|

市場調查報告書

商品編碼

1644939

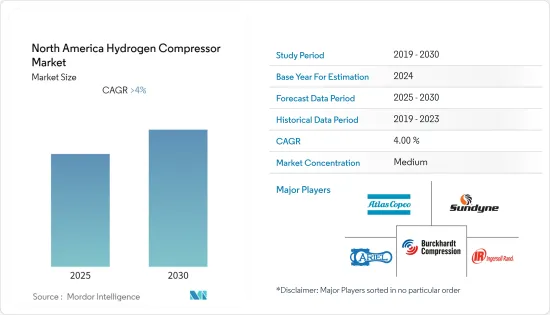

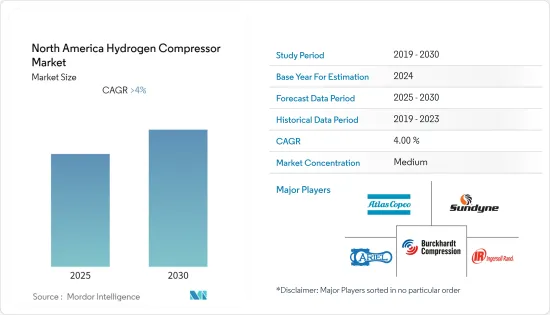

北美氫氣壓縮機:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)North America Hydrogen Compressor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預測期內,北美氫氣壓縮機市場預計將以超過 4% 的複合年成長率成長。

2020 年,市場受到了 COVID-19 的不利影響。目前市場已經恢復到疫情前的水準。

關鍵亮點

- 從中期來看,終端用戶產業的投資增加和對氫的需求增加預計將推動市場成長。

- 然而,預測期內氫氣壓縮機的高成本預計將阻礙北美氫氣壓縮機市場的成長。

- 在預測期內,新的氫源和技術進步可能為太陽能光伏逆變器市場提供有利的成長機會。

- 美國佔據市場主導地位,並可能在預測期內實現最高的複合年成長率。這一成長是由於該國加大了對氫氣生產的投資並支持政府舉措。

北美氫氣壓縮機市場趨勢

單級細分市場成長強勁

- 當具有高入口壓力時,單級壓縮機非常適合輸送大量氣體(主要是氫氣)。廣泛應用於車輛油箱的快速充填、儲存容器之間的氣體轉移、高壓長管拖車的空車運輸等。

- 單級氫氣壓縮機適用於壓力差相對較低的應用,例如運輸、鐵路車輛和船舶卸貨。預計這些壓縮機在預測期內將出現顯著成長。這些壓縮機能夠在精油、石化廠、 NH3 和甲醇服務、天然氣處理、煤炭氣化和發電廠等應用中持續運行,維護成本相對較低。

- 單級氫氣壓縮機專為高溫應用(500 華氏度以上)設計。它們保證可靠的性能和高達 90% 的清單效率。單級氫氣壓縮機的壓縮比限制在約 8:1。

- 2021年,全球整體宣佈在2021年至2030年間開發522個氫能計劃,其中43個是千兆級綠色氫能計劃。北美地區的氫能計畫活動十分活躍,約有 67 個氫能計劃。北美國家正在投資尋找工業和交通運輸的替代性非碳密集型燃料,以加強區域價值鏈。這預計將為北美氫氣壓縮機市場創造重大機會。

- 因此,基於上述因素,預計預測期內單級部分將在北美氫氣壓縮機市場中呈現顯著成長。

美國主導市場

- 由於政府的優惠政策,預計未來幾年美國將成為燃料電池的有前景的市場。

- 美國是世界上最大且成長最快的氫氣壓縮機市場之一。近年來,該國化學、石油天然氣和製造業經歷了顯著成長。

- 氫氣離心式壓縮機用於精製和石化工業,如乙烯工廠的裂解氣壓縮和冷凍服務。由於乙烯和苯產量短缺,該國正在投資增加乙烯和苯的生產能力。

- 美國能源資訊署 (EIA) 報告稱,石油精製的淨氫氣投入量為 76,918,000 桶,比 2020 年增加 2.3%。氫氣也廣泛用於生產氨和甲醇,以及為化學和工業應用提供工業熱。

- 2022年9月,林德宣布計畫在紐約州尼加拉瀑佈建造一座35兆瓦的PEM(質子交換膜)電解槽,生產綠色氫氣。新工廠將成為林德在全球安裝的最大的電解槽,並將使林德在美國的綠色液態氫生產能力增加一倍以上。

- 2022年8月,美國國家再生能源實驗室(NREL)宣布將透過合作研究與開發協議與豐田科羅拉多美國(Toyota)合作,在美國科羅拉多州NREL的Flatrons園區建造、安裝和評估1兆瓦(MW)的固體電解質燃料電池(PEM)發電系統。新研究證明了在綜合能源系統中使用氫燃料電池進行大規模發電的可能性。這些計劃預計將為北美氫氣壓縮機市場創造重大機會。

- 因此,由於上述因素,預計美國將在預測期內主導北美氫氣壓縮機市場。

北美氫氣壓縮機產業概況

北美氫氣壓縮機市場中等分散。市場的主要企業(不分先後順序)包括 Ariel Corporation、Burckhardt Compression AG、Sundyne Corp.、Atlas Copco Group 和 Ingersoll Rand Inc.

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 科技

- 單級

- 多級

- 類型

- 油性

- 無油

- 最終用途產業

- 化學

- 石油和天然氣

- 其他

- 地區

- 美國

- 加拿大

- 北美其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Corken Inc.

- Ariel Corporation

- Burckhardt Compression AG

- Hydro-Pac Inc.

- Haug Kompressoren AG

- Sundyne Corp.

- Howden Group Ltd

- Indian Compressors Ltd

- Atlas Copco Group

- Ingersoll Rand Inc

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 93248

The North America Hydrogen Compressor Market is expected to register a CAGR of greater than 4% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing investments and demand for hydrogen from end-user industries are expected to drive the market's growth.

- On the other hand, the high cost of hydrogen compressors is expected to hamper the growth of the North American hydrogen compressor market during the forecast period.

- Nevertheless, in the forecast period, emerging hydrogen sources and technological advancements will likely create lucrative growth opportunities for the solar PV inverters market.

- The United States dominates the market and will likely witness the highest CAGR during the forecast period. This growth is attributed to the country's increasing investments and supportive government policies for hydrogen generation.

North America Hydrogen Compressor Market Trends

Single-stage Segment to Witness Significant Growth

- Single-stage compressors are ideal for moving large amounts of gas (primarily hydrogen) when high inlet pressures are available. They are widely used to rapidly fill vehicle tanks, move gas between storage vessels, and empty high-pressure tube trailers.

- Single-stage hydrogen compressors are well suited for applications with relatively low differential pressures, such as transport, rail car, and marine unloading. These compressors are expected to witness significant growth during the forecast period. They require relatively less maintenance and offer continuous service in applications such as refineries, petrochemical plants, NH3 and methanol services, natural gas processing, coal gasification, and power stations.

- Single-stage hydrogen compressors are designed for high-temperature applications (above 500° F). They ensure reliable performance and offer efficiencies up to 90%. The compression ratio for single-stage hydrogen compressors is limited to approximately 8:1.

- In 2021, Globally, 522 hydrogen projects were announced to be developed between 2021 and 2030, of which 43 are giga-scale green hydrogen projects. North American region has significant hydrogen activity with about 67 hydrogen projects. North American countries have been invested in finding non-carbon-intensive alternatives for industrial and transportation usage to strengthen the local value chain. This is expected to witness significant opportunities for the North American hydrogen compressor market.

- Therefore, based on the above-mentioned factors, the single-stage segment is expected to witness significant growth in the North American hydrogen compressor market during the forecast period.

United States to Dominate the Market

- The United States is expected to be the promising market for fuel cells in the coming years because of the favorable government policies in the country.

- The United States is one of the world's largest and fastest-growing hydrogen compressor markets. The country has witnessed significant growth in its chemical, oil, gas, and manufacturing sectors in recent years.

- Hydrogen centrifugal compressors are used in refining and petrochemical industries such as ethylene plants for cracked-gas compression and refrigeration services. Due to ethylene and benzene production shortages, the country has been investing to increase its ethylene and benzene production capacity.

- The United States Energy Information Administration (EIA) reported the net hydrogen input in oil refining as 76,918 thousand barrels, recording a growth of 2.3% compared to 2020. Hydrogen is also used extensively to generate ammonia and methanol and provide industrial heat for chemicals and industrial applications.

- In September 2022, Linde announced plans to build a 35-megawatt PEM (Proton Exchange Membrane) electrolyzer to produce green hydrogen in Niagara Falls, New York. The new plant will be the largest electrolyzer installed by Linde globally and will more than double Linde's green liquid hydrogen production capacity in the United States.

- In August 2022, National Renewable Energy Laboratory (NREL) announced the collaboration with Toyota Motor North America (Toyota) through a cooperative research and development agreement to build, install, and evaluate a one-megawatt (MW) proton exchange membrane (PEM) fuel cell power generation system at NREL's Flatirons Campus in Colorado, United States. New research demonstrates large-scale power production using hydrogen fuel cells in an integrated energy system. These projects are expected to witness significant opportunities for the North American hydrogen compressor market.

- Therefore, based on the above-mentioned factors, the United States is expected to dominate the North American hydrogen compressor market during the forecast period.

North America Hydrogen Compressor Industry Overview

The North American hydrogen compressor market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Ariel Corporation, Burckhardt Compression AG, Sundyne Corp., Atlas Copco Group, and Ingersoll Rand Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Single-stage

- 5.1.2 Multistage

- 5.2 Type

- 5.2.1 Oil-based

- 5.2.2 Oil-free

- 5.3 End-Use Industries

- 5.3.1 Chemical

- 5.3.2 Oil and Gas

- 5.3.3 Other End-Use Industries

- 5.4 Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Corken Inc.

- 6.3.2 Ariel Corporation

- 6.3.3 Burckhardt Compression AG

- 6.3.4 Hydro-Pac Inc.

- 6.3.5 Haug Kompressoren AG

- 6.3.6 Sundyne Corp.

- 6.3.7 Howden Group Ltd

- 6.3.8 Indian Compressors Ltd

- 6.3.9 Atlas Copco Group

- 6.3.10 Ingersoll Rand Inc

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219