|

市場調查報告書

商品編碼

1644775

全球光開關市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Global Optical Switches - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

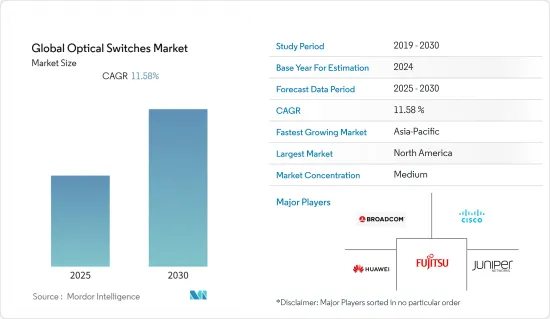

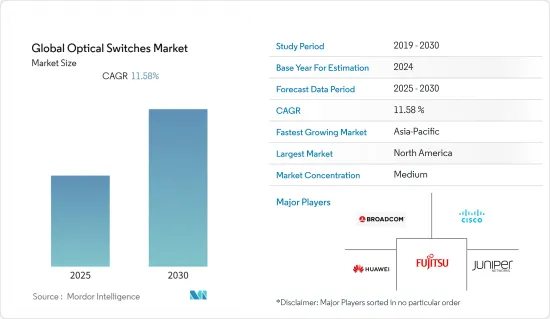

預測期內,全球光開關市場預計將實現 11.58% 的複合年成長率

關鍵亮點

- 光開關促進的能耗降低以及高頻寬和資料傳輸需求激增等因素預計將推動全球光開關市場的發展。

- 推動市場發展的主要因素之一是許多行業自動化程度的提高。光交換機部署在高速網路中,需要大型交換器來處理大量流量。它也廣泛應用於外部調變、網路監視器、光交叉連接器光加取多工器(OADM)和光纖元件測試。

- 它們也用於光纖通訊網路中的恢復、波長路由、光纖管理以及在光纖發生故障時進行切換保護,以便在發生問題之前將訊號切換到另一根光纖。再加上技術的不斷進步,這一趨勢正在推動著產業向前發展。

- 近年來光元件的流行趨勢和光纖通訊的快速發展推動了全球光開關市場的大幅成長。資料流量的增加和雲端運算的採用正在推動市場成長。 5G的廣泛應用和資料中心的需求不斷成長是影響光開關市場成長的兩個主要因素。此外,由於重點轉向數位轉型,該行業正在成長。

- 預算限制和高成本正在阻礙光開關市場的發展。此外,由於生產設施停滯以及對電子和半導體產品的需求增加,COVID-19 疫情也對電子產業產生了影響。主要影響是歐洲大規模工業停工和中國零件出口停止,限制了對光開關的需求。

光開關市場趨勢

預計 IT 和電信業在預測期內將呈現最高成長率。

- 交換器在任何通訊網路中都發揮著至關重要的作用。在裝置之間傳輸資料時,交換器存在於連接到網路的裝置中,用於改變資料傳輸的路徑。透過快速重新路由傳輸並僅將資料傳送到相關設備,可以減少網路上的總負載。

- 光訊號無需轉換成電訊號,即可沿著指定的通訊路徑傳播。因此,可以在不損害高速光纖通訊優勢的情況下傳輸訊號。在通訊中,光開關是一種可以選擇性地將光纖或光積體電路(IOC)中的訊號從一個電路切換到另一個電路的開關。

- 分析認為,為滿足消費者需求,產品創新的大幅成長將拉動市場成長率。例如,Tejas Networks宣布推出TJ1600S/I,這是專為5G、雲端和寬頻網路設計的最大的分解式多Terabit分組光纖交換器。

- 諾基亞最近宣布推出用於5G Cloud RAN的新型分組光纖交換器。新型交換器系列透過透明地支援現有和新興的空中介面標準,統一了 4G 和 5G 網路的行動傳輸。

- 此外,到 2023 年,預計全球 70% 以上的人口將能夠使用行動連線。據思科系統公司稱,全球行動用戶預計將從 2018 年的 51 億(佔人口的 66%)成長到 2023 年的 57 億(佔人口的 71%)。隨著 5G 的出現,預計預測期內資料中心的需求將會增加。到2023年,5G設備和連接預計將達到全球行動裝置和連接的10%。

亞太地區可望實現強勁成長

- 通訊技術的不斷進步是亞太光開關市場成長的主要動力。該地區的通訊網路營運商正在為所有通訊應用部署光纖,包括城際、城內、FTTx 和行動蜂窩系統。除企業外,中國政府部門也在部署光纖系統以支援電網、高速公路、鐵路、管道、機場、資料中心和許多其他應用,推動市場成長。

- 隨著人工智慧、5G、物聯網、虛擬實境等技術的快速發展和這些新技術的商業性應用,資料處理和資訊互動的需求日益增加,將加速國內資料中心的建設,引發行業爆發式成長。據 Cloud Scene 稱,資料中心的主要市場包括中國、日本、澳洲、印度和新加坡。

- 該地區的大量研究進一步促進了市場成長率。 2022年1月,日本產業技術綜合研究所(AIST)展示了131,072埠的光交換網路有可能實現全球最大的總光交換容量1.25億Gbps。這相當於每秒傳輸超過 60 萬張藍光碟的資料。

- 使用AIST生產的最大容量為3232埠的光開關,進行了將寬頻光訊號透過同一光開關傳輸9次的循環傳輸實驗。此外,我們統計研究了光開關中串擾的行為,並開發了最大化光開關連接埠數量的綜合理論。該成果滿足了下一代資料和超級電腦對光開關的要求,該技術將為大容量、低延遲的下一代資訊基礎設施的發展做出貢獻。

光開關產業概況

由於有許多大大小小的公司在多個國家開展業務,因此光開關市場競爭較為激烈。市場集中度適中,正走向細分階段。主要企業正在採用產品創新和夥伴關係等策略來擴大其影響力並保持競爭優勢。我們將介紹一些最近的市場發展趨勢。

- 2022 年 2 月-著名的網路數位轉型解決方案供應商富士通與光傳輸和網路存取解決方案供應商Ekinops 建立合作夥伴關係。富士通正在將 Ekinops 的下一代 OTN 緊湊型模組化交換器納入其 FUJITSU 1FINITY 開放光纖網路連結產品組合,為服務供應商提供更多選擇和靈活性。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 價值鏈/供應鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 數位化的進步

- 5G 的普及和資料中心需求的增加

- 市場限制

- 光開關成本高

第6章 市場細分

- 按類型

- 電光開關

- 聲光開關

- 基於微機電系統的開關

- 磁光開關

- 其他

- 最終用戶產業

- 政府和國防

- 資訊科技和電訊

- BFSI

- 製造業

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Broadcom Inc.

- Cisco Systems Inc

- Huawei Technologies Co., Ltd.

- Fujitsu Ltd

- Nokia Corporation

- Juniper Networks

- NTT Advanced Technology Corporation

- Furukawa Electric Co. Ltd.

- Keysight Technologies Inc.

- Agiltron Inc.

第8章投資分析

第 9 章:未來趨勢

簡介目錄

Product Code: 91065

The Global Optical Switches Market is expected to register a CAGR of 11.58% during the forecast period.

Key Highlights

- Factors such as reduced energy consumption facilitated by optical switches and a surge in demand for high bandwidth & data transmission rates are expected to propel the global optical switches market forward.

- One of the primary factors driving the market is the rising automation in many industry verticals. Optical switches are deployed in high-speed networks, where large switches are needed to handle significant traffic. They are also widely used in external modulators, network monitors, optical cross-connects (OXCs), optical add-drop multiplexers (OADM), and fiber optic component testing.

- They are also used for restoration, wavelength routing, and fiber management in fiber communication networks and for switching protection as they allow signals to be switched to another fiber before an issue emerges when a fiber fails. This, coupled with increasing technical improvements, is propelling the industry forward.

- With the growing investments in optical devices and the fast development of optical communication in recent years, the global optical switches market has seen significant growth. Increasing data traffic and adopting cloud computing are driving the market growth. The widespread implementation of 5G and the rise in demand for data centers are two major factors influencing the growth of the optical switches market. Furthermore, the industry is growing due to a shift in focus on digital transformation.

- Budget constraints and high costs hamper the optical switches market. Further, the COVID-19 pandemic has impacted the electronics industry since production facilities have stagnated, resulting in increased demand for electronics and semiconductor products. Its main effects are a significant industrial halt in Europe and a halt in Chinese parts exports, limiting the demand for optical switches.

Optical Switches Market Trends

IT and Telecom is Analyzed to Grow at Highest Rate During the Forecast Period

- Switches play a crucial role in any communication network. When transporting data between devices, switches are present inside network-linked devices and are used to change data transmission paths. The total load on the network can be decreased by swiftly altering the transmission path and transmitting data only to relevant devices.

- Optical signals can be routed along a specified communication path without being converted into an electrical signal. As a result, signals can be sent without affecting the benefits of high-speed optical communications. An optical switch in telecommunications is a switch that allows signals in optical fibers or integrated optical circuits (IOCs) to be switched from one circuit to another selectively.

- The significant growth in product innovations to meet consumer demand is analyzed to boost the market growth rate. For instance, Tejas Networks has announced the launch of the TJ1600S/I, the largest disaggregated multi-terabit packet-optical switch designed for 5G, cloud, and broadband networks.

- Nokia has recently launched new packet-optical switches for 5G Cloud RAN. The new switch family unifies mobile transport for 4G and 5G networks by transparently supporting existing and new radio interface standards.

- Furthermore, over 70% of the global population is expected to have access to mobile connectivity by 2023. According to Cisco Systems, the global mobile subscribers are expected to increase from 5.1 billion (or 66% of the population) in 2018 to 5.7 billion (or 71% of the population) by 2023. With the advent of 5G, the demand for data centers is expected to increase over the forecast period. By 2023, 5G devices and connections are expected to reach 10% of the global mobile device and connections.

Asia-Pacific is Expected to Register the Significant Growth Rate

- The constant advancements in communication technologies are the primary drivers of optical switches market growth in the Asia-Pacific. The region telecom network operators have installed fiber in the full range of telecom applications - inter-city, intra-city, FTTx, and mobile cellular systems. Apart from enterprises, the Chinese government authorities also install fiber systems to support the electric power grid, highways, railways, pipelines, airports, data centers, and many other applications, driving the market growth.

- With the rapid development of AI, 5G, the Internet of Things, virtual reality, and the commercial application of these new technologies, the demand for data processing and information interaction is growing, which would speed up the construction of data centers in the country and lead to the explosive growth of the industry. According to Cloud Scene, some of the top markets in data centers include China, Japan, Australia, India, and Singapore.

- The significant research in the region is further contributing to the market growth rate. In January 2022, the National Institute of Advanced Industrial Science and Technology (AIST), Japan, demonstrated that a 131,072 port optical switch network may attain the world's biggest total optical switch capacity of 125 million Gbps. This is equivalent to the ability to send data from 600,000 or more Blu-ray discs per second.

- A circular transmission experiment was conducted using the greatest 3232 port optical switch produced by AIST, in which a wideband optical signal was transferred nine times over the same optical switch. In addition, the behavior of crosstalk in the optical switch was statistically investigated, and a comprehensive theory for maximizing the number of optical switch ports was developed. These results meet the optical switch requirements of next-generation data centers and supercomputers, and this technology will contribute to high-capacity, low-latency next-generation information infrastructure.

Optical Switches Industry Overview

The optical switches market is moderately competitive, owing to many large and small players operating in multiple countries. The market appears to be moderately concentrated, moving towards the fragmented stage. Major players adopt strategies like product innovation and partnerships to expand their reach and stay ahead of the competition. Some of the recent developments in the market are:

- February 2022 - Fujitsu, a prominent network digital transformation solutions provider, partnered with Ekinops, an optical transport and network access solutions producer. Fujitsu will incorporate Ekinops' next-generation OTN compact modular switches into its Fujitsu 1FINITY open optical networking portfolio, giving service providers even more options and flexibility.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Digitalization

- 5.1.2 Widespread Implementation of 5G and Increase in Demand for Data Centers

- 5.2 Market Restraints

- 5.2.1 High Costs of Optical Switches

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Electro-optic Switching

- 6.1.2 Acoustic-Optic switching

- 6.1.3 Mems-based Switching

- 6.1.4 Magneto-Optic Switching

- 6.1.5 Others

- 6.2 End-User Industry

- 6.2.1 Government and Defense

- 6.2.2 IT and Telecom

- 6.2.3 BFSI

- 6.2.4 Manufacturing

- 6.2.5 Others

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Broadcom Inc.

- 7.1.2 Cisco Systems Inc

- 7.1.3 Huawei Technologies Co., Ltd.

- 7.1.4 Fujitsu Ltd

- 7.1.5 Nokia Corporation

- 7.1.6 Juniper Networks

- 7.1.7 NTT Advanced Technology Corporation

- 7.1.8 Furukawa Electric Co. Ltd.

- 7.1.9 Keysight Technologies Inc.

- 7.1.10 Agiltron Inc.

8 INVESTMENTS ANALYSIS

9 FUTURE TRENDS

02-2729-4219

+886-2-2729-4219