|

市場調查報告書

商品編碼

1644845

非洲 LED 照明:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Africa LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

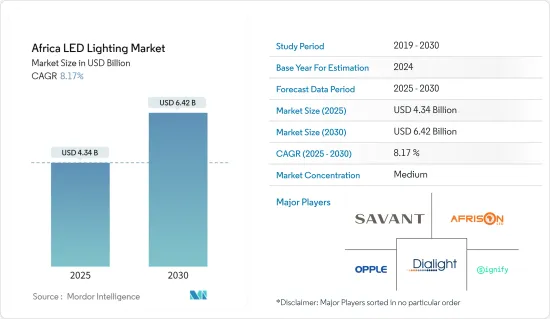

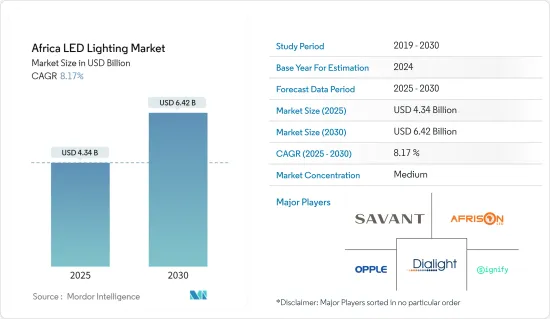

預計 2025 年非洲 LED 照明市場規模為 43.4 億美元,到 2030 年將達到 64.2 億美元,預測期內(2025-2030 年)的複合年成長率為 8.17%。

LED 技術主導著幾乎所有的照明應用,因為 LED 比緊湊型螢光(CFL) 和白熾燈等傳統光源更可靠、更堅固、更節能、光源更清潔。

關鍵亮點

- 發光二極體) 是一種由半導體晶片組成的電子元件,當電流通過時會發光。當電子在能帶之間躍遷時,能量以光的形式釋放。採用晶片組或垂直陣列上的小型 LED 陣列作為光源,並以燈、警棍、燈泡和條帶等各種形式在市場上銷售。 LED 比其他替代光源更環保,在包括非洲在內的世界各地越來越受歡迎。

- 國際上正在推廣 LED,以解決各種照明選擇的有害影響,因為其他光源會產生有害的加熱效應和溫室氣體。 LED的使用直接和間接地有助於解決電力短缺和碳排放。因此,非洲地區各國政府也大力推廣LED的使用與銷售。例如,根據africa.com報道,2021年5月,非洲代表提交了《關於汞的水俁公約》修正案。解除照明中汞的特別豁免將為大規模採用LED鋪平道路,透過在全部區域節省能源來減輕電網負擔。

- 然而,廣泛的電力供應仍然是一個主要障礙,影響了 LED 照明的需求。政府和私人組織正在尋求擴大離網電力供應並推動傳統和可再生能源發電計劃。例如,據非洲開發銀行集團稱,2022年2月,南非主要可再生能源投資之一的南非紅聚光型太陽光電(CSP)計劃實現了首次債務減免。非洲開發銀行作為牽頭安排行(MLA)和協調銀行,為該交易承諾投資 23.06 億蘭特,總投資額為 116 億蘭特。

- 新冠肺炎疫情爆發後的經濟決策影響了非洲國家的總體經濟和貿易活動。來自中國和其他國家的進口產品對當地製造商構成了挑戰。然而,在 LED 照明製造商的適當投資下,市場中的新本地進入者可能會繼續推動該地區這一領域的成長。

非洲 LED 照明市場趨勢

政府措施和不斷成長的基礎設施推動市場

- 政府正在不斷採取措施,消除該地區廣泛使用的汞等有害光源。當汞被排放到環境中時,它會釋放有毒蒸氣,隨著時間的推移,這些有毒氣體會進入食物鏈,並可能造成致命的影響。例如,為了解決這個問題,各國政府成立了清潔照明聯盟,這是一個由技術專家、計劃者和產業相關人員使命是推出《水俁公約》對照明產品中汞的豁免規定。這些措施為LED照明解決方案更廣泛地普及鋪平了道路。

- 非洲的衛生基礎設施需要迅速發展,這一點在疫情期間成為人們關注的焦點。根據afdb.org報道,非洲儘管人口居住全球15%,但傳染病死亡人數卻佔全球的50%。非洲開發銀行集團等組織制定了《非洲優質衛生基礎設施策略》等策略,並正在與該地區的政府合作擴大衛生基礎設施。預計此類發展將產生對照明解決方案的巨大需求,這將有助於更好地管理能源並促進整體成長。

- 根據世界銀行預測,2022年西非和中非地區的GDP成長率將達到3.6%。此外,預計 2022 年成長率將達到 5.3%,而 2021 年為 4.5%。儘管受到新冠疫情的影響,該地區仍將實現顯著的經濟成長,並吸引更好的工業和城市基礎設施發展。這需要高效、清潔的照明解決方案,為 LED 照明鋪平了道路。良好的成長前景可能會吸引投資者建立和擴大 LED 照明製造設施。

- 停電是非洲大陸不同地區常見的災害。這個問題阻礙了非洲大多數產業的成長,包括LED需求和製造業。政府正採取多項舉措,努力推廣 LED 等節能電器產品。例如,根據 engineeringnews.co.za 報導,南非礦產資源和能源部 (DMRE) 和南非國家能源發展實驗室 (SANEDI) 正在製定街道照明最低能源性能標準 (MEPS)。 MEPS 允許監管機構確保產品符合一定的能源性能標準,這有望提高優質照明產品的效率和採用率。

- 許多組織正在與政府和其他私人實體密切合作,擴大非洲全部區域的電網。根據 Power Africa 統計,撒哈拉以南非洲地區三分之二的人缺電。 Power Africa 和美國國際開發署提供了 280 萬美元的津貼,為 220 多個醫療機構提供可靠的可再生醫療電力,幫助 9 個國家的 200 多萬人受益。這種積極的電氣化措施,加上民眾和私營部門對能源效率的努力,將使 LED 照明解決方案成為非洲未來的關鍵,並有望實現強勁成長。

工業 LED 產品需求推動市場

- 未來幾年,非洲地區將經歷一場類似20世紀80年代的工業革命。該地區將為各行業各種規模的企業設立新設施和製造單位。 LED是一種可行、經濟、節能的光源,適合大規模安裝,因此對LED的大規模安裝需求龐大。

- 在撒哈拉以南非洲(SSA),收入水準和就業率正在上升,這是工業化進程加快的關鍵指標。近幾十年來,勞動力規模不斷擴大,低工資推動了新企業成為創造就業機會的動力。雖然低薪就業成長空間正在縮小,但工業化的崛起並沒有被掩蓋,並將為照明解決方案帶來巨大的推動力。

- 越來越多的公司和企業希望透過促進內部生產和出口產品和服務成為全球價值鏈 (GVC) 的一部分。企業正在探索政策在進入其供應鏈時所發揮的作用。許多公司為了促進國內貿易,正在取消外部訂單和合約。例如,加納終止了與總部位於北京的Everyway Traffic and Lighting Techn公司的合約。該公司承包計劃該國的智慧交通管理系統。此類計劃不僅可以增強當地經濟,還可以在 LED 等照明解決方案領域創造就業機會。

- 由於大多數工業應用需要節能高效的照明,各國都對LED製造計劃表示歡迎。例如,根據 africanminingmarket.com 報導,2022 年 5 月,利勃海爾非洲公司選擇了 BEKA Schreder 的 Ecobay LED 解決方案,為其位於約翰內斯堡附近斯普林斯的起重機設施提供照明。 Ecobay LED 裝置在南非設計和製造。此類安裝為銷售和電力效率帶來了互利,推動了該地區的發展。

非洲LED照明產業概況

非洲的LED照明市場處於中等到高度細分化狀態。基本製造設備的價格合理意味著設置成本低,使得新進入者能夠進入市場並在當地提供他們的產品。這會影響在國內或國際層面營運的知名品牌的整體銷售。政府支持永續能源和永久電氣化的計畫正在吸引越來越多的投資者到該地區,增加就業機會並為經濟做出貢獻。

- 2021 年 10 月-歐普設計街道照明解決方案,以改善城市的交通和照明品質。該公司將點亮烏邦戈立交橋這一“標誌性計劃”,這是坦尚尼亞第一個由政府主導的立交橋計劃。這有助於歐普推出符合「一帶一路」計劃的戶外照明解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 價值鏈分析

- 評估新冠肺炎疫情對市場的影響

第5章 市場動態

- 市場促進因素

- LED 照明成本下降

- 高能量、長壽命

- 市場挑戰/限制

- 與傳統照明相比,照明產品價格昂貴

第6章 市場細分

- 細分:依照明類型

- 燈/燈泡

- 照明燈具

- 按用途細分

- 住宅/消費者

- 商業/建築

- 工業的

- 戶外用

- 按分銷管道

- 直接銷售

- 批發零售/建築師/顧問及其他

- 地理細分

- 埃及

- 南非

- 奈及利亞

- 非洲其他地區

第7章 競爭格局

- 公司簡介

- AFRISON LED

- DIALIGHT PLC

- SIGNIFY HOLDING

- SAVANT SYSTEMS INC.

- OPPLE LIGHTING CO.

- NVC SA LIGHTING

- SHANGHAI YAMING LIGHTING CO.

- HELIOSPECTRA AB

- LED LIGHTING SA

- GL LIGHTING

- NORDLAND LIGHTING

- LEDWISE LIGHTING(PTY)LTD.

第8章投資分析

- 企業進入或進一步確立市場地位最常採用的策略

- 市場投資分析

第9章:未來市場展望

The Africa LED Lighting Market size is estimated at USD 4.34 billion in 2025, and is expected to reach USD 6.42 billion by 2030, at a CAGR of 8.17% during the forecast period (2025-2030).

The LED technology is taken over pretty much every application of lighting, as the LEDs are more reliable, robust, more power-efficient, and cleaner sources of light compared to the other conventional sources like Compact Fluorescent Lamps (CFLs) and incandescent lights.

Key Highlights

- Light Emitting Diode, or LED, is the electronic component comprising a semiconductor chip, emitting light as current passes through it. The transition of electrons among the energy bands results in a release of energy in the form of light. An array of small LEDs on a chipset or a vertical array is used as a light source, sold commercially in different forms, including lamps, batons, bulbs, strips, etc. LEDs are environment-friendly compared to other light alternatives and are gaining popularity worldwide, including in Africa.

- Since other light sources come with harmful heating effects and greenhouse gases, LEDs are promoted internationally to tackle the detrimental impact of different lighting options. The use of LED helps address the power shortage and the carbon footprints directly and indirectly. Hence, governments in the African region are also promoting the use and sales of LEDs. For instance, according to africa.com, in May 2021, an amendment has proposed the representatives from Africa to the Minamata Convention on Mercury. The restraint from the special exemptions for mercury in lighting would pave the way for LED for mass adoption, relieving the power grids through energy-saving across the regions.

- However, the penetration of electricity remains a major hurdle, affecting the demand for LED lighting. Government and private organizations are looking forward to expanding the reach of electricity through off-grid power alternatives and boosting conventional and renewable energy generation projects. For instance, according to the African Development Bank Group, in February 2022, South African Redstone concentrated solar power (CSP) project achieved its first debt drawdown on one of the major renewable energy investments in South Africa. The African Development Bank acted as the Mandated Lead Arranger (MLA) and Coordinating Bank for the ZAR 11.6 billion total investment, committing ZAR 2.306 billion to the transaction.

- The economic decisions after the COVID-19 pandemic have affected African countries' general economic and trade activities. Importing items from Chinese counterparts and other countries has challenged the local manufacturers. However, new local entrants in the market, along with decent investments for LED lighting manufacturers, will continue the growth of the sector in the region.

Africa LED Lighting Market Trends

Government Initiatives and Growing Infrastructure Driving the Market

- The governments are constantly taking measures toward eliminating harmful light sources like Mercury, which is used widely in the region. When disposed of in the environment, Mercury might produce toxic vapors that may be fatal as they enter the food chain with time. For instance, to tackle this, the governments came up with the Clean Lighting Coalition, a team of technical experts, advocates, and industry stakeholders aiming to eliminate the exemptions for Mercury in lighting products under the Minamata Convention. Such measures pave the way for LED lighting solutions to reach the masses.

- The health care infrastructure in Africa needs to be developed at a high rate, which was majorly highlighted during the pandemic. According to afdb.org, despite 15% of the world population residing in Africa, African citizens account for 50% of the global deaths from communicable diseases. Organizations like the African Development Bank Group are forming strategies like Strategy for Quality Health Indfratrucsture in Africa, coordinating with the region's governments for upscaling the healthcare infrastructure. Such developments will create enormous demands for lighting solutions to manage the energy better and contribute to overall growth.

- According to the world bank, the growth of the economy estimated GDP in Western and Central Africa will be at 3.6% in 2022. The subregion is also expected to project a growth rate of 5.3% in 2022, compared to the 4.5% in 2021. Despite the COVID impact, the regions will display significant economic growth, attracting better industrial and urban infrastructure development. This would create the need for efficient and cleaner lighting solutions, paving the way for LED lighting. The promising growth would attract investors to establish and expand the LED lighting manufacturing facilities.

- Load shedding is a common hurdle in different parts of the African continent. The issue hampers the growth of most African industries, including LED demand and manufacturing. Several government initiatives are trying to promote energy-efficient appliances like LED. For instance, according to engineeringnews.co.za, South Africa is observing the Department of Mineral Resources and Energy (DMRE) and the South African National Energy Development Institute (SANEDI) developing minimum energy performance standards (MEPS) for streetlights. The MEPS is expected to boost efficiency and increase the adoption of high-quality lighting products for the regulators to ensure that the products meet certain criteria related to energy performance.

- Many organizations are working closely with the government and other private groups to expand the electrical grid across several untouched African regions. According to Power Africa, two out of three humans lack electricity in sub-Saharan Africa. Power Africa and USAID contribute to providing a grant of USD 2.8 million for delivering reliable and renewable health electricity to more than 220 health facilities, benefitting more than two million people in nine countries. Such measures of active electrification, with people's and private sectors' focus on energy efficiency, make LED lighting solutions indispensable in Africa's coming times, promising high growth.

Demand for Industrial LED Products Drive the Market

- The African region is bound to witness an industrial revolution like the 1980s in the coming years. The region will welcome new facilities and manufacturing units for businesses of different sizes belonging to various sectors. This would generate enormous demand for extensive installation of LEDs since LEDs mark a viable, economical, and energy-efficient light source for preference in a large-scale installation.

- The income levels and employment have increased, the critical indicators of increasing industrialization in Sub-Saharan Africa (SSA). The size of the workforce has expanded in the recent decades, with the new firms driving the job creation, accelerated by low wages. Although the scope for job growth at low wages has declined, the increasing industrialization is not hidden, pacing the way for lighting solutions to get a significant push.

- An increasing number of businesses and companies are looking forward to becoming a part of the Global Value Chain (GVCs) by promoting in-house manufacturing and exporting products and services. The companies are exploring the role of policies in entering the supply chains. Many companies have canceled the orders and contracts with external sources to promote local trade. For instance, Ghana canceled the agreement signed with the Beijing Everyway Traffic and Lighting Techn company. The company had undertaken a project to develop an intelligent traffic management system for the country. Such projects not only strengthen the local economy but also create employment and opportunities for lighting solutions like LED.

- Countries welcome LED manufacturing projects, as most industrial applications demand energy-saving, efficient lighting alternatives. For instance, according to africanminingmarket.com, in May 2022, Liebherr-Africa opted for BEKA Schreder's Ecobay LED solutions to light up their crane facility in Springs near Johannesburg. The Ecobay LED units are designed and manufactured in South Africa. Such installations offer a mutual benefit of sales and power efficiency, leading the region in a constructive direction.

Africa LED Lighting Industry Overview

The Africa LED lighting market is moderate to highly fragmented. The affordable essential manufacturing equipment contributes to low setup costs, enabling new local entrants to enter the market space and provide the products locally. This affects the overall sales of the more prominent brands operating at the national or international level. The government programs for supporting sustainable energy and constant electrification are attracting more and more investors in the region, generating more employment and contributing to the economy.

- October 2021 - Opple designed a street lamp solution to improve the quality of urban traffic flow and lighting. The company lights up the "landmark project" of Ubungo Interchange, which marked Tanzania's first government-led interchange project. It helped Opple deploy its outdoor lighting solutions in response to the Belt and Road initiative.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption And Market Defination

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of the Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Declining Cost of LED Lighting

- 5.1.2 High Energy and Long Lifespan

- 5.2 Market Challenges/Restraints

- 5.2.1 Expensive Light Products Compared to Traditional Light

6 MARKET SEGMENTATION

- 6.1 Segmentation - By Light Type

- 6.1.1 Lamp/Bulb

- 6.1.2 Luminaire/Fixture

- 6.2 Segmentation - By Application

- 6.2.1 Residential/Consumer

- 6.2.2 Commercial/Architecture

- 6.2.3 Industrial

- 6.2.4 Outdoor

- 6.3 Segmentation - By Distribution Channel

- 6.3.1 Direct Sales

- 6.3.2 Wholesale Retail/Architects/Consultants & Others

- 6.4 Segmentation - By Geography

- 6.4.1 Egypt

- 6.4.2 South Africa

- 6.4.3 Nigeria

- 6.4.4 Rest of Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AFRISON LED

- 7.1.2 DIALIGHT PLC

- 7.1.3 SIGNIFY HOLDING

- 7.1.4 SAVANT SYSTEMS INC.

- 7.1.5 OPPLE LIGHTING CO.

- 7.1.6 NVC SA LIGHTING

- 7.1.7 SHANGHAI YAMING LIGHTING CO.

- 7.1.8 HELIOSPECTRA AB

- 7.1.9 LED LIGHTING SA

- 7.1.10 GL LIGHTING

- 7.1.11 NORDLAND LIGHTING

- 7.1.12 LEDWISE LIGHTING (PTY) LTD.

8 INVESTMENT ANALYSIS

- 8.1 Most Adopted Strategies By Companies To Enter or Further Establish in the Market

- 8.2 Market Investment Analysis