|

市場調查報告書

商品編碼

1645110

印度微型電池:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)India Micro Batteries - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

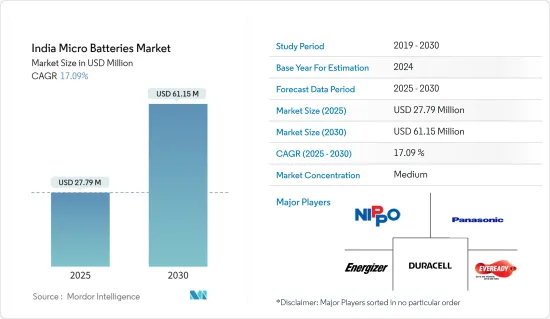

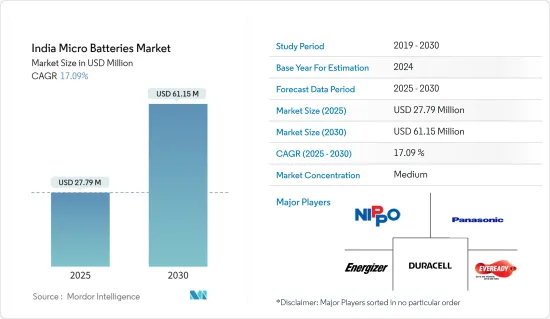

印度微型電池市場規模預計在 2025 年為 2,779 萬美元,預計到 2030 年將達到 6,115 萬美元,預測期內(2025-2030 年)的複合年成長率為 17.09%。

關鍵亮點

- 從中期來看,預計鋰離子電池價格下跌和微型電池應用激增等因素將在預測期內推動印度微型電池市場的發展。

- 另一方面,鋰等原料的供需不匹配可能會在預測期內阻礙印度微型電池市場的成長。

- 然而,在預測期內,家用電子電器產業對微型電池的使用不斷增加以及新型儲能電池技術的進步可能為印度微型電池市場創造豐厚的成長機會。

印度微型電池市場趨勢

鋰離子電池成本下降推動市場

- 傳統上,鋰離子電池主要用於行動電話、個人電腦等家用電子電器。鋰離子電池因其良好的容量重量比而比其他類型的電池越來越受歡迎。推動鋰離子電池廣泛應用的其他因素包括性能的提高、使用壽命的延長和價格的下降。

- 鋰離子電池製造商正致力於降低鋰離子電池的成本。過去十年來,鋰離子電池價格大幅下跌。 2023 年,鋰離子電池的平均價值約為每千瓦時 139 美元。與 2010 年相比,2023 年價格下跌了 82.17% 以上。

- 成本大幅降低的兩個主要原因是透過持續的研究和開發,改進電池材料,減少非活性材料的數量和材料成本,改善電池設計和生產產量比率,並提高生產速度,從而實現了電池性能的穩步提高。

- 由於產量的增加,鋰離子電池製造已經實現了規模經濟。而且,產能的大規模擴張也加劇了廠商之間的競爭,進一步壓低了價格,損害了廠商的盈利。

- BloombergNEF 預計,隨著更多採礦和精製能運作以及鋰價格開始下降,電池成本將在 2024 年再次下降。根據 BNEF 的 2022 年電池定價研究,到 2026 年,平均電池組價格預計將降至 100 美元/千瓦時以下。

- 該國大部分鋰從中國進口,但目標是在未來減少對中國的依賴。該國正致力於探勘國內礦產以滿足眾多應用日益成長的需求。

- 例如,2023 年 2 月,印度地質調查局 (GSI) 在查謨和克什米爾雷西縣的薩拉爾-海馬納地區發現首個鋰蘊藏量約 590 萬噸。鋰是非鐵金屬,也是微電池的關鍵成分。這些發現將有助於各國在預測期內滿足全部區域對超小型電池日益成長的需求。

- 因此,由於上述因素,預計預測期內鋰離子電池成本下降將推動市場發展。

細分市場,佔領市場

- 隨著電子元件尺寸不斷縮小以及處理能力不斷增強,攜帶式電子應用越來越受歡迎。這些新型電子設備需要輕薄、光滑的電池組。越來越小的微型電池的出現推動了對節能家用電子電器產品的需求。鋰電池的快速普及導致其在可攜式和手持式電子設備中的使用增加。

- 由於能量密度高、壽命長、自放電率低,鋰離子微電池擴大被用於智慧型手機、筆記型電腦、平板電腦、相機、手錶、遙控器和掌上遊戲機等家用電子電器。

- 過去幾年,印度各地智慧型手機和筆記型電腦消費量的增加推動了智慧型手機和耳機中使用的微型電池的需求。截至 2024 年 1 月,印度智慧型手機市場僅次於中國,位居第二,預計 2023 年出貨量將達到 1.44-1.45 億台。這項進展對印度的「印度製造」舉措產生了重大推動作用,政府和業內消息人士透露,2023-2024 會計年度 4 月至 8 月期間,行動電話出口額達 55 億美元。與22-23會計年度同期的30億美元相比,這一數字大幅成長。

- 印度預計在 2024-2025 財政年度實現行動電話出口額突破 144 億美元。 5G技術的出現也有望推動智慧型手機的需求。

- 根據中央電力局(CEA)預測,2023年印度家用電子電器產品銷售額將達700億美元,比2022年成長7.7%。由於該地區對電子產品的需求呈指數級成長,這一數字可能會大幅增加。

- 此外,家用電子電器越來越小、越來越輕的趨勢也進一步推動了鋰離子電池的普及。

- 因此,預計預測期內家用電子電器領域的電池將推動印度微型電池市場的發展。

印度微型電池產業概況

印度微型電池市場呈現細分化。市場的主要企業(不分先後順序)包括金霸王公司、松下能源、印度國家有限公司、勁量控股公司和 Eveready Industries India Ltd.。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2029 年市場規模與需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 微型電池應用蓬勃發展

- 鋰離子電池成本下降

- 限制因素

- 原料供需不匹配

- 驅動程式

- 供應鏈分析

- PESTLE分析

第5章 市場區隔

- 電池技術

- 鹼性電池

- 鋰離子

- 其他

- 應用

- 車

- 手錶

- 醫療設備

- 家用電子電器產品

- 其他

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Duracell Inc.

- Panasonic Energy Co. Ltd

- Renata Battery

- Indo National Ltd

- Murata Manufacturing Co. Ltd

- Maxell Ltd

- Energizer Holdings Inc.

- Eveready Industries India Ltd

- VARTA Microbattery

- Sony Corporation

- 其他知名公司名單

- 市場排名/佔有率分析

第7章 市場機會與未來趨勢

- 消費性電子產業對高效能微電池的需求日益成長

簡介目錄

Product Code: 50002221

The India Micro Batteries Market size is estimated at USD 27.79 million in 2025, and is expected to reach USD 61.15 million by 2030, at a CAGR of 17.09% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as declining prices of lithium-ion batteries and a surge in micro battery applications are likely to drive India's micro battery market during the forecast period.

- On the other hand, the demand-supply mismatch of raw materials, like lithium, will likely hinder the growth of the Indian micro battery market during the forecast period.

- However, the rising use of micro batteries in the consumer electronics industry and technological advancements in new battery technologies to store energy will likely create lucrative growth opportunities for the Indian micro battery market during the forecast period.

India Micro Batteries Market Trends

Declining Cost Of Lithium Ion Battery Drive the Market

- Lithium-ion batteries have traditionally been used mainly in consumer electronic devices like mobile phones and PCs. Lithium-ion batteries are gaining more popularity than other battery types due to their favorable capacity-to-weight ratio. Other factors boosting its adoption include better performance, better shelf life, and a decreasing price.

- Lithium-ion battery manufacturers are focusing on reducing the cost of Lithium-ion batteries. The price of lithium-ion batteries declined steeply over the past 10 years. In 2023, an average lithium-ion battery was valued at around USD 139 per kWh. It witnessed a decrease in the price of more than 82.17% in 2023 compared to 2010.

- The two principal reasons for the drastic cost decline are the steady improvement of battery performance achieved through sustained R&D aimed at improving battery materials, reducing the amount of non-active materials and the cost of materials, improving cell design and production yield, and increasing production speed.

- As a result of increased production volume, economies of scale were achieved in lithium-ion battery manufacturing. These significant capacity additions also resulted in more competition among manufacturers, further reducing prices at the expense of manufacturers' profitability.

- BloombergNEF anticipates that battery costs will decline again in 2024 as more extraction and refinery capacity becomes operational and lithium prices begin to ease. According to BNEF's 2022 Battery Price Survey, by 2026, the average pack price is expected to drop below USD 100/kWh.

- The country imports the majority of lithium from China and aims to decrease its reliance in the future. The country is focused on exploring domestic minerals to meet the increasing demand from numerous applications.

- For instance, in February 2023, the Geological Survey of India (GSI) discovered lithium reserves of about 5.9 million tonnes in the Salal-Haimana area of the Reasi district of Jammu and Kashmir for the first time. Lithium is a non-ferrous metal and is one of the critical components in micro batteries. These discoveries help countries fulfill the increased demand for micro batteries across the region during the forecast period.

- Therefore, owing to the above factors, the declining cost of lithium-ion batteries is expected to drive the market during the forecast period.

The Consumer Electronics Segment to Dominate the Market

- Portable consumer electronic applications become more popular as the size of electronic components continually reduces and processing power increases. These new electronic devices require sophisticated and lightweight battery packs. The availability of ever-smaller micro batteries has increased the demand for energy-efficient appliances. The rapid proliferation of lithium batteries has increased their use in portable and handheld electronic devices.

- Lithium-ion micro batteries are increasingly used in consumer electronics such as smartphones, laptops, tablets, cameras, clocks, watches, remote controls, and portable gaming devices due to their high energy density, longer lifespan, and low self-discharge rate.

- The increasing consumption of smartphones and laptops across India in the past few years has aided the demand for micro batteries used in smartphones and headphones. As of January 2024, the Indian smartphone market was significant after China, reaching 144-145 million shipments in 2023. The development significantly boosts India's "Make in India" initiative, as government and industry sources revealed mobile phone exports worth USD 5.5 billion during the April-August period of the 2023-2024 fiscal year. This marks a substantial increase compared to the USD 3 billion recorded during the same period in FY22-23.

- India is on track to surpass USD 14.4 billion in mobile phone exports in the current fiscal year 2024-2025. The emergence of 5G technology is also expected to boost smartphone demand.

- According to the Central Electricity Authority (CEA), in 2023, consumer electronics sales in India were USD 70 billion, an increase of 7.7% compared to 2022. The number will likely increase significantly as the demand for electronics products rises exponentially in the region.

- Additionally, the trend toward miniaturization and lightweight designs in consumer electronics has further propelled the adoption of lithium-ion batteries, as they allow for slimmer and more compact device form factors without compromising performance.

- Therefore, the consumer electronics segment battery is expected to drive the Indian micro battery market during the forecast period.

India Micro Batteries Industry Overview

The Indian micro batteries market is fragmented. Some of the major players in the market (in no particular order) include Duracell Inc., Panasonic Energy Co. Ltd, Indo National Limited, Energizer Holdings Inc., and Eveready Industries India Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Surge in Micro Battery Applications

- 4.5.1.2 Declining Cost Of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 Demand-supply Mismatch Of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Technology

- 5.1.1 Alkaline

- 5.1.2 Lithium-ion

- 5.1.3 Other Battery Technologies

- 5.2 Application

- 5.2.1 Automotive

- 5.2.2 Watches

- 5.2.3 Medical Devices

- 5.2.4 Consumer Electronics

- 5.2.5 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Duracell Inc.

- 6.3.2 Panasonic Energy Co. Ltd

- 6.3.3 Renata Battery

- 6.3.4 Indo National Ltd

- 6.3.5 Murata Manufacturing Co. Ltd

- 6.3.6 Maxell Ltd

- 6.3.7 Energizer Holdings Inc.

- 6.3.8 Eveready Industries India Ltd

- 6.3.9 VARTA Microbattery

- 6.3.10 Sony Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Need for Efficient Micro Batteries in the Consumer Electronics Industry

02-2729-4219

+886-2-2729-4219