|

市場調查報告書

商品編碼

1644819

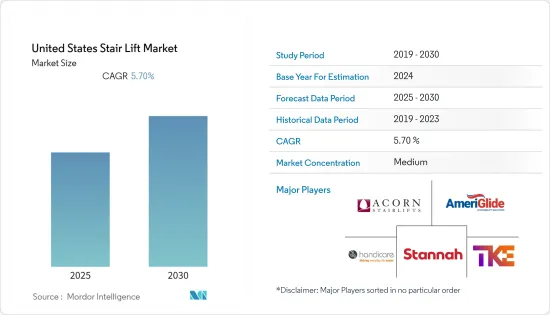

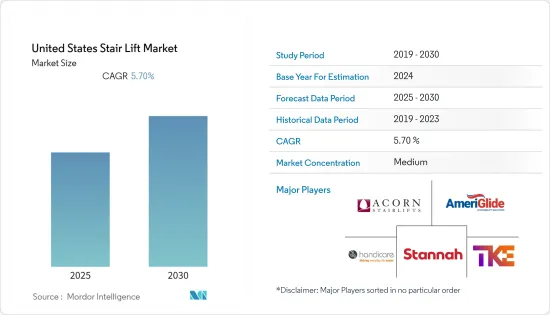

美國樓梯升降機:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)United States Stair Lift - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預測期內,美國樓梯升降機市場預計將實現 5.7% 的複合年成長率

關鍵亮點

- 先進技術的採用也在市場成長中發揮關鍵作用。 3D MDB 和 GrabCAD 等公司提供樓梯升降機設計及其零件的 3D 圖紙,使買家更容易改進和決定正確的樓梯升降機系統類型。

- 樓梯升降機安裝成本高和售後服務差是阻礙樓梯升降機市場成長的因素。例如,直樓梯升降機的成本在 3,000 美元到 5,500 美元之間,而定製曲線樓梯升降機的成本在 7,500 美元到 20,000 美元之間。此外,主要由於機制缺陷和安裝不正確而導致的潛在受傷風險也是市場面臨的一些挑戰。

- 明尼蘇達州和康乃狄克州等許多州都提供醫療補助家庭和社區豁免計劃,這些計劃通常涵蓋安裝樓梯升降機等住宅改造的費用。要獲得這些豁免,您通常必須達到您所在州獲得醫療援助的收入門檻。患有某些與服役有關的殘疾的退伍軍人可以申請住宅補助,以使他們的住房變得無障礙。其中包括 SAH(特殊改造住房)補助金和 SHA(特殊住宅改造)補助金。

- 此外,由於越來越多的殘障人士選擇住在醫療機構,醫療保健領域可能會推動成長。您不能指望專業護理人員提供 24 小時的支援。因此,由於這些升降機能夠實現獨立移動,醫療中心對樓梯升降機的需求可能會增加。

美國樓梯升降機市場的趨勢

日益嚴重的健康問題推動美國樓梯升降機市場

- 老年人口快速增加、肌肉骨骼和行動障礙患者增多以及意外傷害發生率等因素推動了該地區對樓梯升降機的需求。例如,美國有超過 5,400 萬 65 歲或以上的成年人。根據美國人口普查局的數據,到 2050 年,65 歲及以上成年人總數預計將達到 8,570 萬,約占美國總人口的 20%。

- 根據 2022 年西澳州殘疾和健康狀況調查,西澳州有 1,273,876 名成年人殘疾。主要障礙是行走和爬樓梯。此外,美國有 6,100 萬成年人患有殘疾。

- 此外,疾病預防控制中心預測,未來幾年美國人口老化和醫生診斷的關節炎的盛行率將會增加。預計到 2040 年,超過 7,840 萬 18 歲及以上的成年人將被診斷出患有關節炎,3,460 萬人將報告活動受限。

- 根據美國退休人員協會(AARP,美國的關注 50 歲及以上老年人問題的利益組織)的調查,超過 90% 的老年人希望盡可能長時間地住在自己的家中,而只有 10% 的老年人認為搬家是一個可行的選擇。情感連結、對社區的熟悉程度以及整體的經濟舒適度都促使老年人選擇住在自己的家中。樓梯升降機是最容易安裝的預防工具之一,可以讓老年人健康老去。樓梯升降機消除了從樓梯上摔倒的風險,這是家庭環境中最具挑戰性的方面之一。

室內安裝預計佔很大佔有率

- 其在美國的大部分銷售額來自室內樓梯升降機。樓梯升降機可以安裝在室內或室外的任何樓梯上。最近,我們發現室內樓梯升降機的使用量顯著成長。

- 《退休生活》雜誌進行的一項調查顯示,超過 80% 的 55 歲以上的美國人希望盡可能長時間地繼續在自己的家中獨立生活。因此,老年人希望在自己熟悉的地方養老,所以需要適當的維修,使他們的家盡可能的安全。安裝樓梯升降椅可以幫助您輕鬆地在多層住宅中移動,讓您繼續獨立生活。

- 在住宅領域,由於座式樓梯升降機與站立式樓梯升降機相比具有成本效益,並且最終用戶中骨關節炎和膝關節骨關節炎等肌肉骨骼問題的發病率不斷增加,因此對座式樓梯升降機的需求強勁。

- 此外,該地區政府發起的國家援助計畫正在增加對樓梯升降機市場的需求。例如,伊利諾伊州居民可以從伊利諾伊州家庭無障礙計劃(HAP)獲得幫助。該計劃的目標是透過提供更安全、更方便的居住環境讓人們能夠留在自己的家中。這最終將有助於防止老人安養院。透過此計劃可以進行各種各樣的住宅維修和維修。

- 此外,印第安納州的 CHOICE 計劃為老年人和殘障人士提供廣泛的援助,包括日常家務的個人護理援助、住宅改造和醫療用品援助。所有 CHOICE 服務旨在幫助受助者獨立生活或看護者在自己的家中照顧親人。

美國樓梯升降機產業概況

樓梯升降機市場較為分散,主要供應商包括蒂森克虜伯電梯技術公司、Handicare Group 和 Stannah Lifts Holdings Ltd.。為了進一步擴大基本客群和佔領市場佔有率,供應商正在利用策略合作計畫和收購作為競爭優勢來增強其產品線。

- 2021 年 7 月 - Bespoke 樓梯升降機推出了一種全新的創新方式,透過其獨特的 Infinity 充電點為您的樓梯升降機充電。這提高了耐用性並允許多種安裝選項以適應不同類型的樓梯升降機系統。電力透過彈簧接觸針傳輸至托架,新系統可提供穩定的接觸。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 價值鏈分析

- COVID-19 市場影響分析

第5章 市場動態

- 市場促進因素

- 老化和殘疾將成為樓梯升降機需求的主要驅動力

- 市場限制

- 安裝成本高,後製服務也較高

第6章 市場細分

- 搭乘鐵路方向

- 直線

- 曲線

- 按使用者導向

- 就座

- 常設

- 融合的

- 按安裝位置

- 室內的

- 戶外的

- 按應用

- 住宅

- 醫療

- 其他

第7章 競爭格局

- 公司簡介

- AmeriGlide Distributing 2019, Inc.

- Handicare Group

- ThyssenKrupp Elevator Technology

- Stannah Lifts Holdings Ltd.

- Bruno Independent Living Aids Inc.

- Acorn Stairlifts Inc.

- Bespoke Stairlifts Limited

- Acme Home Elevator

- Harmar

- Ascent Mobility

- Les Escalateurs Atlas

第8章投資分析

第9章:市場的未來

簡介目錄

Product Code: 91154

The United States Stair Lift Market is expected to register a CAGR of 5.7% during the forecast period.

Key Highlights

- Adopting advanced technologies has also played a vital role in the market's growth. Companies, such as 3D MDB and GrabCAD, offer 3D drawings of stairlift designs and their components, making it more sophisticated and easy for buyers to decide the suitable type of Stairlift system.

- High installation costs of stairlifts and inadequate post-sale services are factors hindering the growth of the stairlift market. For instance, a straight stair lift is around USD 3,000 to USD 5,500, while the custom curved stairlift price may range from USD 7,500 to USD 20,000. Also, the potential risk of injury, primarily faulty mechanism and incorrect installation, are a few challenges the market faces.

- Many states, such as Minnesota and Connecticut, offer Medicaid home and community-based waiver programs that often cover the cost of home modifications such as a stair lift. To qualify for these waivers, one typically needs to meet the income criteria to receive Medical Assistance from the state. Veterans with certain service-connected disabilities can apply for housing grants to make their homes accessible. These include the Specially Adapted Housing (SAH) Grant and the Special Home Adaptations (SHA) Grant.

- Further, the healthcare segment might fuel the growth because of the increasing rate of disabled people opting to live in healthcare facilities. Professional caretakers cannot be expected to offer help round the clock. Hence, the demand for stairlifts in healthcare centers is likely to increase as these lifts enable individuals to traverse independently.

US Stair Lift Market Trends

Increasing Health Issues is Driving the Stair Lift Market in United States

- Factors such as an upsurge in the geriatric population increasing number of patients with musculoskeletal and movement disabilities, coupled with incidences of accidental injuries, are driving the need for stairlifts in the region. For instance, more than 54 million adults aged 65 and older live in the United States. As per the U.S. Census Bureau, by 2050, the total number of adults ages 65 and older is projected to rise to an estimated 85.7 million, roughly 20% of the overall U.S. population.

- As per the 2022 W.A. Disability and Health State Profile, 1,273,876 adults in Washington have a disability. Out of which, major difficulty includes walking or climbing stairs. Moreover, 61 million adults in the United States live with a disability.

- Further CDC suggests that the aging of the U.S. population and the prevalence of doctor-diagnosed arthritis are expected to increase in the coming years. It is also estimated that by 2040, over 78.4 million adults aged 18 years and above will be diagnosed with arthritis, and 34.6 million adults will report activity limitations.

- According to AARP (a United States-based interest group focusing on issues affecting those over the age of fifty), more than 90 percent of seniors prefer living at home for as long as possible versus 10 percent who see moving as a viable option. Emotional ties, familiarity with their community, and overall affordability play a part in a senior's choice to live at home. Stairlifts are one of the easiest preventive tools to install that allow seniors to age. Stairlifts eliminate the fall risk on one of the most challenging environmental aspects of a home-the stairs.

Indoor Installation is Expected to Hold a Major Share

- Most of the sales in the United States occur through stair lifts for indoor purposes. The stair lifts can be mounted on any stairs, regardless of indoor or outdoor surroundings. Recently, it has been observed that the use of indoor stairlifts is growing significantly.

- A survey conducted by Retirement Living revealed that over 80% of Americans aged 55 and older wished to remain independent in their own homes for as long as possible. This preference among the elderly population to age in place necessitates appropriate modifications to their homes to make them as safe as possible. Installation of a stairlift enables them to move around their multi-level home easily, allowing them to continue living independently.

- There is significant demand for the seated stairlift within the residential segment majorly due to its cost-effectiveness as compared to stand stairlift counterpart and end-users growing musculoskeletal problems such as Osteoarthritis, Knee Problems, among others.

- Furthermore, State assistance programs launched by the Government in the region are increasing the demand for the stairlift market. For instance, Illinois residents can seek assistance from the Illinois Home Accessibility Program (HAP), which provides grants to low-income seniors and disabled persons living in the state. The program's goal is to allow an individual to stay at home by making their home safer and more accessible. In turn, the program helps prevent premature nursing home placement. A wide range of home modifications and repairs are available through the program.

- Further, the CHOICE program in Indiana provides a wide range of assistance for seniors and the disabled, from personal care to assist with everyday chores, home modifications, and medical supply assistance. All CHOICE services are designed to help the beneficiary live independently or assist caregivers in caring for loved ones at home.

US Stair Lift Industry Overview

The Stair Lift market is moderately fragmented with major vendors, including ThyssenKrupp Elevator Technology, Handicare Group, and Stannah Lifts Holdings Ltd. The vendors are enhancing the product line by leveraging strategic collaborative initiatives and acquisitions as a competitive advantage to expand their customer base further and gain market share.

- July 2021 - The Bespoke stairlift launched a new innovative way to charge the stairlift using the unique infinity charge point, which provides increased durability and allows for a wide range of installation methods for different types of stairlift systems. Power will be transmitted to the carriage via spring-loaded contact pins to provide consistent contact in the new system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Impact Analysis of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Old age and disability significantly propel the demand for stair lifts

- 5.2 Market Restraints

- 5.2.1 High installation cost and post installation services

6 MARKET SEGMENTATION

- 6.1 By Rail Orientation

- 6.1.1 Straight

- 6.1.2 Curved

- 6.2 By User Orientation

- 6.2.1 Seated

- 6.2.2 Standing

- 6.2.3 Integrated

- 6.3 By Installation

- 6.3.1 Indoor

- 6.3.2 Outdoor

- 6.4 By Application

- 6.4.1 Residential

- 6.4.2 Healthcare

- 6.4.3 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AmeriGlide Distributing 2019, Inc.

- 7.1.2 Handicare Group

- 7.1.3 ThyssenKrupp Elevator Technology

- 7.1.4 Stannah Lifts Holdings Ltd.

- 7.1.5 Bruno Independent Living Aids Inc.

- 7.1.6 Acorn Stairlifts Inc.

- 7.1.7 Bespoke Stairlifts Limited

- 7.1.8 Acme Home Elevator

- 7.1.9 Harmar

- 7.1.10 Ascent Mobility

- 7.1.11 Les Escalateurs Atlas

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219