|

市場調查報告書

商品編碼

1644774

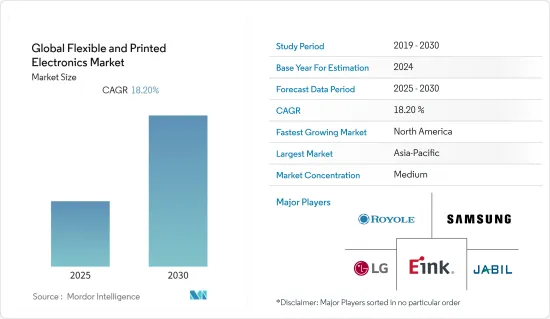

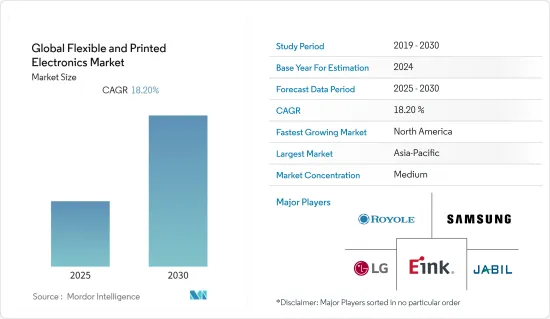

軟性和印刷電子:全球市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Global Flexible and Printed Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預測期內,全球軟性和印刷電子市場預計複合年成長率為 18.2%。

主要亮點

- 三星和 LG 電子等電子公司正在向市場推出軟性、折疊式和旋轉性的智慧型手機、顯示器和平板電腦產品。由於世界人口快速老化和家庭醫療保健需求的急劇成長,穿戴式和行動醫療監測技術最近引起了全世界的極大興趣。

- 根據BNP Media通報,2030年,電子元件將佔汽車總生產成本的50%。而在此之前的十年,這一比例僅為30%。更薄、更輕、更靈活的電子產品的進步正在推動從曲面電視到血糖監測隱形眼鏡等一系列革命性技術的發展。這可能促進可印刷太陽能電池和基於有機發光二極體(OLED)的軟性螢幕的發展。

- 電子業正在迅速從標準的剛性外形規格轉向可拉伸和可變形的設備。醫療穿戴式裝置、智慧包裝、感測器、汽車尾燈和顯示器、軟性顯示器、太陽能和其他印刷軟性和可拉伸電子產品每週都在成長。

- 此外,套模電子(IME)和軟性感測器正在擴大軟性和印刷電子在智慧穿戴技術中的應用。穿戴式設備,尤其是智慧穿戴設備的成長可能會在預測期內擴大市場範圍。思科預測,到2021年連網穿戴裝置的數量將超過11.05億。

- COVID-19的出現和蔓延對軟性電子產品以及公司在電子價值鏈中的地位產生了重大影響。同時,軟性電子市場受到全球停工的嚴重打擊,所有公共建築、工業設施和辦公室都完全關閉。

- 新冠肺炎疫情導致電子產品製造商的生產嚴重延誤,中國供應商正努力維持工廠運作。許多美國和歐洲的電子產品製造商依賴中國製造的零件。電子產業組織 IPC 在 2 月對 150 家參與的電子製造商和供應商進行了調查,其中 65% 報告稱,由於 COVID-19 疫情,供應商出現了延誤的情況。

軟性和印刷電子市場趨勢

智慧型穿戴裝置爆發式成長將推動市場成長

- 根據數位材料的新趨勢,可列印、軟性和可拉伸的感測器和電子產品將為醫療保健、汽車、建築等廣泛行業開闢新的可能性。這些技術將推動智慧醫療技術、汽車、智慧製造、物聯網(IoT)和消費性電子產品的創新。

- 全球軟性電子印刷市場受到穿戴式裝置、電子紡織品、可攜式電子產品、無線感測器和智慧包裝中軟性電池的使用所推動。這阻礙了印刷軟性電子產品製成的OLED眼罩市場的成長。

- 印刷電子為使用者提供各種基板上的光子裝置和印刷電子產品。印刷技術包括柔版印刷、噴墨印刷、凹版印刷和網版印刷。這些技術可以列印到織物、紙張和塑膠等基材上。此列印方式廣泛應用於穿戴式裝置、運動產業、軟性螢幕等領域。

- 薄膜太陽能組件在廣泛應用領域的接受度日益提高以及軟性顯示器在穿戴式裝置和智慧型手機中的使用日益增多是推動市場成長的一些力量。此外,物聯網應用中軟性電氣元件的使用日益增多,以及醫療保健應用中軟性電子產品的使用日益增多,正在影響軟性電子元件市場。

- 刺激響應表面和介面、感測器和致動器、軟性電子產品、奈米塗層和導電奈米材料的最新進展,正在催生用於電子紡織品的新一代智慧且適應性強的電子纖維、紗線和織物。此外,穿戴式低功耗矽電子裝置、織物上的發光二極體(LED)、嵌入鋰離子電池(LIB)的紡織品、智慧眼鏡、手錶、鏡頭和其他電子設備正在廣泛的研究和商業化。

亞太地區佔較大市場佔有率

- 預計在整個預測期內,亞太地區將佔據全球印刷電子市場的很大佔有率。亞太地區是電子設備和電子元件的製造中心。亞太地區印刷電子市場的擴張得益於該地區電子元件的大規模生產和對印刷電子相關研發活動的投資不斷增加。

- 亞太印刷電子市場由於其規模和多樣性而與其他地區相比具有獨特性。該地區人口占世界人口的60%以上,僅在20世紀就增加了近四倍。不斷成長的人口在經濟潛力方面代表著巨大的優勢,為印刷電子行業的供應商提供了幫助。

- 亞太地區是三星顯示器和 LG 顯示器的所在地,這兩家公司是軟性顯示器製造和技術創新的全球領導者。這為當地市場提供了獨特的生產基地和更低的價格,刺激了印度和中國等人口稠密經濟體的需求。

- 該地區也是全球主要的汽車製造區之一。用於引擎控制、ADAS 和未來自動駕駛汽車基礎設施的先進汽車電子產品的快速成長,推動了對高效解決方案的需求,以降低整體組裝成本、實現最高產量比率並確保可靠性。目前已經取得了一些顯著的進展。列印加熱器早已成為汽車的一部分。此外,一些高階奧迪和寶馬車型的後尾燈也採用了 OLED 照明。 OLED 照明解決方案使設計師能夠設計出新穎、創造性的外觀。

軟性和印刷電子行業概況

近年來,大集團、大公司為市場帶來了重大衝擊。隨著全球對高品質消費性電子產品和產品的需求不斷增加,預計公司將投入大量資金為客戶開發創新和先進的解決方案。

- 2022 年 2 月—伊頓公司 (Eaton Corporation PLC) 與 LG 電子聯手,使靈活的家庭能源管理更加有效、無縫。根據協議,伊頓的智慧斷路器和電動車充電技術將與 LG 能源管理服務同步,為太陽能和儲能應用提供關鍵資訊和負載管理。

- 2022 年 4 月—Carevive Systems (Carevive) 是主要企業,致力於了解和改善癌症患者的體驗,今天宣布與穿戴式無線醫療設備解決方案領域的領導者和創新者 Blue Spark Technologies 合作。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 對產業的影響

第5章 市場動態

- 市場促進因素

- 成本優勢以及與多種應用的整合度提高

- 對輕量、機械靈活且經濟高效的產品的需求日益增加

- 市場限制/挑戰

- 法規和熟練整合商的短缺

第6章 市場細分

- 依產品類型

- 展示

- 導電油墨/套模電子 (IME)

- 印刷軟性感測器

- RFID 標籤

- 其他應用(OLED照明、電池、OPV、電子紡織、邏輯等)

- 按應用

- 消費性電子與物聯網

- 穿戴式科技

- 零售與包裝

- 衛生保健

- 汽車和運輸設備

- 其他用途

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- Royole Corporation

- Carre Technologies Inc.

- E Ink Holdings Inc.

- Blue Spark Technologies

- Jabil Inc.

- Bebop Sensors Inc.

- Sensing Tex SL

- Samsung Electronics Co. Ltd

- Coatema Coating Machinery GmbH

- LG Electronics Inc.

- Flex Ltd

- Agfa-Gevaert NV

- GSI Technologies

- Ynvisible Interactive Inc.

- Flex Ltd

- Isorg SA

第8章投資分析

第9章:未來展望

簡介目錄

Product Code: 91064

The Global Flexible and Printed Electronics Market is expected to register a CAGR of 18.2% during the forecast period.

Key Highlights

- Electronics players in the market, such as Samsung and LG Electronics, have introduced the flexible, foldable, and rollable smartphone, display, and tablet products. Because of the rapidly aging global population and the dramatically increasing demand for in-home healthcare, wearable and mobile health monitoring technologies have recently sparked tremendous interest worldwide.

- According to BNP Media, electronic components will account for 50% of an automobile's total production cost by 2030. Earlier in the decade, it was only 30%. Thin, light, and flexible electronics advancements are driving various innovative technologies, from curved TVs to glucose-monitoring contact lenses. This could result in the development of printable solar cells and flexible screens based on organic light-emitting diodes (OLEDs).

- The electronics industry is rapidly transitioning from standard, rigid form factors to stretchable and conformable devices. Wearables for healthcare, smart packaging, sensors, automotive taillights and displays, flexible displays, photovoltaics, and other printed, flexible, and stretchable electronics products are increasing weekly.

- Furthermore, in-mold electronics (IME) and flexible sensors are expanding the application of flexible and printed electronics in smart wearable technologies. Wearable device growth, particularly smart wearable device growth, may broaden the market scope over the forecast period. Cisco predicts that the number of connected wearables will exceed 1,105 million by 2021.

- COVID-19's emergence and expansion have significantly impacted the company's position in the flexible electronics and electronics value chain. On the other hand, the market for flexible electronics has declined significantly due to global shutdowns that have resulted in the complete closure of all public places, industrial facilities, and offices.

- The COVID-19 outbreak caused major delays for electronic manufacturers, as Chinese suppliers have struggled to keep factories running at full capacity. Many electronic manufacturers in the United States and Europe rely on components manufactured in China. In February, IPC, an electronic equipment trade organization, surveyed 65% of the 150 electronic manufacturers and suppliers who participated and reported supplier delays due to the spread of COVID-19.

Flexible & Printed Electronics Market Trends

The explosive growth of smart wearable devices to augment market growth

- Based on a new wave of digital materials, printed, flexible, and stretchable sensors and electronics will open up new possibilities in industries ranging from healthcare to automotive to buildings. These technologies will drive innovation in smart medical technology, automotive, smart manufacturing, the Internet of Things (IoT), and consumer electronics.

- The global flexible and electronics Printing market is being driven by using flexible batteries in wearables, electronic textiles, portable electronics, wireless sensors, and smart packaging-their ability to treat skin patches integrated with printed batteries displacing medicine. The market growth of OLED eye masks configured with printed and flexible electronics is being disrupted.

- Printed electronics provide users with photonic devices and printed electronics on various substrates; printing technologies include flexography, inkjet, gravure, and screen printing. These techniques print on substrates such as cloth, paper, and plastics. This printing method is widely used on wearable devices, in the sports industry, and for flexible screens, among other things.

- The growing acceptance of thin-film solar modules for a wide range of applications and the growing use of flexible displays for applications such as wearable devices and smartphones are all driving market growth. Furthermore, the growing use of flexible electrical parts in IoT applications, and flexible electronics in healthcare applications, are influencing the flexible electronic components market.

- Recent advancements in stimuli-responsive surfaces and interfaces, sensors and actuators, flexible electronics, nanocoatings, and conductive nanomaterials have created a new generation of smart and adaptive electronic fibers, yarns, and fabrics for use in E-textiles. In addition, Wearable low-power silicon electronics, light-emitting diodes (LEDs) on fabrics, textiles with integrated Lithium-ion batteries (LIB), and electronic devices such as smart glasses, watches, and lenses have all been widely explored and commercialized.

Asia-Pacific to hold considerable market share

- APAC is expected to have a considerable share of the global printed electronics market throughout the forecast period. APAC is a hub for the production of electronic devices and components. The expansion of the APAC printed electronics market can be attributed to the region's large-scale production of electronic components and increased investments in R&D activities related to printed electronics.

- Asia-Pacific printed electronics market is unique compared to the other regions because of its size and diversity. The region accounts for more than 60% of the global population, and its population has grown nearly four-fold in the 20th century alone. This rise in population is a huge advantage in terms of economic potential and aids the suppliers of the printed electronics industry.

- APAC is home to Samsung Display and LG Display, two global leaders in flexible display manufacturing and innovation. This provides the local market with indigenous production sites and low-cost prices, which increases local demand from the densely populated economies of India and China.

- The region is also one of the major automotive manufacturing regions globally. The rapid growth of advanced automotive electronics for engine control, ADAS, and future autonomous vehicle infrastructure is increasing the need for efficient solutions that lower the overall assembly cost, deliver the highest yield, and ensure reliability. There have been several noteworthy advances already. Printed heaters have long been part of cars. Additionally, OLED lighting appears on rear taillights in a few high-end Audi and BMW models. OLED lighting solutions allow designers to come up with new and creative looks.

Flexible & Printed Electronics Industry Overview

In recent years, major firms and corporations have significantly impacted the market. With the increased demand for high-quality consumer electronics and products worldwide, companies are expected to invest heavily in developing novel and advanced solutions for their customers.

- February 2022 - Eaton Corporation PLC and LG Electronics collaborated to make flexible household energy management more effective and seamless. According to the agreement, Eaton smart breakers and EV charging technology will sync with LG energy management services, providing critical information and load management for solar and storage applications.

- April 2022- Carevive Systems (Carevive), a leading oncology-focused health technology company focused on understanding and improving the cancer patient experience, today announced a collaboration with Blue Spark Technologies, a leader and innovator in wearable wireless medical device solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Cost Advantages and Increased Integration into Numerous Applications

- 5.1.2 Emerging Need for Lightweight, Mechanically Flexible, and Cost-effective Products

- 5.2 Market Restraints/Challenges

- 5.2.1 Regulations and Lack of Skilled Integrators

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Displays

- 6.1.2 Conductive Ink/In-Mold Electronics (IME)

- 6.1.3 Printed & Flexible Sensors

- 6.1.4 RFID Tags

- 6.1.5 Other Applications (OLED Lighting, Batteries, OPV, E-textiles, Logic etc.,)

- 6.2 By Application

- 6.2.1 Consumer Electronics & IoT

- 6.2.2 Wearable Technology

- 6.2.3 Retail & Packaging

- 6.2.4 Healthcare

- 6.2.5 Automotive & Transportation

- 6.2.6 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 Royole Corporation

- 7.1.2 Carre Technologies Inc.

- 7.1.3 E Ink Holdings Inc.

- 7.1.4 Blue Spark Technologies

- 7.1.5 Jabil Inc.

- 7.1.6 Bebop Sensors Inc.

- 7.1.7 Sensing Tex SL

- 7.1.8 Samsung Electronics Co. Ltd

- 7.1.9 Coatema Coating Machinery GmbH

- 7.1.10 LG Electronics Inc.

- 7.1.11 Flex Ltd

- 7.1.12 Agfa-Gevaert NV

- 7.1.13 GSI Technologies

- 7.1.14 Ynvisible Interactive Inc.

- 7.1.15 Flex Ltd

- 7.1.16 Isorg SA

8 INVESTMENT ANALYSIS

9 FUTURE OUTOOK

02-2729-4219

+886-2-2729-4219