|

市場調查報告書

商品編碼

1645146

歐洲車隊管理:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Fleet Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

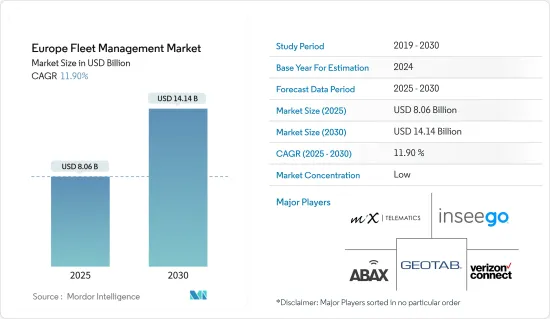

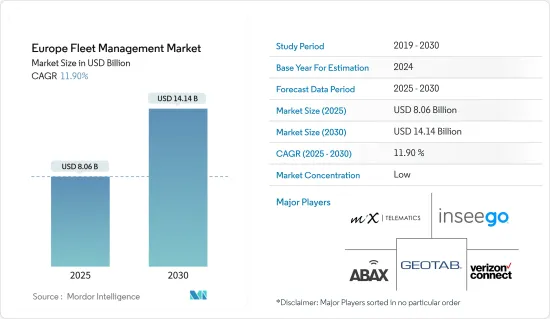

預計 2025 年歐洲車隊管理市場規模為 80.6 億美元,預計到 2030 年將達到 141.4 億美元,預測期內(2025-2030 年)的複合年成長率為 11.90%。

關鍵亮點

- 有利的市場法規和對業務效率的日益關注正在推動歐洲車隊管理的成長。自從全球統一輕型車輛檢查程序(WLTP)的截止日期生效以來,歐洲各車隊市場的註冊數量出現了大幅下降和波動,但預計到 2022 年註冊數量將恢復到接近正常水平。

- 此外,在這個市場營運的供應商關注的是運輸總成本而不是總擁有成本。這可以透過提高生產力、簡化路線並在發生中斷時完全清楚地了解車輛的移動和狀態來顯著降低營運成本。此類發展預計將提高客戶的投資收益,從而增加該地區對車隊管理的需求。

- 此外,供應商正在透過夥伴關係、合併和收購來為客戶提供更好的解決方案並更深入地了解車輛性能。例如,總部位於英國的 Rent-A-Car 收購了 SHB Hire,持有超過 18,500 輛商用車。該協議創建了英國最大的商用車租賃營運商之一,持有超過 45,000 輛。

- 歐洲汽車工業協會(ACEA)數據顯示,3月和4月,歐盟新商用車需求下降34.5%,主要原因是受到冠狀病毒的影響。該地區的四個主要市場均出現兩位數的跌幅:西班牙(-46.6%)、法國(-41.6%)、義大利(-41.4%)和德國(-22.5%),這些市場均受到了與冠狀病毒相關的註冊處和展示室關閉以及工廠生產停工的打擊。銷售下降可能會對該地區的車隊管理市場產生直接影響。除了供應方面的限制外,我們也預期短期至中期內需求也會下降。

歐洲車隊管理市場趨勢

資產管理應用領域可望佔據主要市場佔有率

- 資產管理應用程式在歐洲車隊管理市場中發揮關鍵作用。這些應用程式旨在追蹤和監控各種資產,如車輛、設備和資源,以最佳化其利用率、提高業務效率並降低成本。

- 資產管理應用程式即時追蹤和監控車輛。這使車隊管理人員能夠看到每輛車的確切位置並監控其速度、消費量、里程和其他相關資料。這有助於最佳化路線、規劃維護計劃並提高車輛效率。

- 資產管理應用程式有助於管理維護計劃、通知服務間隔警報並記錄維護歷史記錄。這將確保及時維護車輛,減少故障並延長資產壽命。

- 預計資產追蹤在工業IoT領域將大幅成長,未來十年內大多數連網設備都將具備位置感知功能。低功耗射頻晶片技術的改進以及低功耗廣域網路 (LPWAN) 和低功耗藍牙 (BLE) 信標的採用正在催生新的資產追蹤物聯網解決方案。採用 RFID 技術的資產追蹤設備將會促進多個產業的需求,包括工業自動化、供應鏈、物流、農業、建築、採礦和相關市場。

- 根據GSMA預測,2025年歐洲的物聯網連線數將達到約43.25億,其中約10億將屬於智慧建築和智慧家庭領域。物聯網連接性的興起為歐洲車隊管理市場帶來了成長機會。

英國可望佔據主要市場佔有率

- 英國車隊管理市場正在經歷顯著的成長。由於大量商用車輛在各個領域運作,車隊管理解決方案對於最佳化業務、提高效率和降低業務成本至關重要。

- 根據 OICA 的數據,2022 年英國商用車銷量將達到 329,509 輛左右,低於一年前的 396,910 輛。該類車輛包括用於運輸貨物或付費乘客的機動車輛。

- 英國對車輛操作有嚴格的規定,包括駕駛時間、行車記錄器記錄和車輛維修。車隊管理系統可以幫助確保遵守這些法規,降低處罰風險並提高業務效率。

- 英國參與企業已建立策略夥伴關係,以加強其在車隊管理市場的供應。 2022 年 7 月,全球領先的車聯網車隊管理解決方案 SaaS 供應商之一 MiX Telematics 與商業汽車保險公司 Humn 合作。此次英國合作將透過整合 MiX Telematics 的連網汽車遠端資訊處理平台和 Humn 的計量收費保險解決方案,為兩家公司的現有和潛在新客戶帶來附加價值,提高車輛活動的可視性並最佳化保險成本。

- 英國的車隊管理由意識、法規遵循、最佳化、安全、技術進步和環境永續性所驅動。憑藉廣泛的解決方案,英國企業有充足的機會利用車隊管理系統來簡化業務、提高效率並實現其業務目標。

歐洲車隊管理行業概況

歐洲車隊管理市場高度分散,主要企業有 Mix Telematics、Inseego Group、ABAX、Geotab Inc. 和 Verizon Corporation(Connect)。該市場的參與企業正在採取合作和收購等策略來加強其產品供應並獲得永續的競爭優勢。

2023 年 1 月,Inseego UK 與車輛和駕駛員管理軟體公司 Pocket Box 合作,推出了支援遠端資訊處理功能的車隊管理解決方案。該合作夥伴關係為公司的車隊客戶提供了易於使用的工具,以確保他們的車輛符合道路行駛法規且安全,並且他們的員工健康且隨時可以駕駛。

2022 年 11 月,連網車隊管理解決方案提供商 MiX Telematics 宣布,該公司因與麥吉爾大學的夥伴關係而獲得了車隊安全夥伴關係獎。車隊管理解決方案可協助使用者持續改善駕駛行為並提高安全性和合規性。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- COVID-19 對車隊管理和遠端資訊處理產業的影響

第5章 市場動態

- 市場促進因素

- 有利的市場監管和對營運效率的日益重視

- 售後市場供應商和 LCV 製造商之間的合作

- 定價模式的演變與交通網際網路的出現

- 市場問題

- 有關地理編碼的隱私和操作問題

第6章 市場細分

- 依部署類型

- 一經請求

- 本地

- 按主要應用

- 資產管理

- 資訊管理

- 驅動程式管理

- 安全與合規管理

- 風險管理

- 營運管理

- 其他解決方案

- 按行業

- 運輸

- 能源

- 建造

- 製造業

- 其他

- 按國家

- 德國

- 英國

- 法國

- 西班牙

- 義大利

第7章 競爭格局

- 公司簡介

- Mix Telematics

- Inseego Group

- ABAX

- Geotab Inc.

- Verizon Corporation(Connect)

- Trimble Navigation

- Viasaet Group

- EasyFleet

- ArealControl

- G4S Telematix

- EcoFleet

- Aeromark

第8章 投資分析及市場展望

The Europe Fleet Management Market size is estimated at USD 8.06 billion in 2025, and is expected to reach USD 14.14 billion by 2030, at a CAGR of 11.90% during the forecast period (2025-2030).

Key Highlights

- Favorable market regulations, coupled with a growing emphasis on operational efficiency, are driving the growth of fleet management in the European region. Various fleet markets in the European region saw registration numbers return to near normal in 2022 after experiencing a notable decrease in numbers and fluctuations since the implementation of the Worldwide Harmonized Light Vehicle Test Procedure (WLTP) deadline.

- Moreover, the vendors operating in the market focus on the total cost of mobility instead of the total cost of ownership. This significantly reduces operational costs by boosting productivity, streamlining routes, and giving customers complete clarity over their fleet's activity and condition in an otherwise confusing time. Such developments are expected to increase the return on investment for customers and thus increase the demand for fleet management in the region.

- Further, the vendors are adopting partnerships, mergers, and acquisitions to offer better solutions to customers and deeper insights into their fleet's performance. For instance, Rent-A-Car, UK acquired SHB Hire, which operates a fleet of over 18,500 commercial vehicles. The agreement created one of the UK's largest commercial-vehicle rental businesses, with a combined fleet of more than 45,000 commercial vehicles.

- According to the European Automobile Manufacturers Association (ACEA), European Union demand for new commercial vehicles contracted by 34.5%, mainly due to the impact of the coronavirus on March and April results. The region's four major markets posted double-digit percentage drops: Spain (-46.6%), France (-41.6%), Italy (-41.4%), and Germany (-22.5%) due to closures of registration offices and showrooms due to the coronavirus, combined with the production stops in factories. This fall in the numbers will directly impact the fleet management market in the region. In addition to supply-side constraints, the demand is expected to decrease in the short and medium term.

Europe Fleet Management Market Trends

Asset Management Application Segment is Expected to Hold Significant Market Share

- Asset management applications play a significant role in the fleet management market in Europe. These applications are designed to track and monitor various assets, such as vehicles, equipment, and resources, to optimize their utilization, improve operational efficiency, and reduce costs.

- Asset management applications provide real-time tracking and monitoring of vehicles with a fleet. This allows fleet managers to view the exact location of each vehicle and monitor their speed, fuel consumption, mileage, and other relevant data. It helps optimize routing, planning maintenance schedules, and improving fleet efficiency.

- Asset management applications assist in managing maintenance scheduling, notification alerts for service intervals, and recording maintenance history. This ensures timely servicing of vehicles, reduces breakdowns and extends asset lifespan.

- Asset tracking is expected to grow considerably for industrial IoT, and most connected devices will be location-aware within the next decade. Due to the improvements in low-power RF chip technologies and the adoption of Low Power Wide Area Networks (LPWAN) and Bluetooth Low Energy (BLE) beacons, new asset-tracking IoT solutions have been created. Implementing asset trackers utilizing RFID technology will strengthen demand in several industries, including industrial automation, supply chain, logistics, agriculture, construction, mining, and related markets.

- According to GSMA, the forecast for 2025 expects approximately 4.325 billion IoT connections in Europe, of which about one billion connections are in the smart buildings and smart home sectors. The increase in IoT connections provides growing opportunities for the European fleet management market.

United Kingdom is Expected to Hold Significant Market Share

- The Fleet management market in the United Kingdom is significantly growing. With many commercial vehicles operating across various sectors, fleet management solutions are crucial in optimizing operations, improving efficiency, and reducing business costs.

- According to OICA, In 2022, the United Kingdom recorded approximately 329,509 commercial vehicles, down from around 396,910 units one year earlier. This type of vehicle includes motor vehicles used for transporting goods or paid passengers.

- The United Kingdom has stringent regulations related to fleet operations, including drive hours, tachograph recording, and vehicle maintenance. Fleet management systems help ensure compliance with these regulations, reducing the risk of penalties and improving operational efficiency.

- Players in the United Kingdom are making strategic partnerships to enhance their offerings in the fleet management market. In July 2022 - MiX Telematics, one of the leading global SaaS providers of connected fleet management solutions, partnered with Humn, the commercial motor insurance company. The partnership in the United Kingdom offers additional value to both organizations' existing and potential new customers through integrating MiX Telematics' connected vehicle telematics platform and Humn's pay-as-you-drive insurance solution, optimizing fleet activity visibility and insurance costs.

- The United Kingdom fleet management is driven by awareness, regulatory compliance, optimization, safety, technology advancements, and environmental sustainability. With a wide range of solutions available, businesses in the United Kingdom have ample opportunities to leverage fleet management systems to streamline operations, improve efficiency, and achieve their business objectives.

Europe Fleet Management Industry Overview

The Europe Fleet Management Market is highly fragmented, with major players like Mix Telematics, Inseego Group, ABAX, Geotab Inc., and Verizon Corporation (Connect). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In January 2023, Inseego UK partnered with vehicle and driver management software company, Pocket Box, to deliver telematics-enabled fleet management solutions. Under the partnership, the company's fleet customers could use the easy-to-use tool to ensure that vehicles are kept road legal and safe while staff are fit and eligible to drive.

In November 2022, MiX Telematics, a provider of connected fleet management solutions, announced that the company had won a fleet safety partnership award for its partnership with McGill. The fleet management solutions assist users in the constant drive to improve driver behavior and increase safety and compliance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Fleet Management and Telematics Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Favorable Market Regulations Coupled with Growing Emphasis on Operational Efficiency

- 5.1.2 Collaborations between Aftermarket Providers and LCV Manufacturers

- 5.1.3 Evolving Pricing Models and Emergence of Internet of Transportation

- 5.2 Market Challenges

- 5.2.1 Privacy and Operational Concerns Related to Geocoding

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-demand

- 6.1.2 On-Premises

- 6.2 By Major Applications

- 6.2.1 Asset Management

- 6.2.2 Information Management

- 6.2.3 Driver Management

- 6.2.4 Safety and Compliance Management

- 6.2.5 Risk Management

- 6.2.6 Operations Management

- 6.2.7 Other Solutions

- 6.3 By End User Vertical

- 6.3.1 Transportation

- 6.3.2 Energy

- 6.3.3 Construction

- 6.3.4 Manufacturing

- 6.3.5 Other End-Users

- 6.4 By Country

- 6.4.1 Germany

- 6.4.2 United Kingdom

- 6.4.3 France

- 6.4.4 Spain

- 6.4.5 Italy

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mix Telematics

- 7.1.2 Inseego Group

- 7.1.3 ABAX

- 7.1.4 Geotab Inc.

- 7.1.5 Verizon Corporation (Connect)

- 7.1.6 Trimble Navigation

- 7.1.7 Viasaet Group

- 7.1.8 EasyFleet

- 7.1.9 ArealControl

- 7.1.10 G4S Telematix

- 7.1.11 EcoFleet

- 7.1.12 Aeromark