|

市場調查報告書

商品編碼

1645151

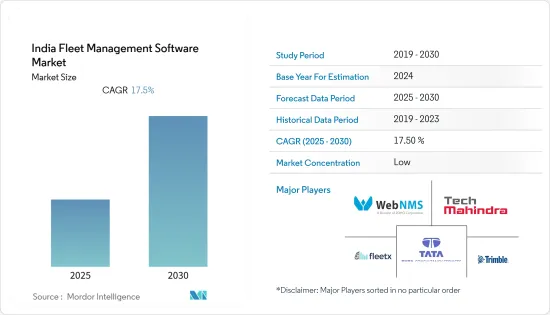

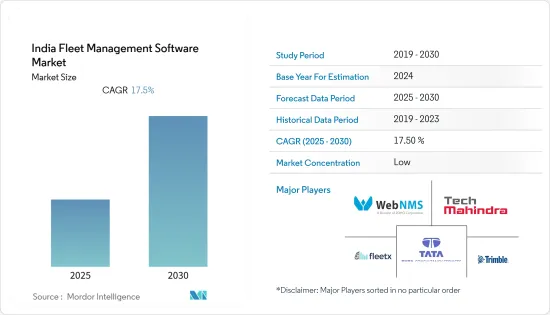

印度車隊管理軟體市場:佔有率分析、產業趨勢與成長預測(2025-2030 年)India Fleet Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預測期內,印度車隊管理軟體市場預計複合年成長率為 17.5%

關鍵亮點

- 車隊管理軟體包括一系列功能,包括車隊財務、車隊維護、追蹤和診斷、駕駛員管理、速度管理、燃料管理、健康和安全管理等。印度此類解決方案的市場仍處於起步階段,供應商們看到了充足的商機。

- 根據印度政府的報告,印度的國家公路和州公路僅佔全國公路總長度的5%多一點,但卻造成了61%以上的道路交通事故死亡人數。這些道路每天承載著數百萬輛車輛,管理價值超過10億美元的貨物運輸,並為採礦、建築、運輸和公共服務等行業提供服務。預計預測期內道路事故數量的增加將推動成長。

- 印度是世界上經濟成長最快的國家。在過去五年中的四年中,由於對商品和服務的需求增加,經濟規模非常大。境內和跨境的貨物運輸為數百萬印度人創造了經濟機會。

- 物流業目前佔印度國內生產總值(GDP)的5%,僱用人員2.2億人。印度每年處理 46 億噸貨物,每年總成本為 95 萬印度盧比(11,421 美元)。這些產品代表了全國各地各種各樣的行業和產品。 22%的商品為農產品,39%為礦產品,39%為製造業相關商品。這些貨物的運輸主要由卡車和其他車隊進行。其餘運輸涉及鐵路、內陸水道、沿海、管道和航空。

- 此外,2022 年 8 月,公路運輸和公路部 (MoRTH) 將強制要求所有用於運輸危險或危險產品的貨運車隊配備位置追蹤設備,適用於 2022 年 9 月 1 日之後建造的車隊。

- 由於人們認知的提高和提供的福利不斷增加,該地區對車隊管理的資金正在增加。例如,2023 年 5 月,第三方物流新興企業Zyngo EV 在 Delta Corp Holdings主導的A 輪融資前籌集了 500 萬美元。現有投資者 LC Nueva Investment Partners LLP 也參與了此輪融資。該筆資金籌措將用於擴大機隊、拓展新區域和技術升級。

- 縱觀市場中的其他相關人員,即車隊租賃公司,趨勢表明可再生能源的成長可能會進一步推動車隊管理採用市場。

印度車隊管理軟體市場趨勢

物聯網應用預計將大幅成長

- 市場上的供應商之所以選擇雲端服務,是因為與本地部署相比,雲端服務具有上市時間更快、效率更高、功能更多、成本更低等優勢。物聯網對於駕駛員、物流人員和車隊管理人員近乎即時地做出明智的決策至關重要。在邊緣處理資料(也稱為在資料產生時收集和分析資料)使這成為可能。車隊管理人員、雲端和車隊透過網路連接,使用具有整合處理器功能的支援物聯網的設備。

- 例如,Zoho Corporation 正在利用雲端、物聯網 (IoT) 和人工智慧 (AI) 等技術來利用 IRDA 報價。例如,WebNMS 透過人工智慧和機器學習為其車隊管理解決方案提供支持,聲稱持有25-50 輛車的中型車隊透過使用其產品可以節省 10-15% 的燃料。此外,該公司還與印度二輪車製造商合作,監控和管理他們的測試車隊。追蹤、報告和分析位置、狀態等有助於最大限度地降低營運成本並提高產品品質。

- 例如,支援邊緣的物聯網遠端資訊處理解決方案可以透過 GPS、支援人工智慧的電腦視覺技術和車載診斷系統收集、儲存和分析有關車輛健康和道路狀況的資訊。向車隊所有者和管理人員提供這些資訊可以讓他們專注於駕駛員的表現、車隊維護和貨物管理。

- 新興企業進一步成為印度車隊管理軟體市場中新興但重要的供應商。使用雲端基礎的GPS 追蹤系統和射頻識別軟體等先進技術,使他們在與知名全球參與企業的競爭中佔據競爭優勢。

- 例如,LocoNav 以前是新興企業,但最近已發展成為一個綜合車隊管理平台。該公司提供車隊管理解決方案、車隊追蹤系統、FASTag 和 AIS 140 認證的 GPS 追蹤器服務。憑藉智慧分析和物聯網作為其產品的核心,該公司能夠降低車隊運作成本、提高安全性並增加銷售額。

- 到2025年,預計交通運輸業將在全球範圍內透過蜂窩方式連接到物聯網,佔據整體市場佔有率的12%。造成這種情況的因素有很多,包括對車隊管理軟體的需求不斷增加以及 5G 技術的採用。這也可能是促進印度市場成長的因素。

物流將大幅成長

- 根據世界銀行的物流績效指數,印度的物流業是全球最大的,價值1,600億美元,直接僱用2,200萬人。預計到 2022 年將以 10% 的複合年成長率成長,達到 2,150 億美元。車隊管理實踐在當前情況下至關重要,不僅對業務效率而且對車隊和駕駛員的安全都有重大影響。

- 新技術的採用,尤其是人工智慧和物聯網,可能會對印度的物流業產生重大影響。這種變化已經發生,許多公司正在開發智慧解決方案來幫助車隊所有者和營運商更有效地經營業務。例如,LocoNav 為印度和全球各地的車隊提供客製化的、全面的 SaaS 車隊管理解決方案,使多位車隊所有者和司機受益。

- 印度對燃油效率和燃油盜竊問題的日益擔憂促使全球公司紛紛在市場上提供先進的解決方案。例如,Aeris Communications 已與 Omnicomm 合作在印度推出燃料監控解決方案。此次合作將把 Omnicomm 的燃料監控功能加入其包裝物聯網解決方案組合中。目標包括物流運輸、施工機械和機車,該公司將打擊印度的燃料竊盜行為。

- 同月,殼牌車隊解決方案進入印度,帶來一系列產品和服務——殼牌燃料、殼牌車隊預付費計劃和殼牌遠端資訊處理——旨在降低總擁有成本 (TCO) 並提高車隊所有者的效率。據說車隊解決方案的這三個關鍵部分可以提供更好的營運管理並增強對詐欺活動的防範。

- 同時,物流公司也透過提供車隊管理解決方案進入市場。 Kale Logistics 等公司為車隊所有者和營運商提供 Helios Fleet 綜合車隊維護軟體。該軟體可以管理從行程單、司機報銷、燃料追蹤和車隊週轉時間到發票和帳單等活動。

- 印度貨櫃公司截至 2023 年 7 月的市值約為 4,130 億印度盧比(4,965,281,100 美元),是印度領先的物流公司。在此期間,Blue Dart Express是印度第二重要的物流公司。

印度車隊管理軟體產業概況

印度車隊管理軟體市場競爭激烈,有本地小型供應商、多家泛印度供應商和幾家大型國際遠端資訊處理公司。市場競爭的關鍵促進因素是所提供解決方案的技術整合水準不斷提高。市場上有幾家公司正在採用物聯網、資產追蹤和 RFID 等先進技術來提高車隊性能。隨著國內外參與企業將這些技術融入其產品中,預測期內競爭預計會加劇。

2023 年 1 月,EVaaS 平台 Zypp Electric 宣布推出名為 ZyppDash 的電動車隊管理系統。該新興企業旨在透過其新的乘客追蹤應用程式簡化申請流程和車隊管理。 Zypp 得到了印度最大線上零售商的支持,它希望透過在印度 20 個城市推出 2,000 輛電動Scooter來擴大其服務。該公司得到了 Zomato、Swiggy、Zepto、BlinkIt、BigBasket、亞馬遜、Flipkart、Myntra、Easy Pharm、JioMart、Delhivery 和 Spencers 等電子商務公司的支持。

2022年9月,印度成長最快的低溫運輸市場營運商Celcius Logistics推出了智慧最後一哩配送平台,以針對性地解決印度脆弱的冷鏈供應鏈中的關鍵問題。該品牌還與車隊所有者和汽車製造商 (IMS) 合作,打造一個整合智慧平台並基於專有庫存管理系統的強大的冷凍車地面網路。在接下來的六個月裡,Celcius 希望在六個大都市推出這個平台,然後將其擴展到更多的二線城市和城鎮。

2022 年 12 月,Trucknetic推出其電動卡車「EVolev」平台,顛覆印度卡車運輸產業的電動車生態系統並加速其應用。 Trucknetic 正在解決退貨問題,以降低物流成本並降低該國的碳排放。然而,這家總部位於德里的公司並非採用 EVolev,而是致力於消除廣泛應用電動車的障礙,並將整個電動車生態系統整合到一個平台上。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 市場定義和範圍

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 印度車隊管理軟體市場概況

- 印度車隊管理相關人員分析(車隊管理解決方案供應商、車隊租賃公司、車隊管理公司等)

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 市場促進因素

- 降低車隊營運商的整體擁有成本

- 行動性需求和數位轉型趨勢日益成長

- 市場問題

- 對傳統車隊管理公司不願採用技術的擔憂

- COVID-19 對印度車隊管理市場的影響

第5章印度車隊管理軟體市場格局

- 主要船隊統計數據

- 印度商用車產銷售(2014-2019年)

- 車隊產業概況 - 全面分析車隊營運商趨勢

- 關鍵市場洞察與機遇

- 軟體供應商/供應商創新與夥伴關係-全球與本地

- OEM在印度車隊管理生態系統中的作用

- 影響印度車隊管理市場的線上聚合器分析

第6章 市場細分

- 按部署

- 本地

- 雲

- 按最終用戶

- 後勤

- 製造業

- 其他最終用戶(商業、教育等)

第7章 競爭格局

- 公司簡介

- Trimble Inc.(Trimble Mobility Solutions India)

- TATA Consultancy Services Limited

- Mahindra Group(Mahindra Telematics)

- Zoho Corporation(WebNMS)

- fleetx Technologies Private Limited

- Efkon India Private Limited

- Kale Logistics Solutions Pvt Ltd

- iTriangle Infotech Pvt Ltd

- BT TechLabs(LocoNav)

- Uffizio India Software Consultants Pvt Ltd

- Orange GPS Solutions Pvt Ltd(iTrack)

第8章投資分析

第9章:未來市場展望

The India Fleet Management Software Market is expected to register a CAGR of 17.5% during the forecast period.

Key Highlights

- Fleet management software includes a range of functions, such as vehicle financing, vehicle maintenance, tracking and diagnostics, driver management, speed management, fuel management, and health and safety management, to name a few. The market for such solutions in India is observed to be still at a nascent stage, thereby portraying ample opportunities for the vendors.

- According to the Government of India report, Indian national and state highways account for a little over 5% of all road length but are responsible for more than 61% of traffic fatalities. Millions of cars drive through these roads every day, either managing the movement of goods exceeding a billion dollars or being used by industries like mining, construction, transport, and even public services. Rising cases of road accidents are anticipated to drive growth during the projected period.

- India has become the world's hottest-growing economy. For four of the last five years, this is a very big economy due to an increase in demand for goods and services. The movement of goods in and out of the country and beyond its borders has created economic opportunities for millions of Indians.

- The logistics sector currently accounts for 5% of India's Gross Domestic Product (GDP) and employs 2.2 crore people. India handles 4.6 billion tons of goods every year, amounting to a total annual cost of INR 9.5 lacs (USD 11421). These products represent a wide variety of industries in the country and products: 22% of the goods are agriculture, Mining products represent 39%, and 39% are manufacturing-related commodities. Trucks and other vehicles majorly handle the movement of these goods. Railways, inland waterways, coastal, pipelines, and airways are involved for the rest of transport.

- Additionally, in August 2022, the Ministry of Road Transport and Highways (MoRTH) mandated that all goods vehicles used for transporting dangerous or hazardous products must be equipped with a location tracking device, effective for any vehicles constructed on or after September 1, 2022.

- The region is witnessing increased funding towards fleet management due to increasing awareness and offered benefits. For instance, in May 2023, third-party logistics startup Zyngo EV raised USD 5 million in a Pre-Series A round led by Delta Corp Holdings. This round was also attended by an existing investor, LC Nueva Investment Partners LLP. The funding will allow for fleet enlargement, entering new regions, and improving technology.

- Looking at other stakeholders in the market, that is, fleet leasing companies, the trend suggests that the growth of renewable energy resources is likely to further push the market in the adoption of fleet management.

India Fleet Management Software Market Trends

IoT Deployment is expected to Witness Significant Growth

- The vendors in the market are opting for cloud offerings due to their offered benefits, such as faster time to market, High efficiency, more features, and lower cost as compared to On-premise. IoT is essential in enabling drivers, logistics managers, and fleet managers to make well-informed decisions in close to real-time. Processing data at the edge, also known as gathering and analyzing data as it is generated, makes this possible. The fleet manager, the cloud, and the vehicle are connected via network connectivity using IoT-enabled devices with integrated processor capabilities.

- For instance, Zoho Corporation is banking on technologies such as the cloud, the Internet of Things (IoT), and artificial intelligence (AI) to leverage IRDA's estimates. For instance, WebNMS enhanced its fleet management solutions with AI and machine learning and claimed that a midsized fleet with 25-50 vehicles could benefit from 10-15% fuel savings by using its offerings. The company, in addition, has collaborated with a bike manufacturer in India to monitor and manage their test vehicles. Location, condition, and, among others, can be tracked, reported, and analyzed to minimize operational costs and improve product quality.

- For instance, edge-enabled IoT telematics solutions may gather, store, and analyze information about the state of a car and the condition of the road through GPS, AI-enabled computer vision technologies, and onboard diagnostics. Giving this information to fleet owners and managers can aid them in keeping an eye on driver performance, vehicle upkeep, and cargo management.

- Startups additionally form an emerging yet key vendor for the Indian fleet management software market. The use of advanced technologies, such as cloud-based GPS tracking systems and radio-based frequency identifying software, will offer a competitive advantage while competing with global players that are already present.

- For instance, LocoNav, a startup offering fleet solutions earlier, recently evolved into an integrated vehicle management platform. The company offers Fleet Management Solutions, Vehicle Tracking systems, FASTag, and AIS 140 Certified GPS Trackers services. Via intelligent analytics and IoT as the core of their offerings, the startup is able to achieve lower running costs of vehicles, greater security, and repeated sales.

- In 2025, the transport industry is expected to have cellular Internet of Things connections around the world, with a predicted 12 percent market share overall. A number of factors contribute to this, such as increased demand for fleet management software and the use of 5G technology. This can be another factor in driving market growth in India.

Logistics is Expected to Witness Significant Growth

- According to the World Bank's Logistics Performance Index, India has the largest logistics sector in the world, with a total value of USD 160 billion and 22 million direct jobs. By 2022, this was expected to grow at a 10% annual growth rate, reaching USD 215 billion. Fleet management practices are extremely important in the current scenario, with a significant impact on business efficiency as well as the safety of vehicles and drivers.

- The adoption of new technologies, in particular AI and IoT, will have a profound impact on the Indian logistics sector. This change has already started to take place, as a number of companies have developed smart solutions that help fleet owners and operators run their businesses more effectively. For instance, LocoNav provides fleets in India and throughout the world with a bespoke, total SaaS fleet management solution that benefits several fleet owners and drivers.

- The rising concern about fuel efficiency and fuel theft activity in the country is supporting the emergence of global players to offer sophisticated solutions in the market. For instance, Aeris Communications partnered with Omnicomm to launch a fuel monitoring solution in India. The collaboration is expected to add fuel monitoring features from Omnicomm to the former's portfolio of packaged IoT solutions. With the target audience being logistics & transportation, construction equipment, and locomotives, the company will address fuel pilferage in India.

- At the same time of the month, Shell Fleet Solutions, with the aim of lowering the total cost of ownership (TCO) of the fleet owners and increasing efficiency, entered India with its portfolio of products and services, namely Shell Fuels, Shell Fleet Prepaid program and Shell Telematics. These three main segments of the Fleet Solution are said to provide better control over operations and increased protection against fraud.

- Logistic companies, on the other hand, are observed to have entered the market by offering fleet management solutions. Companies like Kale Logistics offer Helios Fleet, a comprehensive fleet maintenance software catering to fleet owners and operators. The software is capable of managing activities ranging from trip sheets, driver settlement, fuel tracking, and vehicle turn-around time to billing and invoicing.

- According to the market capitalization of about INR 413 billion (USD 4965280110) on July 2023, Container Corporation of India is the leading logistics company in India. In this period, Blue Dart Express was the second most important logistics company in the country.

India Fleet Management Software Industry Overview

The Indian fleet management software market is highly competitive, with the presence of small local vendors, several pan-Indian players, and a few international telematics giants. The competitiveness in the market is driven majorly by the increasing level of technology integration in the solutions offered. Several players in the market are adopting advanced technologies such as IoT, Asset Tracking, and RFID, among others, to enhance the performance of their fleets. As domestic and international players integrate these technologies into their offerings, the competition is expected to grow during the forecast period.

In January 2023, Electric vehicle-as-a-service platform Zypp Electric launched an EV fleet management system called ZyppDash. The startup seeks to simplify the request process and fleet management via its new rider-tracking app. Zypp, backed by India's biggest online retailers, wants to roll out two thousand electric scooters in 20 Indian cities and is expanding its services. The firm has the backing of e-commerce players such as Zomato, Swiggy, Zepto, BlinkIt, BigBasket, Amazon, Flipkart, Myntra, Easy Pharm, JioMart, Delhivery, and Spencers.

In September 2022, Celcius Logistics, the cold-chain marketplace business with India's highest growth rate, launched its intelligent last-mile delivery platform, which targets and resolves the critical problems in India's vulnerable cold supply chains. To build a solid on-ground network of reefer cars that were integrated with the smart platform and made with a unique Inventory Management System, the brand also partnered with vehicle owners and automakers (IMS). In the following six months, Celcius wanted to roll out this platform to more tier-2 cities and towns after launching it in six metro areas.

In December 2022, Trucknetic launched the "EVolev" platform for electric trucks to upend the Indian truck industry's EV ecosystem and hasten its widespread adoption. Trucknetic has already resolved the return load issue to lower logistical costs and lessen the nation's carbon footprint. With the introduction of EVolev, however, the Delhi-based business aimed to eliminate obstacles to the widespread use of electric vehicles and integrate the entire EV ecosystem into one platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope of the Study

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 India Fleet Management Software Market Overview

- 4.2 India Fleet Management Stakeholders Analysis (Fleet management solution providers, fleet leasing companies, fleet management companies, etc.)

- 4.3 Industry Attractiveness -Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Lowering Total Cost of Ownership Among Fleet Operators

- 4.4.2 Growing Demand for Mobility and Digital Transformation Trends

- 4.5 Market Challenges

- 4.5.1 Concerns Regarding Traditional Fleet Management Companies Reluctant to Adopt Technology

- 4.6 Impact of COVID-19 on the India Fleet Management Market

5 INDIA FLEET MANAGEMENT SOFTWARE MARKET LANDSCAPE

- 5.1 Key Fleet Statistics

- 5.1.1 Commercial Vehicle Production and Sales in India (2014-2019)

- 5.1.2 Fleet Industry Overview -Analysis covering trends across Fleet Operators (<10, 11-50, 51-100, and >100)

- 5.2 Key Market Insights and Opportunities

- 5.2.1 Software Provider/Vendor Innovations and Partnerships -Global vs Local

- 5.2.2 Role of Vehicle Manufacturers(OEMs) in the Fleet Management Ecosystem in India

- 5.2.3 Analysis on Online Aggregators Impacting Fleet Management Market in India

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-Premise

- 6.1.2 Cloud

- 6.2 By End User

- 6.2.1 Logistics

- 6.2.2 Manufacturing

- 6.2.3 Other End Users (Corporate, Education, etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Trimble Inc. (Trimble Mobility Solutions India)

- 7.1.2 TATA Consultancy Services Limited

- 7.1.3 Mahindra Group (Mahindra Telematics)

- 7.1.4 Zoho Corporation (WebNMS)

- 7.1.5 fleetx Technologies Private Limited

- 7.1.6 Efkon India Private Limited

- 7.1.7 Kale Logistics Solutions Pvt Ltd

- 7.1.8 iTriangle Infotech Pvt Ltd

- 7.1.9 BT TechLabs (LocoNav)

- 7.1.10 Uffizio India Software Consultants Pvt Ltd

- 7.1.11 Orange GPS Solutions Pvt Ltd (iTrack)