|

市場調查報告書

商品編碼

1644868

閥門:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Valves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

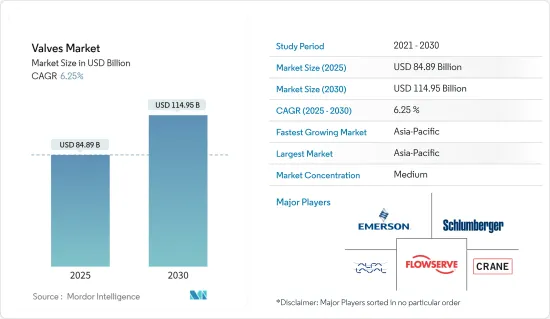

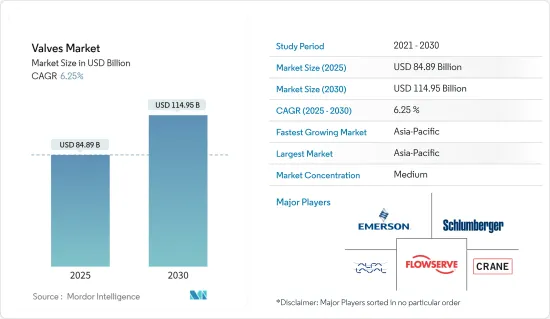

閥門市場規模預計在 2025 年為 848.9 億美元,預計到 2030 年將達到 1149.5 億美元,在市場估計和預測期(2025-2030 年)內以 6.25% 的複合年成長率成長。

閥門控制系統或製程內的流量和壓力。它是輸送液體、氣體、蒸氣、漿液等的管道系統中必不可少的組成部分。因此,對基礎設施建設和工業自動化的投資不斷增加正在推動所研究市場的成長。預計石油和天然氣領域管道基礎設施投資的增加將推動工業閥門的安裝。

主要亮點

- 此外,許多新興國家的政府供水和衛生計劃正在增加,這可能會促進家用和農業工業閥門的銷售。此外,由於閥門廣泛應用於用水和污水和污水處理廠以及配水管道,各國加大對水和用水和污水基礎設施建設的投資也是推動市場發展的主要因素。

- 全球閥門市場由多家公司主導,它們針對不同終端用戶產業的應用提供各種解決方案。這大大增加了供應商之間的競爭,並鼓勵他們開發創新的解決方案並採用獨特的商務策略來擴大其市場佔有率。因此,預計預測期內日益激烈的市場競爭將進一步推動研究市場的成長。

- 許多公司正在利用人工智慧 (AI) 和工業物聯網 (IIoT) 等新技術來最大限度地減少閥門故障和其他不良事件造成的非計劃性停機時間。配備感測器的閥門也變得越來越普遍,以減少故障和整體維護成本。預計這些先進價值觀的採用將在預測期內進一步提振市場。

- 然而,市場參與者需要遵守各種區域閥門製造認證和政策,由於閥門在多個終端用戶行業中的廣泛應用,導致產品規格多樣化。由於公司必須根據當地政策生產產品,這限制了市場成長,因此很難實現理想的安裝成本。

閥門市場趨勢

石油和天然氣產業佔大部分市場佔有率

許多石油和天然氣業務,包括精製和發行,都依賴管道系統。因此,基礎設施和可靠的控制系統對這項業務至關重要。油氣閥門是確保管路安全的重要零件。閥門系統是任何管道系統的重要組成部分。它可以控制流量、隔離和保護設備以及引導和指揮原油精製。例如,閘閥是一種用於打開和關閉流體流動的線性運動裝置,通常用於許多管道和管線應用。

石油和天然氣探勘和生產(E&P)活動的增加是市場的主要成長趨勢。此外,許多國家都在大力投資探勘非傳統資源,這為全球閥門市場帶來了樂觀的前景。由於對石油產品的需求不斷增加,石油和天然氣行業正在不斷擴張,並且在這個市場營運的供應商正在推出針對石油和天然氣行業應用的創新解決方案。

所有類型閥門在所有石油和天然氣行業基礎設施中的廣泛使用都支持了市場的成長,其中包括石油和天然氣行業中最常用的閘閥。當使用閘門系統完全打開或關閉管道並需要控制流速時,它是適用的。當致動器將閥門完全打開時,流路暢通無阻,甚至原油等泥漿狀流體也可以輕鬆流動。

閥門具有管理壓力、調節流量和控制整個工業領域資源流動的能力,在維持營運連續性和確保石油和天然氣工業正常運作方面發揮著至關重要的作用。這證實了其在維持營運穩定方面的重要作用,這可能會在預測期內刺激市場成長。

全球對郵輪油的需求不斷成長,受到石油和天然氣行業上游、中游和下游活動以及公共和私人對該行業發展生產和加工能力的投資的支持,正在支持世界各地精製和石油產品工廠的工業成長,這可能會在未來推動閥門市場的發展。

亞太市場預計將大幅成長

亞太地區由於各行業製造和研發活動的不斷發展而佔有較高的市場佔有率。此外,加大力度確保化學、石油和天然氣等行業工人的安全也支持了該地區市場的成長。

印度是成長最快的製造業和機械工業國家之一,對工業閥門的需求龐大。印度政府正在為設立製造工廠的公司提供設施。政府也推出了各種政策來促進製造業的發展。例如,2024年2月,印度政府宣布計劃在天然氣供應鏈上投資670億美元,以滿足印度日益成長的能源需求。該計劃預計將支持該國供應鏈和天然氣分配中閥門的採用,從而刺激亞太地區的市場成長。

此外,由於全部區域工業活動的不斷增加以及石油和天然氣、化學品和水處理等製造工廠數量的不斷增加,中國繼續佔據相當大的市場佔有率。這導致對能夠承受高壓的工業閥門的需求增加。例如,蘇伊士集團訂單了一份為期30年的契約,透過當地的合資企業,在中國常熟建設和營運一座工業污水處理廠。合資企業將設計、建造和營運該污水處理廠,並計劃於 2024 年開始營運。

發電設施需要能夠承受高溫、高壓和腐蝕環境等惡劣操作條件的閥門。鍋爐給水系統、一次蒸氣隔離、給水流量調節和渦輪機控制中使用的閥門顯示了亞太地區的市場需求,這與預測期內發電行業的工廠自動化趨勢一致。

包括印度、中國、日本、韓國和其他東南亞國家在內的新興經濟體的工業領域正在顯著成長,以支持其經濟發展,這將有助於亞太地區的工業建設,並推動未來閥門市場的成長,因為閥門應用於工廠基礎設施以控制蒸氣、水、冷卻劑等各種流體的流動。

閥門行業概況

全球閥門市場的特點是競爭力適中,且擁有多家領導企業。這些主要企業在國際上擁有相當大的市場佔有率和不斷成長的基本客群。這些行業巨頭正在建立策略聯盟,以擴大市場佔有率並提高盈利。著名的市場參與者包括艾默生電氣公司、斯倫貝謝有限公司、阿法拉伐公司、福斯公司和克蘭公司。

2023 年 12 月-自動化技術與軟體公司艾默生電氣 (Emerson Electric) 被韓國鋰離子電池回收專家 SungEel HiTech 選中。此次合作旨在提高位於全北群山市水力中心綜合設施內的 SungEel 最先進的鋰離子回收設施的永續生產和營運效率。根據協議,艾默生將提供先進的儀器和閥門解決方案,以滿足 SungEel HiTech 自主開發的先進濕法冶金製程的嚴格要求,幫助該公司發展閥門業務。

2023 年 11 月 - 福斯公司推出 Worcester 低溫系列,直角回轉浮動球閥,因其在 LNG、氫氣和工業氣體應用中的可靠性而聞名。此系列有兩種配置:三件式設計(CF44 系列)和法蘭選項(CF51/CF52 系列)。它具有高強度閥桿和升級的活載閥桿密封,以確保對逸散排放進行卓越的控制。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 產業價值鏈分析

- 新冠肺炎疫情對產業的影響

第5章 市場動態

- 市場促進因素

- 基礎建設相關發展增加

- 採用新技術

- 市場挑戰

- 缺乏標準化政策

第6章 市場細分

- 按類型

- 球

- 蝴蝶

- 門/手套/檢查

- 插頭

- 控制

- 其他類型

- 按行業

- 石油和天然氣

- 發電

- 化學

- 用水和污水

- 礦業

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Emerson Electric Co.

- Schlumberger Limited

- Alfa Laval Corporate AB

- Flowserve Corporation

- Crane Co.

- Rotork plc

- IMI Critical Engineering

- Samson Controls Inc.

- KITZ Corporation

- Spirax Sarco Limited

第8章投資分析

第9章:市場的未來

The Valves Market size is estimated at USD 84.89 billion in 2025, and is expected to reach USD 114.95 billion by 2030, at a CAGR of 6.25% during the forecast period (2025-2030).

Valves control the flow and pressure within a system or process. It forms an essential piping system component that conveys liquids, gases, vapors, slurries, etc. Hence, the growing investment in infrastructure development and the automation of industries are driving the growth of the studied market. Rising investments in pipeline infrastructure in the oil and gas sector are expected to boost the installation of industrial valves.

Key Highlights

- Additionally, many developing countries are witnessing increased government water supply and sanitation projects, which will likely propel the sales of industrial valves for domestic and agricultural applications. Furthermore, the growth in investments made by various countries to develop the water and wastewater infrastructure is another major factor driving the studied market's growth, as valves are widely used in water and wastewater plants and distribution pipelines.

- The global valve market has many players offering various solutions targeting applications across various end-user industries. This significantly drives competition among the vendors, encouraging them to develop innovative solutions and adopt unique business strategies to expand their market presence. Hence, the growing market competitiveness is anticipated to drive the studied market's growth further during the forecast period.

- Many companies are leveraging emerging technologies such as artificial intelligence (AI) and industrial Internet of Things (IIoT) to minimize unplanned downtime and other unfavorable incidents due to valve failures. Valves equipped with sensors are also being increasingly adopted to reduce failures and overall maintenance costs. The adoption of these advanced values is expected to boost the market further over the forecast period.

- However, the market players need to comply with the various certifications and policies of different regions concerning valve manufacturing, resulting in diversity in product specifications due to the widespread application of valves in several end-user industries. This acts as a restraint for market growth as the companies have to manufacture products according to the regional policies, making it difficult for them to achieve an ideal installation cost.

Valves Market Trends

Oil and Gas Vertical Accounts for a Major Market Share

Many oil and gas operations, such as refining and distribution, rely on pipeline systems. Therefore, infrastructure and trustworthy control systems are crucial in the business. Oil and gas valves are essential to ensure the safety of pipeline industrial operations. Valve systems are important parts of any piping system. They can control flow rates, isolate and protect equipment, and guide and direct crude oil refining. For instance, gate valves, which are linear motion devices used to open and close fluid flow, are commonly used in many piping and pipeline applications.

Increasing oil and gas exploration and production (E&P) activities is a major market growth trend. Many countries also invest heavily in drilling activities to tap unconventional resources, creating a positive outlook for the global valves market. With the oil and gas industry expanding owing to a growing demand for petroleum products, vendors operating in the market are launching innovative solutions targeting oil and gas industry applications.

The broad usage of all types of valves in the infrastructure of any oil and gas industry supports the market's growth, including gate valves, which could be the most commonly used in the oil and gas industry. It uses a gate system to open or close a pipeline entirely and is suitable if the flow rate needs to be controlled. When the actuator completely opens the valve, the channel is unobstructed, allowing even slurry fluids like crude oil to flow more easily, showing the usage of valves in the oil and gas industries.

Valves play an instrumental role in sustaining operations' continuity and ensuring that the oil and gas industry functions due to their ability to manage pressure, regulate flow, and control the movement of resources across this industrial domain. This supports their pivotal role in maintaining operational stability, which would fuel the market's growth during the forecast period.

The growth of cruise oil demand worldwide, supported by the upstream, midstream, and downstream activities of the oil and gas sector and public and private investments in the sector to develop production and processing capabilities, is supporting the industrial growth of oil refineries and petroleum product plants worldwide, which will fuel the valve market in the future.

Asia-Pacific Market is expected to Grow Significantly

The region holds a high market share due to the growing development in manufacturing and R&D activities in various industries across Asia-Pacific. Further, the rising number of initiatives taken to ensure the safety of workers in industries such as chemicals, oil, and gas also support the market growth in the region.

India is one of the fastest-growing countries in manufacturing sectors and machinery, creating a significant demand for industrial valves. The Indian government provides benefits to companies setting up manufacturing units. It has also outlined various policies to boost the manufacturing sector. For instance, in February 2024, the government of India announced a USD 67 billion investment plan for the natural gas supply chain to meet India's surging energy demands. This plan would support the adoption of valves in the supply chain and the distribution of natural gas in the country and fuel the market growth in Asia-Pacific.

Furthermore, China continues to account for a significant market share due to the growing industrial activities across the region and the rise in the number of manufacturing plants for oil and gas, chemical, and water, among others. This has increased the demand for industrial valves that can handle high pressure. For instance, SUEZ was awarded a 30-year build-and-operate contract for an industrial wastewater treatment plant in Changshu, China, through a local joint venture. The SUEZ joint venture is responsible for designing, constructing, and operating the wastewater treatment plant, which is expected to be commissioned in 2024.

Power generation facilities require valves that withstand harsh operating conditions, such as high temperatures, pressures, and corrosive environments. Valves used in boiler feedwater systems and primary steam isolation, as well as to regulate feed water flow rate and turbine control, show the demand for the market in Asia-Pacific, which is in line with the factory automation trend in the power generation industries during the forecast period.

The emerging economies, including India, China, Japan, South Korea, and other Southeast Asian countries, have been registering significant growth in their industrial sector to support their economic progress, which would help the construction of industries in the Asia-pacific region and can fuel the market growth of Valves in the future due to the application of Valves in the factories' infrastructure for controlling the flow of various fluids, such as steam, water, and cooling agents, among others.

Valves Industry Overview

The global valves market is characterized by moderate competitiveness and several influential players. These key actors hold significant market shares and are expanding their customer bases internationally. These industry leaders engage in strategic collaborations to bolster their market presence and enhance profitability. Notable market players include Emerson Electric Co., Schlumberger Limited, Alfa Laval Corporate AB, Flowserve Corporation, and Crane Co.

December 2023 - Emerson Electric Co., a company in automation technology and software, has been chosen by SungEel HiTech Co. Ltd, a Korean expert in lithium-ion battery recycling. The collaboration aims to enhance sustainable production and operational efficiency at SungEel's latest lithium-ion recycling facility within the Hydro Center complex in Gunsan, Jeollabuk-do. Under this agreement, Emerson will deliver advanced instrumentation and valve solutions tailored to meet the stringent demands of SungEel HiTech's advanced proprietary hydrometallurgical processes, underscoring the growth in the company's valve business.

November 2023 - Flowserve Corporation introduced the Worcester Cryogenic series, showcasing quarter-turn floating ball valves known for reliability in LNG, hydrogen, and industrial gas applications. The series offers two configurations: a three-piece design (CF44 series) and a flanged option (CF51/CF52 series). The features include a high-strength stem and an upgraded live-loaded stem seal, ensuring superior control over fugitive emissions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Outbreak on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in Infrastructure-Related Developments

- 5.1.2 Adoption of Emerging Technologies

- 5.2 Market Challenges

- 5.2.1 Lack of Standardized Policies

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Ball

- 6.1.2 Butterfly

- 6.1.3 Gate/Globe/Check

- 6.1.4 Plug

- 6.1.5 Control

- 6.1.6 Other Types

- 6.2 By End-User Vertical

- 6.2.1 Oil and Gas

- 6.2.2 Power Generation

- 6.2.3 Chemical

- 6.2.4 Water and Wastewater

- 6.2.5 Mining

- 6.2.6 Other End User Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Emerson Electric Co.

- 7.1.2 Schlumberger Limited

- 7.1.3 Alfa Laval Corporate AB

- 7.1.4 Flowserve Corporation

- 7.1.5 Crane Co.

- 7.1.6 Rotork plc

- 7.1.7 IMI Critical Engineering

- 7.1.8 Samson Controls Inc.

- 7.1.9 KITZ Corporation

- 7.1.10 Spirax Sarco Limited