|

市場調查報告書

商品編碼

1645134

射線檢測設備:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Radiography Test Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

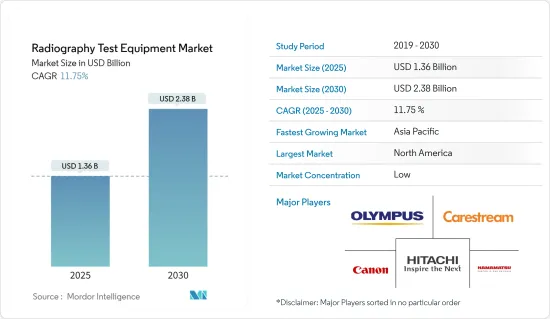

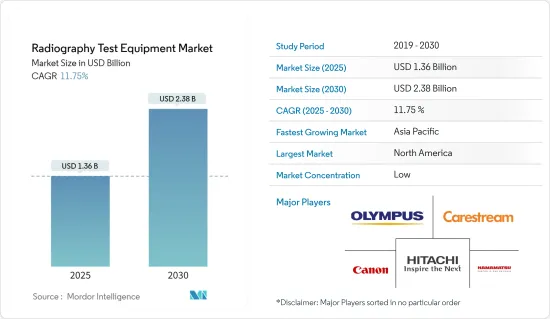

射線檢測設備市場規模預計在 2025 年為 13.6 億美元,預計到 2030 年將達到 23.8 億美元,預測期內(2025-2030 年)的複合年成長率為 11.75%。

冠狀病毒(COVID-10)疫情正在影響全球生活的各個層面。這為市場環境帶來了一些變化,對製造業和汽車市場產生了重大影響。印度統計和計畫部(MOSPI)數據顯示,新冠疫情對建築業、製造業和採礦業總增加價值的影響分別為-13.3%、-6.3%和-14.7%。因此,這些產業成長放緩減少了對X光檢測設備製程活動的需求,進而影響了市場成長。

關鍵亮點

- 由於遵守高工業標準和安全法規,航太和汽車領域的需求不斷增加,推動了射線照相檢測解決方案的採用。

- 從類比技術到數位技術的轉變為無損檢測應用的工業X光檢測市場注入了新的活力,擴大了X光檢測系統的應用範圍,超越了傳統應用。

- 公司越來越注重降低輻射相關風險,並青睞高度便攜性的解決方案。例如,三星在 Note 7 事故發生後就採用了 X 光測試來檢查電池。

- BP馬孔多災難、聖布魯諾管線爆炸和BP德克薩斯城煉油廠爆炸等事件進一步凸顯了安全和環境永續性的必要性。

- 超音波系統競爭激烈,輻射風險高,以及操作伽瑪輻射X光設備,尤其是數位X光設備的熟練人員短缺。此外,相對較高的實施成本預計也將阻礙該市場的成長。

射線檢測設備的市場趨勢

航太領域應用佔市場需求的大部分

- 射線檢測設備主要用於軍用和民航機的製造和維護,屬於航太領域。

- 航太領域的應用包括檢測厚而複雜的金屬和非金屬的內部缺陷,以及關鍵航太零件、結構和組件的品質。

- 對安全標準的日益重視、更短的服務間隔、低排放目標以及新材料和新製程的出現是推動航太領域 X光透視市場發展的關鍵因素。

- 在航太領域,傳統射線照相術正被數位射線照相術取代,預計除一些關鍵的高解析度成像應用外,數位射線照相術將完全主導市場。

- 這種轉變也受到國家航空航太和國防承包商認證計畫(NADCAP)規定的通用、具有約束力的認證標準的推動。

北美佔據主要市場佔有率

- 該地區是市場主要企業的所在地,加上廣泛的研究和開發活動,推動了無損檢測的廣泛應用。

- 由於美國是最早採用製造業自動化的國家之一,預計在某些檢查領域使用自動化解決方案將有助於解決熟練勞動力短缺的問題,使工人從艱苦、危險、重複和單調的任務中解放出來。

- NTS 在北美擁有 28 個實驗室,提供自訂測試以滿足 FDA、產品安全和其他重要認證,幫助醫療器材與設備製造商更快地將產品推向市場。測試範圍從大型設備到放置在人體內的小型植入,需要強大的測試方法。例如,該公司提供聽力植入的組件分析、標準X光和電腦斷層掃描(CT)。

- 此外,石油和天然氣產業佔加拿大GDP的資本投資和出口的很大一部分。富有吸引力的省級激勵措施鼓勵鑽探,以及頁岩資源中長水平井和多級壓裂的日益廣泛實踐是加拿大石油和天然氣行業發展的主要驅動力。

射線檢測設備產業概況

主要企業包括YXLON International、GE Measurement and Control、Nikon Metrology Inc.、Teledyne Dalsa Inc.、Hamamatsu Photonics KK、Canon Inc. 和 Hitachi。每家公司都投入大量資金進行研發,使其設備更加精確,進而導致各大公司之間的競爭異常激烈,市場也變得分散。因此,市場集中度較低。

- 2020 年 3 月 - 為滿足即時應對 COVID-19 疫情的需要,並預計全球對醫療設備和其他製造業的需求將在中長期內持續成長,GTMA 組建了叢集有興趣在醫療保健領域業務的會員公司集群。

- 2020年12月 - 印度政府計劃透過向企業提供包括土地、電力、新能源和可再生能源等具有吸引力的價格的獎勵,建立三個大型電力和清潔能源設備製造區。預計此類政府措施將鼓勵對設備的投資,並推動對包括透視設備在內的設備檢查的需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- COVID-19 對市場的影響

- 市場促進因素

- 可攜式X光設備的出現

- 市場問題

- 由於使用伽馬射線和 X光而導致的高輻射風險

- 對高技能人才的需求

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 技術板塊

- 底片 X 光

- 電腦放射攝影

- 直接射線照相術

- 電腦斷層掃描

- 按行業

- 航太和國防

- 能源動力

- 建造

- 石油和天然氣

- 車

- 製造業

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- Hitachi Ltd

- Canon Inc.

- Carestream Health Inc

- Hamamatsu Photonics KK

- Olympus Corporation

- Vidisco Ltd

- Nikon Metrology Inc.

- Teledyne Dalsa Inc.

- GE Measurement and Control

- YXLON International GmbH(COMET Group)

7.供應商市場佔有率分析

第8章投資分析

第9章 市場機會與未來趨勢

The Radiography Test Equipment Market size is estimated at USD 1.36 billion in 2025, and is expected to reach USD 2.38 billion by 2030, at a CAGR of 11.75% during the forecast period (2025-2030).

The Coronavirus (COVID-19)pandemic has affected every aspect of life globally. This has brought along several changes in market conditions and affected the manufacturing and automotive sector for the market majorly. According to the Ministry of Statistic and Program Institute (MOSPI) India, the impact of COVID-19 on Gross value-added on the construction, manufacturing, and mining sector has accounted for -13.3%,-6.3%, and -14.7%, respectively. Thus, the decline in the growth of these industries has reduced the demand for the radiography test equipment process activities that impact the market growth.

Key Highlights

- Increase in demand from aerospace and automotive sectors, primarily due to conformance to high industry standards and safety regulations is boosting the adoption of radiography testing solutions.

- The shift from analog to digital technology has given the industrial radiography market a new lease of life for NDT applications, broadening the scope of X-ray inspection systems beyond traditional applications.

- Companies are increasingly focusing on reducing radiation-related risks, and preferring portability solutions, which has prompted companies to revamp their product portfolio. For instance, Samsung has adopted radiography to test their batteries after the much-publicized Note 7 fiasco.

- Incidents, like the BP Macondo disaster, the San Bruno pipeline explosion, and the BP Texas City refinery explosion, have further emphasized on the need for safety, environmental sustainability, therefore governmental agencies and regional bodies like ASME & ISO have taken stringent measures to assure safety and regulatory compliances.

- Intense competition from ultrasonic systems, high risk of radiation, lack of skilled personnel, to handle radiography equipment which uses gamma rays (especially in digital radiography). Also, relatively high deployment costs are expected to hinder the growth of the study market.

Radiography Test Equipment Market Trends

Application in Aerospace to Account for a Significant Portion of the Market Demand

- Radiography test equipment, mainly used in manufacturing and maintenance of military and civil aircraft, are considered under the scope of the aerospace segment.

- Applications in aerospace, include detection of internal defects in thick and complex shapes, in metallic and non-metallic shapes, quality of critical aerospace components, structures, and assemblies.

- Increasing emphasis on safety standards, decreasing service intervals, low emission targets, and the advent of new materials and process are the major factors driving the radiography market in the aerospace segment.

- Conventional radiography is being increasingly replaced with digital radiography in aerospace, and the latter is expected to completely overshadow the market, except for some critical high-resolution imaging applications.

- This shift has also been fuelled by the advent of common binding standard for the common accreditation, in accordance with the National Aerospace and Defense Contractors Accreditation Program (NADCAP).

North America to Account for Significant Market Share

- The region is home to some of the major players in the market, coupled with the extensive research and development activities that have resulted in the wide-scale adoption of non-destructive testing.

- As the United States is one of the early adopters of manufacturing automation, the use of automated solutions in some regions of testing is expected to address the issue of lack of skilled personnel, by releasing workers from hard and dangerous, repetitive, and monotonous work.

- NTS with 28 labs in North America, provides custom testing to meet FDA, product safety, and other essential certifications to bring products to market quickly to medical device and equipment manufacturers. The testing varies from bigger devices to smaller implants that are then implanted in the human body and thus need robust testing methods. For instance, the company provides component analysis, standard radiography, and computer tomography (CT) of hearing implants.

- Furthermore, the Canadian GDP is majorly dominated by the oil and gas sector to capital investments and exports. Attractive provincial incentives to encourage drilling and increased implementation of long horizontal wells and multistage fracturing in shale resources are the major drivers for the Canadian oil and gas industry.

Radiography Test Equipment Industry Overview

The major companies like YXLON International, GE Measurement and Control, Nikon Metrology Inc., Teledyne Dalsa Inc., Hamamatsu Photonics K.K., Canon Inc., Hitachi Ltd, among others. The market is fragmented due to the intense competition among the major players since they are investing significantly in the R&D for immeasurable accuracy in their equipment. Therefore, the market concentration will be low.

- March 2020 - The GTMA formed a cluster of member companies interested in working in the medical sector, anticipating the need for an immediate response to the COVID-19 pandemic and ongoing medium/long-term growth in the global requirement for medical devices and other manufacture.

- December 2020 - The Indian government planned to set up three large manufacturing zones for power and clean energy equipment by offering companies incentives such as land and electricity at attractive prices, power, and new and renewable energy. Such initiatives by the government are expected to boost the investment in equipment, leading to the growing demand for equipment testing, including radiography testing equipment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Impact of COVID-19 on the Market

- 4.3 Market Drivers

- 4.3.1 Advent of Portable Radiography Equipment

- 4.4 Market Challenges

- 4.4.1 High Risk of Radiation Since it Uses Gamma Rays and X-Rays

- 4.4.2 Requirement of Highly Skilled Personnel

- 4.5 Industry Value Chain Analysis

- 4.6 Porters Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Film Radiography

- 5.1.2 Computed Radiography

- 5.1.3 Direct Radiography

- 5.1.4 Computed Tomography

- 5.2 End-user Vertical

- 5.2.1 Aerospace and Defense

- 5.2.2 Energy and Power

- 5.2.3 Construction

- 5.2.4 Oil and Gas

- 5.2.5 Automotive

- 5.2.6 Manufacturing

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Hitachi Ltd

- 6.1.2 Canon Inc.

- 6.1.3 Carestream Health Inc

- 6.1.4 Hamamatsu Photonics KK

- 6.1.5 Olympus Corporation

- 6.1.6 Vidisco Ltd

- 6.1.7 Nikon Metrology Inc.

- 6.1.8 Teledyne Dalsa Inc.

- 6.1.9 GE Measurement and Control

- 6.1.10 YXLON International GmbH (COMET Group)