|

市場調查報告書

商品編碼

1645108

蒸氣發電水泵:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Steam Generation Water Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

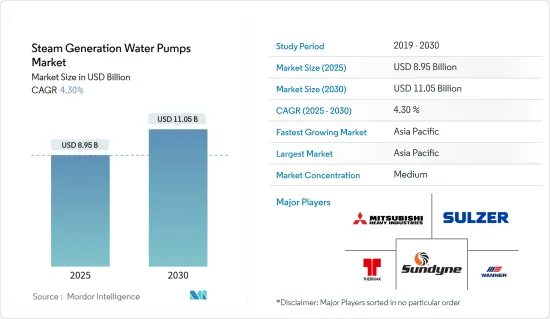

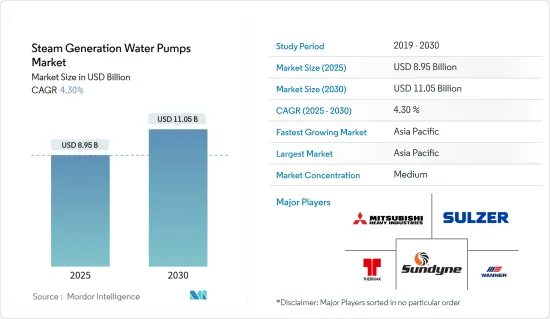

蒸氣發電水泵市場規模預計在 2025 年為 93.3 億美元,預計到 2030 年將達到 115.2 億美元,預測期內(2025-2030 年)的複合年成長率為 4.3%。

從中期來看,預計預測期內政府對建立水處理基礎設施的投資增加以及蒸氣發電量的增加將推動市場發展。

然而,預計排放法規、高昂的資本和營運成本以及政府的可再生能源目標將在預測期內阻礙市場發展。

蒸氣發電水泵技術的進步預計將在未來創造市場機會。

預計預測期內亞太地區將佔據市場主導地位。

蒸氣發生水泵的市場趨勢

鍋爐供水泵預計將佔據主要市場佔有率

- 鍋爐供水泵又稱給水泵,依排放的蒸氣量比例向鍋爐、核子反應爐等蒸汽產生器供給蒸汽。

- 鍋爐供水幫浦的運轉流體溫度為 160°C 至 210°C 之間。在特殊情況下,處理的流體的溫度甚至可能更高。鍋爐給水泵的設計主要受發電廠技術發展的決定,包括輸入功率、材料、泵浦類型、驅動裝置等。

- 發電廠使用的鍋爐給水泵是能夠輸送高溫流體的高溫、高壓、多級泵浦。隨著電力需求的增加、都市化和人口的成長,發電廠使用的泵浦的需求預計會增加。例如,根據《世界能源資料統計評論》預測,2023年全球發電量將為29,924.8 TWh,年增率與前一年同期比較的2.5%。

- 典型的複合迴圈發電廠包含 50 到 100 個泵,包括鍋爐供水泵。為了滿足日益成長的能源需求,隨著新複合迴圈電廠的建設,預計鍋爐供水泵和其他泵浦的數量將會增加。

- 例如,2023年7月,三菱重工旗下的電力解決方案品牌三菱動力決定建造一個新的複合迴圈電廠,其中包括鍋爐供水幫浦。三菱重工旗下的電力解決方案品牌三菱動力於 2023 年 7 月獲得千葉袖浦電力的全套交鑰匙訂單,計劃將在千葉縣訂單浦市建設三座 650,000 千瓦天然氣燃氣渦輪機複合迴圈(GTCC) 發電廠。

- 因此,由於電力消耗的增加和發電廠的建設,鍋爐供水泵預計將佔據很大的市場佔有率。

亞太地區可望主導市場

- 亞太地區是一個發展中大陸,經濟成長迅速,電力需求旺盛,受基礎設施顯著成長和許多大型建設計劃的推動。

- 根據《世界能源數據統計評論》預測,2023年亞太地區能源消費量總量將為291.77艾焦耳,與前一年同期比較成長率為4.7%。蒸氣發生水泵通常用於發電廠和其他應用中,以蒸氣的形式提供能量。

- 到2023年,亞太地區在全球能源消費量中的佔有率將達到近47.1%。隨著能源消耗的增加,預計蒸氣運作的水泵使用量將會增加。

- 例如,2023年10月,Thermax訂單了菲律賓內格羅斯島19.9兆瓦發電廠的訂單。該公司完成的計劃包括一台 90 TPH 鍋爐、一台 19.9 MW蒸氣渦輪發電機和一個平衡電廠系統。

- 此外,該地區運作幾座火力發電廠,可能會產生對蒸氣發電水泵的需求。例如,中國、印度、印尼、越南和其他一些國家正在計劃建造火力發電廠以滿足其能源需求。

- 2022年和2023年,光是中國就已核准218吉瓦的燃煤電廠。此類計劃的試運行可能會在該地區產生對蒸氣發電水泵的巨大需求。

- 因此,鑑於上述情況,預計亞太地區將在預測期內佔據市場主導地位,尤其是由於蒸氣在發電中的使用不斷增加。

蒸氣發電水泵產業概況

蒸氣發電水泵市場規模減少了一半。市場的主要企業包括(不分先後順序):Sulzer Limited、Thermax Limited、Wanner International Limited、Sundyne 和三菱重工有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2029 年市場規模與需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 增加政府對水處理基礎設施的投資

- 蒸氣發電的興起

- 限制因素

- 排放法規、高資本與營運成本

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場區隔

- 類型

- 鍋爐供水泵

- 立式多級直列泵

- 臥式多級環段式泵

- 循環泵

- 蒸氣冷凝水泵

- 其他

- 鍋爐供水泵

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 英國

- 法國

- 德國

- 西班牙

- 俄羅斯

- 土耳其

- 北歐的

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 越南

- 泰國

- 印尼

- 馬來西亞

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 奈及利亞

- 卡達

- 埃及

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Sulzer Limited

- Thermax Limited

- Wanner International Limited

- Sundyne

- Mitsubishi Heavy Industries, Ltd.

- EBARA CORPORATION.

- Modo Pumps Co, Ltd.

- Castle Pumps.

- Inproheat Industries.

- Fuji Electric Co., Ltd.

- Marquee 排名分析

- 其他知名公司名單

第7章 市場機會與未來趨勢

- 蒸氣發生水泵的技術進步

The Steam Generation Water Pumps Market size is estimated at USD 9.33 billion in 2025, and is expected to reach USD 11.52 billion by 2030, at a CAGR of 4.3% during the forecast period (2025-2030).

Over the medium period, increased government investment in establishing water treatment infrastructure and increased power generation using steam is expected to drive the market in the forecast period.

On the other hand, the emissions regulations, high capital and operations costs, and government renewable energy targets are expected to hinder the market in the forecast period.

Nevertheless, technological advancements in steam-generation water pumps are expected to create future market opportunities.

Asia-Pacific is expected to dominate the market in the forecast period.

Steam Generation Water Pumps Market Trends

Boiler Feed Pump is Expected to have a Significant Market Share

- Boiler feed pumps, also known as feed pumps, feed a steam generator such as a boiler or a nuclear reactor with a quantity of feed water corresponding to the amount of steam emitted.

- Boiler feed pumps operate at fluid temperatures of 160 to 210 0C. In exceptional cases, the temperature of the fluid handled may be higher still. The design of boiler feed pumps, including power input, material, type of pump, and drive, is primarily governed by developments in power station technology.

- The boiler feed water pump used in power plants is a high-temperature and high-pressure multi-stage pump that can transport high-temperature fluids. With the increase in power demand and growing urbanization and population, the need for pumps used in power plants is expected to increase. For instance, according to the Statistical Review of World Energy Data, in 2023, global electricity generation accounted for 29924.8 TWh, with an annual growth rate of 2.5% compared to the previous year.

- A typical combined-cycle plant may have between 50 to 100 pumps, including boiler feed pumps. With the establishment of new combined-cycle plants to cope with the increasing energy demand, boiler feed pumps and other pumps are expected to increase.

- For example, in July 2023, Mitsubishi Power, a power solutions brand of Mitsubishi Heavy Industries, Ltd. (MHI), got a full-turnkey contract from Chiba-Sodegaura Power Co., Ltd., for a project to build three gas turbine combined cycle (GTCC) power plants with 650MW class natural gas-fired units in Sodegaura City, Chiba Prefecture.

- Thus, owing to the increasing power consumption and power plant construction, boiler feed pump is expected to have a significant share in the market.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is a developing continent with rapid economic and power demands due to significant growth driven by infrastructure development and many large construction projects.

- According to the Statistical Review of World Energy Data, in 2023, the Asia Pacific's total energy consumption accounted for 291.77 Exajoules, with an annual growth rate of 4.7 % compared to the previous year. Steam generation water pumps are generally used in power plants or any other application to provide energy in the form of steam.

- The share of Asia-Pacific's total global energy consumption is nearly 47.1% in 2023. With increasing energy consumption, the use of water pumps is expected to grow with its use coming from power plants running from steams.

- For instance, in October 2023, Thermax commissioned a contract for the 19.9 MW power plant in Negros Island in the Philippines - a first in South East Asia. The company completed the project, whose scope comprised a 90 TPH boiler, 19.9 MW steam turbine generator, and Balance of Plant systems.

- Further, the region have several upcoming thermal power plants, which are likley to create demand for steam generation water pumps. For instance, most of the countries like China, India, Indonesia, Vietnam, and a few others have plans to construct thermal power plants to meet its energy demand.

- In 2022 and 2023, China alone approved 218 GW of coal power plants. Commissioning of such projects is likley to have significant demand for steam generation water pumps in the region.

- Thus, owing to the above points, with the increasing use of steam, especially in power generation, Asia-Pacific is expected to dominate the market in the forecast period.

Steam Generation Water Pumps Industry Overview

The steam generation water pumps market is semi-fragmented. Some of the key players in this market include (in no particular order) Sulzer Limited, Thermax Limited, Wanner International Limited, Sundyne, and Mitsubishi Heavy Industries Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increased Government Investment in Establishing Water Treatment Infrastructure

- 4.5.1.2 Increase in Power Generation Using Steam

- 4.5.2 Restraints

- 4.5.2.1 The Emissions Regulations, High Capital and Operations Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Boiler feed pump

- 5.1.1.1 Vertical multistage inline pumps

- 5.1.1.2 Multistage horizontal ring section pumps

- 5.1.2 Circulation pumps

- 5.1.3 Steam condensate pumps

- 5.1.4 Others

- 5.1.1 Boiler feed pump

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 France

- 5.2.2.3 Germany

- 5.2.2.4 Spain

- 5.2.2.5 Russia

- 5.2.2.6 Turkey

- 5.2.2.7 NORDIC

- 5.2.2.8 Rest of the Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Vietnam

- 5.2.3.5 Thailand

- 5.2.3.6 Indonesia

- 5.2.3.7 Malaysia

- 5.2.3.8 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Nigeria

- 5.2.5.4 Qatar

- 5.2.5.5 Egypt

- 5.2.5.6 Rest of Middle East & Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Sulzer Limited

- 6.3.2 Thermax Limited

- 6.3.3 Wanner International Limited

- 6.3.4 Sundyne

- 6.3.5 Mitsubishi Heavy Industries, Ltd.

- 6.3.6 EBARA CORPORATION.

- 6.3.7 Modo Pumps Co, Ltd.

- 6.3.8 Castle Pumps.

- 6.3.9 Inproheat Industries.

- 6.3.10 Fuji Electric Co., Ltd.

- 6.4 Markey Ranking Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Technological Advancement in the Steam Generation Water Pumps