|

市場調查報告書

商品編碼

1644661

電池管理 IC:全球市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Global Battery Management IC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

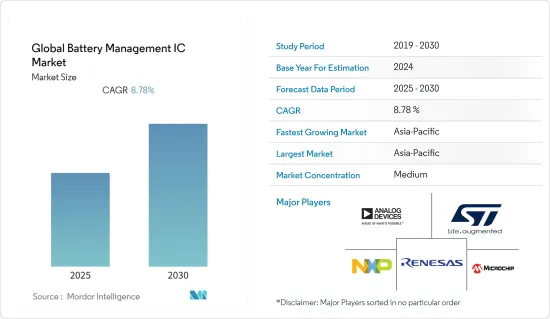

預計預測期內全球電池管理 IC 市場複合年成長率將達到 8.78%。

電池管理積體電路 (IC) 用於所有二次電池化學成分,包括用於有線和無線應用的鋰離子、LiFePO4、鉛酸和鎳基電池。智慧城市和物聯網進一步推動智慧電池的需求,進而促進電池管理IC的需求。有效的電池充電器將提高容量、延長電池壽命並追蹤充電過程。

先進技術的快速進步、都市化進程加快、消費者信心增強和生活水準提高,推動了消費性電子設備消費的成長,從而增加了對電池、電芯和包裝解決方案的需求。此外,電動車的普及減少了二氧化碳的排放,也增加了對鋰離子電池的需求。

電池管理積體電路採用先進的技術。整合過程複雜,需要熟練的人員進行製造。此外,組裝整個電路需要很高的專業知識,這會減慢流程並為電池管理IC市場帶來挑戰。

近年來,電池供電電子產品的普及帶動了穿戴式裝置、智慧卡、電子貨架標籤等工業IoT、可攜式等的使用迅速增加。為了讓這些小工具更容易使用和更方便,它們需要變得更小更薄,設計和功能得到改進,同時還需要更大的電池容量和低耗電量。這推動了重大的產品創新,促進了市場成長率。

電池管理 IC 市場趨勢

預計預測期內汽車產業將出現最高成長率。

預計預測期內汽車產業將出現顯著成長,這主要歸因於電動車的興起。電池管理IC在充電管理等領域發揮重要作用。增加產品創新以滿足需求正在進一步推動IC市場的成長。例如,瑞薩電子推出了一款14芯鋰離子電池管理IC,可延長混合動力汽車和電動車電池的壽命和續航里程。

隨著汽車產業為即將到來的電動車(EV)時代做準備,世界上許多最著名的汽車製造商都在嘗試開發比目前使用的鋰離子電池更安全、充電更快、更強大的電池。為了提高各種尺寸和配置的模組和電池組的容量(這些模組和電池組的重量可達數千磅),每輛電動車都裝有盡可能多的電池單元。電池組中的每個電池都必須連接到電池管理 IC。此 IC 監控模組中所有電池單元的電壓、電流和溫度,以防止能源浪費。

電池管理IC市場由於電動車(EV)和混合電動車(HEV)的日益普及以及業界對鋰離子電池的偏好日益增加等因素而不斷成長。此外,各個終端使用領域對二次電池的採用不斷增加也推動了市場的成長。

IEA進一步指出,到2021年,電動車將佔全球汽車銷量的10%左右,高於2019年的4%。這將使道路上的電動車總數達到約 1,650 萬輛,是 2018 年的三倍多。 2022年電動車銷量持續成長,第一季銷量為200萬輛,較2021年同期成長75%。預計這將在預測期內提振市場需求。

亞太地區可望創下最快成長

由於擁有龐大的電子和汽車製造基地,亞太地區是全球電池管理IC市場成長最快的地區。中國、日本、台灣和韓國是主導半導體製造業並因此對市場產生影響的少數國家之一。該地區還擁有龐大的智慧型手機和先進技術市場,製造業支出正在成長。

隨著各種電子產品不斷轉移到中國,日本、韓國和中國的半導體消費成長速度快於該地區其他國家。此外,亞洲是全球五大家用電子電器產業的所在地,這顯示預測期內該全部區域的技術採用前景廣闊。

根據國際能源總署預測,2021年中國將佔電動車銷售成長的一半。 2021年,中國汽車銷量將比全球其他地區的總合銷量多330萬輛。 2022 年第一季也出現了類似的趨勢,中國市場的銷售額較 2021 年第一季成長了一倍多,佔全球成長的大部分。

2021 年 11 月,Hero Cycles 的母公司 Hero Motor (HMC) 將與日本二輪車製造商Yamaha成立合資企業,為全球市場生產電動自行車馬達。 2021 年 10 月,塔塔汽車宣布私募股權公司 TPG 和阿布達比的 ADQ 已同意向其電動車部門投資 10 億美元。預計這些投資將在預測期內進一步提高該地區的市場成長率。

電池管理IC產業概況

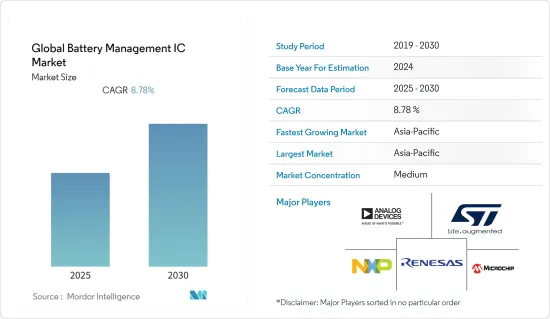

全球電池管理IC市場中等程度分散。市場的主要企業包括意法半導體公司、ADI公司、微晶片科技公司、德州儀器公司和恩智浦半導體公司。

2022年4月-英飛凌科技股份公司宣布推出兩款新型電池管理IC:TLE9012DQU和TLE9015DQU。該 IC 可以更有效地監控和平衡電池單元。新型電池管理IC提供具有競爭力的系統級解決方案,將出色的測量性能與最高的應用穩健性相結合,適用於電池模組、電池到電池組以及電池到汽車的電池拓撲結構。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 波特五力分析

- 購買者和消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 行動運算設備需求成長推動電池管理 IC 需求

- 增加對電動車的投資

- 市場限制

- 電池管理 IC 中多電源域的複雜整合過程

第6章 市場細分

- 按類型

- 電量計積體電路

- 電池充電器 IC

- 認證IC

- 按應用

- 車

- 消費性電子產品

- 產業

- 通訊設備

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- ST Microelectronics

- Analog Devices Inc.

- Microchip Technology Inc.

- NXP Semiconductors

- Semtech Corporation

- ROHM Co. Ltd

- Renesas Electronics Corporation

- Texas Instruments Incorporated

- Diodes Incorporated

- Richtek Technology Corporation

第8章投資分析

第 9 章:未來趨勢

The Global Battery Management IC Market is expected to register a CAGR of 8.78% during the forecast period.

Battery management integrated circuits (ICs) are used in any rechargeable battery chemistry, including Li-Ion, LiFePO4, lead acid, and nickel-based batteries for wired and wireless applications. Smart cities and IoT further drive the demand for smart batteries, thereby contributing to the demand for battery management ICs. An effective battery charger boosts capacity, improves battery life, and keeps track of the charging process.

Rapid technical advancements, increased urbanization, improved consumer purchasing, and rising living standards have increased consumer electronics device consumption, culminating in an ongoing demand for batteries, cells, and packaging solutions. Furthermore, the growing use of electric vehicles to reduce the world's pace with a fast carbon footprint has increased the demand for lithium-ion batteries.

Battery management integrated circuits use advanced technology. Its integration procedure is too intricate, necessitating the use of highly skilled experts in order to manufacture it. Assembling the entire circuit also requires a high level of expertise, slowing down the process, which is a challenge for the battery management ICs market.

Wearables, industrial IoT such as smart cards and electronic shelf labels, and portables have become progressively popular in recent years due to the proliferation of battery-powered electronic gadgets. To improve usability and convenience, these gadgets must be made smaller and thinner to improve design and functionality, and enable bigger battery capacity and lower power consumption. This has led to significant product innovations that are contributing to the market growth rate.

Battery Management IC Market Trends

Automotive Segment Is Analyzed To Grow At Highest Rate During The Forecast Period

Automotive is analyzed to grow at a significant rate during the forecast period, majorly attributed to the boon of electric vehicles. The battery management ICs play a crucial role in the charging management and so on. The growth in product innovations to meet the demand further bolstered the ICs market growth. For instance, Renesas has launched a 14-cell Li-ion Battery Management IC that extends the life and range of battery cells in hybrid and electric vehicles.

As the automotive industry prepares for the impending electric vehicle (EV) phase, many of the world's prominent automakers are attempting to develop batteries that are safer, charge faster, and have more energy than the lithium-ion batteries currently in use. To enhance the capacity of the modules and packs that hold them, which can weigh thousands of pounds and come in various sizes and configurations, every EV is packed with as many battery cells as possible. Every cell in the battery pack must be connected to a battery management IC, which monitors the voltage, current, and temperature of all the battery cells crowded into a module to prevent them from wasting energy.

The battery management IC market is growing due to factors such as the increased use of electric cars (EVs) and hybrid electric vehicles (HEVs) and an increase in industry preference for lithium-ion batteries. Furthermore, market growth is fueled by an increase in the adoption of rechargeable batteries across a variety of end-use sectors.

Moreover, IEA stated that in 2021, electric vehicles accounted for about 10% of global automotive sales, up from 4%in 2019. This increased the overall number of electric vehicles on the road to almost 16.5 million, more than tripling the number in 2018. Electric car sales have continued to rise in 2022, with 2 million sold in the first quarter, up 75% over the same period in 2021. This is analyzed to boost the market demand during the forecast period.

Asia-Pacific Region is Expected to Register the Fastest Growth Rate

Asia-Pacific is the fastest-growing region in the global battery management IC market due to the presence of a huge electronics and automotive manufacturing base. China, Japan, Taiwan, and South Korea are among a few countries that dominate the semiconductor manufacturing industry, thereby impacting the market. The region also has a significant market for smartphones and advanced technologies and an increase in manufacturing expenditures.

Due to the continued transfer of various electronic equipment to China, semiconductor consumption in Japan, South Korea, and China is fast increasing in comparison to other nations in the area. Furthermore, Asia is home to the world's top five consumer electronics sectors, presenting huge prospects for technological adoption across the region in the forecast period.

As stated by International Energy Agency, China accounted for half of the growth in EV sales in 2021. In 2021, China sold 3.3 million more vehicles than the rest of the world combined. Similar trends were seen in the first quarter of 2022, with sales in China more than doubling compared to the first quarter of 2021, accounting for the majority of global growth.

In November 2021, Hero Motor (HMC), the parent company of Hero Cycles, formed a joint venture with Yamaha, a Japanese two-wheeler manufacturer, to produce electric motors for e-bikes for the global market. In October 2021, Tata Motors stated that private equity firm TPG and Abu Dhabi's ADQ had agreed to spend USD 1 billion in its electric vehicle sector. These investments are analyzed to further boost the market growth rate in the region during the forecast period.

Battery Management IC Industry Overview

The global battery management IC market is moderately fragmented. The key players in the market include ST Microelectronics, Analog Devices Inc., Microchip Technology Inc., Texas Instruments Incorporated, and NXP Semiconductors, among others.

April 2022 - Infineon Technologies AG announced the launch of two new battery management ICs TLE9012DQU and TLE9015DQU. The ICs enable more efficient monitoring and balancing of battery cells. The new battery management ICs provide a competitive system-level solution for battery modules, cell-to-pack, and cell-to-car battery topologies, combining exceptional measurement performance with the highest application robustness.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Mobile Computing Devices is Boosting the Demand for Battery Management ICs

- 5.1.2 Increasing Electric Vehicle Investments

- 5.2 Market Restraints

- 5.2.1 Complex Integration Process for Multi-Power Domain Socs of Battery Management ICs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Fuel gauge IC

- 6.1.2 Battery Charger IC

- 6.1.3 Authentication IC

- 6.2 By Application

- 6.2.1 Automotive

- 6.2.2 Consumer Electronics

- 6.2.3 Industrial

- 6.2.4 Communication

- 6.2.5 Others

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ST Microelectronics

- 7.1.2 Analog Devices Inc.

- 7.1.3 Microchip Technology Inc.

- 7.1.4 NXP Semiconductors

- 7.1.5 Semtech Corporation

- 7.1.6 ROHM Co. Ltd

- 7.1.7 Renesas Electronics Corporation

- 7.1.8 Texas Instruments Incorporated

- 7.1.9 Diodes Incorporated

- 7.1.10 Richtek Technology Corporation