|

市場調查報告書

商品編碼

1644901

德國最後一哩配送:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Germany Last Mile Delivery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

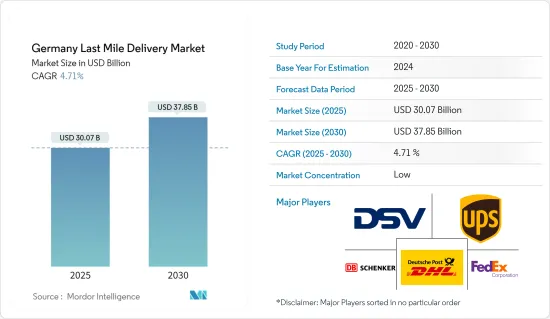

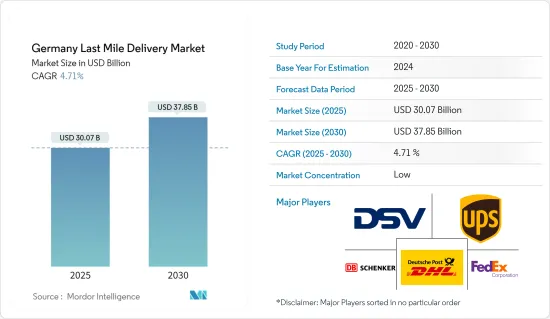

2025 年德國最後一哩配送市場規模預估為 300.7 億美元,預計到 2030 年將達到 378.5 億美元,預測期內(2025-2030 年)的複合年成長率為 4.71%。

里程市場受到多種因素的推動,包括電子商務和全球化的活性化、貿易活動的增加、運輸車輛的技術進步以及快速包裹運送的需求。

然而,基礎設施差、物流成本高、製造商和零售商的物流服務管理不善以及郵政地址系統不準確等因素阻礙了市場的成長。自從德國限制社會和非必要商業活動的指令生效以來,鐵路和公路貨運量下降了約20%。

大多數線上零售商也受到了新冠肺炎的影響。據德國郵政稱,正常情況下,平均每天遞送520萬件小包裹。據德國郵政稱,封鎖期間每天運輸超過800萬件小包裹和快件。冠狀病毒危機導致全國對儲存空間的需求增加,這並不令人意外。

在德國,與世界上幾乎所有國家一樣,電子商務正在經歷前所未有的成長。隨著電子商務的發展,小包裹儲物櫃和小包裹倉庫等全國性宅配選擇越來越受歡迎。例如,德國郵政目前營運約 8,500 台自動包裹機,並計劃在 2023 年將其增加到 12,500 台。

例如,2023年6月,提供當日送達服務的DODO擴展到德國市場,增強了當日最後一哩送達的長期可行性。多年來,DODO已經開發出全面的軟體和交付生態系統,為各行各業的參與者提供支援。該生態系統得到了該公司白牌解決方案的進一步支持,這些解決方案可以直接整合到公司的 IT 結構中。 DODO目前擁有超過2500名宅配業者和超過1000輛車輛。

德國最後一哩配送市場的趨勢

電子商務成長推動市場

德國電子商務平台市場主要受該地區高網際網路普及率和智慧設備日益成長的使用所推動。隨著都市化進程的加快,許多傳統企業開始轉向電子商務平台來擴大客戶群和市場佔有率、降低管理成本並增加產品銷售。

在德國,大多數網路商店接受PayPal或信用卡作為付款方式。許多網站也接受銀行轉帳。大多數網站還允許開立發票/先買後付,並允許線上客戶在 14 天內以任何理由或無理由取消訂單並退回商品或服務。由於電子商務公司提供如此多的好處,該地區的電子商務行業將在未來幾年繼續擴大。

德國電子商務銷售最大的類別是時尚(24.1%),其次是食品和個人護理(22.2%)、家具和電器(20.2%)、電子和媒體(17.4%)和玩具、愛好和 DIY(16.0%)。

政府對交通基礎設施的投資將支持最後一哩的配送

透過投資基礎設施來改善交通網路、減少交通堵塞和提高物流效率,可以改善最後一哩路的交付。更好的道路、橋樑和港口使得貨物運輸更快、更有高效,從而縮短了交貨時間。智慧交通管理系統 (TMS) 和專用送貨通道可以幫助減少交通堵塞並確保及時送貨。支援即時監控、最佳化路線並改善配送團隊和客戶之間溝通的數位基礎設施。

德國聯邦政府計劃在2022年比2021年多撥出數百萬歐元用於交通基礎設施支出。交通基礎設施支出的最大增幅將出現在2021年,屆時聯邦鐵路將獲得110億歐元(120.1億美元)的撥款,是2016年撥款金額的兩倍多。 2022年,聯邦公路的資金將超過120億歐元,水道的資金將達到170億歐元(180.1億美元)。

B247擴建工程已成為圖林根北部最大的基礎建設計劃。該計劃涉及在 22.2 公里長的路段上建造兩至四車道,包括兩條新的繞行道路、31 座建築(包括兩座橋樑和五座鐵路橋)、八個交叉口以及新增約 6 公里的州和聯邦公路。該建築將於 2025 年中期由德國 VINCI 集團(Eurovia、VINCI Construction Terrassement 和 Via Structure)的子公司與圖林根州的當地公司合作完成。

德國最後一哩配送產業概況

德國最後一哩配送市場競爭激烈,既有國際參與者,也有國內參與者。德國最後一哩配送市場的領導者包括DSV(Direktor von Schwerin)、UPS(聯合包裹服務公司)(UPS)、DB Schwerin(德國郵政DHL)和聯邦快遞。該領域的公司正專注於透過整合無人機、電子車輛、運輸管理系統 (TMS) 和人工智慧 (AI) 等新技術來實現成長。由於人事費用上升以及勞動力越來越難找,德國物流公司陷入困境。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 當前市場狀況

- 科技趨勢

- 電子商務產業洞察

- 卡車運輸業洞察

- 倉庫和配送中心洞察

- 了解最後一英里冷藏配送

- 洞察退貨流

- COVID-19 市場影響

第5章 市場動態

- 市場促進因素

- 電子商務成長

- 都市化進程加速

- 市場限制/挑戰

- 行李被竊或損壞的風險

- 經濟高效

- 市場機會

- 電子商務整合

- 產業吸引力-波特五力分析

- 購買者/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第6章 市場細分

- 按服務

- B2B(Business-to-Business)

- B2C(Business-to-Consumer)

- C2C(Customer-to-Customer)

第7章 競爭格局

- 市場集中度概覽

- 公司簡介

- DSV

- UPS

- DB Schenker

- Deutsche Post DHL

- FedEx

- DPD Group

- General Logistics Systems

- Rhenes Logistics

- JJX Logistics

- CEVA Logistics

- SpeedLink Transport*

第8章 市場機會與未來趨勢

第 9 章 附錄

The Germany Last Mile Delivery Market size is estimated at USD 30.07 billion in 2025, and is expected to reach USD 37.85 billion by 2030, at a CAGR of 4.71% during the forecast period (2025-2030).

The mile delivery market is driven by several factors, including the development of the e-commerce sector and the rise in trading activities due to globalization, technological innovations in delivery vehicles, and the need for fast package delivery.

However, poor infrastructure, high logistics costs, a lack of control over logistics services by manufacturers and retailers, and an inaccurate postal address system will impede the market growth. Since the implementation of the directive to restrict social activities and non-essential commercial activities in Germany, freight transport by rail and road has decreased by approximately 20%.

The majority of online retailers were also affected by COVID-19. According to Deutsche Post, a daily average of 5.2 million parcels are usually delivered. Deutsche Post reported that during the lockdowns, more than 8 million packages and deliveries were transported daily. The coronavirus crisis has led to an increase in the demand for storage space in the country, which is not unexpected.

Germany has seen unprecedented growth in e-commerce, as has almost every country in the world. In parallel with the growth of e-commerce, nationwide out-of-the-home delivery options such as parcel lockers and parcel collection stations have become increasingly popular. Deutsche Post, for example, currently operates about 8500 automated parcel machines, with plans to increase that to 12,500 machines by 2023.

For instance, in June 2023, DODO, the same-day delivery service provider, expanded its operations into the German market, reinforcing the long-term viability of same-day, last-mile delivery. DODO has developed a comprehensive software and delivery ecosystem over the years to support players across a variety of industries. This ecosystem is further supported by the company's white-label solution, which allows direct integration into the company's IT structure. DODO currently employs more than 2500 couriers and 1,000 vehicles.

Germany Last Mile Delivery Market Trends

Growth in E-commerce is Driving the Market

The e-commerce platform market in Germany is mainly driven by the high internet penetration in the region and the growing use of smart devices. With increasing urbanization, many traditional businesses are turning to e-commerce platforms to increase the number of customers and market share, reduce overhead expenses, and increase the sales of their products.

In Germany, the majority of online stores accept PayPal or credit cards as the payment method. Many websites also accept bank transfers. Most websites accept invoices/buy now and pay later, and online customers can cancel their orders within 14 days and return their goods or services for any reason or no reason at all. There are so many benefits offered by e-commerce companies that the e-commerce industry in the region will continue to expand over the next few years.

Fashion makes up the biggest chunk of German e-commerce revenue (24.1%), followed by food and personal care (22.2%), furniture and appliances (20.2%), electronics and media (17.4%), and toys, and hobby and DIY (16.0%).

Government Investment in Transport Infrastructure Supports Last Mile Delivery

Last-mile delivery can be improved by investing in infrastructure that improves transportation networks, reduces congestion, and improves logistical efficiency. Roads, bridges, and ports that are upgraded will allow goods to be transported more quickly and efficiently, resulting in shorter delivery times. Smart traffic management systems (TMS) and dedicated delivery lanes can help reduce congestion and ensure timely deliveries. The digital infrastructure that supports real-time monitoring optimizes routes and improves communication between the delivery team and customers, which can also improve last-mile delivery.

Germany's federal government plans to allocate several million euros more in transport infrastructure spending in 2022 compared to 2021. The largest increase in transport infrastructure spending occurred in 2021 when EUR 11 billion (USD 12.01 billion) was allocated to federal railways, which was more than double the amount allocated in 2016. Over EUR 12 billion will be allocated to federal highways in 2022, and EUR 17 billion (USD 18.01 billion) will be allocated to waterways.

The expansion of the B247 became the largest infrastructure project in Northern Thuringia. The project consists of building two to four new lanes on a 22.2 km road section, including two new bypasses, 31 structures, including two bridges and five railway bridges, eight junctions, and around 6 km of additional state and federal roads. The works will be completed by mid-2025 by subsidiaries of the VINCI Group in Germany (Eurovia, VINCI Construction Terrassement, and Via Structure) in local partnership with Thuringian companies.

Germany Last Mile Delivery Industry Overview

Germany's Last Mile Delivery market is highly competitive as it is made up of a mix of international and domestic players. Some of Germany's leading players in the last-mile delivery market are DSV (Direktor von Schwerin), UPS (United Parcel Service) (UPS), DB Schwerin (Deutsche Post DHL), and FedEx (FedEx). Companies in the sector are focusing on growth through the integration of new technologies such as drones, e-vehicles, transport management systems (TMS), and artificial intelligence (AI). Germany's logistics players are struggling as labor costs are on the rise and labor availability is decreasing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Insights into E-Commerce Industry

- 4.4 Insights into Trucking Industry

- 4.5 Insights into Warehousing and Distribution Centers

- 4.6 Insights into Refrigerated Last Mile Delivery

- 4.7 Insights into Return Logistics

- 4.8 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise In eCommerce

- 5.1.2 Rise In Urbanization

- 5.2 Market Restraints/Challenges

- 5.2.1 The Risk of Package Theft or Damage

- 5.2.2 Cost Efficiency

- 5.3 Market Opportunities

- 5.3.1 E- commerce Integration

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Buyers/Consumers

- 5.4.2 Bargaining Power of Suppliers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 B2B (Business-to-Business)

- 6.1.2 B2C (Business-to-Consumer)

- 6.1.3 C2C (Customer-to-Customer)

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 DSV

- 7.2.2 UPS

- 7.2.3 DB Schenker

- 7.2.4 Deutsche Post DHL

- 7.2.5 FedEx

- 7.2.6 DPD Group

- 7.2.7 General Logistics Systems

- 7.2.8 Rhenes Logistics

- 7.2.9 JJX Logistics

- 7.2.10 CEVA Logistics

- 7.2.11 SpeedLink Transport*