|

市場調查報告書

商品編碼

1644865

主資料管理:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Master Data Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

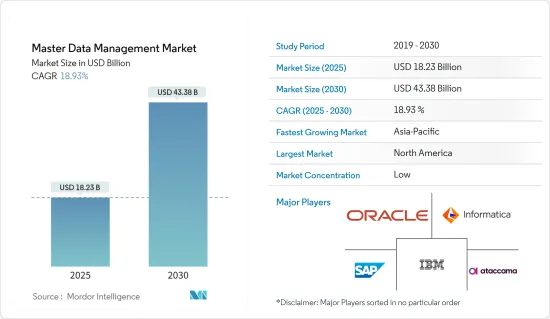

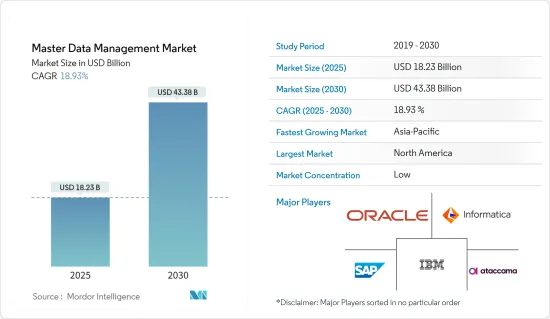

主資料管理市場規模預計在 2025 年為 182.3 億美元,預計到 2030 年將達到 433.8 億美元,預測期內(2025-2030 年)的複合年成長率為 18.93%。

對資料合規性的需求以及知名企業為改善業務而擴大使用主資料管理解決方案可能會推動收益成長。

主要亮點

- 主資料管理和資料管治工具對於決策和消費者拓展提供可信任資訊至關重要。這是因為資料是由資料的企業和合作夥伴組織中的更廣泛的系統、IT 專家和使用者創建和存取的。

- 近年來,企業越來越意識到資料可以成就或破壞其最重要的業務活動。物聯網 (IoT)、互聯設備、雲端處理、行動性和數位化增加了資料的流量和數量,再加上廉價儲存的可用性,使得組織可以儲存幾乎所有的東西。不幸的是,這種策略改變了敏感、有價值和關鍵任務資料點的參數,並且通常會產生黑暗資料沼澤。

- 從隔離的資料環境轉向統一的主資料集是許多公司目前正在探索和嘗試的事情。此類主資料計畫(也稱為主資料管理 (MDM)計劃)的目標是產生和利用關鍵企業資料的黃金副本,並盡可能接近源頭發現、檢驗和解決資料錯誤。成功的 MDM 程序可確保資料的一致性、完整性和準確性。然而,只有在業務支援的資料管理舉措的伴隨下,實施 MDM 計劃才能保證成功。

- 機器學習(ML)、巨量資料和人工智慧(AI)領域的最新創新正在擴大市場。這項技術不僅提供了存取龐大資料集的機會,而且為資料處理和儲存開闢了新的技術可能性。隨著新技術越來越能夠處理來自多個領域和觀點的資料,客戶的期望也隨之改變。最常見的要求是將主資料管理系統與巨量資料、分析和商業智慧技術結合。

- 然而,實施、資料安全和隱私問題限制了市場收益。嚴格的立法和廣泛的業務要求使得 MDM 的採用成為一項挑戰。此外,隨著公司不斷整合技術,它們更容易受到安全漏洞和攻擊。由於擔心丟失敏感的個人資料,用戶不願意使用 MDM 解決方案。這些問題阻礙了 MDM 解決方案的採用並限制了市場的收益成長。

主資料管理市場趨勢

雲端 MDM 領域佔很大佔有率

- 隨著主資料管理 (MDM) 對企業成功變得越來越重要,分析用於擷取、儲存和利用主資料的新技術和方法變得至關重要。新一代 MDM 系統將由 AI/ML、雲端、聯合架構、跨企業共用、全球影響力、資料平台解決方案和其他現代 MDM 功能驅動。

- 隨著供應商和客戶遍布全球並進行虛擬交流,企業部門已轉向基於雲端的 MDM 技術以實現速度和靈活性。企業將客製化MDM雲端服務,更加重視主資料與雲端來源的整合以及本地資料品質。

- 隨著越來越多的應用程式和資料轉移到雲端,資料專業人員發現他們需要跨多個雲端、在單一雲端中以及在本地來源中管理更複雜的資料量。為了實現這種多樣化的拓撲,多重雲端和跨雲端資料管理至關重要。

- 雲端基礎的服務在 MDM(以及其他關鍵企業應用程式)中越來越受歡迎。隨著資料中心重心不斷超越防火牆,在與雲端來源資料和應用程式整合方面,雲端 MDM 等雲端原生解決方案可能會比內部部署解決方案更具優勢。

北美佔據主要市場佔有率

- 據估計,主資料管理產業在北美擁有最大的市場佔有率。該地區技術的應用日益廣泛是推動北美 MDM 市場成長的關鍵原因之一。 IBM、 Oracle、Informatica Inc. 等該地區 MDM 參與者的擴張預計將推動市場進一步擴張。

- 同時,主要區域經濟體不斷增加的研發支出有助於北美主資料管理市場開拓新技術。

- 例如,2022 年 6 月,綜合資料管理和管治解決方案提供商 Ataccama 在一輪成長資本投資中獲得了 1.5 億美元。

- 在美國,有關資料保護和安全的嚴格法規要求某些行業(例如銀行業和醫療保健業)的組織採用 MDM。此外,提高業務效率和減少資料冗餘的日益成長的需求也在推動市場的發展。

主資料管理產業概覽

主資料管理市場高度分散,有幾個主要參與者。目前,只有少數幾家主要企業佔據了很大一部分市場,包括 IBM、 Oracle 、Informatica Inc.、SAP SE 和 Ataccama。市場參與者正在擴大國際消費群,以增加市場佔有率和盈利。

- 2022 年 10 月 - 領先的統一資料管理平台供應商 Ataccama 宣布提前發布其 Ataccama ONE 平台的下一個重大更新。在這個版本中,Ataccama 引入了新功能,支援公司為全球企業提供端到端資料管理並實現資料民主化的目標。此次平台升級使阿塔卡馬站在了日益成長的行業共識的最前沿,即現代資料管治程序必須以單一用途技術無法實現的方式融合資料管治功能。

- 2022 年 2 月-IBM 宣布收購 Neudesic,這是一家美國雲端服務顧問公司,專門從事 Microsoft Azure 平台和多重雲端知識。此次收購大大擴展了 IBM 的混合多重雲端服務組合,並進一步推進了公司的混合雲和 AI 策略。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 檢驗和合規性需求不斷增加

- 資料管理中擴大使用資料品質工具

- 市場限制

- 昂貴的整合和維護工作

- 資料安全和隱私問題

- 各地區均實施嚴格的資料監管

第6章 市場細分

- 按組件

- 軟體

- 服務

- 按部署模型

- 本地

- 雲

- 按公司規模

- 大型企業

- 中小型企業

- 按應用

- 供應商

- 按產品

- 顧客

- 其他用途

- 按行業

- 資訊科技/通訊

- BFSI

- 衛生保健

- 政府

- 零售

- 製造業

- 教育

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- IBM

- Oracle

- Informatica Inc.

- SAP SE

- Ataccama

- SAS Institute Inc.

- TIBCO Software Inc.

- Teradata Corporation

- Syndigo LLC

- Profisee

第8章投資分析

第9章:市場的未來

The Master Data Management Market size is estimated at USD 18.23 billion in 2025, and is expected to reach USD 43.38 billion by 2030, at a CAGR of 18.93% during the forecast period (2025-2030).

The demand for data compliance and the growing usage of master data management solutions in prominent companies to improve business operations would likely fuel revenue growth.

Key Highlights

- To deliver information that can be relied upon for decision-making and consumer outreach, tools for master data management and data governance are essential. This is because a broader range of systems, IT specialists, and users from businesses and partner organizations create and access data.

- In recent years, organizations have become more aware of their data, which is crucial to the success or failure of an organization's most important business activities. The Internet of Things (IoT), interconnected, connected devices, cloud computing, mobility, and digitalization have all boosted data flow and volume, combined with the availability of less expensive storage, pushing organizations to preserve practically everything. Unfortunately, this strategy has caused sensitive, critical, and mission-critical data points to have varying parameters, commonly creating dark data swamps.

- The switch from segregated data environments to a consolidated master data set is now being investigated and tried by many businesses. The purpose of such master data initiatives, also known as master data management (MDM) projects, is to generate a golden copy of crucial company data for consumption and to discover, validate, and address data errors near the source as feasible. A successful MDM program enables data consistency, completeness, and correctness. However, installing an MDM program can only guarantee success if business-supported data management initiatives are implemented concurrently.

- The market is growing due to recent innovations in machine learning (ML), big data, and artificial intelligence (AI). In addition to offering access to enormous datasets, this technology offers new technological possibilities for data processing and storage. As new technologies' capacity for handling data from several domains and perspectives has increased, customers have a wide range of expectations. The most frequent request has been to combine master data management systems with big data, analytics, and business intelligence technologies.

- However, implementation, data security, and privacy issues constrain market revenue. Due to strict laws and extensive business requirements, MDM implementation might be challenging. Furthermore, firms are progressively integrating technologies, which makes them prone to security flaws and assaults. Users resist MDM solutions because they are concerned about losing critical personal data. These issues are inhibiting MDM solution adoption and limiting the market's revenue growth.

Master Data Management Market Trends

Cloud MDM Segment to Hold a Significant Share

- Analyzing new technologies and approaches for acquiring, storing, and utilizing master data is becoming vital as master data management (MDM) becomes essential for fostering company success. The next generation of MDM systems is driven by AI/ML, cloud, federated architectures, inter-enterprise sharing, global deployment, data platform solutions, and other contemporary MDM features.

- Enterprise sectors have used MDM technologies on the cloud for speed and flexibility since vendors and customers are dispersed worldwide and communicate virtually. Businesses will customize their MDM cloud services, while those onshore will result in a stronger focus on master data integration and data quality to and from cloud sources.

- As more apps and data migrate to the cloud, data professionals can manage more complicated amounts of data across several clouds, inside one cloud, and on-premises sources. To enable these various topologies, multi-cloud and inter-cloud data management is essential.

- Cloud-based services are becoming more widely used for MDM (as well as other essential corporate applications). A cloud-native solution, such as cloud MDM, will probably offer advantages over on-premise solutions concerning integration with cloud-sourced data and apps as the center of gravity for data continues to move beyond the firewall.

North America to Hold Major Market Share

- The master data management industry is estimated to have the largest market share in North America. The expanding use of technology in the area is one of the main reasons promoting the growth of the MDM market in North America. The expansion of MDM players across regions, such as IBM, Oracle, and Informatica Inc., is anticipated to drive market expansion further.

- On the other hand, the growth of R&D spending by significant regional economies is helping the development of new technologies in the North American master data management market.

- For instance, in June 2022, Ataccama, a unified data management and governance solutions provider, secured USD 150 million in a growth capital investment round, money that will be used to finance the company's efforts to develop new products and expand its market presence.

- Organizations working in specific industries, including banking and healthcare, are required to adopt MDM because of the strict data protection and security rules in the United States. The increasing desire to enhance operational effectiveness and lessen data redundancy also drives the market.

Master Data Management Industry Overview

The master data management market is highly fragmented and has several significant players. Only some key companies currently hold a large portion of the market, such as IBM, Oracle, Informatica Inc., SAP SE, and Ataccama. The players in the market are growing their consumer bases internationally to raise their market share and profitability.

- October 2022 - Ataccama, a top provider of unified data management platforms, announced the early distribution of the upcoming significant update to its Ataccama ONE platform. With this version, Ataccama will introduce new features that support its objective of giving businesses worldwide end-to-end data management and allowing data democratization. The platform upgrade places Ataccama at the forefront of a growing industry agreement that contemporary data governance programs must converge data governance capabilities in ways that single-purpose technologies cannot.

- February 2022 - IBM announced that it had acquired Neudesic, a US cloud services consultant focused on the Microsoft Azure platform and multi-cloud expertise. The portfolio of hybrid multi-cloud services offered by IBM will be significantly increased due to this purchase, further advancing the company's hybrid cloud and AI strategy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Verification and Compliance

- 5.1.2 Growing Usage of Data Quality Tools for Data Management

- 5.2 Market Restraints

- 5.2.1 Expensive Integration and Maintenance activities

- 5.2.2 Concerns on Data Security and Privacy

- 5.2.3 Stringent Data Regulations Imposed in Various Regions

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Software

- 6.1.2 Service

- 6.2 By Deployment Model

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Enterprise Size

- 6.3.1 Large Enterprises

- 6.3.2 Small and Medium Enterprises

- 6.4 By Application

- 6.4.1 Supplier

- 6.4.2 Product

- 6.4.3 Customer

- 6.4.4 Other Applications

- 6.5 By Industry Vertical

- 6.5.1 IT and Telecommunication

- 6.5.2 BFSI

- 6.5.3 Healthcare

- 6.5.4 Government

- 6.5.5 Retail

- 6.5.6 Manufacturing

- 6.5.7 Education

- 6.5.8 Other Industry Verticals

- 6.6 By Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia

- 6.6.4 Australia and New Zealand

- 6.6.5 Latin America

- 6.6.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM

- 7.1.2 Oracle

- 7.1.3 Informatica Inc.

- 7.1.4 SAP SE

- 7.1.5 Ataccama

- 7.1.6 SAS Institute Inc.

- 7.1.7 TIBCO Software Inc.

- 7.1.8 Teradata Corporation

- 7.1.9 Syndigo LLC

- 7.1.10 Profisee