|

市場調查報告書

商品編碼

1644828

伺服馬達:全球市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Global Servo Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

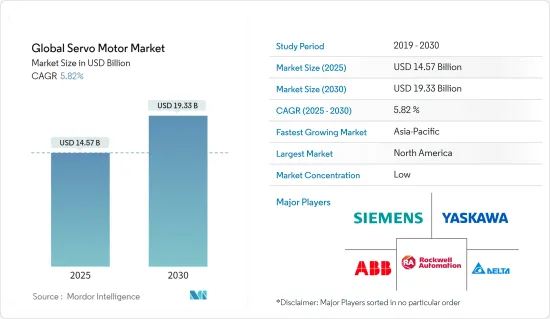

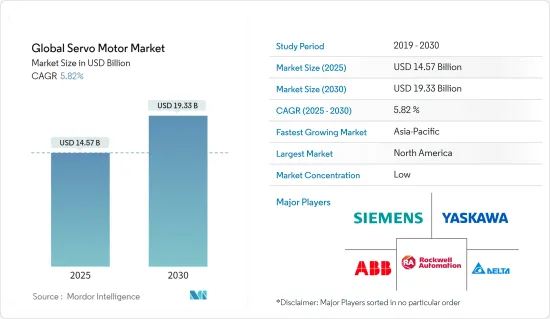

預計 2025 年全球伺服馬達市場規模為 145.7 億美元,到 2030 年將達到 193.3 億美元,預測期內(2025-2030 年)的複合年成長率為 5.82%。

最近的技術進步和政府政策(例如一些國家的最低能源性能標準 (MEPS))使得馬達系統更加節能,從而擴大了伺服馬達和驅動器的市場。

主要亮點

- 最先進的運動控制裝置是伺服馬達。它採用先進的設計技術、高磁性強度磁鐵材料和精確的尺寸公差。雖然這些電動設備不是一種特定類型的馬達,但它們是為需要高性能、快速反轉和精確定位的運動控制應用而設計的。此外,它易於安裝且無需維護,這在預測期內進一步推動了需求。

- 推動市場發展的主要因素是伺服馬達在自動化領域的應用。伺服系統的技術進步正在激發最終用戶的興趣。這些電氣設備用於各種行業,包括汽車製造、包裝器材、食品加工、半導體和醫療保健。

- 截至 2021 年 2 月,Allied Motion Technologies 推出了 H 系列無刷伺服馬達驅動器,其中包括 Hiperface DSL、多重回饋設備支援和安全扭力關閉 (STO) 安全選項。 H-Drive 是 Allied 新型 AMS伺服套件的一部分,旨在驅動 HeiMotion 無刷伺服馬達和 Megaflux 系列無刷力矩馬達。

- 此外,在 2022 年 Automate 展會上,科爾摩根首次推出了其新型 TMB2G 機器人無框伺服馬達。在 2022 年 6 月的分組會議會上,科爾摩根也談到了透過永磁馬達的設計和選擇來提高機器人效率。

- 影響市場成長的關鍵促進因素包括自動化的快速成長和進步,以及擴大採用節能國際標準。嚴格的電力供應標準、不斷上漲的電費以及用高效伺服馬達替換舊的低效馬達的需求預計將在預測期內推動對伺服馬達的需求。

- 受新冠肺炎疫情影響,全球工業生產受到干擾。鋼是伺服馬達常見的原料。鋼鐵業出現了一些混亂,影響了伺服馬達的生產。此外,中國也是主要的鋼鐵生產國。它每年生產世界上一半的鋼鐵。疫情期間,中國政府實施的工廠關閉和貿易限制阻礙了鋼鐵生產。

伺服馬達市場趨勢

提高自動化程度

- 製造過程中自動化、數位化和人工智慧的提高是推動汽車產業工業機器人需求的關鍵因素。

- 庫卡集團 (KUKA AG) 等汽車製造商近年來一直在實現工廠自動化,以減少現場問題、提高效率並降低營運成本。許多公司也紛紛效仿,實現工廠自動化,以提高收益和效率,從而推動伺服馬達和驅動器市場的發展。

- 例如,2022 年 6 月,Aerobotix 和 Automated Solutions Australia 正式建立國際機器人自動化夥伴關係,以開發、測試和生產高超音速飛彈。 Aerobotix 和 ASA 之間的合作將使澳洲國防部門和國防承包商能夠更多地利用兩家公司的自動化專業知識。

- 伺服馬達用於機器人、數控機械和物料輸送、包裝、工廠自動化、工具機、組裝和其他工業領域的自動化製造等要求嚴格的馬達。因此,預計預測期內自動化和機器人技術的普及將推動汽車領域伺服馬達市場的發展。

北美佔很大佔有率

- 在北美,美國是工業機器人最大的用戶,佔該地區總安裝量的79%。排名第二的是墨西哥,佔 9%,排名第三的是加拿大,佔 7%(資料來源:國際機器人聯合會)。

- 例如,2021年12月,先進自動化協會報告稱,北美工廠和工業相關人員在2021年前九個月訂購了29,000台機器人,與前一年同期比較成長了37%。

- 在日本,多個製造過程都已自動化,伺服馬達對精度和重複性有很高的要求。與液壓泵和感應馬達不同,伺服馬達可以在運行過程中開啟和關閉,從而減少高達 65% 的功耗。

- 伺服解決方案是基於最新的單一來源、系統為基礎的設計思維。它利用了科爾摩根的AKD2G伺服驅動器和AKM2G伺服馬達的性能。由於馬達和驅動器在各個方面都精確匹配(驅動器開關頻率、換向演算法、馬達磁性等),工程師可以避免因選擇不同製造商的組件而可能出現的微不相容性。

- Applied Motion Products 已擴大其 MDX 整合伺服馬達的供應商接受度。此認證確保馬達符合美國高品質電氣安全標準。 Integrated 的馬達已依照 ANSI/UL 標準 1004-1 旋轉馬達、1004-6 伺服和步進馬達以及 61800-5-1 可調速驅動器進行測試。此認證的 UL 文件編號為 E472271。

伺服馬達產業概況

由於市場參與企業熱衷於克服處理器的缺點並越來越關注新產品的開發,因此預計預測期內伺服馬達市場將面臨激烈的競爭。公司也正在透過合作、併購來擴大其消費者範圍。 ABB 有限公司、Allied Motion Technologies 有限公司、Ametek 有限公司、通用電氣公司、日本電產株式會社、羅克韋爾自動化公司、施耐德電氣、艾默生電氣公司、西門子股份公司、WEG 工業公司、日立有限公司、東方馬達、三菱電機和安川電機等公司是全球伺服馬達製造業的主要企業。

- 2021 年 11 月-羅克韋爾自動化宣布擴展其 PowerFlex AC 變頻驅動器產品組合,以支援更廣泛的馬達控制應用。借助 TotalFORCE 技術,客戶可以受益於具有更高靈活性、效能和智慧化的下一代驅動器。

- 2021 年 4 月-透過增加新的伺服馬達,西門子擴大了其 Sinamics S210 單電纜伺服驅動系統的應用範圍。該公司正在推出 Simotics S-1FS2,這是一款帶有不銹鋼外殼的馬達版本,適用於製藥和食品行業,最高防護等級為 IP67/IP69,並配備高解析度 22 位元絕對式多圈編碼器。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者和消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 越來越多採用國際能源效率標準

- 提高自動化程度

- 市場挑戰

- 增加低成本替代品的可用性

第 6 章 分割

- 依馬達類型

- 交流伺服馬達

- 直流伺服馬達

- 按最終用戶產業

- 石油和天然氣

- 化工和石化

- 發電

- 用水和污水

- 金屬與礦業

- 飲食

- 離散製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 義大利

- 法國

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 智利

- 其他拉丁美洲國家

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東和非洲地區

- 北美洲

第 7 章 供應商市場佔有率

第8章 競爭格局

- 公司簡介

- Yaskawa Electric Corporation

- ABB Ltd.

- Siemens AG

- Rockwell Automation, Inc.

- Delta Electronics, Inc.

- Maxon Precision Motors, Inc.

- Mitsubishi Electric Corp.

- FANUC Corp.

- SANMOTION R.

- Schneider Electric

第9章投資分析

第10章:市場的未來

The Global Servo Motor Market size is estimated at USD 14.57 billion in 2025, and is expected to reach USD 19.33 billion by 2030, at a CAGR of 5.82% during the forecast period (2025-2030).

Recent technological advancements and government policies such as Minimum Energy Performance Standards (MEPS) in several countries have resulted in energy-efficient motor systems, which has increased the market for servo motors and drives.

Key Highlights

- The most advanced motion control devices are servo motors. It employs advanced design techniques, high-force magnet materials, and precise dimensional tolerance. Although not a specific type of motor, these electrical devices are designed and intended for motion control applications requiring high performance, quick reversing, and precise positioning. Furthermore, it is simple to install and requires no maintenance, further driving their demand over the forecast period.

- The primary factor driving the market is the use of servo motors for automation. Technological advancements in servo systems have increased end-user interest. These electrical devices are used in various industries, including automobile manufacturing, packaging machines, food processing, semiconductors, and healthcare.

- As of February 2021, Allied Motion Technologies introduced the H Series Brushless Servo Motor Drive, which includes Hiperface DSL, multi-feedback device support, and Safe Torque Off (STO) safety options. The H-Drive is part of Allied's new AMS servo packages and is designed to drive the HeiMotion brushless servo motors and Megaflux series of brushless torque motors.

- Further, at Automate 2022, Kollmorgen debuted the new TMB2G Robot-Ready Frameless Servo Motors. At the June 2022 breakout session, Kollmorgen also talked about improving Robot Efficiency Through Permanent Magnet Motor Design and Selection.

- Some significant drivers influencing the market growth are rapid growth and advancements in automation, and increasing adoption of international energy-efficient standards. Stringent electricity utilization standards, rising electricity prices, and the need to replace outdated low-efficiency electric motors with highly efficient servo motors are expected to drive demand for servo motors over the forecast period.

- Global industrial production was disrupted as a result of the COVID-19 pandemic. Steel is a common raw material used in servo motors. Several disruptions occurred in the steel industry and hampered servo motor production. Furthermore, China is a major steel producer. Every year, the country produces half of the world's steel. Steel production was hampered by factory closures and trade restrictions imposed by the Chinese government during the pandemic.

Servo Motor Market Trends

Increasing Automation Advancement

- The growing use of automation in manufacturing processes and the incorporation of digitization and AI are the primary factors driving demand for industrial robots in the automotive sector.

- Automakers, such as KUKA AG, have automated their plants in recent years to reduce the number of issues on the shop floor, improve efficiency, and lower operational costs. Many companies have followed suit, automating their plants to gain better returns and efficiency, thereby driving the servo motors and drives market.

- For instance, in June 2022, Aerobotix and Automated Solutions Australia officially announced an international robotic automation partnership for developing, testing, and manufacturing hypersonic missiles. The Aerobotix-ASA collaboration will make it easier for the Australian defense sector and defense contractors to access both companies' automation expertise.

- Servo motors are used in material handling, packaging, factory automation, machine tools, assembly lines, and other demanding applications such as robotics, CNC machinery, and automated manufacturing in the industrial sector. As a result, increased automation and robotics adoption is expected to drive the market for servo motors in the automotive sector over the forecast period.

North America to Hold Significant Share

- In North America, the United States is the largest industrial robot user in the Americas, accounting for 79% of total installations in the region. Mexico comes second with 9%, and Canada comes third with 7% (source: International Federation of Robotics).

- For Instance, in December 2021, According to the Association for Advancing Automation, factories and industrial concerns in North America ordered a record 29,000 robots in the first nine months of 2021, a 37 % increase over the previous year (A3).

- Servo motors demand accuracy and repeatability in a country where multiple manufacturing processes are becoming increasingly automated. Unlike hydraulic pumps or induction motors, Servo motors are switched on and off during operation to consume less power saving up to 65%.

- The servo solution is based on the most recent single-source, system-based design ideas. It uses Kollmorgen's AKD2G servo drive and AKM2G servo motor's performance capabilities. It avoids micro-incompatibilities when engineers select components from different manufacturers because the motor and drive are precisely matched in every element (e.g., drive switching frequency, commutation algorithms, and motor magnetics).

- Applied motion products increased MDX Integrated servo motor acceptance on the supplier front. The certification ensures that the motors meet high-quality electrical safety standards in the United States. The motors from Integrated were tested by the ANSI/UL standards 1004-1 Rotating Electrical Machines, 1004-6 Servo and Stepper Motors, and 61800-5-1 Adjustable Speed Drives. The certifications are listed as UL file number E472271.

Servo Motor Industry Overview

The market for servo motors is expected to be highly competitive over the forecast period, as market participants are increasingly focusing on new product development with a sharp focus on overcoming the processor's shortcomings. The players are also focusing on partnerships, mergers, and acquisitions to broaden their consumer base. Organizations such as ABB Ltd., Allied Motion Technologies, Inc., Ametek, Inc., General Electric Company, Nidec Corporation, Rockwell Automation Inc., Schneider Electric, Emerson Electric Company, Siemens AG, WEG Industries, Hitachi Ltd., Oriental Motor, Mitsubishi Electric Corp., Yaskawa Electric Corp. are the key performers in manufacturing servo motor globally.

- November 2021- Rockwell Automation, Inc. announced the expansion of its PowerFlex AC variable frequency drive portfolio to support a wider range of motor control applications. Customers will benefit from increased flexibility, performance, and intelligence in their next-generation drive thanks to TotalFORCE Technology.

- April 2021- By adding new servo motors, Siemens is expanding the range of applications for its Sinamics S210 single-cable servo drive system. The company is launching the Simotics S-1FS2, a motor version with a stainless-steel housing, the highest level of protection IP67/IP69, and high-resolution 22-bit absolute multiturn encoders for use in the pharmaceutical and food industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing the adoption of international energy-efficiency standards

- 5.1.2 Growing Automation Advancements

- 5.2 Market Challenges

- 5.2.1 Growing the availability of low-cost alternatives

6 SEGMENTATION

- 6.1 By Motor Type

- 6.1.1 AC Servo Motor

- 6.1.2 DC Servo Motor

- 6.2 By End-user Industry

- 6.2.1 Oil & Gas

- 6.2.2 Chemical & Petrochemical

- 6.2.3 Power Generation

- 6.2.4 Water & Wastewater

- 6.2.5 Metal & Mining

- 6.2.6 Food & Beverage

- 6.2.7 Discrete Industries

- 6.2.8 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 Italy

- 6.3.2.4 France

- 6.3.2.5 Russia

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Australia & New Zealand

- 6.3.3.6 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Chile

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle-East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Turkey

- 6.3.5.4 Rest of Middle-East and Africa

- 6.3.1 North America

7 VENDOR MARKET SHARE

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Yaskawa Electric Corporation

- 8.1.2 ABB Ltd.

- 8.1.3 Siemens AG

- 8.1.4 Rockwell Automation, Inc.

- 8.1.5 Delta Electronics, Inc.

- 8.1.6 Maxon Precision Motors, Inc.

- 8.1.7 Mitsubishi Electric Corp.

- 8.1.8 FANUC Corp.

- 8.1.9 SANMOTION R.

- 8.1.10 Schneider Electric