|

市場調查報告書

商品編碼

1645077

美國服裝物流:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030 年)United States Apparel Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

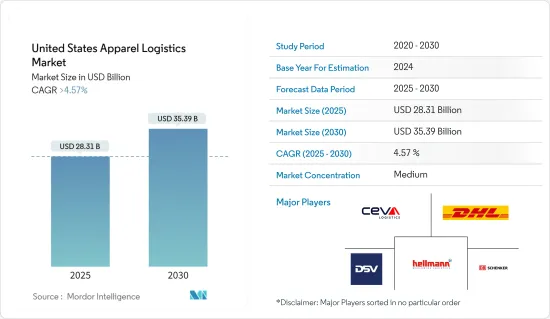

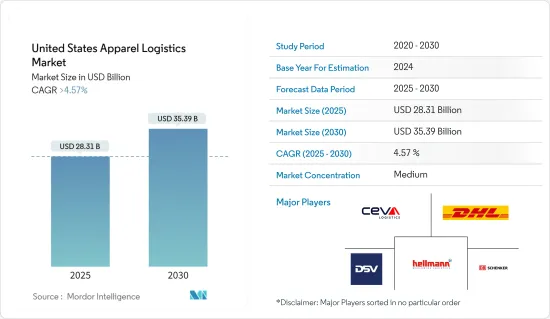

美國服裝物流市場規模預計在 2025 年為 283.1 億美元,預計到 2030 年將達到 353.9 億美元,預測期內(2025-2030 年)的複合年成長率將超過 4.57%。

服裝業的快速補貨週期是市場成長的主要動力。在服裝供應鏈中,零售商和製造商之間的競爭非常激烈,他們紛紛跟上最新潮流,提供最佳的客戶體驗。同時,消費者期望的變化和履約模式的不斷發展也給服裝業務帶來了壓力。許多知名時尚零售商已在單一資訊系統下實施了統一設施的多通路物流,大大提高了勞動效率和庫存管理。服裝市場不斷發展和改革。新銷售管道的出現要求企業不斷評估和重新評估物流和運輸網路。

疫情導致美國工廠停工、生產能力受限、運輸系統中斷。隨著案例的突然增加,服裝物流市場受到多方面影響。封鎖和病毒的傳播迫使人們留在室內,導致勞動力短缺,並擾亂了服裝物流市場的供應鏈。美國服裝業充滿活力並受不斷變化的時尚潮流所驅動。面對激烈的競爭,服裝公司正在整合資料分析和人工智慧等新技術。該行業嚴重依賴外包,為物流公司提供了本地和國際上的巨大商機,也加劇了競爭。供應鏈中斷將對服裝企業造成巨大損失。因此,服裝公司通常選擇將業務委託給物流供應商以減輕這些影響。

美國服裝物流市場趨勢

網路服飾市場的成長

預計預測期內服裝業將成為美國最蓬勃發展的產業。服裝業以女性為主。服裝業成長的主要原因是網路銷售的繁榮。目前,服裝總銷售額中約有 33% 是透過線上銷售的,預計預測期內將成長 39% 以上。

目前,美國購買服裝和鞋類最受歡迎的網路銷售管道是零售商網站,這些網站銷售許多不同的品牌,佔有超過35%的市場佔有率。其餘的是亞馬遜和社群媒體。在此歷史時期,服裝和鞋類購物調查顯示,超過九成的消費者在網路上購買休閒服飾和鞋類。此外,約84%的受訪者表示曾在網路上購買服飾或運動鞋。

美國線上服裝產業的成長是指該產業的長期擴張和發展,其特點是銷售額、市場佔有率和消費者對線上服飾和時尚平台的參與度不斷增加。

美國服裝市場需求不斷成長

美國服裝市場的成長對服裝物流的擴展有重大影響。隨著消費者對服飾和時尚物品的需求不斷成長,服裝公司面臨有效管理產品運輸、儲存和交付的挑戰。對及時、可靠的物流服務的需求不斷成長,導致全國服裝物流業務的發展和擴張激增。

服裝物流公司在確保服飾快速、以最佳狀態到達消費者手中方面發揮關鍵作用。他們負責管理複雜的供應鏈,協調運輸網路並實施創新技術以簡化業務並提高效率。

電子商務和網路購物的興起進一步增加了服裝物流服務的需求。消費者在網上購買服飾時期望獲得快速、便捷的送貨服務,而服裝公司正在投資強大的物流基礎設施以滿足這些期望。

此外,競爭激烈的服裝業要求企業不斷最佳化物流流程,以快速回應不斷變化的市場趨勢。這包括採用資料分析、人工智慧和自動化等先進技術來提高供應鏈可視性、降低成本並提高整體效能。

美國服裝物流業概況

美國服裝物流市場中等分散,全國各地有大量參與者。市場參與者正在採用技術創新、擴張、合併和收購來搶佔更多的市場佔有率。許多國內物流公司都有專門的零售和服裝物流部門來滿足市場需求。此外,本土物流供應商也逐漸提升車輛規模、服務範圍、產品範圍及技術整合能力。電子商務產業的蓬勃發展為物流公司帶來了機會和障礙,特別是在配送速度和效率方面。美國物流市場的一些主要參與者包括 CEVA Logistics、DB Schenker、德國郵政 DHL 集團、DSV 和 Hellmann Worldwide Logistics。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態與洞察

- 市場概況

- 市場促進因素

- 擴大網路服飾銷售

- 快速交貨和上市縮短時間的需求

- 市場限制

- 易逝的時尚潮流

- 技術和基礎設施高成本

- 市場機會

- 消費者越來越偏好供應鏈透明的品牌。

- 時尚品牌有機會透過擁抱變革——整合技術、促進整體性和激發創新——來蓬勃發展。

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 市場創新洞察

- COVID-19 市場影響

第5章 市場區隔

- 按服務

- 運輸

- 倉庫管理、庫存管理

- 其他附加價值服務

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- Ceva Logistics

- DB Schenker

- Deutsche Post DHL Group

- DSV

- Hellmann Worldwide Logistics

- Apparel Logistics Group Inc.

- Logwin AG

- Bollore Logistics

- GAC Group

- Nippon Express

- Genex Logistics

- Expeditors International of Washington Inc.

- BGROUP SRL

- Yusen Logistics*

第7章 市場機會與未來趨勢

第8章 免責聲明及發布者

The United States Apparel Logistics Market size is estimated at USD 28.31 billion in 2025, and is expected to reach USD 35.39 billion by 2030, at a CAGR of greater than 4.57% during the forecast period (2025-2030).

The apparel industry's rapid replenishment cycles are the major market growth drivers. Across retailers and manufacturers, apparel supply chains fiercely vie to deliver the latest trends and optimal customer experiences. Concurrently, shifting consumer expectations and evolving fulfillment models exert pressure on apparel businesses. Numerous prominent fashion retailers have implemented multi-channel distribution from a unified facility with a single information system, significantly enhancing labor efficiency and inventory management. The apparel market undergoes constant evolution and reinvention. Emerging sales channels require companies to assess and revamp their logistics and transportation networks consistently.

The pandemic resulted in lockdowns, capacity constraints, and disruptions in transportation systems in the United States. With rapidly rising cases, the apparel logistics market is experiencing various impacts. The availability of labor is disrupting the supply chain of the apparel logistics market, as lockdowns and the spread of the virus compel people to stay indoors. The US apparel sector is dynamic and driven by continually evolving fashion trends. Faced with fierce competition, apparel firms are integrating new technologies like data analytics and AI. The industry relies heavily on outsourcing, offering logistics firms significant opportunities in both domestic and international realms, intensifying competition. Disruptions in the supply chain result in substantial losses for apparel firms. Consequently, apparel companies typically opt to outsource their operations to logistics providers to mitigate these impacts.

United States Apparel Logistics Market Trends

Growth in the online apparel market

The apparel industry is expected to be the most booming industry in the United States during the forecasted period. Women make up the vast majority of the apparel industry. The major reason for the growth of the apparel industry is the booming of online sales. Currently, approximately 33% of the total apparel sales are done through online sales, and during the forecasted period, it is expected to grow by more than 39%.

In the current years, the most popular online sales channel used for apparel and footwear shopping in the United States is a retailer's website, which sells a lot of different brands and has a more than 35% majority share. The rest are followed by Amazon and social media. During the historic period, the apparel and footwear shopping survey revealed that more than nine out of ten shoppers purchased casual clothing and footwear online. Furthermore, approximately 84% of respondents reported purchasing athletic clothing and footwear online.

The growth of the online apparel industry in the United States refers to the increasing expansion and development of the sector over time, characterized by rising sales, market share, and consumer engagement with online clothing and fashion platforms.

Increasing demand in the United States' apparel market.

The growing apparel market in the United States is significantly influencing the expansion of apparel logistics. As consumer demand for clothing and fashion items continues to rise, apparel companies are faced with the challenge of efficiently managing the transportation, storage, and delivery of their products. This increased demand for timely and reliable logistics services has led to a surge in the development and expansion of apparel logistics operations across the country.

Apparel logistics companies play a critical role in ensuring that clothing items reach consumers quickly and in optimal condition. They are responsible for managing complex supply chains, coordinating transportation networks, and implementing innovative technologies to streamline operations and improve efficiency.

With the rise of e-commerce and online shopping, the demand for apparel logistics services has grown even further. Consumers expect fast and convenient delivery options when purchasing clothing online, driving apparel companies to invest in robust logistics infrastructure to meet these expectations.

Additionally, the competitive nature of the apparel industry means that companies must continuously optimize their logistics processes to remain agile and responsive to changing market trends. This includes adopting advanced technologies such as data analytics, artificial intelligence, and automation to enhance supply chain visibility, reduce costs, and improve overall performance.

United States Apparel Logistics Industry Overview

The US apparel logistics market is moderately fragmented, with the presence of a large number of players across the country. Players in the market are adopting technological innovation, expansion, mergers, and acquisitions to capture more market share. Many country logistics firms maintain a dedicated retail and apparel logistics division to cater to market demands. Moreover, local logistics providers are progressively bolstering their fleet size, service spectrum, handled products, and technological integration capacities. The booming e-commerce sector presents both opportunities and hurdles for logistics companies, particularly in terms of delivery speed and efficiency. Some of the significant players operating in the US logistics market include CEVA Logistics, DB Schenker, Deutsche Post DHL Group, DSV, and Hellmann Worldwide Logistics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of online apparel sales

- 4.2.2 The demand for faster delivery and quicker time to market

- 4.3 Market Restraints

- 4.3.1 Highly perishable fashion trends

- 4.3.2 High cost of technology and infrastructure

- 4.4 Market Opportunities

- 4.4.1 Consumers are showing a growing preference for brands that have transparent supply chains.

- 4.4.2 Fashion brands have the opportunity to flourish by embracing transformations such as integrating technology, promoting inclusivity, and fostering innovation.

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porters' Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on technology Innovation in the Market.

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Transportation

- 5.1.2 Warehousing, and Inventory Management

- 5.1.3 Other Value-added Services

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Ceva Logistics

- 6.2.2 DB Schenker

- 6.2.3 Deutsche Post DHL Group

- 6.2.4 DSV

- 6.2.5 Hellmann Worldwide Logistics

- 6.2.6 Apparel Logistics Group Inc.

- 6.2.7 Logwin AG

- 6.2.8 Bollore Logistics

- 6.2.9 GAC Group

- 6.2.10 Nippon Express

- 6.2.11 Genex Logistics

- 6.2.12 Expeditors International of Washington Inc.

- 6.2.13 BGROUP SRL

- 6.2.14 Yusen Logistics*