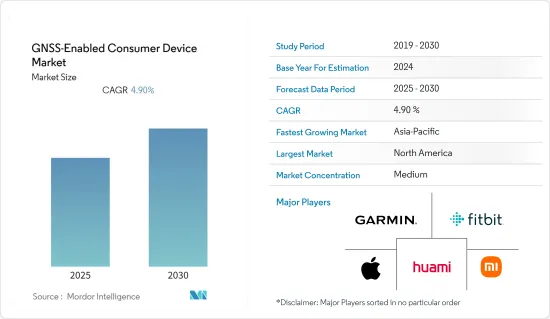

預計預測期內,支持 GNSS 的消費性設備市場將以 4.9% 的複合年成長率成長。

物聯網 (IoT) 和使用位置資訊的穿戴式設備的日益普及正在推動對 GNSS 接收器 LSI 的需求。由於物聯網及穿戴式裝置應用於惡劣、不穩定的通訊環境中,需要確保精準定位和高可靠的通訊。此外,由於設備尺寸的限制,電池需要小型化,但接收衛星訊號和使用GNSS功能確定位置會消耗大量電量,從而縮短電池壽命。因此,各大科技公司正在開發並發布增強穿戴式裝置功能的新產品。

此外,新一代Android智慧型手機配備了高效能全球導航衛星系統(GNSS)晶片,能夠追蹤雙頻多衛星群資料。此外,從Android 9版本開始,使用者可以停用佔空比省電選項,從而獲得更高品質的偽距和載波相位原始資料。此外,PPP(精密單點定位)演算法的應用也變得更加有趣。本研究旨在評估小米首款搭載Broadcom BCM47755的雙頻GNSS智慧型手機的PPP效能。透過比較小米與單頻智慧型手機三星S8的效能,可以凸顯取得雙頻資料的優勢。小米的垂直精度達到了0.51米,水平精度達到了6米,而三星的水平和垂直精度均為15米,水平誤差為5.64米。

小型工業資產追蹤器用於工業資產追蹤應用,旨在管理大量支援 GPS 的資產標籤,以檢查小包裹、箱子、滾籠、牲畜以及整個龐大的供應鏈。只有將維護工作量保持在最低限度、主要集中於保持追蹤器供電的情況下,這些才有可能在重型應用中生存。透過使用一系列基於硬體和韌體的調整來最佳化追蹤效能與功耗的比率,可以顯著延長電池壽命。然而,在低功耗資產追蹤和相關應用中實現雄心勃勃的功耗目標是一項挑戰。將 GNSS接收器整合到最終產品中的方法有很多,其中一些方法比其他方法更節能。

2022 年 2 月,總部位於科羅拉多的 Dronee 宣布準備推出“Loko”,這是一款開放原始碼資產追蹤器,旨在將 GNSS 支援與遠距、低功耗 LoRa 無線上行鏈路相結合,一次充電即可進行長達一年的追蹤。該設備具有較長的電池壽命,內建電池一次充電即可運行 30 天至一年以上,具體取決於您傳輸位置的頻率。

COVID-19 催生了多種新應用,並增加了 GNSS 晶片的使用。例如,COVID-19 增加了供應鏈中準確運輸和追蹤資產的需求。有效利用 GNSS 來監控和執行隔離,透過稱為地理圍欄的過程為自我隔離的人設置虛擬邊界。通常,位置資料將從智慧型手機和其他支援設備收集,並用於在自我隔離被打破時通知當地當局。

支持 GNSS 的消費性設備市場趨勢

智慧型手機市場可望推動市場成長

儘管歐盟28國、北美和中國等成熟市場的智慧型手機已經飽和,但智慧型手機的出貨量仍超過使用 GNSS 晶片的設備的出貨量。智慧型手機已經使用 GNSS 晶片很長一段時間了。大多數情況下,這些晶片支援所有公開的衛星網路,包括 GPS、GLONASS 和 Galileo。然而,與專用導航設備相比,這些解決方案的準確性較低。

此外,智慧型手機硬體市場的一定程度的壟斷限制了GNSS晶片的範圍。高通硬體通常不包括博通 GNSS 晶片,反之亦然。但近年來,這種情況正在改變。此外,歐盟委員會也核准了相關法規,要求新上市的智慧型手機必須配備衛星和 Wi-Fi定位服務。根據該法規,配備全球導航衛星系統 (GNSS) 功能的晶片組將能夠存取伽利略,這是一個提供精確位置和計時資訊的歐盟衛星系統。八個歐盟國家遵守此規定並使用符合伽利略標準的晶片組。

據歐洲GNSS機構稱,超過95%的衛星導航晶片組市場在其新產品中支援伽利略,其中包括博通、高通和聯發科等多家智慧型手機晶片組製造商。隨著主要 GNSS 晶片組供應商生產伽利略晶片組並且全球智慧型手機品牌已將這些晶片組納入其最新的智慧型手機型號,預計市場在預測期內將經歷進一步的成長機會。

此外,Google表示,在都市區中,行人每天使用智慧型手機進行超過 10 億次更正,導致他們走錯了街道或城區。 2021 年,博通宣布了一項新解決方案,該解決方案透過將博通的雙頻 GNSS BCM47765 晶片與一項新的 Android 服務相結合,顯著提高了行人導航的精確度,該服務使用該公司的 3D 建築模型透過複雜的 GNSS 反射射線建模提供 GNSS 輔助。

自 Android 7.0 發布以來,就可以在運行 Android 的智慧型手機上存取原始追蹤的 GNSS 測量值。這些 GNSS 觀測資料可直接利用特殊的自研演算法和校正資料來估計使用者的位置。智慧型手機擁有簡單且經濟高效的 GNSS 晶片和天線,但它們提供的測量品質較差,這帶來了挑戰。此外,大多數智慧型手機僅在一個頻率上提供一個頻率的 GNSS 測量。

精密單點定位(PPP)是全球導航衛星系統(GNSS)資料最有前景的處理技術之一。該技術的獨特之處在於它使用精確的衛星產品(軌道、時鐘、偏差)並應用先進的演算法來估計用戶的位置。與相對定位方法相比,PPP 不依賴附近的參考站或本地參考網路。此外,PPP 非常靈活,考慮到智慧型手機上(單頻)GNSS 測量的挑戰,這也是一個優勢。

亞太地區市場預計將實現高成長

2021年3月,中國發布「十四五」規劃。該計劃涉及未來五年發展的方面,並概述了中國2035年的願景。 「十四五」規劃高度重視研發和創新,對中國GNSS產業影響深遠。 「深化北斗系統推廣利用,推動產業高品質成長」被提出作為國家重大戰略計劃和規劃政策指南。該戰略可望推動全球導航衛星系統產業研發,促進北斗的產業應用,並加速關鍵核心技術的進步。

2021年5月18日,中國衛星定位與位置資訊服務協會(GLAC)在京發布《中國衛星定位與定位服務產業發展白皮書(2021年版)》,總結2020年GNSS產業發展。白皮書顯示,2020年中國衛星導航與定位服務產業總產值達4,033億元人民幣(約627.5億美元),較2019年成長16.9%。

該地區的公司正在將新功能融入現有產品並開發新產品以滿足客戶的多樣化需求。例如,2022年4月,ComNavTechnology向全球市場推出了P300系列GNSS平板電腦。基於K8平台的高精度GNSS車載安卓加固平板,為精密農業、自動駕駛、機器控制等產業提供業界領先的性能與易用性。 P300 系列 GNSS 平板電腦配備新一代 K8 OEM模組,能夠追蹤所有當前和計劃中的星座(包括 GPS、北斗、北斗全球、GLONASS、伽利略和 QZSS),並實現厘米級精度。 P300系列GNSS平板電腦採用先進的QUANTUMTM III技術,升級的SinoGNSS ASIC晶片和先進的微處理器單元,提供更好的定向和定位性能,適合日常現場使用。

此外,2021年12月,聯發科宣布其用於下一代旗艦智慧型手機的5G智慧型手機晶片Dimensity9000已被OPPO、Vivo、小米和榮耀等一些全球領先智慧型手機品牌的設備製造商採用和認可。首款搭載天璣9000的旗艦智慧型手機預計將於2022年第一季上市。該處理器支援最新的Wi-Fi、藍牙和GNSS標準,為智慧型手機用戶提供無縫的通訊體驗。

自從資訊科技和行動電話技術出現以來,各國都嚴重依賴基於PVT的應用。目前全球有四大GNSS系統:美國的GPS、俄羅斯的GLONASS、歐盟的伽利略、中國的北斗。此外,印度的 NavIC 和日本的 QZSS 是兩個區域導航衛星系統,可在指定覆蓋區域提供導航訊號。

支持 GNSS 的消費性設備產業概覽

支持 GNSS 的消費性設備市場已適度整合。市場參與者傾向於投資新的和先進的產品創新,以滿足各個行業的需求。此外,市場參與者正在採取夥伴關係、合併和收購等策略活動來擴大其影響力。最近的市場發展趨勢包括:

2022 年 3 月-Trimble 和 Qualcomm Technologies, Inc. 宣佈為 Snapdragon 8 Gen 1 和 Snapdragon 888 行動平台提供 Trimble RTX GNSS 技術。這項技術使世界各地的高階 Android 智慧型手機擁有卓越的定位功能。 Trimble RTX GNSS 技術(一種校正服務平台)與驍龍的整合將有助於提供更高品質、更準確的基於位置的使用者體驗,包括具有車道級導引的車載導航。

2021 年 8 月-三星電子宣布推出用於穿戴式裝置的新型處理器 Exynos W920。新處理器整合了 LTE 調變解調器,採用先進的 5 奈米(nm)極紫外線製程節點製造,可提供下一代穿戴式裝置所需的強大且高效的性能。 Exynos W920 內建 GNSS L1 接收器(GPS、GLONASS、北斗、伽利略),可讓您在戶外活動期間追蹤速度、距離和高度。它還配備了4G LTE Cat.4數據機。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業相關人員分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- 智慧型手機出貨量日趨成熟,穿戴式裝置和追蹤設備推動 GNSS 市場發展

- 市場挑戰

- 電力複雜性

- 市場機會

- 支援 GNSS 的消費設備的新興應用(擴增實境、機器人、行動醫療、地理行銷和廣告、欺詐管理和收費、安全和緊急等)

- COVID-19 對市場的影響

第6章 市場細分

- 依設備類型

- 智慧型手機

- 平板電腦和穿戴式裝置

- 個人追蹤設備

- 低功耗資產追蹤器

- 其他設備類型

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Apple Inc.

- Garmin Ltd

- Fitbit(Google)

- Samsung

- Huami Corporation

- Fossil Group Inc.

- Samsung Electronics Co. Ltd

- Huawei Technologies Co. Ltd

- Xiaomi

第8章投資分析

第9章:市場的未來

The GNSS-Enabled Consumer Device Market is expected to register a CAGR of 4.9% during the forecast period.

Escalating the Internet of Things (IoT) usage and wearable devices that use location information has increased the demand for GNSS receiver LSIs. Precise positioning and reliable communications must be ensured for the proper operation of IoT and wearable devices, which are used even in challenging communication environments and unstable conditions. Further, device size constraints necessitate a compact battery, whereas satellite signal reception and positioning when using GNSS functionality consume a lot of power, resulting in poor battery life. Therefore, various technology companies are developing and launching new products that augment the capabilities of wearable devices.

Further, the new generation of Android smartphones is equipped with high-performance Global Navigation Satellite System (GNSS) chips capable of tracking dual-frequency multi-constellation data. Moreover, starting from Android version 9, users can disable the duty cycle power saving option; thus, better quality pseudo-range and carrier phase raw data are available. Also, applying the Precise Point Positioning (PPP) algorithm has become more interesting. This work aims to assess the PPP performance of the first dual-frequency GNSS smartphone produced by Xiaomi equipped with a Broadcom BCM47755. The advantage of acquiring dual-frequency data is highlighted by comparing the performance obtained by Xiaomi with that of a single-frequency smartphone, the Samsung S8. The vertical and horizontal accuracy achieved by Xiaomi is 0.51 m and 6 m, respectively, while those achieved by Samsung are 5.64 m for 15 m for horizontal and vertical.

Small industrial asset trackers used in industrial asset tracking applications are designed for managing a large fleet of GPS-enabled asset tags to keep checks on parcels, boxes, roll cages, livestock, and across vast supply chains. These may only become viable in heavy applications if maintenance efforts, primarily focused on keeping trackers powered up, are kept to a minimum. The battery longevity can be extended considerably by using a series of hardware and firmware-based tweaks to optimize the proportion between tracking performance and power consumption. But meeting ambitious power consumption targets in low-power asset tracking and related applications can be challenging. There are many ways to integrate GNSS receivers into an end-product, some of which are more power-efficient than others.

In February 2022, Colorado-based Dronee announced that it is preparing to launch an open-source asset tracker, Loko, designed to combine GNSS support with a long-range low-power LoRa radio uplink, with up to a year of tracking per charge. A USP of the device is a long battery life, which can work for over 30 days to a year per charge of its internal battery, depending on how frequently it transmits its position.

Multiple new applications sprang up due to COVID-19, increasing the usage of GNSS chips. For instance, COVID-19 has increased the need for supply-chain assets to be transported and tracked with precision. The effective use of GNSS has been for quarantine monitoring and enforcement, where it is used to set up a virtual perimeter for those who are in self-quarantine through a process known as geofencing. In general, the location data is gathered from a smartphone or other supporting device and is utilized to inform local authorities when the self-quarantine is breached.

GNSS-Enabled Consumer Device Market Trends

The Smartphones Segment is Expected to Considerably Drive the Market's Growth

Despite considerable saturation of mature markets, such as EU28, North America, and China, for smartphones, the shipments of smartphones still outnumber devices using GNSS chips. Smartphones have been using GNSS chips for a considerable time. In most cases, these chips support all publicly available satellite networks, such as GPS, GLONASS, Galileo, etc. However, when compared to dedicated navigation devices, these solutions were less accurate.

Additionally, a degree of monopoly in the smartphone hardware market limited the scope for GNSS chip installations. Qualcomm hardware usually does not include Broadcom GNSS chips and vice versa, as they are prime competitors. But in recent years, this scenario has been changing. Moreover, the European Commission has approved a regulation mandating that new smartphones launched in the market will have to include satellite and Wi-fi location services. According to the regulation, chipsets enabled with the Global Navigation Satellite System (GNSS) capabilities will likely have access to the EU's satellite system Galileo, which provides accurate positioning and timing information. Eight EU countries have been following this regulation and are using Galileo-compatible chipsets.

According to the European GNSS Agency, over 95% of the satellite navigation chipset supply market supports Galileo in new products, including various manufacturers of smartphone chipsets like Broadcom, Qualcomm, and Mediatek. With leading GNSS chipset providers producing Galileoreadychipsets and global smartphone brands already integrating these chipsets in their latest smartphone models, the market is expected to have further growth opportunities in the forecasted period.

Further, according to Google, more than 1 billion fixes per day from pedestrians' smartphones in cities are on the wrong side of the street or the wrong city block. In 2021, Broadcom launched a new solution that significantly improves accurate walking navigation by combining the Broadcom dual-frequency GNSS BCM47765 chip and a new Android service that provides GNSS assistance through complex GNSS reflection ray modeling using their 3D building models.

Since the release of Android 7.0, raw GNSS measurements tracked by smartphones operating with Android can be accessed. These GNSS observations can be used directly to estimate the user position with specialized self-developed algorithms and correction data. Since smartphones are equipped with simple, cost-effective GNSS chips and antennas, so they provide challenging, low-quality measurements. Furthermore, most smartphones offer GNSS measurements on just one frequency.

Precise Point Positioning (PPP) is one of the most promising processing techniques for Global Navigation Satellite System (GNSS) data. The technique is characterized by using precise satellite products (orbits, clocks, and biases) and applying sophisticated algorithms to estimate the user's position. In contrast to relative positioning methods, PPP does not rely on nearby reference stations or a regional reference network. Furthermore, PPP is very flexible, which is another advantage considering smartphones' challenging nature of (single frequency) GNSS measurements.

The Asia-Pacific Region is Expected to Witness a High Market Growth

In March 2021, China rolled out its 14th five-year plan; it is a plan touching on all aspects of development over the next five years and presenting China's 2035 vision. The 14th Five-Year Plan's persistent emphasis on R&D and innovation substantially impacts China's GNSS industry. "Deepen the promotion and use of BeiDousystems; Promote the industry's high-quality growth" is advocated as a policy guideline in the plan as an important national strategic project. The strategy is expected to signify a boost in GNSS industry research and development, the promotion of BeiDou'sindustrial application, and the acceleration of important core technology advancements.

The GNSS & LBS Association of China (GLAC) presented a White Paper on the Development of China's Satellite Navigation and Location Services Industry (2021) on May 18, 2021, in Beijing, summarising the GNSS industry's development in 2020. According to the White Paper, the overall output value of China's satellite navigation and location services business reached CNY 403.3 billion (about USD 62.75 billion) in 2020, up 16.9% from 2019.

The firms in the region are incorporating new features in the existing products or developing new products to meet the wide needs of the customer. For instance, in April 2022, The P300 Series GNSS Tablet was offered to the global market by ComNavTechnology. The high-precision GNSS in-cab Android rugged tablet, based on the K8 platform, delivers extreme, industry-leading performance and ease of use to precision agriculture, autonomous driving, machine control, and other industries. The P300 series GNSS tablet, which is equipped with a new generation K8 OEM module, can track all current and planned constellations (including GPS, BeiDou, BeiDouGlobal, GLONASS, Galileo, and QZSS) and achieve centimeter-level precision. The P300 series GNSS tablet uses advanced QUANTUMTM III technology in conjunction with an upgraded SinoGNSSASIC chip and advanced Microprocessor unit to provide improved heading and positioning performance for everyday field use.

Furthermore, in December 2021, MediaTek announced device maker acceptance and endorsements from some of the world's leading smartphone brands, including OPPO, Vivo, Xiaomi, and Honor, for its Dimensity9000 5G smartphone chip for next-generation flagship smartphones. The first flagship smartphones powered by the Dimensity9000 will hit the market in the first quarter of 2022. Because the processor supports the newest Wi-Fi, Bluetooth, and GNSS standards, smartphone users can experience seamless communication.

Since introducing information and mobile phone technologies, various countries have relied heavily on PVT-based applications. Currently, four GNSS systems are available worldwide: GPS from the United States, GLONASS from Russia, Galileo from the European Union, and BeiDoufrom China. Also, NavICfrom India and QZSS from Japan are two regional navigation satellite systems that provide navigation signals for the stated coverage area.

GNSS-Enabled Consumer Device Industry Overview

The GNSS-enabled Consumer Device market is moderately consolidated. The market players tend to invest in innovating new and advanced product offerings to cater to the needs of various industries. Moreover, the market players adopt strategic activities like partnerships, mergers, and acquisitions to expand their presence. Some of the recent developments in the market are:

March 2022 - Trimble and Qualcomm Technologies, Inc. announced the availability of Trimble RTX GNSS technology for Snapdragon 8 Gen 1 and Snapdragon 888 Mobile Platforms. This technology facilitates superior location capabilities in premium Android smartphones worldwide. The integration of Trimble RTX GNSS technology, a correction services platform with Snapdragon, contributes to higher quality, more accurate location-based user experiences like car navigation with lane-level guidance.

August 2021 - Samsung Electronics introduced a new processor for wearables, the ExynosW920. The new processor integrates an LTE modem and is built with an advanced 5-nanometer (nm) extreme ultraviolet process node, offering powerful and efficient performance demanded by next-generation wearable devices. The ExynosW920 is embedded with a GNSS L1 receiver (GPS, GLONASS, Beidou, Galileo) for tracking speed, distance, and elevation during outdoor activities. It also has a 4G LTE Cat. 4 modem.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Wearables and tracking devices are boosting the GNSS market, whilst smartphone shipments are maturing

- 5.2 Market Challenges

- 5.2.1 Complexity regarding power consumption

- 5.3 Market Opportunities

- 5.3.1 Emerging Applications of GNSS enabled consumer devices (Augmented Reality, Robotics, mHealth, Geo marketing and advertising, Fraud management and billing, Safety and emergency etc)

- 5.4 Impact of COVID-19 on the market

6 MARKET SEGMENTATION

- 6.1 By Device Type

- 6.1.1 Smartphones

- 6.1.2 Tablets & Wearables

- 6.1.3 Personal Tracking Devices

- 6.1.4 Low-Power Asset Trackers

- 6.1.5 Other Device Types

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Apple Inc.

- 7.1.2 Garmin Ltd

- 7.1.3 Fitbit (Google)

- 7.1.4 Samsung

- 7.1.5 Huami Corporation

- 7.1.6 Fossil Group Inc.

- 7.1.7 Samsung Electronics Co. Ltd

- 7.1.8 Huawei Technologies Co. Ltd

- 7.1.9 Xiaomi