|

市場調查報告書

商品編碼

1644806

美國供應鏈管理軟體:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)U.S. Supply Chain Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

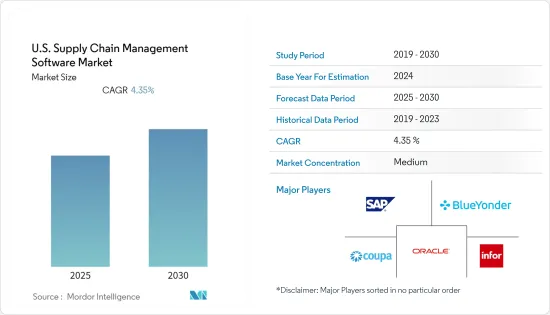

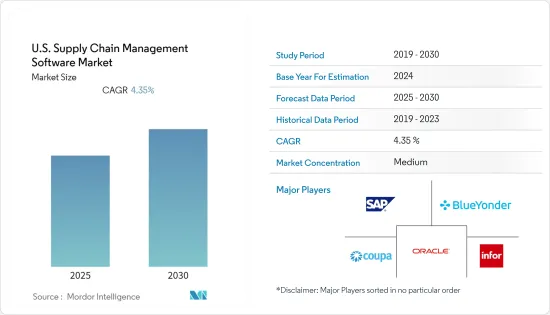

預計預測期內美國供應鏈管理軟體市場複合年成長率為 4.35%。

主要亮點

- 新冠疫情導致美國對物流供應的需求增加,尤其是快速消費品和必需品,預計將推動對供應鏈管理軟體的正面需求。

- 數位化和企業在線上收集資料導致了對資料洞察、客戶分析和各種業務流程的強烈需求。這項發展推動了對企業軟體,尤其是商業情報(BI)軟體的需求。在 BI 之後,企業軟體部分包括企業資源規劃 (ERP)、客戶關係管理 (CRM) 和供應鏈管理 (SCM) 軟體。一般來說,企業軟體支撐著企業的數位化進程,佔了軟體全部收益的近一半。在數位商業環境中,CRM 引領企業軟體領域,因為以客戶為中心是競爭優勢的關鍵。

美國供應鏈管理軟體市場趨勢

使用 SCM 軟體降低成本

- 預計美國的供應鏈管理軟體市場將透過使用 SCM 軟體來降低成本。由於企業的全球化和競爭的加劇,供應鏈變得越來越複雜。供應商的數量、訂單/完成的訂單數量、產品供應數量以及產生的資訊量急劇增加。使用SCM軟體可以幫助降低流程複雜性,節省成本和資源。在日益激烈的競爭中,企業需要維持市場競爭力,這是推動 SCM 軟體市場成長的關鍵因素。

- 例如,美國最大的家居裝飾和建築產品及服務零售商之一家得寶(Home Depot),以前為其每家實體店都設立了單獨的物流管理部門,以開展與店面管理相關的活動。這是因為每家商店必須處理來自供應商的單獨補貨訂單才能獲得所需的材料,成本很高。然而,在技術和正確的 SCM 軟體解決方案的幫助下,家得寶新的集中庫存和補貨部門的整體績效提高了需求預測的準確性,並降低了補貨訂單的業務成本。

快速消費品領域的成長

受新冠疫情影響,經濟的許多產業都遭遇挫折,但快速消費品和製藥業除外。這兩個行業都是必需品,因此需求正在上升。隨著監管的加強,零售電子商務產業的收益正在增加。 2019年,美國零售電子商務的食品和飲料銷售額達到近73億美元,而且還在成長。在線上食品和飲料零售商中,亞馬遜擁有最大的市場佔有率,其次是沃爾瑪和克羅格。由於時間緊迫的顧客正在尋找創新的方式來讓生活變得更輕鬆,虛擬雜貨店仍然具有很高的成長潛力。但新鮮度仍然是網上購物的一個主要障礙,因為許多顧客更喜歡在購買前看到和觸摸產品。為了解決這個問題,亞馬遜推出了兩項線上雜貨服務:AmazonFresh 和 Prime Pantry。亞馬遜的食品和儲藏室銷售額預計將從 2018 年的約 145 億美元成長到 2021 年的 230 億美元以上。在所有食品和飲料類別中,包裝食品板塊的成長率最高,其次是冷凍食品和乳製品板塊。

美國供應鏈管理軟體產業概況

美國供應鏈管理軟體市場是一個不斷成長的市場。目前的市場佔有率被少數專注於在IT領域提供服務解決方案的科技公司所佔據。在預測期內,市場參與者可能會根據其以具有市場競爭力的成本為快速消費品和醫療保健供應鏈管理提供遠端存取/雲端服務的能力來脫穎而出。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- COVID-19 市場影響評估

第5章 市場動態

- 電子商務的興起、中小企業對雲端供應鏈管理的接受度不斷提高以及業務流程的增強正在推動對 SCM 軟體的需求。

- 供應鏈組織增加對支援人工智慧和分析功能的應用程式的投資

- 市場挑戰(缺乏意識和整合複雜性)

第6章 市場細分

- 按部署(市場估計和預測(2020-2027 年)、趨勢和其他市場動態)

- 本地

- 雲端(深入了解 SCM SaaS 服務-物聯網優勢、自動化功能、集中管理塔等)

- 按公司規模

- 中小型企業

- 大型企業

- 按最終用戶

- 製造業

- 衛生保健

- 快速消費品(FMCG)

- 石油和天然氣

- 其他最終用戶產業

第7章 競爭格局

- 公司簡介(業務概述 |產品系列| 財務狀況 | 業務策略與最新趨勢、SWOT 分析)

- Oracle Corporation

- Infor Inc.

- SAP SE

- Blue Yonder

- Coupa

- Manhattan Associates

- Jaggaer, Inc.

- E2Open

- WiseTech Global

- Descartes Systems Group

第 8 章 供應商管理與採購部門的供應商名單

第9章投資分析

第10章 市場潛力

The U.S. Supply Chain Management Software Market is expected to register a CAGR of 4.35% during the forecast period.

Key Highlights

- COVID-19 pandemic is expected to trigger a positive demand for supply chain management software in the US, on account of increased logistics supply-demand in the country, especially for FMCG and essential goods.

- Needs for data insights, customer analysis, and all kinds of business processes have strongly increased due to digitization and data collected online by companies. This development drives the demand for Enterprise Software, especially Business Intelligence (BI) Software. Next to BI, Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), and Supply Chain Management (SCM) Software is included in the Enterprise Software segment. In general, Enterprise Software supports the digitization processes of companies and accounts for almost half of total software revenues. CRM is the leading Enterprise Software segment as customer orientation is important in digital business environments to stand out from the competition.

US Supply Chain Management Software Market Trends

Cost Savings Due To SCM Software

- The U.S. supply chain management software is expected to be driven by cost savings caused by utilizing SCM software. With businesses going global and increased competition, supply chains are getting more complex. The number of suppliers, orders received/completed, product offerings, and information generated has increased substantially. Using SCM software would reduce the complexity of the process, cost, and resource savings. The need for companies to remain relevant in the market amidst the highly competitive conditions is a crucial driver for the growth of the SCM software market.

- For instance, Home Depot in the United States, one of the biggest retailers selling home improvement and construction products and services, used to have separate logistics management departments in every single physical store to utilize store management-related activities. This was costly as each store had to process the replenishment orders to get the required materials from the suppliers separately. However, with the help of technology and the right SCM software solutions, Home Depot's new centralized inventory and replenishment department's overall performance improved demand forecast accuracy and decreased the cost of operations for the replenishment orders.

Growth of FMCG Segment

With the onset of COVID-19, many sectors of the economy have experienced a setback, except for FMCG and Pharmaceutical Sectors. These two sectors have experienced an increase in demand as they are a part of the essential goods category. With lockdown restrictions, the Retail eCommerce industry has witnessed a revenue boost. The US Retail eCommerce revenue from food & beverage sales amounted to almost $ 7.3 billion in 2019 and has been increasing since. Amazon had the highest market share among the online food and beverage retailers, followed by Walmart and Kroger. Virtual grocery stores still have higher growth potential as more time-strapped customers look for innovative ways to make their lives easier. However, a significant hurdle for online grocery buys remains freshness, as many customers still prefer to see and touch the product before purchase. To tackle this, Amazon has introduced Amazon Fresh and Prime Pantry, two online grocery shopping services that provide same-day or two-hour delivery. Amazon's food and pantry sales are projected to rise from approximately $ 14.5 billion in 2018 to over $ 23 billion in 2021. Among all the food & beverages categories, Packaged Food segment registered the highest growth percentage, followed by Frozen Foods & Dairy segments.

US Supply Chain Management Software Industry Overview

The United States supply chain management software market is a growing market. The current market share is majorly controlled by a few technology companies that have expertise in providing service solutions in the IT domain. Over the forecast period, market players will be differentiated based on the ability to provide remote access/cloud service in FMCG and healthcare supply chain management at competitive costs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of COVID-19 impact on the market

5 MARKET DYNAMICS

- 5.1 Increasing growth in e-commerce, increased acceptance of cloud supply chain management among SMEs, and enhancing business processes are all driving demand for SCM software.

- 5.2 Growing investments by supply chain organizations in applications that support artificial intelligence and analytics capabilities

- 5.3 Market Challenges (Lack of Awareness and Integration Complexities)

6 MARKET SEGMENTATION

- 6.1 By Deployment (Market estimates, forecast (2020-2027), trends and other market dynamics)

- 6.1.1 On Premise

- 6.1.2 Cloud (Insights on SCM SaaS offerings- IoT advantage, automation capabilities, centralized control towers etc.)

- 6.2 By Enterprise Size

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By End User

- 6.3.1 Manufacturing

- 6.3.2 Healthcare

- 6.3.3 Fast Moving Consumer Goods (FMCG)

- 6.3.4 Oil and Gas

- 6.3.5 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles (Business Overview | Product Portfolio | Financials | Business Strategy And Recent Developments, SWOT analysis)

- 7.1.1 Oracle Corporation

- 7.1.2 Infor Inc.

- 7.1.3 SAP SE

- 7.1.4 Blue Yonder

- 7.1.5 Coupa

- 7.1.6 Manhattan Associates

- 7.1.7 Jaggaer, Inc.

- 7.1.8 E2Open

- 7.1.9 WiseTech Global

- 7.1.10 Descartes Systems Group