|

市場調查報告書

商品編碼

1645157

歐洲程序化廣告:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Programmatic Advertising - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

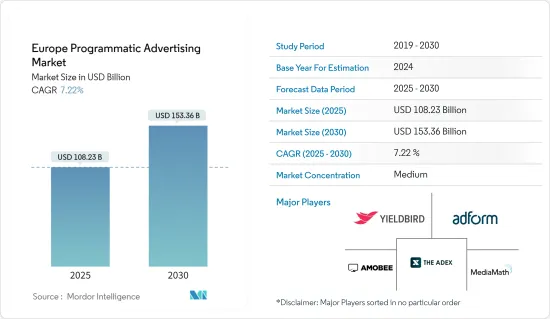

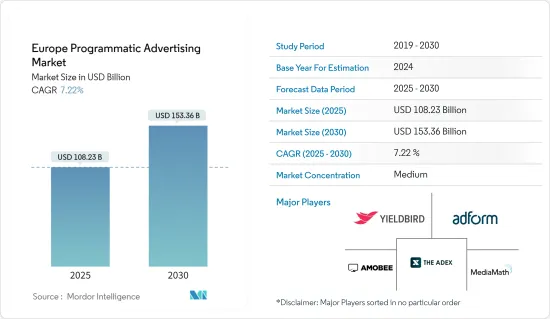

預計 2025 年歐洲程式化廣告市場規模為 1,082.3 億美元,到 2030 年將達到 1,533.6 億美元,預測期內(2025-2030 年)的複合年成長率為 7.22%。

主要亮點

- 歐洲程序化廣告市場正在迅速擴張,預計將繼續成長。程序化廣告的優點之一是它允許用戶使用機器和產品購買和出售網路廣告庫存,這正在推動市場的成長。

- 程序化影片影片主要透過程序化市場進行交易。此外,自動保證的購買方式正在興起。此外,它還有助於自動化選擇最佳媒體元件和媒體購買的動態循環,以推進您在程式化廣告領域的目標。

- 根據 IAB Europe 的一項調查,更好地利用資料被認為是 2021 年程序化投資的驅動力。調查發現,代理商和出版商擴大更好地利用資料進行程序化廣告,代理商更好地利用資料的比例從 2020 年的 75% 增加到 2021 年的 94%,出版商更好地利用資料的比例從 2020 年的 48% 增加到 2021 年的 62%。

- 此外,數位隱私實踐的改變導致機構擴大採用情境定位實踐來佔領更大的市場佔有率。強大的受眾定位是最佳化程序化廣告宣傳和高效使用媒體預算的關鍵方法。

- 此外,隨著數位化的進步,客戶對資料收集和隱私的意識越來越強。人們對收集和使用消費者資料的意識不斷增強,這抑制了程序化廣告市場的成長。

- 由於歐洲企業和組織在該地區實施全球封鎖後正在轉向數位廣告方式,COVID-19 疫情對歐洲程式化廣告市場產生了正面影響。此外,我們看到業界標準(例如 App ads.txt、Sellers.json、Buyers.json、Supply Path Object 和 Demand Path Object)的採用率日益提高。

歐洲程序化廣告市場趨勢

程序化廣告中資料的使用正在推動成長。

- 程序化廣告意味著即時競價,使用機器對機器的廣告和媒體交易自動化,允許多個廣告商在有庫存時在同一位置對廣告進行競標。

- 在程式化廣告中,廣告主使用來自三個來源的資料:廣告商、發布者和第三方。利用這些資料,廣告主可以在數十億次廣告廣告曝光率中找到最佳受眾,從而提高程式化廣告的效率。

- 消費者和廣告商之間的每一次互動都會產生大量的資料。這些產生的資料包括客戶興趣、決策、接觸點、與參與時刻相關的活動、感知需求、關鍵人口統計和行為背景等等。這些資料為建立客戶洞察力和創建個人化行銷內容提供了強大的平台。

- 為了確定新的目標群體,廣告主正在利用受眾發現演算法等工具,這些工具可以找到轉換用戶過度索引的資料屬性、相似定位以及基於所有資料訊號即時建立受眾,以創建更精準的受眾。

- 廣告主、媒體代理商和媒體所有者可以利用可用的資料和受眾,將資料與宣傳活動目標相匹配,使用受眾資料來增強創造力,使用宣傳活動資料來最佳化宣傳活動效果,獲得洞察力並做出決策。

行動程序化廣告推動市場成長

- 行動程序化廣告是指購買、銷售和展示行動廣告的自動化過程。行動廣告包括行動橫幅廣告、行動影片廣告、行動原生廣告等。

- 行動程序化需要需求端平台 (DSP) 和供應端平台 (SSP) 之間的協作,以實現行動程式化廣告的自動化。在行動程式化廣告中,您可以定義系統定位受眾所需的特徵,例如地理位置、作業系統和目標受眾擁有的智慧型手機類型。

- 行動 - 程式化廣告提供精準定位,使廣告主能夠即時接觸特定受眾,並使用特定的指標和人口統計資料將他們引導至正確的受眾。

- 此外,愛立信稱,歐洲的行動用戶數量預計將在 2021 年成長到約 10.9 億,到 2027 年將成長到 11.1 億。

歐洲程序化廣告產業概況

歐洲程序化廣告市場競爭較不激烈。市場集中度似乎較高,參與者採用合併、收購和服務創新等關鍵策略。

- 2022 年 4 月 - 新加坡電信 (Singtel) 的完全子公司、全球廣告科技領導者 Amobee 宣佈建立合作夥伴關係,為 Amobee 平台帶來創新的串流廣告技術。此次合作將使品牌能夠利用 SeenThis 的技術在其程式化生態系統中傳輸高品質的影片資產。

- 2022 年 4 月 - 法蘭克福機場行銷機構 Media Frankfurt 與技術合作夥伴 VIOOH 合作。此次合作使該公司能夠推出針對機場廣告的新型程式化媒體解決方案。新系統將使整個機場的數位客戶宣傳活動控制更加精確和靈活。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者和消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 新冠疫情對歐洲程式化廣告市場的影響

第5章 市場動態

- 市場促進因素

- 數位媒體廣告的成長

- 在程序化廣告中使用資料

- 市場挑戰

- 程式化廣告人才短缺

第6章 市場細分

- 按交易平台

- 即時競價(RTB)

- 私人市場擔保

- 自動保固

- 固定利率

- 按廣告媒介

- 數字顯示

- 行動顯示器

- 按公司規模

- 中小企業

- 大型企業

第7章 競爭格局

- 公司簡介

- Yieldbird Sp. z oo

- MediaMath

- The ADEX

- Adform

- Amobee, Inc.

- IPONWEB Limited.

- Eskimi DSP

- PubMatic, Inc.

- Teads SA.

- Digital East GmbH

第8章投資分析

第9章:未來市場展望

簡介目錄

Product Code: 91332

The Europe Programmatic Advertising Market size is estimated at USD 108.23 billion in 2025, and is expected to reach USD 153.36 billion by 2030, at a CAGR of 7.22% during the forecast period (2025-2030).

Key Highlights

- The market for programmatic advertising in Europe is expanding swiftly and will do so in the next years. It is a highly automated form of advertising that makes the best use. one of the advatnages of programmatic advertising is that it lets users buy and sell internet advertising stock by using a machine or a product, which is proplling the market growth.

- Programmatic Advertisement videos are mainly traded through Programmatic marketplaces. Further, there has been an increase in automated guaranteed buying methods. Additionally, it aids in automating the dynamic cycle of selecting the optimal media component and making the media purchase to advance a goal in the programmatic advertising sector.

- According to a survey by IAB Europe, better use of data acted as an accelerator for programmatic investments in 2021. The survey states that Agencies and Publishers have increased better use of data for programmatic advertisement as better usage of data by agencies increased from 75% in 2020 to 94% in 2021, and better usage of data by publishers increased from 48% in 2020 to 62% in 2021.

- Further, with changes to digital privacy practices, contextual targeting practices are increasing in adoption by agencies to increase their market share. A strong audience targeting is a crucial way to optimize programmatic advertising campaigns and efficiently use the media budget.

- Also, with increasing digitalization, customers are becoming increasingly aware of data collection and privacy. This increasing awareness of the collection and utilization of consumer data is restricting the growth of the Programmatic advertising market.

- The Covid-19 pandemic had a positive effect on the Programmatic Advertising Market in Europe as businesses and organizations in Europe are swticihng to digital advertising methoda in the wake of global lockdown imposed in the region. Also the adoption of industry standards such as App ads.txt, Sellers.json, Buyers.json, Supply Path Object, Demand Path Object, has increased.

Europe Programmatic Advertising Market Trends

Better use of Data for Programmatic Advertising drives the growth.

- Programmatic advertising refers to real-time bidding, which means multiple advertisers bidding for advertising at the same spot whenever an ad inventory is available using machine-to-machine automation of advertising and media transactions.

- In programmatic advertising, advertisers use three data types: advertisers, publishers, and third-party data. Using this data, advertisers can find the most suitable audiences among billions of ad impressions and increase the efficiency of Programmatic advertising.

- With every interaction between the consumer and advertiser, there is a lot of data being generated. This generated data comprises customer interests, decisions, points of contact, activities relative to those moments of engagement, perceived needs, the key demographic and behavioral background, and many more. Such data serves as a robust platform to build insights about customers and create personalized marketing content.

- Advertisers are utilizing tools such as audience discovery algorithms that find data attributes that over-index for those users that have converted to identify new targeting segments, look-alike targeting, and building audiences in real-time based on all data signals to create more sophisticated audiences.

- Advertisers, media agencies and media owners can utilize the data and audiences available to match data to campaign objectives, enhance creativity using audience data, optimise campaign performance using campaign data, gain insights and make decisions.

Mobile Programmatic Advertisements to Drive the Market Growth

- Mobile Programmatic Advertisement refers to the automated process of buying, selling, and displaying mobile ads. Mobile Ads include mobile banner ads, mobile video ads, mobile native ads, and many more.

- Mobile Programmatic necissates cooperation between the Demand-side platform (DSP) and supply-side platform (SSP) and automates mobile programmatic advertising. Mobile Programmatic advertising will define the characteristics according to which the system needs to target audiences such as geolocation, operational system, and type of smartphone of your target audience and many more.

- Mobile Programmatic Advertising provides precise targeting which allows advertisers to reach their specific audience in real-time and dictate right audience using certain metrics and demographics.

- Also the mobile programmatic advertisement is a great channel for expanding reach and increasing user acquisition rate as Europe has nearly 1,090 million mobile subscription in 2021 and it is expected to increase to 1,110 million by 2027 according to Ericcson, and further individuals spend more time on their mobile devices than on conventional screens such as television.

Europe Programmatic Advertising Industry Overview

The Europe Programmatic Advertising Market is moderatively competitive. The market appears to be moderately concentrated, with players adopting key strategies like mergers, acquisitions, and service innovation. Some of the major players in the market are Yieldbird Sp. z o.o., MediaMath, The ADEX, Adform, etc. Some of the recent developments are:

- April 2022 - Amobee, a wholly owned subsidiary of Singtel and global leader in advertising technology announced a partnership which brings innovative streaming ad technology to the Amobee platform. The partnership allows brands to stream their high-quality video assets using SeenThis technology across the programmatic ecosystem of the company.

- April 2022 - Frankfurt Airport marketing agency Media Frankfurt has partnered with technical partner VIOOH. This partnership enabled the company to launch a new programmatic media solution for airport advertising. This new system will enable digital client campaigns to be controlled more precisely and flexibly across the airport.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness-Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Europe Programmatic Advertising Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Digital Media Advertisement

- 5.1.2 Better use of Data for Programmatic Advertising

- 5.2 Market Challenges

- 5.2.1 Lack of Skilled personel in Programmatic Advertisement

6 Market Segmentation

- 6.1 By Trading Platform

- 6.1.1 Real Time Bidding (RTB)

- 6.1.2 Private Marketplace Guaranteed

- 6.1.3 Automated Guaranteed

- 6.1.4 Unreserved Fixed-rate

- 6.2 By Advertising Media

- 6.2.1 Digital Display

- 6.2.2 Mobile Display

- 6.3 By Enterprise size

- 6.3.1 SMB's

- 6.3.2 Large Enterprises

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Yieldbird Sp. z o.o.

- 7.1.2 MediaMath

- 7.1.3 The ADEX

- 7.1.4 Adform

- 7.1.5 Amobee, Inc.

- 7.1.6 IPONWEB Limited.

- 7.1.7 Eskimi DSP

- 7.1.8 PubMatic, Inc.

- 7.1.9 Teads SA.

- 7.1.10 Digital East GmbH

8 Investment Analysis

9 Future Outlook of the Market

02-2729-4219

+886-2-2729-4219