|

市場調查報告書

商品編碼

1645120

非洲食品低溫運輸物流 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Africa Food Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

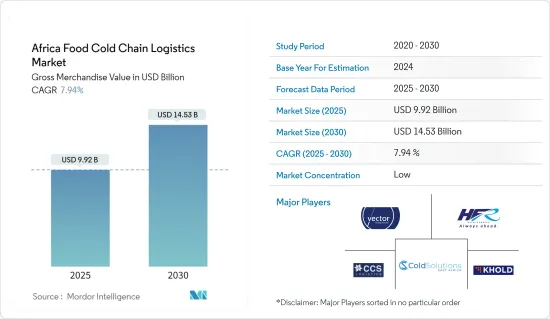

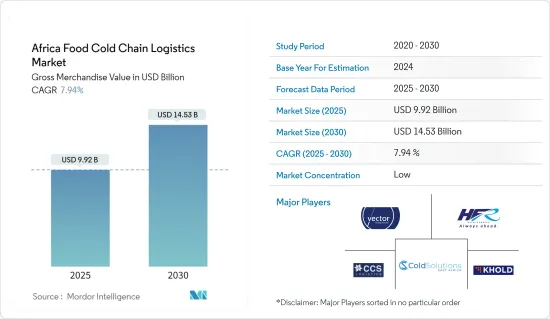

基於商品總價值,非洲食品低溫運輸物流市場規模預計將從 2025 年的 99.2 億美元成長到 2030 年的 145.3 億美元,預測期內(2025-2030 年)的複合年成長率為 7.94%。

生活方式的改變和都市化促進了該國加工食品消費量的增加,同時,隨著人們的健康意識增強、需要解決食物浪費問題和確保糧食安全,消費模式的改變(包括新鮮水果消費量的增加)也是支持市場成長的因素。

氣候危機是造成非洲嚴重糧食不安全和糧食浪費的主要原因。據估計,非洲生產的三分之一以上的食物因變質或浪費而損失。聯合國糧食及農業組織估計,撒哈拉以南非洲地區超過 40% 的食物在到達消費者手中之前就被浪費了。撒哈拉以南非洲的生鮮食品的比例上升至 60%。

食物浪費的主要原因是腐敗,尤其是由於缺乏倉儲設施來延長對溫度敏感的食物的保存期限。非洲農民和農業承包商依賴臨時冷卻器和過時的通用冷藏室。這些系統不可靠、維護不善且運作成本高。

冷藏倉庫和冷藏供應鏈產品有助於減少損失並維持產品的品質和效力,但它們需要足夠的電力才能有效運作。根據非洲開發銀行(AfDB)統計,非洲有超過 6.4 億人無法用電,維持持續低溫也是一項挑戰。非洲迫切需要建立一個有彈性、可靠和永續的低溫運輸,以解決食品和藥品損失問題。

一些非洲新興企業正在創新數位解決方案以應對新的挑戰。這些新興企業提供節能且符合出口要求的冷藏產品和解決方案。它們價格合理,並配有全面的溫度和性能監控系統。

根據低溫運輸儲存產業報告,東非的低溫運輸基礎設施更發達,而南部非洲的低溫運輸基礎設施更發達,並迎合出口商的需求。

非洲食品低溫運輸物流市場趨勢

電力危機對南非食品低溫運輸物流市場造成負面影響

南非目前擁有非洲大陸大部分的冷藏容量,並擁有多種正冷藏(新鮮水果、蔬菜)和負冷藏(魚、肉)選擇。許多在非洲營運的低溫運輸物流供應商的總部都設在南非。但該國電力短缺現象嚴重,各地區普遍停電,每天停電時間長達10小時。根據礦產資源和能源部的數據,南非國內總發電量為 58,095 兆瓦(MW)。煤炭仍是主要能源來源,佔該國能源結構的80%左右。然而,一些燃煤電廠老化、狀況惡化,導致實際發電量嚴重短缺,缺口達4,000-6,000兆瓦。

這種短缺導致了嚴重的停電,也稱為「負載削減」。可靠、穩定的能源供應對於維持低溫運輸至關重要。在電力不穩定或不可靠的地區,溫控環境受到干擾的風險會增加。這些中斷對農業領域的低溫運輸產生了不利影響,尤其是影響了生鮮食品的儲存和運輸。據報道,由於運輸延遲和低溫運輸中斷,一些零售商拒絕生鮮食品,而這種情況在天氣炎熱時會更加嚴重。此次能源危機對南非食品低溫運輸物流市場提出了重大挑戰。

新鮮水果出口促進市場成長

埃及是該地區最大的水果和蔬菜出口國。埃及每年透過出口各種新鮮、乾燥和冷凍水果和蔬菜產品賺取約 30 億美元。出口到國際市場的主要產品包括柳橙、馬鈴薯、冷凍草莓、鮮食葡萄和新鮮洋蔥。南非在出口市場也扮演著重要角色。南非的農業部門明顯以出口為導向,約有一半的產量以金額為準出口。南非水果產業在該國農業出口中佔據主導地位,新鮮水果約佔南非農業出口的35%。數十年來針對種植者和行業協會的研發和能力建設舉措幫助生產出能夠在全球有效競爭的高品質水果。

南非在全球水果生產中佔有重要地位,是世界第二大柑橘出口國、第六大梨生產國、第七大葡萄出口國、第八大蘋果出口國和第九大酪梨出口國。在出口市場方面,南非水果產業的目標是維持並擴大在歐盟、英國和美國的傳統市場。此外,公司的策略重點是進入東亞和中東的新市場。非洲是南非多種水果的重要潛在出口市場。目前,蘋果和梨在西非和東非的銷售情況良好。這些水果在非洲國內外的出口是低溫運輸物流的重要需求驅動力,凸顯了持續發展低溫運輸基礎設施的重要性。

非洲食品低溫運輸物流產業概況

鑑於非洲大陸的多樣性,當地和區域物流供應商發揮關鍵作用。區域參與者是非洲食品低溫運輸物流市場的主要參與企業。這些公司對當地市場動態、法規和基礎設施挑戰有更好的了解。低溫運輸物流業務集中在非洲大陸南部地區。提供運輸、倉儲和配送等綜合低溫運輸服務的公司具有競爭優勢。這些服務的無縫協調對於保持溫度敏感食品的完整性至關重要。 CCS Logistics、Khold、Cold Solutions East Africa、Vector Logistics、HFR Transport 等是市場的主要企業。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 價值鏈/供應鏈分析

- 政府對產業的監管和舉措

- 市場技術開發

- 深入了解市場上的創新新興企業(Solar Freeze、InspiraFarms、Coldbox Store、ColdHubs、Freezelink)

- 新冠肺炎疫情對市場的影響

第5章 市場動態

- 驅動程式

- 水果出口增加

- 限制因素

- 電力危機

- 機會

- 缺乏冷藏設施導致食物浪費

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第6章 市場細分

- 按服務

- 貯存

- 運輸

- 附加價值服務(冷凍、標籤、庫存管理等)

- 按溫度

- 冷藏

- 冷凍

- 常溫

- 按產品類型

- 園藝(新鮮水果和蔬菜)

- 乳製品(牛奶、冰淇淋、奶油等)

- 肉類、家禽、魚貝類

- 加工食品

- 其他

- 按國家

- 埃及

- 奈及利亞

- 南非

- 其他國家

第7章 競爭格局

- 市場集中度

- 公司簡介

- CCS Logistics

- Khold

- Cold Solutions East Africa

- Vector Logistics

- HFR Transport

- Africa Cold Chain Limited

- African Perishable Logistics

- Unitrans

- Africa Global Logistics (AGL)

- Go Global

- Lieben Logistics

- BigCold Kenya Ltd

- Southern Shipping Services Ltd (SSSL)*

- 其他公司

第 8 章:市場的未來

第 9 章 附錄

The Africa Food Cold Chain Logistics Market size in terms of gross merchandise value is expected to grow from USD 9.92 billion in 2025 to USD 14.53 billion by 2030, at a CAGR of 7.94% during the forecast period (2025-2030).

Changes in lifestyle and urbanization contributing to increased domestic consumption of processed foods and a shift in consumption patterns, including increased consumption of fresh fruits, as people become more health concerned, need to address food wastage and ensure food security, are the factors assisting the market's growth.

The climate change crisis has significantly contributed to the dire food insecurity and food wastage in Africa. Over one-third of food produced in Africa is estimated to be lost to spoilage or waste. The United Nations Food and Agriculture Organization estimates that over 40% of food in Sub-Saharan Africa perishes before it reaches a consumer. This can be as high as 60% for fresh produce in Sub-Saharan Africa.

The leading cause of food wastage is spoilage due to the lack of cold storage facilities to extend the shelf life, especially temperature-sensitive food items. Farmers and agri-traders in Africa rely on makeshift coolers or outdated, generic cold rooms. These systems are unreliable, poorly maintained, and have high operational costs.

Cold storage or cold supply chain products can help reduce spoilage and maintain quality and efficacy, but they require sufficient electricity to work effectively. In Africa, according to the African Development Bank (AfDB), electricity is out of reach for more than 640 million people, and the ability to sustainably maintain constant cold temperatures remains a challenge. There is an urgent need to deploy resilient, reliable, and sustainable cold chains to tackle food and medicine losses in Africa.

Several startups in Africa are innovating digital solutions to respond to emerging challenges. These startups offer cold storage products and solutions that are energy-efficient and compliant with export standards. They are also affordable and well-equipped with temperature and performance monitoring systems.

According to a Cold Chain Storage industry report, the cold chain infrastructure is developing in East Africa, with cold chain infrastructure in Southern Africa being more developed and geared toward exporters.

Africa Food Cold Chain Logistics Market Trends

Electricity Crisis is Negatively Affecting the South African Food Cold Chain Logistics Market

South Africa currently hosts most of the continent's cold storage capacity, encompassing many positive (fresh fruit and vegetables) and negative (fish and meat) cold storage options. Numerous cold chain logistics providers operating in Africa are headquartered in South Africa. However, the country is grappling with significant electricity shortages, resulting in widespread daily power cuts lasting up to 10 hours in various regions. As per the Ministry of Mineral Resources and Energy, South Africa's total domestic electricity generation capacity is 58,095 megawatts (MW). Coal remains the predominant energy source, constituting approximately 80% of the country's energy mix. Nonetheless, due to the aging and deteriorating condition of some coal power stations, actual power generation falls substantially short, creating a deficit ranging between 4000 - 6000 MW.

This shortfall has led to severe power cuts, also known as 'load shedding.' A reliable and consistent energy supply is crucial for maintaining the cold chain. In regions with inconsistent or unreliable power, the risk of disruptions to temperature-controlled environments increases. These power cuts are adversely affecting the cold chains within the agricultural sector, particularly impacting the storage and transport of fresh produce. Reports indicate that some retailers have rejected fresh produce due to delivery delays and disruptions in the cold chain, exacerbating the situation during warmer months. This energy crisis is a significant challenge for the South African food cold chain logistics market.

Fresh Fruit Exports are Contributing to the Growth of the Market

Egypt holds the position of being the largest exporter of fruits and vegetables in the region. Annually, the country generates approximately USD 3 billion in revenue from exporting various fresh, dried, and frozen fruit and vegetable products. Key products exported to international markets include oranges, potatoes, frozen strawberries, table grapes, and fresh onions. South Africa also plays a vital role in the export market. The agricultural sector in South Africa is distinctly export-focused, with approximately half of its produce being exported in value terms. The South African fruit industry is a predominant force in the country's agricultural exports, with fresh fruit accounting for around 35% of South African agricultural exports. Decades of research and development and capacity-building initiatives for growers and industry associations have been instrumental in producing high-quality fruit that can compete effectively globally.

South Africa boasts significant rankings in global fruit production, including being the world's 2nd largest citrus exporter, 6th largest pear producer, 7th largest grape exporter, 8th largest apple exporter, and 9th largest avocado exporter. Regarding export markets, the South African fruit industry aims to retain and maximize its traditional markets within the European Union, the United Kingdom, and the United States. Additionally, there is a strategic focus on gaining access to new markets in East Asia and the Middle East. Africa represents a substantial potential export market for various types of fruit from South Africa. Presently, apples and pears are performing well in West and East Africa. The export of these fruits within and outside Africa is a significant demand driver for cold chain logistics, emphasizing the importance of ongoing development in cold chain infrastructure.

Africa Food Cold Chain Logistics Industry Overview

Given the diversity of the African continent, local and regional logistics providers play a crucial role. Regional players are the major players in the African food cold chain logistics market. They have a better understanding of local market dynamics, regulations, and infrastructure challenges. Cold Chain logistics operations are concentrated in the Southern region of the continent. Companies that offer integrated cold chain services, including transportation, warehousing, and distribution, have a competitive advantage. Seamless coordination of these services is essential for maintaining the integrity of temperature-sensitive food products. CCS Logistics, Khold, Cold Solutions East Africa, Vector Logistics, and HFR Transport are some of the key players in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain/Supply Chain Analysis

- 4.3 Government Regulations and Initiatives in the Industry

- 4.4 Technological Developments in the Market

- 4.5 Insights on Innovative Startups in the Market (Solar Freeze, InspiraFarms, Coldbox Store, ColdHubs, and Freezelink)

- 4.6 Impact of the COVID - 19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Increasing Fruit Exports

- 5.2 Restraints

- 5.2.1 Electricity Crisis

- 5.3 Opportunities

- 5.3.1 Food Wastage Due to Lack of Cold Storage Facilities

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Storage

- 6.1.2 Transportation

- 6.1.3 Value-added Services (Blast Freezing, Labeling, Inventory Management, etc.)

- 6.2 By Temperature

- 6.2.1 Chilled

- 6.2.2 Frozen

- 6.2.3 Ambient

- 6.3 By Product Category

- 6.3.1 Horticulture (Fresh Fruits and Vegetables)

- 6.3.2 Dairy Products (Milk, Ice Cream, Butter, etc.)

- 6.3.3 Meat, Poultry, and Seafood

- 6.3.4 Processed Food Products

- 6.3.5 Other Categories

- 6.4 By Country

- 6.4.1 Egypt

- 6.4.2 Nigeria

- 6.4.3 South Africa

- 6.4.4 Other Countries

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Company Profiles

- 7.2.1 CCS Logistics

- 7.2.2 Khold

- 7.2.3 Cold Solutions East Africa

- 7.2.4 Vector Logistics

- 7.2.5 HFR Transport

- 7.2.6

Africa Cold Chain Limited

- 7.2.7 African Perishable Logistics

- 7.2.8 Unitrans

- 7.2.9 Africa Global Logistics (AGL)

- 7.2.10 Go Global

- 7.2.11 Lieben Logistics

- 7.2.12 BigCold Kenya Ltd

- 7.2.13 Southern Shipping Services Ltd (SSSL)*

- 7.3 Other Companies