|

市場調查報告書

商品編碼

1645100

太陽能板 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Solar Panel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

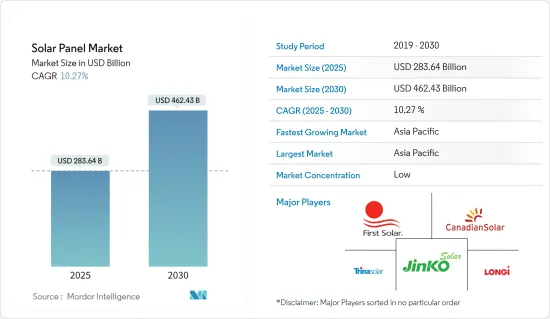

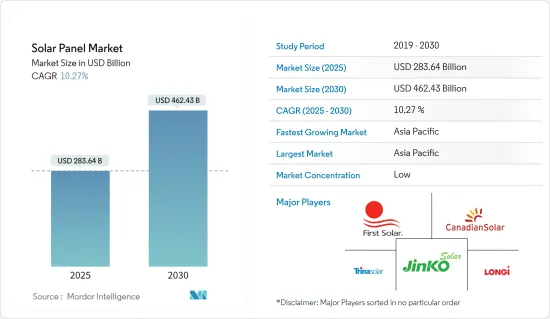

預計 2025 年太陽能板市場規模為 2,836.4 億美元,預計到 2030 年將達到 4,624.3 億美元,預測期內(2025-2030 年)的複合年成長率為 10.27%。

關鍵亮點

- 從中期來看,政府對太陽能應用的支持政策和太陽能價格下降等因素預計將成為預測期內太陽能板市場最重要的促進因素之一。

- 另一方面,預測期內,來自生質能源、風力發電和水電等其他可再生能源的競爭將威脅市場。

- 然而,更具創新性和更有效率的太陽能電池板正在被開發出來。預計這一因素將在未來為市場創造許多機會。

- 亞太地區佔據市場主導地位,並可能在預測期內實現最高的複合年成長率。中國、印度和日本等國家憑藉其強大的太陽能板製造基礎以及新興市場和基礎設施開發活動的不斷成長,正在推動太陽能板市場的發展。

太陽能板市場趨勢

薄膜太陽能板成長強勁

- 薄膜太陽能模組被視為太陽能電池技術的突破,並在光伏領域迅速佔據佔有率。薄膜太陽能電池包括非晶質(a-Si)、碲化鎘(CdTe)和硒化鎵(CIGS)電池。 CIGS薄膜太陽能電池將太陽光轉化為電能,是透過在玻璃基板上鍍多層薄膜而製成的。 CIGS薄膜太陽能電池在非晶矽太陽能電池中具有較高的吸收係數,因而具有較高的轉換效率和較長的穩定性。在所有類型中,CdTe 的應用最為廣泛,預計在薄膜太陽能電池產業中佔有很大的市場佔有率。

- 薄膜太陽能電池比傳統晶矽太陽能電池所需的構造材料更少,這意味著它們的生產成本(每千瓦)可能略低一些。例如,薄膜太陽能電池的材料成本約為每瓦 0.50 至 1 美元,而傳統太陽能電池的材料成本約為每瓦 3 美元。由於成本較低,薄膜太陽能電池比矽晶型更容易大規模生產。然而,它的效率低於矽晶型。

- 薄膜太陽能電池板可以在軟性基板上製造,例如軋製不銹鋼或塑膠。這種靈活性允許在曲面和不規則屋頂形狀上進行獨特的安裝。薄膜面板的多功能性為製造商開闢了新的市場。

- 由於這些太陽能電池板類型的獨特特性,太陽能裝置近年來經歷了顯著成長。根據國際可再生能源機構的預測,2023年太陽能發電裝置容量將從目前的1,066.55吉瓦增加到1,412.09吉瓦左右,這意味著全球太陽能板的安裝量將迅速增加。

- 此外,全球對太陽能的投資正在蓬勃發展。在太陽能板成本下降和應對氣候變遷的緊迫感不斷增強的推動下,太陽能投資預計將在 2024 年首次超過石油和天然氣投資。

- 2024 年 2 月,義大利政府宣布將向 Enel 位於西西里島的太陽能發電面板工廠 3Sun 投資 9,000 萬歐元(9,700 萬美元)。國家復甦和復原力計畫為該計劃累計9,000 萬歐元,將加強現有工廠並在工廠內建立新的生產線,以生產不同類型的太陽能電池板,包括薄膜太陽能板。

- 因此,預計薄膜太陽能電池板在預測期內將顯著成長。

亞太地區可望主導市場

- 在快速成長的能源需求、有利的政府政策以及向可再生能源轉型的堅定承諾的推動下,亞太地區正在成為全球太陽能板市場的強大力量。這個廣闊而多樣化的地區包括中國、印度、日本、澳洲和東南亞等國家,為太陽能板製造商、安裝商和相關行業提供了巨大的成長機會。

- 亞太地區是一些人口最多、成長最快的經濟體的所在地,例如印度和中國。隨著該地區工業化和都市化進程不斷推進,其能源需求也快速成長。在迫切需要採用可再生能源的情況下,太陽能已成為理想的解決方案,因為這些國家擁有巨大的太陽能潛力,而且太陽能成本正在下降。

- 中國擁有龐大的製造設施,在太陽能板製造領域處於世界領先地位。該國佔全球太陽能板和相關設備製造總量的約80%,凸顯了該地區對太陽能板產業的重要性。

- 除了中國成熟的太陽能板製造業之外,目前各國都在努力發展自己的製造業基礎。例如,2023年10月,中國電力公司龍翼宣布已與馬來西亞政府達成協議,在馬來西亞首都吉隆坡以北25公里的小鎮Serendah建造三座太陽能光電(PV)工廠。

- 政府大力推廣清潔能源的優惠政策以及太陽能板價格的下降使得太陽能成為越來越有吸引力的選擇。這一趨勢在屋頂太陽能領域尤其明顯,因為商業和工業部門採用太陽能解決方案來降低能源成本並永續性,進一步推動了該地區的太陽能板市場的發展。

- 除了分散式屋頂太陽能外,亞太地區的大型太陽能發電工程也在激增。中國、印度、澳洲和越南等國家正在大力投資太陽能園區和公用事業規模的設施,以實現其可再生能源目標並減少碳排放。這些大型計劃需要大型太陽能電池板,這為電池板製造商和供應商創造了一個利潤豐厚的市場。

- 因此,預計預測期內亞太地區將主導太陽能板市場。

太陽能板產業概況

太陽能電池板市場是部分細分的。該市場的主要企業(不分先後順序)包括隆基綠色能源科技、天合光能、晶科能源、阿特斯陽光電力公司和 First Solar 公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 至2029年的市場規模及需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 政府支持措施和政策

- 太陽能價格下跌

- 限制因素

- 與其他可再生能源的競爭

- 驅動程式

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅產品/服務

- 競爭對手之間的競爭

第5章 市場區隔

- 類型

- 結晶

- 多晶

- 薄膜

- 矽晶型

- 其他

- 最終用戶

- 住宅

- 商業和工業

- 公共產業

- 2029 年市場規模與需求預測(按地區)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 北歐的

- 俄羅斯

- 土耳其

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 澳洲

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 卡達

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- First Solar Inc.

- Hanwha Q CELLS Technology Co. Ltd

- Canadian Solar

- JinkoSolar Holding Co. Ltd

- Trina Solar Europe

- LONGi Solar

- JA SOLAR Technology Co. Ltd

- SunPower Corporation

- Adani Solar

- TataPower Solar

- 市場排名/佔有率分析

第7章 市場機會與未來趨勢

- 技術創新的進步

簡介目錄

Product Code: 50002210

The Solar Panel Market size is estimated at USD 283.64 billion in 2025, and is expected to reach USD 462.43 billion by 2030, at a CAGR of 10.27% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as supportive government policies for solar energy adoption and decreasing solar energy prices are expected to be among the most significant drivers for the solar panel market during the forecast period.

- On the other hand, competition from other renewable energy sources, such as bioenergy, wind energy, and hydropower, threatens the market during the forecast period.

- However, advancements in developing more innovative and efficient solar panels are ongoing. This factor is expected to create several opportunities for the market in the future.

- The Asia-Pacific region dominates the market and will likely register the highest CAGR during the forecast period. Due to the growing number of industries and infrastructural development activities in countries such as China, India, and Japan, as well as their high solar panel manufacturing base, they are driving the solar panel market.

Solar Panel Market Trends

Thin Film Solar Panel to Witness Significant Growth

- The thin-film photovoltaic module is considered a breakthrough in solar technology and is rapidly increasing its share in the solar power sector. Thin-film solar cells include amorphous silicon (a-Si), cadmium telluride (CdTe), and gallium selenide (CIGS) cells. CIGS thin-film solar cells convert sunlight into electrical energy and are made by coating multiple thin films on a glass substrate. They have a relatively higher absorption coefficient among non-silicon-based cells, which results in high conversion efficiency and long stability. Among all the types, CdTe is the most widely used and is estimated to hold a significant market share in the thin-film industry.

- Thin-film solar PV cells can be slightly less expensive to produce (per kW) than traditional silicon solar cells, as they require fewer construction materials. For instance, thin-film solar panels cost around USD 0.50 to USD 1 per watt for the materials, while traditional solar panels cost around USD 3 per watt. Due to their lower cost, mass production of thin-film solar cells is much easier than crystalline silicon. However, they are less efficient than crystalline silicon.

- Thin-film solar panels can be manufactured on flexible substrates, such as rolls of stainless steel or plastic. This flexibility allows for unique installations with irregular shapes on curved surfaces and rooftops. The versatility of thin-film panels opens up a new market for manufacturers to explore.

- With such unique features of this solar panel type, solar energy installation has witnessed significant growth in recent years. According to the International Renewable Energy Agency, the installed solar PV capacity in 2023 was around 1412.09 GW compared to 1066.55 GW, signifying the rapid solar panel installations worldwide.

- Additionally, investment in solar energy is experiencing a global boom. Driven by falling panel costs and a growing urgency to combat climate change, solar is on track to surpass oil and gas investment for the first time as of 2024.

- In February 2024, the Italian government announced an investment of EUR 90 million (USD 97 million) in Enel's 3Sun solar photovoltaic panel factory in Sicily. The National Recovery and Resilience Plan has EUR 90 million for this project, which allows the current factory to strengthen itself and establish a new production line potentially manufacturing different solar panel types in the factory, including thin film solar panels.

- Therefore, the thin-film solar panel is expected to grow significantly during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is emerging as a powerhouse in the global solar panel market, driven by rapidly growing energy demands, favorable government policies, and a solid commitment to transitioning toward renewable energy sources. This vast and diverse region, encompassing countries like China, India, Japan, Australia, and Southeast Asia, presents immense growth opportunities for solar panel manufacturers, installers, and associated industries.

- Asia-Pacific is home to the most populous and rapidly developing economies like India and China. As industrialization and urbanization activities in the region increase, there is a surge in energy demand. With the imperative of renewable energy adoption, solar energy has emerged as an ideal solution as these countries have high solar potential, and the cost of solar energy is declining.

- With its massive manufacturing facilities, China has been a global leader in solar panel manufacturing. The country is responsible for approximately 80% of the global solar panel and associated equipment manufacturing, highlighting the region's importance in the solar panel industry.

- Beyond China's already established solar panel manufacturing sector, various countries are still striving to develop their manufacturing base. For instance, in October 2023, China-based photovoltaics company Longi announced that the company reached an agreement with the Malaysian government to build three photovoltaic (PV) factories in Serendah, a town located 25km north of the country's capital, Kuala Lumpur.

- Favorable government policies promoting clean energy and declining solar panel prices are making solar power an increasingly attractive option. This trend is particularly evident in the rooftop solar segment, where commercial and industrial sectors are embracing solar solutions to reduce energy costs and enhance their sustainability profile, further driving the solar panel market in the region.

- In addition to distributed rooftop solar, Asia-Pacific is witnessing a surge in large-scale, utility-scale solar power projects. Countries like China, India, Australia, and Vietnam invest heavily in solar parks and utility-scale installations to meet their renewable energy targets and reduce carbon footprints. These massive projects require substantial solar panels, creating a lucrative market for panel manufacturers and suppliers.

- Therefore, the Asia-Pacific region is expected to dominate the solar panel market during the forecast period.

Solar Panel Industry Overview

The solar panel market is partially fragmented. Some key players in this market (in no particular order) include LONGI Green Energy Technology Co. Ltd, Trina Solar Co. Ltd, JinkoSolar Holding Co. Ltd, Canadian Solar Inc., and First Solar Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Supportive Government Policies and Regulations

- 4.5.1.2 Decreasing Solar Prices

- 4.5.2 Restraints

- 4.5.2.1 Competition from Other Renewable Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Monocrystalline

- 5.1.2 Polycrystalline

- 5.1.3 Thin Film

- 5.1.4 Crystal Silicon

- 5.1.5 Other Types

- 5.2 End Users

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial

- 5.2.3 Utility

- 5.3 Geography [Market Size and Demand Forecast till 2029 (for Regions Only)]

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 NORDIC

- 5.3.2.7 Russia

- 5.3.2.8 Turkey

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 South Korea

- 5.3.3.6 Malaysia

- 5.3.3.7 Thailand

- 5.3.3.8 Indonesia

- 5.3.3.9 Vietnam

- 5.3.3.10 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Nigeria

- 5.3.4.4 Egypt

- 5.3.4.5 Qatar

- 5.3.4.6 South Africa

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Colombia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 First Solar Inc.

- 6.3.2 Hanwha Q CELLS Technology Co. Ltd

- 6.3.3 Canadian Solar

- 6.3.4 JinkoSolar Holding Co. Ltd

- 6.3.5 Trina Solar Europe

- 6.3.6 LONGi Solar

- 6.3.7 JA SOLAR Technology Co. Ltd

- 6.3.8 SunPower Corporation

- 6.3.9 Adani Solar

- 6.3.10 TataPower Solar

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Technological Innovation

02-2729-4219

+886-2-2729-4219