|

市場調查報告書

商品編碼

1644986

北美大型風力發電機:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)North America Large Wind Turbine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

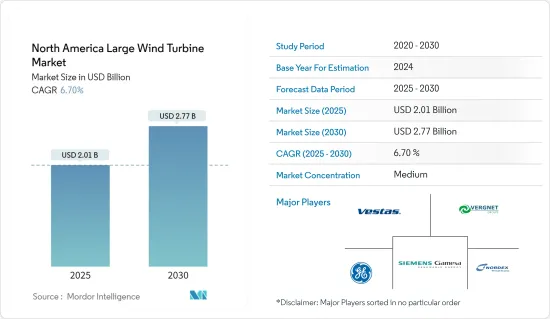

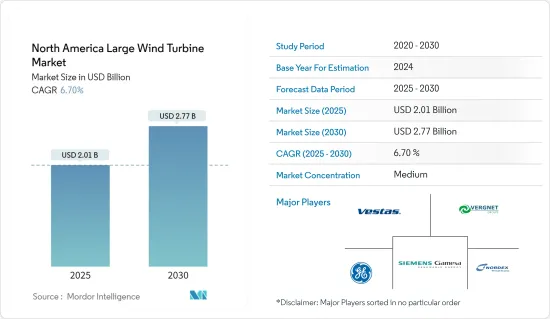

北美大型風力發電機市場規模預計在 2025 年為 20.1 億美元,預計到 2030 年將達到 27.7 億美元,預測期內(2025-2030 年)的複合年成長率為 6.7%。

主要亮點

- 從中期來看,成本降低和風力發電投資增加預計將推動市場成長。

- 另一方面,採用太陽能等替代清潔能源可能會抑制大型風力發電機市場的成長。

- 不過,全球風力發電理事會已承諾在2030年實現全球離岸風力發電達到380GW,到2050年實現2000GW,這對市場相關人員來說是一個巨大的機會。

- 美國佔據市場主導地位,由於風力發電投資增加和電力需求增加,美國很可能在預測期內實現最高的複合年成長率。

北美大型風力發電機市場趨勢

海上業務快速成長

- 隨著對清潔能源的需求不斷增加,各國和企業都開始擁抱可再生能源,尤其是風力發電。

- 離岸風力發電機需要比陸上風力發電機堅固得多的材料,並且通常比陸上風力發電機更大。因此,海上風力發電機產業的成長預計將對市場產生重大影響。

- 加拿大政府的目標是到2025年將風電裝置容量提升至55GW,滿足該國20%的能源需求。但要達到這個目標,仍需增加超過42GW的新增產能。這預計將為風發電工程開發商創造投資機會。

- 加州洪堡灣港已獲得 1,050 萬美元的港口維修投資,以支持洪堡煤炭區計畫開發的 1.6 兆瓦離岸風力發電。

- 根據國際可再生能源機構(IRENA)的預測,2022年離岸風力發電裝置容量為41MW。

- 因此,鑑於上述情況,預測期內對海上部門的投資增加可能會推動市場發展。

美國主導市場

- 據美國風力發電協會稱,美國風電裝置容量大幅成長。此次擴張很大程度上得益於德克薩斯州陸上風電的持續蓬勃發展。德克薩斯州的風力發電容量佔全國的四分之一以上。

- 由於旨在擴大國內能源生產的「美國優先」政策,美國風電產業正在獲得政府的大力支持。由於該國擁有大片可供租賃的沿海地區,離岸風力發電產業被視為重點發展領域。

- 2021年3月,根據美國內政部(DOI)、能源部(DOE)和商務部(DOC)的聯合聲明,美國決定在2030年安裝30吉瓦的離岸風電。此外,它還將減少7,800萬噸二氧化碳排放,並提供足夠的電力為1000多萬美國家庭提供一年的電力。

- 政府推出的優惠政策鼓勵眾多風力發電工程,預計將推動該地區風力發電機市場的發展。例如,2021年11月,西門子能源獲得Orsted和Eversource的核准,為924兆瓦的離岸風力發電提供輸電。該發電廠位於蒙托克角以東 30 多英里處,預計將為約 60 萬戶紐約家庭提供電力。預計於 2025 年開始營運。

- 截至2022年終,美國累積風電裝置容量最多的州是德克薩斯州。當時德克薩斯州的裝置容量約為4000萬千瓦,是排名第二的愛荷華州的三倍多。同年,只有三個州的風電裝置容量超過 10 吉瓦。

- 鑑於上述情況,預計預測期內美國大型風力發電機市場將顯著成長。

北美大型風力發電機產業概況

北美大型風力發電機市場處於半分散狀態。該市場的主要企業(不分先後順序)包括通用電氣公司、維斯塔斯風力系統公司、西門子歌美颯可再生能源公司、Nordex SE 和 Vergnet VSA SA。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2028 年市場規模與需求預測(美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 降低風力發電成本

- 增加對風力發電的投資

- 限制因素

- 採用太陽能等替代清潔能源來源

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 按位置

- 陸上

- 海上

- 按地區

- 美國

- 加拿大

- 北美其他地區

第6章 競爭格局

- 合併、收購、合作及合資

- 主要企業策略

- 公司簡介

- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy, SA

- General Electric Company

- Nordex SE

- Envision Group

- Enercon GmbH

- Hitachi, Ltd.

- Vergnet VSA SA

- Orsted AS

- Duke Energy Corporation

- NextEra Energy Inc.

第7章 市場機會與未來趨勢

- 雄心勃勃的風力發電目標

簡介目錄

Product Code: 5000235

The North America Large Wind Turbine Market size is estimated at USD 2.01 billion in 2025, and is expected to reach USD 2.77 billion by 2030, at a CAGR of 6.7% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, reducing costs and increasing investment in wind energy is likely to drive the market's growth.

- On the other hand, adoption of alternative clean energy sources like solar and other alternatives will likely restrain the growth of the large wind turbine market.

- Nevertheless, the Global Wind Energy Council committed to achieving 380 GW of offshore wind by 2030 and 2,000 GW by 2050 worldwide, likely providing significant opportunities for the market player.

- The United States dominates the market and is also likely to witness the highest CAGR during the forecast period, owing to the increasing wind energy investments and growing electricity demand.

North America Large Wind Turbine Market Trends

Offshore Segment Is the Fastest Growth Segment

- With the increasing demand for clean energy, countries and companies are adopting renewable energy sources, especially wind energy, as they can provide clean energy and help carbon emission missions by 2050.

- Offshore wind turbines require a much sturdier material than onshore wind turbines and are generally larger than onshore wind turbines. Hence, the offshore wind turbine industry's growth is expected to significantly impact the market.

- In Canada, the government aims to increase the wind power capacity to 55 GW by 2025 to meet 20% of the country's energy needs. However, the country must still add more than 42 GW of new capacity to meet the targets. This, in turn, is expected to provide investment opportunities for wind project developers.

- The Port of Humboldt Bay in California has received USD 10.5 million in investment for the port's renovation to support the intended 1.6 GW of offshore wind development in the Humboldt Call area.

- According to International Renewable Energy Agency (IRENA), the total offshore installed wind capacity was 41 MW in 2022.

- Hence, owing to the above points, increasing investment in the offshore segment is likely to drive the market during the forecast period.

United States to Dominate the Market

- According to the American Wind Energy Association, the total installed wind generating capacity in the United States increased significantly. This expansion was caused mainly by Texas's remarkable and ongoing onshore wind boom. Texas has over a quarter of the nation's total wind energy capacity.

- The United States wind power sector is receiving immense support from the government due to the America First policy, which aims to boost domestic energy production. The offshore wind power sector is considered a significant development area, as the country has a large coastal area for leasing.

- In March 2021, the United States decided to deploy 30 GW of offshore wind by 2030, according to a joint announcement from the Departments of Interior (DOI), Energy (DOE), and Commerce (DOC). Additionally, it produces 78 million metric tons less CO2 emissions and enough electricity to provide more than 10 million American homes for a whole year.

- Favorable government policies raising many wind power projects are expected to increase the wind turbine market in the region. For instance, in November 2021, Siemens Energy was approved by Orsted and Eversource to provide the transmission system for a 924-Megawatt offshore wind farm. Nearly 600,000 New York homes will be powered by the facility more than 30 miles east of Montauk Point. It is scheduled to begin operating in 2025.

- As of the end of 2022, Texas was the United States state with the highest cumulative wind power capacity. At the time, it had around 40 GW of installed capacity, over three times that of runner-up Iowa. Only three states had more than 10 GW of installed wind capacity in the same year.

- Hence, owing to the above points, the United States is expected to see significant growth in the Large Wind Turbine market during the forecast period.

North America Large Wind Turbine Industry Overview

The North American Large Wind Turbine market is semi fragmented. Some of the key players in this market (in no particular order) include General Electric Company, Vestas Wind Systems AS, Siemens Gamesa Renewable Energy SA, Nordex SE, and Vergnet VSA SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Reducing Costs of Wind Energy

- 4.5.1.2 Increasing Investment in Wind Energy

- 4.5.2 Restraints

- 4.5.2.1 Adoption of Alternative Clean Energy Sources like Solar and Others

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Geography

- 5.2.1 United States

- 5.2.2 Canada

- 5.2.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Vestas Wind Systems A/S

- 6.3.2 Siemens Gamesa Renewable Energy, S.A.

- 6.3.3 General Electric Company

- 6.3.4 Nordex SE

- 6.3.5 Envision Group

- 6.3.6 Enercon GmbH

- 6.3.7 Hitachi, Ltd.

- 6.3.8 Vergnet VSA SA

- 6.3.9 Orsted AS

- 6.3.10 Duke Energy Corporation

- 6.3.11 NextEra Energy Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ambitious Wind Energy Targets

02-2729-4219

+886-2-2729-4219