|

市場調查報告書

商品編碼

1644949

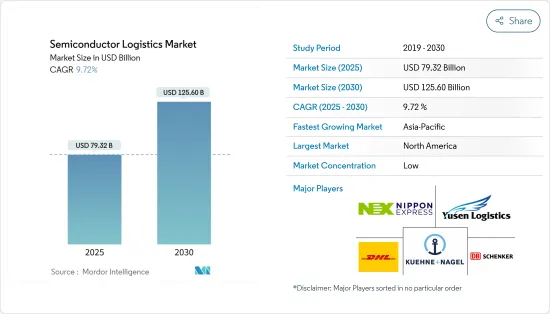

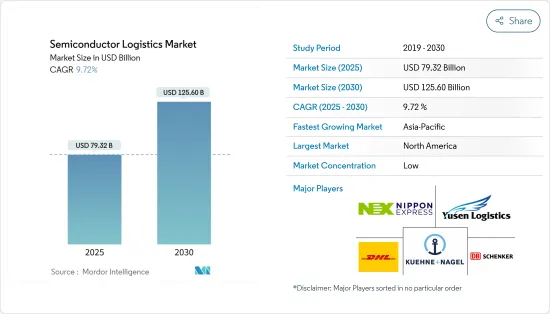

半導體物流:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Semiconductor Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計預測期內半導體物流市場將以超過 7% 的複合年成長率成長。

主要亮點

- 對智慧型設備的需求不斷成長、對永續生產方法的需求、人才發展的重要性以及亞太地區不斷成長的半導體市場佔有率將塑造半導體物流行業。然而,新冠疫情造成的供應鏈和勞動力中斷已導致全球晶片短缺,而持續的美國貿易緊張局勢以及俄羅斯的衝突則加劇了這一短缺。科技進步的步伐可能會加快。 5G網路和物聯網的建置已經為互聯互通和自動化奠定了基礎。

- 缺乏滿足市場需求的製造能力是貫穿半導體供應鏈諸多方面的主要主題趨勢。半導體是許多可再生能源應用、電動車、智慧型手機和其他個人電子產品、資料中心甚至防禦性武器的重要組成部分。但在幕後,現今的半導體公司面臨許多挑戰。即使工廠滿載運作,也無法滿足需求,導致產品前置作業時間長達六個月或更長時間。持續的半導體短缺經常成為頭條新聞,特別是因為它迫使汽車OEM製造商推遲汽車生產。此外,半導體公司還面臨日益複雜的設計、人才短缺和疫情相關問題,所有這些都擾亂了連接不同市場參與者的複雜的全球供應鏈。

- 半導體產業必須以過去兩年的物流挑戰為警鐘,意識到需要採取嚴厲措施。當新冠疫情爆發時,許多企業的銷售額大幅下降。汽車業失去了80%的買家,導致半導體需求急劇下降。預計全球半導體短缺狀況將持續至2024年。據估計,2020年至2022年間,此類短缺已造成全球經濟超過5,000億美元的損失。比直接的經濟影響更嚴重的是,這些供不應求暴露了半導體供應鏈的不足。一些明顯的缺陷已經暴露出來,解決這些問題需要的不僅僅是趕上訂單。

- 半導體公司的未來取決於找到應對物流挑戰的方法,這是一個需要採取嚴厲措施的訊號。隨著對半導體的需求不斷成長,能夠更有效地將這些產品送到最終用戶的公司將成為未來幾年最大的受益者。半導體價值鏈極為複雜,依賴全球材料和設備供應商網路。這使得有效的供應鏈管理變得極其困難,導致庫存過剩和常規瓶頸。貨物管理就是一個很好的例子。從港口堵塞到貨櫃短缺,貨物問題導致前置作業時間延長和航運延誤延長。影響供應鏈的其他因素包括濕度、衝擊和竊盜。但由於缺乏準確的資料和有關貨運進度的 GPS 追蹤,領導者經常在黑暗中業務。

半導體物流市場趨勢

半導體需求不斷成長推動市場

自2020年以來,全球晶片短缺現象加劇,價格上漲成為半導體產業的必然趨勢。上游材料、設備廠商面臨供不應求,晶片廠商加大投資擴大產品線,下游半導體公司則獲得巨額利潤。整體來看,面板驅動IC、消費性MCU、記憶體晶片等供不應求開始緩解,預示價格開始下滑。然而,部分功率半導體晶片仍處於供不應求的狀態,尤其是用於汽車、工業控制和物聯網等領域的晶片。

其主要原因是受市場週期性波動影響,DRAM價格突然開始下滑。全球最大記憶體晶片生產國韓國的晶片庫存增幅創四年來最大。根據韓國統計廳2022年6月發布的統計數據,該國晶片庫存較2021年同期成長53.4%,並從2021年10月開始持續穩定增加。隨著智慧型手機、個人電腦和消費應用的需求下降,全球對電子產品使用的記憶體晶片的需求也在下降。雖然伺服器需求較為強勁,但由於庫存水準高企,2022年下半年記憶體晶片價格可能仍將持續下跌。

消費市場的下滑趨勢會加速儲存市場的週期性變化,這也會對MCU晶片帶來影響。以行動電話、個人電腦為代表的消費性電子產品近年來呈現下滑趨勢,2022年全年負成長的可能性很高。針對這些趨勢,今年 4 月有消息稱,家電設備晶片的訂單訂單可能高達 30%,這給爭相準備產品的設備製造商和供應鏈帶來了巨大的庫存壓力。消費性電子設備訂單取消現在也影響了晶片製造商。

使用先進技術和附加價值服務將推動市場

半導體供應鏈和物流的透明度低會導致決策失誤。隨著卡車市場的分化和貨櫃運輸成本的飆升,領導者必須能夠看清他們的選擇,並比較不同的行動方案。但要做到這一點,你需要集中的、可靠的、即時的資料。儘管 83% 的企業表示,他們比疫情前更意識到交通封鎖帶來的風險,但他們仍需要找到能夠為他們提供正確視覺性的正確技術。這次疫情表明,單一事件可能會造成多大的破壞,並對整個半導體供應鏈產生連鎖反應。這凸顯了供應鏈靈活性的重要性——調整材料採購、生產水準和運輸能力以滿足需求的能力。但這很難實現。

在半導體供應鏈中,過度依賴單一合作夥伴是有問題的。為了確保供應鏈的彈性,半導體公司需要接觸多個合作夥伴,無論是材料供應商、製造地或承運商。另一方面,要獲得多個合作夥伴並不容易。尤其是當許多仲介存在隱藏的偏見時。這意味著領導者必須自己駕馭高度複雜的多個市場,或找到能夠完全公正地將他們與供應商聯繫起來的合作夥伴。另一個問題是信任。為了確保靈活性,公司需要有多個可依賴的供應商來遵守法規。這意味著公司必須進行廣泛的實質審查,或找到可以完全透明地委託這項責任的合作夥伴。

半導體物流行業概況

半導體物流市場競爭激烈且分散,有大量本地、區域和少數全球參與者參與市場。主要參與者包括 DHL、日本通運、Yusen 物流、DB Schenker 和 Kuehne+Nagel。採用適當且先進的技術來明確半導體供應鏈和物流,很可能會對企業產生重大影響。與地區和本地參與者相比,全球參與者由於服務的可用性而佔據了該市場的很大佔有率。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章執行摘要

第4章 市場動態

- 當前市場狀況

- 市場概況

- 市場動態

- 驅動程式

- 限制因素

- 機會

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 對市場的影響

第5章 市場區隔

- 按功能

- 運輸

- 路

- 鐵路

- 水路和海路

- 航空

- 倉儲和配送

- 附加價值服務(包裝、清關、貨運經紀及其他服務)

- 運輸

- 目的地

- 國內的

- 國際的

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- DHL

- Nippon Express

- Yusen Logistics

- DB Schenker

- Kuehne+Nagel

- Omni Logistics

- Dimerco

- CEVA Logistics

- HOYER Group

- MAERSK

- Dintec Shipping Express

第7章:市場的未來

第 8 章 附錄

The Semiconductor Logistics Market is expected to register a CAGR of greater than 7% during the forecast period.

Key Highlights

- There has been an increasing demand for smart devices, the need for sustainable production methods, the importance of cultivating a talent pool, and growth in APAC's semiconductor market share will shape the semiconductor logistics industry. However, supply chain and labour disruptions caused by COVID-19 had resulted in a worldwide chip shortage crisis, which had been exacerbated by ongoing trade tensions between the US and China, as well as conflict in Russia. The pace of technological advancement will quicken. The construction of 5G networks and the Internet of Things has already laid the groundwork for connectivity and automation.

- Insufficient manufacturing capacity to meet market demand is a key thematic trend permeating many facets of the semiconductor supply chain. Semiconductors are essential components in many renewable energy applications, electric vehicles, smartphones and other personal electronics, data centres, and even defence weapons. However, behind the scenes, today's semiconductor companies are facing a slew of challenges. Even at full capacity, fabs have been unable to meet demand, resulting in product lead times of six months or longer. The ongoing semiconductor shortage is now making headlines regularly, especially when it forces automotive OEMs to delay vehicle production. Furthermore, semiconductor firms are dealing with increased design complexity, a talent shortage, and pandemic-related issues, all of which are disrupting the complex, global supply chain that connects players in different markets.

- The semiconductor industry must see the logistical challenges of the last two years as a wake-up call that drastic action is required. When COVID-19 went into effect, many businesses saw a significant drop in sales. The automotive industry lost 80% of its buyers, resulting in a sharp drop in semiconductor demand. Some predict a global semiconductor shortage that will last until 2024. Between 2020 and 2022, it was estimated that these shortages cost the global economy more than USD 500 billion. Worse than the immediate financial impact, these shortages have revealed that semiconductor supply chains are inadequate. Several obvious flaws have been exposed, and addressing them requires more than simply catching up on order backlogs.

- The future of semiconductor companies is dependent on finding a way to compete with logistical challenges as a signal that drastic action is required. Because the demand for semiconductors is only going to increase, those who can get them to end users more efficiently will be the ones to benefit the most in the coming years. The semiconductor value chain is unusually complex, relying on a global network of material and equipment suppliers. This makes efficient supply chain management extremely difficult, resulting in excess stock and routine bottlenecks. A good example is freight management. Freight issues, ranging from port congestion to container shortages, can result in longer lead times and longer shipment delays. Other factors influencing the supply chain include humidity, shock impact, and theft. But without precise data on the progress of shipments and GPS tracking, leaders are often left operating in the dark.

Semiconductor Logistics Market Trends

Increasing demand for semiconductor driving the market

Since 2020, the global chip shortage has worsened, with price increases being the semiconductor industry's defining trend. Upstream material and equipment manufacturers are facing supply shortages, chipmakers have increased investments to expand their product lines on occasion, and downstream semiconductor companies have made significant profits. Overall, the supply shortage of panel drive IC, consumer-grade MCU, memory chips, and other products have begun to ease, signalling the start of a price decrease. However, some power semiconductor chips, particularly those used in automotive, industrial control, IoT, and other fields, remain scarce.

The primary reason for this is that DRAM has quickly entered a downward price trend as the market undergoes cyclical changes. South Korea, the world's largest memory chip producer, has seen the largest increase in chip inventory in more than four years. According to statistics released by the South Korean statistics office in June 2022, the country's chip inventory increased by 53.4% over the same period in 2021 and has been steadily increasing since October 2021. As demand for smartphones, PCs, and consumer applications falls, global demand for memory chips used in electronic products falls. Despite relatively strong server demand, memory chip prices will continue to fall in the second half of 2022 as a result of high inventory levels.

The consumer market's downward trend has accelerated the cyclical changes in the storage market, and MCU chips are also affected. Consumer electronics, as represented by mobile phones and computers, have shown a downward trend in recent years, with likely negative growth in the entire year of 2022. According to this trend, news circulated in April of this year that terminal chips for consumer electronics could face up to 30% order cancellations, putting huge inventory pressure on the supply chain and terminal manufacturers who were busy preparing goods. Order cancellations from consumer electronic terminals have now gradually spread to chip manufacturers.

Increasing use of advanced technology and value-added services driving the market

Key decisions are made with insufficient insight as there is less visibility in the semiconductor supply chain and logistics. Leaders must be able to see their options and compare different courses of action as truck markets fragment and shipping container costs spiral. However, this requires centralized, dependable real-time data. While 83% of businesses say they are more aware of the risks associated with transportation blockades than they were before the pandemic, they still need to find the right technology to enable proper visibility. The pandemic exemplified how disruptive a single event can be, causing cascading effects across entire semiconductor supply chains. This highlights the critical importance of supply chain flexibility - the ability to adjust material purchases, production levels, and transportation capacity to meet demand. However, acknowledging this proves extremely tough.

Overreliance on single partners in semiconductor supply chains is a problem. To ensure the resilience of their supply chains, semiconductor companies require access to multiple partners, whether it's a material supplier, manufacturing base, or freight provider. Gaining access to multiple partners, on the other hand, is not so simple, especially when many brokers have hidden biases. This means that leaders must either navigate multiple highly complex markets on their own or find a partner who can connect them with providers with complete impartiality. Another issue is trust: flexibility necessitates companies having multiple providers they can trust to comply with regulations. This means they must either conduct extensive due diligence or find a partner to whom they can delegate this responsibility in complete transparency.

Semiconductor Logistics Industry Overview

The Semiconductor Logistics Market is highly competitive and fragmented with a large number of local, regional and a few global players penetrating the market. Major players are DHL, Nippon Express, Yusen Logistics, DB Schenker, Kuehne+Nagel, and many more. The use of proper and advanced technology to bring clarity in the semiconductor supply chain and logisitcs is going to bring a difference between the companies. Global players hold a good share in this market due to availibility of services compared to the regional and local players.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Method

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Overview

- 4.3 Market Dynamics

- 4.3.1 Drivers

- 4.3.2 Restraints

- 4.3.3 Opportunities

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of the COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Function

- 5.1.1 Transportation

- 5.1.1.1 Roadways

- 5.1.1.2 Railways

- 5.1.1.3 Water and Seaways

- 5.1.1.4 Airways

- 5.1.2 Warehousing and Distribution

- 5.1.3 Value-added Services (Packaging, Customs Clearance, Freight Brokerage, and Other Services)

- 5.1.1 Transportation

- 5.2 By Destination

- 5.2.1 Domestic

- 5.2.2 International

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 DHL

- 6.2.2 Nippon Express

- 6.2.3 Yusen Logistics

- 6.2.4 DB Schenker

- 6.2.5 Kuehne+Nagel

- 6.2.6 Omni Logistics

- 6.2.7 Dimerco

- 6.2.8 CEVA Logistics

- 6.2.9 HOYER Group

- 6.2.10 MAERSK

- 6.2.11 Dintec Shipping Express*