|

市場調查報告書

商品編碼

1645158

北美工業緊固件:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)North America Industrial Fasteners - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

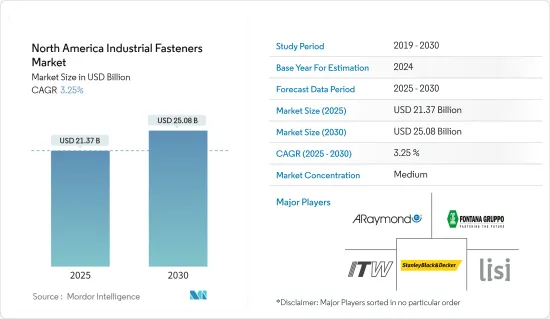

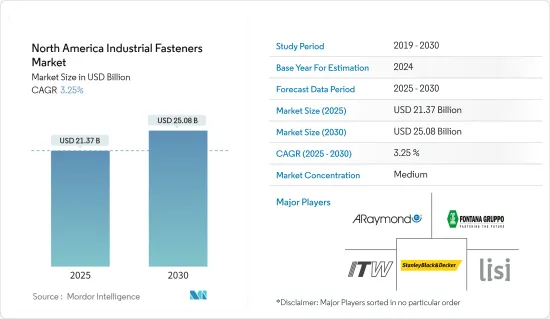

北美工業緊固件市場規模預計在 2025 年為 213.7 億美元,預計到 2030 年將達到 250.8 億美元,預測期內(2025-2030 年)的複合年成長率為 3.25%。

關鍵亮點

- 由於製造業、汽車業和建設業等終端用戶行業的成長,北美對工業緊固件的需求正在增加。

- 工業緊固件是五金設備、五金裝置的主要零件之一,設計用於永久或半永久使用。使用半永久性緊固件的主要優點之一是能夠拆卸硬體設備接頭而不會損壞緊固件。終端用戶產業重型五金設備中使用的大部分緊固件都是由鋁合金製成的,鋁合金由鐵、銅、錳和鎂等元素組成。由於含有這些元素,因此容易腐蝕,需要塗層。

- 防腐塗層是工業金屬緊固件的主要要求之一。由於這種需求,各種防腐金屬塗層供應商正在為研究市場開發新的防腐方法。例如,2021 年 6 月,Greenkote 推出了其新型 Greenkote G5K 塗層,在鹽霧測試中可提供至少 5,000 小時的耐腐蝕性能。這種方法使我們能夠遵守 ASTM 規範 B117。

- 北美是許多汽車、電子元件、航太和醫療設備製造商的所在地。例如,根據 ATD 的《Truck Beat》報告(2021 年),2021 年上半年商用卡車銷售量為 231,813 輛,比 2020 年上半年成長 28.5%。預計這些趨勢將推動該地區對工業緊固件的需求。

- 此外,建築業工業緊固件的使用不斷增加,進一步推動了所研究市場的成長。例如,根據美國商務部的數據,2022 年 5 月建築支出增加了 0.1%,而 2022 年 2 月則增加了 0.5%。

- 然而,高品質黏合劑等替代品的出現以及對永續解決方案的需求不斷增加等挑戰阻礙了研究市場的成長。

- 新冠肺炎疫情為北美帶來了嚴重影響。由於需求萎縮、供應鏈中斷和營運挑戰,這繼續對各行業產生不利影響。終端用戶產業活動的減少對所研究的市場產生了負面影響。不過,隨著北美全部區域新冠疫情影響的減弱,預計市場將呈現上升趨勢。

北美工業緊固件市場趨勢

汽車業佔有較大市場佔有率

- 汽車和航空航太工業是工業緊固件的主要消費者之一,因為生產過程和產品本身涉及的零件數量眾多。螺帽、螺栓、螺絲和墊圈是這些行業中最常用的緊固件。

- 該地區對商用車和乘用車的需求不斷增加,推動了對汽車級工業緊固件的需求。例如,根據加拿大統計局2022年4月公佈的資料,2021年乘用車銷量為345,350輛,輕型卡車銷量為1,293,700輛,而2020年乘用車銷量為325,490輛,輕型卡車銷量為1,233,060輛。

- 鑑於這種需求,供應商正在推出各種品牌來滿足輕型車輛工業緊固件的需求。例如,2022 年 2 月,MacLean-Fogg Component Solutions 宣布推出其 Treadstrong 品牌,並將附帶一個電子商務網站。該品牌正在展示輕型車輛的車輪緊固件。在緊固件中,我們有適用於福特 F-150 的黑色車輪螺母、適用於福特 Explorer 的黑色車輪螺母、適用於福特 Mustang 的黑色車輪螺母、適用於福特 F-150 的黑色車輪螺母。

- 此外,由於輕型車輛的需求不斷增加,該地區的供應商也在擴大其輕型車輛緊固件產品系列。例如,2022年1月,Auto Bolt宣布與Pac-West Fasteners建立合作夥伴關係,以擴大基本客群。此次合作預計將為該公司增加新的強大的基本客群。

美國佔主要市場佔有率

- 美國是北美最大的經濟體,擁有許多不同類型的公司,其中汽車、航太和軍事部門是緊固件產品的主要買家。因此,預計該國仍將是工業緊固件的主要消費國。

- 公共和私營部門加大對國家基礎設施現代化的投資,預計將進一步推動對工業緊固件的需求。例如,2021年11月,美國總統拜登簽署了一項1兆美元的兩黨基礎設施法案,對重組該國的道路、港口、橋樑、鐵路等進行多項投資。工業緊固件廣泛應用於此類計劃,以確保最終建築的安全、堅固,從而為市場參與企業創造了新的機會。

- 該地區的多家公司正致力於利用新技術,並專門為廣泛的應用開發創新的客製化緊固解決方案。特種緊固件市場正在不斷成長,廣泛應用於航太、汽車、建築、機械和農業等行業。

- 例如,2021 年 3 月,美國載重指示緊固件製造商 Valley Forge & Bolt 推出了一種新型高溫 MaxBolt,能夠在高達 650°F 的溫度下工作,涵蓋廣泛的應用範圍,並在長時間高溫工作時間和熱循環中提供經過驗證的性能。這款新型螺栓配有高溫鏡頭和易於查看的儀表,可在快速熱循環應用和延長高溫條件下發揮作用。

- 此外,汽車產業也是推動工業緊固件需求的主要產業。例如,根據汽車研究中心的數據,汽車產業是美國組織化程度最高的產業之一。從歷史上看,汽車業對整體國內生產總值(GDP)的貢獻率約為3-3.5%。這些趨勢預計將為該國工業緊固件市場的成長創造有利的市場格局。

北美工業緊固件產業概況

北美工業緊固件市場細分程度適中,國內和國際參與企業都擁有數十年的行業經驗。該市場的供應商正在利用他們的專業知識採取強力的競爭策略。市場的一些主要參與者包括 ARaymond Industrial、Fontana Gruppo、Illinois Tool Works Inc. 和 LISI Group。

- 2021 年 12 月-Trimas Corporation 宣布收購 TFI Aerospace。 TFI 位於加拿大多倫多附近,是一家特殊緊固件製造商和供應商,其產品主要用於航太終端市場的各種應用。此次收購預計將進一步增強該公司在北美的影響力。

- 2022 年 1 月 - Fastenal Co.,一家OEM(目標商標產品製造)、MRO(維護、維修和營運)、建築、工業和安全產品分銷商。 “該公司的目標是到 2022 年達到 55%,但相信最終可能會達到 85%。”

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 科技趨勢

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 建築業成長

- 防腐蝕技術的發展

- 增加對汽車和航空領域的投資

- 市場問題

- 替代品的出現

- 對永續產品的需求不斷成長對塑膠緊固件的成長構成挑戰

第6章 市場細分

- 按材質

- 金屬

- 塑膠

- 按年級

- 標準

- 高效能

- 按類型

- 外螺紋

- 內螺紋

- 無螺紋

- 按應用

- 按最終用戶應用

- OEM

- 汽車/汽車

- 內燃機底座

- 輕型車

- 中型/大型卡車和客車

- 電

- 航太

- 機器

- 電氣/電子製造

- 金工

- 醫療設備

- 其他OEM應用

- 維護、修理和操作

- 建造

- OEM

- 按國家

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- ARaymond Industrial

- Marmon Holdings Inc(Berkshire Hathaway)

- Fontana Gruppo

- Illinois Tool Works

- Stanley Black & Decker Inc.

- LISI Group

- Nifco Inc.

- Agrati Group

- TriMas Aerospace

- Hilti Inc.

- Bulten AB

- Kamax Inc.

- Wurth Group

第 8 章 供應商排名分析

第9章:未來市場展望

The North America Industrial Fasteners Market size is estimated at USD 21.37 billion in 2025, and is expected to reach USD 25.08 billion by 2030, at a CAGR of 3.25% during the forecast period (2025-2030).

Key Highlights

- Owing to the growth of end-user industries such as manufacturing, automotive, and construction, among others, the demand for industrial fasteners has been increasing in the North American region.

- Industrial fasteners have been one of the primary components for hardware equipment or hardware devices and are designed as permanent or semi-permanent. One of the major advantages of using a semi-permanent fastener is the joints of hardware equipment can be dismantled without damaging the fasteners. Most of the fasteners used for heavy-duty hardware equipment across end-user industries are made of aluminum alloys that consist of elements like iron, copper, manganese, magnesium, and others. The presence of such elements makes it more prone to corrosion and requires coating.

- Anti-corrosion coating is one of the primary requirements for industrial metal fasteners in the industry. Owing to the demand, various anti-corrosion metal coating vendors have been developing newer methods to prevent corrosion for the studied market. For instance, in June 2021, Greenkote announced the new Greenkote G5K coating that delivers a minimum of 5,000 hours of corrosion protection from salt spray testing. The method has enabled to meet ASTM specification B117.

- North America is a home for many Automotive manufacturers, electrical component manufacturers, aerospace manufacturers, and medical equipment manufacturers. For instance, according to the Truck Beat report (2021) by ATD, in H1 of 2021, the sale of commercial trucks stood at 231,813 units, which was up by 28.5% when compared to H1 of 2020. Such trends are expected to drive the demand for industrial fasteners in the region.

- Additionally, the increasing use of industrial fasteners across the construction sector is further supporting the growth of the studied market. For instance, according to The Commerce Department (USA), in May 2022, the construction spending edged up to 0.1% after increasing 0.5% in February 2022.

- However, factors such as emergence of alternatives such as high quality adhesives along with increasing demand for sustainable soultions are challenging the growth of the studied market.

- The outbreak of COVID-19 had severely affected the North American region. This is continuing to have a negative impact on various industries, as demands are shrinking along with several disruptions to supply chain and operational challenges. Decreased activities across the end-user industries had a negative impact on the studied market. However, the market is expected to witness upward trend with the impact of COVID-19 diminishing across the North American region.

North America Industrial Fasteners Market Trends

Automotive Industry to Hold Significant Market Share

- The automotive and aviation sector is among the major consumer of industrial fasteners owing to a large number of parts involved in both the production process and the product itself. Nuts, bolts, screws, and washers are among the most used fasteners across these industries.

- Owing to the increasing demand for commercial and passenger vehicles in the region, demand for automotive-grade industrial fasteners is increasing. For instance, according to data published by StatCan in April 2022, the sale of passenger cars in 2021 accounted for 345.35 thousand units and 1293.7 thousand units in 2021, compared to 325.49 thousand units of passenger cars and 1233.06 thousand units of light trucks in 2020.

- Owing to the demand, vendors are introducing various brands to address the demand for industrial fasteners for lightweight vehicles. For instance, in February 2022, MacLean-Fogg Component Solutions announced the launch of the Treadstrong brand, which is accompanied by an e-commerce website. The brand showcases wheel fasteners for lightweight vehicles. Some of the fasteners are a black wheel Lug nut for Ford F-150, Black Wheel Lug Nut for Ford Explorer, a Black wheel lug nut for Ford Mustang, and a Black Wheel lug Nut for Ford F-150.

- Furthermore, the vendors operating in the region are also expanding their fasteners product portfolio for lightweight vehicles as their demand has been increasing. For instance, in January 2022, Auto Bolt announced its association with Pac-West Fasteners to expand its customer base on the West Coast of America. The collaboration is expected to add a new and strong customer base for the company.

United States to Hold Major Market Share

- The United States is the largest economy in the North American region and has many varied companies centered around the main purchasers of fastener products, including the automotive, aerospace, and military sectors. Hence, the country is expected to remain a major consumer of industrial fasteners.

- Increasing investment by the public and private sectors to modernize the country's infrastructure is expected to drive the demand for industrial fasteners further. For instance, in November 2021, US President Joe Biden signed a USD 1 trillion bipartisan infrastructure bill into law, making several investments to rebuild the country's roads, ports, bridges, and rails, among others. This will create new opportunities for the players in the market as industrial fasteners are extensively used in such construction projects to ensure a safe and strong final construction.

- Several players in the region are focusing on utilizing new technologies and specialization to develop innovative and customized fastening solutions for a wide range of applications. Special fasteners are already a growing market and are commonly used in the aerospace, automotive, construction, mechanical, and agricultural industries.

- For instance, in March 2021, a US-based manufacturer of load-indicating fasteners, Valley Forge & Bolt, launched the new High Temp Maxbolt, which can operate in temperatures up to 650° F for a wide range of applications and with proven performance in extended high-temperature run times and thermal cycling. With a high-temperature lens and easy-to-read gauge, the new bolt operates in rapid thermal cycle applications and in prolonged high-temp situations.

- Furthermore, the automotive sector is another major sector that is driving the demand for industrial fasteners. For instance, according to the Center for Automotive Research Organization, the auto industry is one of the highly organized industries in the United States. Historically, the auto sector has contributed about 3 - 3.5 percent to the overall Gross Domestic Product (GDP). Such trends are expected to create a favorable market scenario for the growth of the industrial fasteners market in the country.

North America Industrial Fasteners Industry Overview

The North America Industrial Fasteners Market is moderately fragmented, with both local and international players having decades of industry experience. The vendors in the market are incorporating a powerful competitive strategy by leveraging their expertise. Some of the major players operating in the market include ARaymond Industrial, Fontana Gruppo, Illinois Tool Works Inc., and LISI Group, among others.

- December 2021 - Trimas Corporation announced the acquisition of TFI Aerospace. Located near Toronto, Canada, TFI is a manufacturer and supplier of specialty fasteners used in a variety of applications, predominantly for the aerospace end market. The acquisition is expected to help the company further strengthen its presence in the North American region.

- January 2022 - Fastenal Co., a distributor of original equipment manufacturers (OEM), maintenance, repair, and operations (MRO), construction, industrial, and safety products, is working to speed up the process. In 2022 and beyond, Fastenal expects its "digital footprint" sales to account for an even higher percentage of overall sales. "The company's goal is to reach 55 percent by 2022, but they feel it might eventually reach 85 percent".

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Trends

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of the Construction Sector

- 5.1.2 Development of Anti-Corossion Techniques

- 5.1.3 Increasing Investment in Automotive and Aviation Sector

- 5.2 Market Challenges

- 5.2.1 Emergence of Alternatives

- 5.2.2 Increasing Demand for Sustainable Products to Challenge the Growth of Plastic Fasteners

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Metal

- 6.1.2 Plastic

- 6.2 By Grade

- 6.2.1 Standard

- 6.2.2 High-Performance

- 6.3 By Type

- 6.3.1 Externally Threaded

- 6.3.2 Internally Threaded

- 6.3.3 Non-Threaded

- 6.3.4 Application Specific

- 6.4 By End-User Application

- 6.4.1 OEM

- 6.4.1.1 Motor Vehicles/Automotive

- 6.4.1.1.1 IC Engine Based

- 6.4.1.1.1.1 Light Vehicle

- 6.4.1.1.1.2 Medium/Heavy Trucks & Buses

- 6.4.1.1.2 Electric

- 6.4.1.2 Aerospace

- 6.4.1.3 Machinery

- 6.4.1.4 Electrical and Electronic Goods

- 6.4.1.5 Fabricated Metal

- 6.4.1.6 Medical Equipment

- 6.4.1.7 Other OEM Applications

- 6.4.2 Maintenance, Repair and Operations

- 6.4.3 Construction

- 6.4.1 OEM

- 6.5 By Country

- 6.5.1 United States

- 6.5.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ARaymond Industrial

- 7.1.2 Marmon Holdings Inc (Berkshire Hathaway)

- 7.1.3 Fontana Gruppo

- 7.1.4 Illinois Tool Works

- 7.1.5 Stanley Black & Decker Inc.

- 7.1.6 LISI Group

- 7.1.7 Nifco Inc.

- 7.1.8 Agrati Group

- 7.1.9 TriMas Aerospace

- 7.1.10 Hilti Inc.

- 7.1.11 Bulten AB

- 7.1.12 Kamax Inc.

- 7.1.13 Wurth Group