|

市場調查報告書

商品編碼

1644925

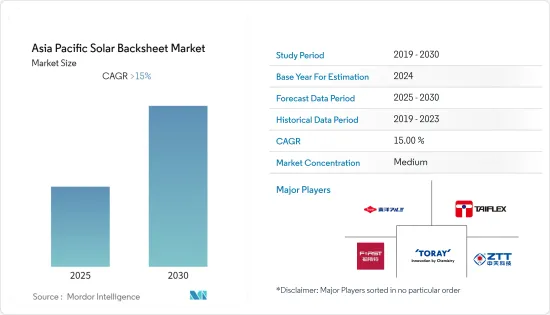

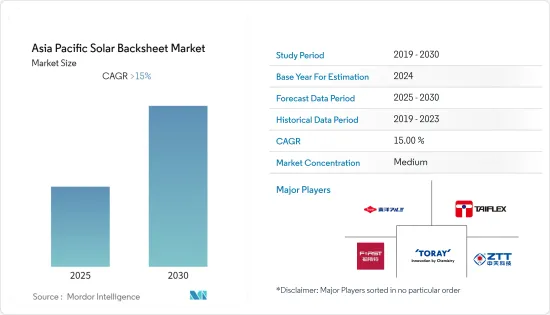

亞太太陽能背板-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia Pacific Solar Backsheet - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預計預測期內亞太太陽能背板市場複合年成長率將超過 15%。

2020 年,市場受到了 COVID-19 的不利影響。目前市場已恢復至疫情前的水準。

關鍵亮點

- 從中期來看,政府的支持政策和滿足可再生能源電力需求的努力等因素預計將為太陽能電池板和太陽能背板創造一個利潤豐厚的市場。

- 然而,用於製造太陽能電池的純矽的可用性是市場的主要限制因素之一。二氧化矽資源豐富,但從化合物中除去氧以產生純矽需要耗費大量能量。

- 太陽能計劃,特別是離網計劃,可能會提供巨大的市場機會,因為新興低度開發國家的消費者更傾向於在偏遠和島嶼地區獲取離網電力。

- 由於即將推出的各種太陽能板安裝計劃和政府鼓勵發展再生能源來源的政策,中國預計將在市場中佔據主導地位。

亞太地區太陽能背板市場趨勢

氟聚合物可望成為重要細分市場

- 氟樹脂太陽能背板由內層、中階、外層三層組成,貼於太陽能板的最外層。太陽能背板的內外層主要採用聚氟乙烯(PVF)或聚二氟亞乙烯(PVDF)材質。同時,中階由聚對苯二甲酸乙二酯(PET或聚酯)製成。

- 2021年,氟聚合物背板佔據了大部分市場佔有率。氟聚合物背板比非氟聚合物更昂貴,因為它具有額外的安全特性,例如在各種條件下表現出的水解穩定性和 PVF 或 PVDF 層的優異耐候性。

- 韓國承諾迅速提高再生能源來源在電力供應上的比重,並逐步淘汰煤炭和核能。 2020年12月,韓國公佈第9個《電力供需長期基本計畫(2020-2034年)》,決定到2034年將可再生能源在其能源結構中的佔比從2020年的15.1%提升至42%。預計太陽能將在減少火力發電對燃料進口的依賴方面發揮關鍵作用,從而在未來幾年支持太陽能市場並增加對氟聚合物背板的需求。

- 在澳大利亞,由於對可再生能源的投資增加和鼓勵國家級舉措,太陽能市場預計將大幅成長。例如,新南威爾斯(NSW)的電力基礎設施藍圖旨在到2030年吸引320億澳元的私人投資,建造12GW的新可再生計劃,包括大型太陽能發電廠。同樣,澳洲北領地也持續朝著2030年實現50%可再生能源的目標邁進。

- 亞太地區預計將成為最重要的地區,主要由於其高經濟成長和太陽能產量逐年增加。該地區的太陽能裝置容量將從 2020 年的 427,850 吉瓦增加到 2021 年的 505,290 吉瓦。預計這一成長將對太陽能背板市場產生重大影響。此外,由於政府的政策和獎勵,亞太地區仍處於安裝量和容量的領先地位。例如,印度的目標是到 2024年終安裝 40 吉瓦的屋頂太陽能。因此,印度政府為住宅屋頂安裝提供了高達 40% 的補貼。預計這將成為未來幾年市場的主要動力。

- 因此,與非氟聚合物相比,該材料具有其他優勢,很可能在太陽能計劃中得到更廣泛的應用。此外,預計大規模生產將降低價格,從而在預測期內推動該領域發展。

中國主導市場

- 中國是該地區的領先國家,預計 2021 年安裝的太陽能光電容量為 307 吉瓦。預計到 2025 年裝置容量將加倍,這可能會在預測期內提振背板市場。

- 此外,作為世界第二大經濟體,中國正致力於提高太陽能的普及率,鼓勵住宅和商業終端用戶安裝屋頂太陽能光電發電。 2021 年 8 月,國家能源局 (NEA)核准了試驗計畫,以加速該國屋頂太陽能發電的普及。因此,到 2023 年,現有住宅和商業建築將強制安裝屋頂太陽能發電系統,這將進一步推動市場成長。

- 此外,過去十年來,住宅和商業建築安裝太陽能的成本有所下降。例如,根據國際可再生能源機構(IRENA)的數據,到2020年,中國住宅和商業太陽能光伏發電的安裝成本將達到每千瓦746美元和每千瓦691美元,高於2012年的每千瓦2,856美元。

- 中國幾乎擁有所有全球最大的太陽能發電面板和設備製造商和設施,佔全球太陽能製造產能的近70%。這些公司也控制著太陽能供應鏈中的其他業務,例如生產多晶矽、錠、晶圓等材料以及用於太陽能板的含氟聚合物和非氟聚合物背板。

- 2022年3月,中國宣布計畫在戈壁和其他沙漠地區建造450吉瓦(GW)的可再生能源發電裝置容量,包括太陽能。中國國家主席承諾,2030年,中國風能和太陽能發電總裝置容量將達到至少1,200吉瓦,二氧化碳排放將降至高峰。

- 因此,基於上述因素,預計中國仍將是全球最大的太陽能及太陽能板等設備市場。預計預測期內太陽能背板的需求將穩定成長。

亞太地區太陽能背板產業概況

亞太地區太陽能背板市場本質上是分散的。主要企業(不分先後順序)包括東洋鋁業株式會社、台虹科技、杭州第一應用材料、東麗株式會社和中天國際有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 類型

- 氟樹脂

- 非氟樹脂

- 地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Toyo Aluminium KK

- Taiflex Scientific Co. Ltd

- Hangzhou First Applied Material Co. Ltd

- Toray Industries Inc.

- ZTT International Limited

- DuPont de Nemours Inc.

- Arkema SA

- 3M Co.

- Hanwha Group

- Brij Encapsulants

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 93181

The Asia Pacific Solar Backsheet Market is expected to register a CAGR of greater than 15% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as supportive government policies and efforts to meet power demand using renewable energy sources are expected to create a favorable market for solar panels as well as for solar backsheets.

- On the other hand, the availability of pure silicon to make solar PV cells is one of the major restraints on the market. Although silicon dioxide is plentiful, it requires considerable energy to remove oxygen from the compound to produce pure silicone.

- Nevertheless, as consumers in developing and underdeveloped countries are more likely to provide off-grid electricity to remote places and islands, solar projects, especially off-grid projects, may provide a significant opportunity for the market.

- China is expected to dominate the market with various upcoming solar panel installation projects, along with encouraging government policies to develop renewable energy sources.

APAC Solar Backsheet Market Trends

Fluoropolymer is Expected to Become a Significant Segment

- Fluoropolymer solar backsheet consists of three layers, i.e., inner, middle, and outer layer, which is attached to the outermost layer of a solar panel. The inner and outer layer of the solar backsheet is primarily made of polyvinyl fluoride (PVF) or polyvinylidene fluoride (PVDF). In contrast, the middle layer consists of polyethylene terephthalate (PET or polyester).

- In 2021, fluoropolymer backsheet had a majority of the market share. The fluoropolymer backsheet is costlier than non-fluoropolymer due to its additional safety features like proven hydrolytic stability and excellent resistance to weathering effects in various conditions with PVF or PVDF layer.

- South Korea is committed to surging the share of renewable energy sources in the electricity supply, gradually phasing out coal and nuclear power from the energy mix. In December 2020, South Korea introduced its Ninth Basic Plan for Long-Term Electricity Demand and Supply 2020-2034 to increase the share of renewable energy in its energy mix from 15.1% in 2020 to 42% by 2034. Solar PV is expected to play a vital role in reducing dependency on fuel imports for thermal power generation, thus supporting the solar energy market in the coming years, thus creating an increasing demand for fluoropolymer backsheet.

- In Australia, the solar energy market is expected to grow significantly owing to the country's increasing renewable investments and supportive state-level policies. For instance, the Electricity Infrastructure Roadmap of New South Wales (NSW) aims to construct 12 GW of new renewable projects, which include large-scale solar generations, attracting AUD 32 billion in private investment by 2030. Similarly, Australia's Northern Territory continued to progress toward its target of 50% renewable energy by 2030.

- Asia-Pacific is expected to be the most important region, mainly due to high economic growth and increasing solar energy production every year. The solar energy installed capacity in the region increased to 505.290 GW in 2021 from 427.850 GW in 2020. This growth is expected to be a significant for Solar backsheet market. Furthermore, Asia-Pacific has been at the forefront of installations and capacities mainly due to government policies and incentives. For instance, India targets to install 40 GW of rooftop solar by the end of 2024. Therefore, the government of India rolled out subsidies of up to 40% for residential rooftop installations. This is expected to be a major driver for the market in the coming years.

- Hence, with additional benefits than non-fluoropolymer, the segment is likely to have high adoption in solar energy projects. Furthermore, mass production is expected to reduce prices and boost the segment during the forecast period.

China to Dominate the Market

- China is estimated to be the major country in the region, with approximately 307 GW of solar PV installations in 2021. It is expected to double its installation capacity by 2025, which may boost the backsheet market during the forecast period.

- Furthermore, China, the world's second-largest economy, is focusing on increasing the penetration of solar PV generation by encouraging residential and commercial end users to install rooftops solar PV. In August 2021, the National Energy Administration (NEA) approved a pilot program to push the deployment of rooftop solar PV installations in the country. Accordingly, by 2023, the existing residential or commercial buildings will be required to install a rooftop solar PV system, further aiding the growth of the market.

- Moreover, the solar PV installation cost in the residential and commercial sectors are also declining over the past decade. For instance, according to the International Renewable Energy Agency (IRENA), in 2020, the residential and commercial solar PV installations cost in China reached USD 746 per kW and USD 691 per kW from USD 2,856 per kW and USD 2,524 per kW in 2012.

- China is home to nearly all the largest solar photovoltaic (PV) panel and equipment manufacturing companies and facilities across the world, with nearly 70% of the global solar PV manufacturing capacity situated in the country. These companies also dominate other businesses in the solar energy supply chain, such as the manufacture of polysilicon, ingot, and wafers for panels and materials like fluoropolymer and non-fluoropolymer backsheets.

- In March 2022, China planned to build 450 gigawatts (GW) of renewable power generation capacity, which includes solar PV, in the Gobi and other desert regions. The president of China had pledged to bring China's total wind and solar capacity to at least 1,200 GW and reduce the carbon emission to a peak by 2030.

- Hence, due to the above factors, China is expected to remain the world's largest market for solar energy and equipment, such as panels. The demand for solar backsheets is expected to rise steadily during the forecast period.

APAC Solar Backsheet Industry Overview

The Asia-Pacific solar backsheet market is fragmented in nature. Some of the major players (in no particular order) include Toyo Aluminium KK, Taiflex Scientific Co. Ltd, Hangzhou First Applied Material Co. Ltd, Toray Industries Inc., and ZTT International Limited, among other companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Fluoropolymer

- 5.1.2 Non-fluoropolymer

- 5.2 Geography

- 5.2.1 China

- 5.2.2 India

- 5.2.3 Japan

- 5.2.4 South Korea

- 5.2.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Toyo Aluminium KK

- 6.3.2 Taiflex Scientific Co. Ltd

- 6.3.3 Hangzhou First Applied Material Co. Ltd

- 6.3.4 Toray Industries Inc.

- 6.3.5 ZTT International Limited

- 6.3.6 DuPont de Nemours Inc.

- 6.3.7 Arkema SA

- 6.3.8 3M Co.

- 6.3.9 Hanwha Group

- 6.3.10 Brij Encapsulants

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219