|

市場調查報告書

商品編碼

1645137

道路照明:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Street And Roadway Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

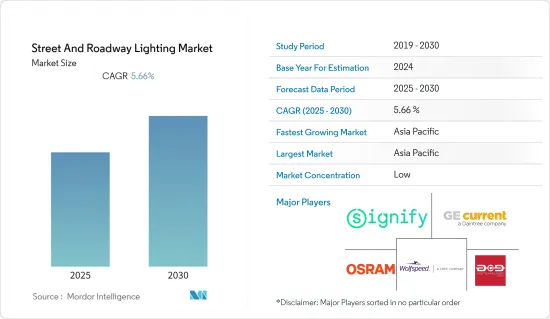

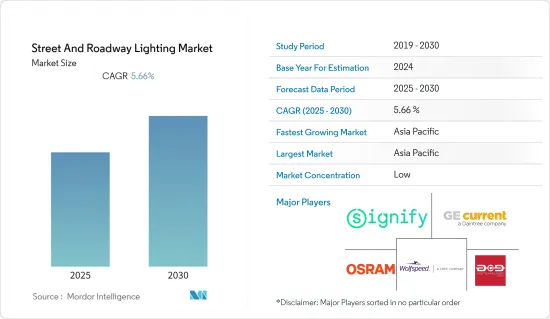

預計預測期內道路照明市場複合年成長率為 5.66%。

隨著交通基礎設施變得越來越複雜,對道路和公路照明的改善需求也越來越大,以保持交通順暢並確保人們的道路安全,同時保持成本效益。

關鍵亮點

- 道路照明對於提供符合道路照明標準設計準則的節能照明系統至關重要。它描述了為了駕駛員和行人的安全而在道路上適當且統一的照明。由於對道路照明系統智慧解決方案的需求不斷成長,道路和車道照明市場正在加速發展。

- 在繁忙的道路和高速公路上,良好的能見度非常重要,道路照明被視為重要的安全功能。據 CED Engineering 稱,適當的照明可以將夜間交通事故減少約 30%,從而提高駕駛員、騎士和行人的安全性。

- 街道照明至關重要,因為它可以提高行人的安全性和可見度。 LED路燈解決方案比傳統路燈消費量更少的能源,有助於減少碳排放並使城市更綠色。此類照明系統還可與智慧技術結合,以降低成本、節省能源並提高公共照明基礎設施的適應性、靈活性和效率。因此,世界各地的城市都在努力用 LED 取代老舊、低效的照明燈具。

- 此外,新興國家能源效率的提高和街道照明系統的無線技術可能會在未來幾年推動街道和道路照明市場的成長。然而,對廣泛接受的開放標準的需求以及產品測試成本的快速上升可能會在不久的將來對街道和道路照明市場的擴張造成進一步的障礙。除此之外,還缺乏一種能夠適用於所有智慧路燈並適合城市採用的單一網路選項。

道路照明市場趨勢

LED 照明領域成長強勁

- LED 燈透過提高整體可見度提供穩定的光線,為您的道路或高速公路位置增加了額外的安全性。它們還可以與光電管、佔用感應器和計時器結合使用,以提供高效使用的照明控制系統。

- LED 照明越來越受歡迎,能帶來本地能源效率的益處。根據美國能源局的數據,經能源之星認證的 LED 燈泡比傳統白熾燈泡節能 90%,在其使用壽命內可節省超過 80 美元的電費。政府支持節能照明的法規促使美國許多企業採用 LED 照明。

- 國際能源總署(IEA)估計,道路照明佔全球總照明的4%,改用LED照明可平均節省50%的能源成本,在全球整體節省1,600億美元的能源成本和5.55億噸二氧化碳。此外,根據國際能源總署的預測,到2030年,LED滲透率預計將佔全球照明市場的87.4%。

- 此外,政府措施也推動了市場成長,因為世界各國政府都在製定法規來鼓勵採用 LED。例如,在印度,政府推出的「國家路燈計畫」(SLNP)等措施(舉措旨在將 2,100 萬盞路燈替換為 LED)進一步促進了市場的成長。

- 此外,LED 照明應用提供全頻譜顏色,有助於改善戶外空間、橋樑、道路和建築物的美觀。例如,2022年8月,匹茲堡政府在該市的三座姊妹橋上安裝了LED照明。該項目包括在連接匹茲堡市中心和北岸的三座橋樑上安裝 601,440 盞彩色 LED 燈,首先在 9 月安裝雷切爾卡森大橋。計劃預計於 2023年終完工。

北美佔據主要市場佔有率

- 由於智慧城市計畫的興起,北美將主導街道和道路照明市場。此外,預測期內,政府加大力度在高速公路和道路應用中採用 LED 技術,將支持該地區道路和道路照明市場的成長。

- 影響該地區照明市場的主要因素之一是對聯網街道照明的投資。街道和道路照明計劃已經使該地區的許多社區受益。例如,2022 年 9 月,美國政府具有歷史意義的 1.2 兆美元基礎設施投資和就業法案為 Signify 和 Upcity 提供了機會,幫助美國和加拿大的城市和公共從其照明基礎設施中獲得的不僅僅是光亮。

- 拉雷多的 12,000 盞路燈將於 2023 年 3 月改用LED燈,拉雷多將成為德克薩斯州第一個實現這項轉換的城市。此外,達拉斯市政府官員正在考慮在 2022 年 3 月之前將路燈全面更換為 LED。達拉斯市有大約 15,000 盞路燈,其中近一半是 LED 燈。

- 根據美國能源部的數據,預計 2020 年至 2035 年間美國對 LED 照明的需求將會增加,尤其是戶外使用。到 2025 年,預計 93% 的戶外照明將採用 LED,成為所有行業中最常見的類型,主要與街道照明相關。

- 此外,為了提高城市街道照明的能源效率,阿拉巴馬市議會於 2022 年 2 月核准了與 NORESCO 能源服務公司簽訂的價值 470 萬美元的節約成本合約。全市已開始安裝 LED 照明。布朗茨維爾鎮和阿拉巴馬電力公司也於 2022 年 4 月簽署了新的 LED 路燈合約。該鎮的成本將分攤到三年內,因此價格可能會降低。這項節能策略將為該市每月節省約 128 美元。預計此類發展將增加該地區對 LED 照明的需求。

道路照明產業概況

街道和道路照明市場分散且競爭激烈,全球有許多地區和國際參與企業。主要參與企業包括Signify、OSRAM和Cree。

2023年6月,印度政府核准在德里公共工程部(PWD)管理的所有道路上安裝90,000盞智慧路燈。政府強調加強中央監控系統,以確保路燈不間斷運作。

2023 年 2 月,門羅市議會宣布已核准一項動議,向密西根州東南市政委員會 (SEMCOG) 提交津貼申請,將全市路燈改為發光二極體(LED) 燈。如果核准,預計該筆撥款將支付該市改建資金成本的 80%。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 對產業的影響

第5章 市場動態

- 市場促進因素

- 街道照明系統對智慧解決方案的需求不斷增加

- 智慧城市基礎設施的採用率不斷提高

- 市場限制

- 安裝智慧照明成本高

第6章 市場細分

- 照明類型

- 傳統照明

- 智慧照明

- 光源

- LED

- 螢光

- 高強度氣體放電燈泡

- 奉獻

- 硬體

- 照明和燈泡

- 照明燈具

- 控制系統

- 軟體和服務

- 硬體

- 力量

- 小於 50W

- 50 至 150W 或更低

- 150W 或以上

- 應用

- 高速公路

- 路

- 地區

- 北美洲

- 歐洲

- 亞洲

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- GE Current

- Cree Inc.(Wolfspeed Inc.)

- Signify Holding

- OSRAM Licht AG

- DCD Technologies ME FZCO

- Hubbell Inc

- Zumbotel Group(Thorn Lighting)

- LED roadway lighting Ltd

- Acuity Brands, Inc.

- Syska LED Lights Pvt. Ltd.

第8章投資分析

第9章 市場機會與未來趨勢

The Street And Roadway Lighting Market is expected to register a CAGR of 5.66% during the forecast period.

The increasing complexities of transportation infrastructure have increased the need for enhanced illumination on streets and roadways to ensure smooth traffic flow and people's safety on the streets while remaining cost-effective.

Key Highlights

- Street and roadway lighting is essential for providing an energy-efficient lighting system that is suitable as per the standard design criteria for roadway lighting. It provides adequate and uniform lighting on the roads for both motorists' and pedestrians' safety. The market for street and roadway lighting is accelerating due to the growing demand for intelligent solutions in street lighting systems.

- Roadway lighting is regarded as an essential safety feature for busy streets and highways where clear visibility is critical. According to CED Engineering, adequate lighting can reduce nighttime collisions by about 30 percent, enhancing the safety of drivers, riders, and pedestrians.

- Street lighting is crucial because it increases pedestrian safety and visibility. Owing to their lower energy consumption compared to conventional street lamps, LED street lighting solutions can help cities become more environmentally friendly by reducing their carbon footprint. In order to reduce costs, conserve energy, and improve the adaptability, flexibility, and efficiency of public lighting infrastructure, such lighting systems can also be integrated with smart technologies. As a result, cities all over are switching out older, inefficient fixtures with LEDs.

- Additionally, in the upcoming years, the street and roadway lighting market may grow due to improvements in energy efficiency in developing nations and wireless technology for street lighting systems. However, the need for widely accepted open standards and the rapidly rising costs of product testing could pose additional obstacles to the market's expansion for street and roadway lighting in the near future. In addition to this, the unavailability of a single networking option that works best for all smart street lights and is suitable for a city to adopt is also a significant challenge.

Street and Roadway Lighting Market Trends

LED Lights Segment to Exhibit Significant Growth

- LED lights provide consistent light by improving overall visibility and providing added security for street and highway locations. They can also be paired with photocells, motion sensors, and timers to offer a lighting control system for efficient usage.

- LED lighting is becoming increasingly common to reap the benefits of energy efficiency in the area. According to the U.S. Department of Energy, an Energy Star-certified LED light bulb can utilize up to 90 percent less energy compared to traditional incandescent bulbs while saving more than USD 80 in power costs throughout its lifetime. Due to government regulations supporting energy-efficient lighting, many businesses in the U.S. are implementing LED lighting.

- The International Energy Agency (IEA) estimated that road lighting accounts for 4 percent of total global light, and a switch to LED lights can save an average of 50 percent in energy costs, which results in global savings of USD 160 billion in energy costs, and 555 million tons of CO2. Further, according to IEA, the LED penetration rate is expected to be 87.4 percent of the global lighting market by 2030.

- Moreover, government initiatives are fueling market growth, as many governments worldwide are structuring regulations for encouraging LED adoption. For instance, in India, the government's industry, such as SLNP (Street Light National Program), an initiative to replace 21 million streetlights with LED, further contributes to the market growth.

- Additionally, LED lighting applications provide color across the entire spectrum and thus help improve the aesthetics of outdoor spaces, bridges, roads, and buildings. For instance, in August 2022, the Government of Pittsburgh installed LED lights on three of the city's sister bridges. The installation of 601,440 colored LED lights across the three bridges that connect Downtown Pittsburgh to the North Shore will begin in September with the Rachel Carson Bridge. The project is anticipated to be finished by the end of 2023.

North America to Witness the Significant Market Share

- The rise in smart city initiatives will cause North America to dominate the street and roadway lighting market. Additionally, expanding government initiatives to adopt LED technology for highway and roadway applications will support the growth of the region's street and roadway lighting market over the forecast period.

- One of the key factors influencing the area's lighting market is investments in connected streetlights. Street and road lighting initiatives have already benefited numerous communities across the region. For instance, in September 2022, with the US government's historic USD 1.2 trillion Infrastructure Investment and Jobs Act, Signify and Upciti took the opportunity to aid cities and utilities across the United States and Canada get added value, well beyond illumination from their lighting infrastructure.

- 12,000 streetlights in the City of Laredo were converted to LED lamps as of March 2023, making Laredo the first City in the state of Texas to accomplish such a conversion, according to officials. Additionally, Dallas city officials discussed significantly switching to LED streetlights in March 2022. The City owns about 15,000 streetlights in Dallas, nearly half of which are LEDs.

- The demand for LED lights is expected to increase in the United States between 2020 and 2035, particularly for outdoor uses, according to the Department of Energy. By 2025, 93 percent of outdoor lighting installations are expected to be LED lighting, making it the most popular type across all industries, primarily for connected street lights.

- Furthermore, to make the City's streetlights more energy-efficient, the Alabama City Council approved a USD 4.7 million cost-saving agreement with NORESCO Energy Services in February 2022. Work started on installing LED lights all over the City. The Town of Blountsville and Alabama Power also signed a new LED streetlights contract in April 2022. The price will likely be reduced because the town's expenses will be dispersed over three years. The City will save an estimated USD 128 per month with the power savings strategy. These developments are anticipated to increase the region's demand for LED lighting.

Street and Roadway Lighting Industry Overview

The street and roadway lighting market is fragmented and highly competitive owing to the presence of many regional and international players across the globe. Some of the significant players are Signify, OSRAM, and Cree, among others.

In June 2023, The Government of India approved the installation of 90,000 smart street lights on all the roads maintained by the Public Works Department (PWD) in Delhi to eliminate dark spots and bolster women's security. The government stressed a robust central monitoring system for ensuring the uninterrupted functioning of the lights.

In February 2023, The Monroe City Council announced the approval of a motion to submit a grant request to the Southeast Michigan Council of Governments (SEMCOG) to convert street lights around the city to light-emitting diode (LED) lamps. After approval, the grant is expected to cover up to 80 percent of the capital costs the city would incur in the conversion.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Intelligent Solutions in Street Lighting Systems

- 5.1.2 Increasing Adoption of Smart City Infrastructure

- 5.2 Market Restraints

- 5.2.1 High Installation Cost of Smart Lighting

6 MARKET SEGMENTATION

- 6.1 Lighting Type

- 6.1.1 Conventional Lighting

- 6.1.2 Smart Lighting

- 6.2 Light Source

- 6.2.1 LEDs

- 6.2.2 Fluorescent Lamps

- 6.2.3 High-intensity Discharge Lamps

- 6.3 Offering

- 6.3.1 Hardware

- 6.3.1.1 Lights and Bulbs

- 6.3.1.2 Luminaires

- 6.3.1.3 Control Systems

- 6.3.2 Software and Services

- 6.3.1 Hardware

- 6.4 Power

- 6.4.1 Below 50W

- 6.4.2 Between 50W - 150W

- 6.4.3 More Than 150W

- 6.5 Application

- 6.5.1 Highways

- 6.5.2 Street and Roadways

- 6.6 Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia

- 6.6.4 Latin America

- 6.6.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 GE Current

- 7.1.2 Cree Inc. (Wolfspeed Inc.)

- 7.1.3 Signify Holding

- 7.1.4 OSRAM Licht AG

- 7.1.5 DCD Technologies ME FZCO

- 7.1.6 Hubbell Inc

- 7.1.7 Zumbotel Group (Thorn Lighting)

- 7.1.8 LED roadway lighting Ltd

- 7.1.9 Acuity Brands, Inc.

- 7.1.10 Syska LED Lights Pvt. Ltd.