|

市場調查報告書

商品編碼

1645161

繼電器:全球市場佔有率分析、行業趨勢和統計、成長預測(2025-2030)Global Relay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

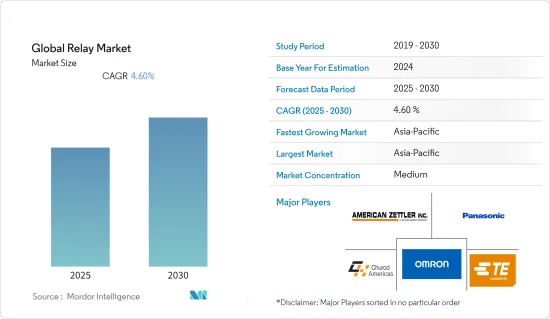

預計預測期內全球繼電器市場複合年成長率為 4.60%。

主要亮點

- 電力消耗的增加、電動車的日益普及、智慧電網的引入以及車輛安全技術的日益普及是預計推動繼電器市場發展的主要因素。然而,原物料價格的波動是預測期內阻礙繼電器市場成長的主要因素之一。

- 全球新興和已開發國家都在大力投資建造智慧電網,預計將推動未來繼電器市場的發展。例如,2021 年 7 月,GridWise Alliance 宣布資金籌措50 億美元,透過智慧感測器、控制和儲存對美國輸配電基礎設施進行現代化改造。

- 智慧電網是一種先進的電網基礎設施,旨在提高可靠性和效率,並與自動控制、現代通訊基礎設施、高功率轉換器以及最新的能源管理、感測和測量技術協同工作。

- 自動化電網對繼電器的需求龐大,因為它們支援變壓器監控,可以防止變壓器過載、過勵磁和穿越故障,並提供包括過電流、差動和接地故障在內的標準保護功能。

- COVID-19的出現對全球繼電器市場產生了不利影響。各類繼電器主要終端用戶產業的大幅下滑,影響了全球繼電器市場的下滑。由於許多國家實施停工措施以遏制疫情蔓延,疫情也導致2020年和2021年初可再生資源領域的重大計劃暫停。

- 不過,世界各地的產業正在重新開放,供應鏈限制正在緩解。但預計疫情造成的干擾至少在短期內會產生影響。

繼電器市場趨勢

擴大汽車產業繼電器的採用

- 汽車產業正在從硬體轉向軟體驅動的汽車轉變,每輛汽車的平均軟體和電子設備數量正在迅速增加。電子設備通常可以將新功能和新特性整合到車輛中。因此,電子設備擴大被整合到動力傳動系統、安全、車身、便利性和資訊娛樂等關鍵應用中。

- 此外,乘客安全也是採用自動駕駛系統的促進因素。過去幾十年來,汽車安全功能和系統的加入對減少道路上的事故和死亡人數做出了巨大貢獻。

- 目前和未來車輛中電氣元件使用的快速增加,持續推動製造可靠、標準化元件的需求,以便高效、安全、可靠地切換電氣負載。這些因素目前正在推動市場成長。

- 汽車繼電器旨在管理乘客舒適度和資訊娛樂系統中的直流 (DC) 電壓以及惡劣環境下的功率等級。繼電器幾乎應用於整個車輛的每個線束和箱體模組,包括車輛的後部和前部區域、車身控制、乘客和引擎區域、動力傳動系統、車門、座椅、車頂和風扇模組。

- 此外,由於全球對混合動力汽車和電動車的需求不斷成長,對輕量化和高性能先進繼電器的需求正在推動製造商投資生產更多的固態繼電器,而不是傳統的重型電子機械繼電器。這將推動未來的市場成長。

預測期內亞太地區將佔據顯著的市場佔有率

- 預計預測期內亞太地區將佔據主要市場佔有率。亞太地區繼電器市場的成長受到可再生能源容量增加的推動。此外,預計在預測期內,IEC 61850 標準下電網基礎設施活動的增加以及對變電站自動化的重視將推動亞太地區市場的發展。

- 該全部區域可再生能源發電的興起為繼電器製造商提供了機會。繼電器被用於該領域,因為它們提供非常大的接觸間隙、強大的切換能力和許多其他應用。除此之外,政府和各本地公司正在大力投資發展該產業。

- 此外,中國政府的「中國製造2025」計畫等項目正在推動工廠自動化和技術的研發利用和投資。由於大多數自動化設備都是從德國和日本進口的,「中國製造」舉措旨在擴大自動化硬體和設備的國內生產。政府在自動化領域的舉措可能會推動研究市場的發展。

- 此外,不斷增加的投資、製造能力和汽車銷售可能很快就會推動繼電器市場的發展。此外,更嚴格的政府排放法規正在鼓勵該地區的汽車製造商投資電動車。因此,各汽車製造商都在大力投資開發和推出新型電動車。例如,韓國現代汽車在2021年12月宣布,計畫投資400億盧比(5.3億美元),到2028年在印度推出六款電動車。預計電動車投資的增加將進一步推動繼電器的需求。

- 此外,2022年2月,現代汽車集團旗下汽車零件生產部門現代摩比斯宣布,計畫在未來3年內斥資高達67.2億美元,強化汽車晶片、移動出行等領域作為未來驅動力。

- 因此,由於上述因素,預計預測期內亞太地區的收益佔有率將比其他地區成長更快。

繼電器產業概況

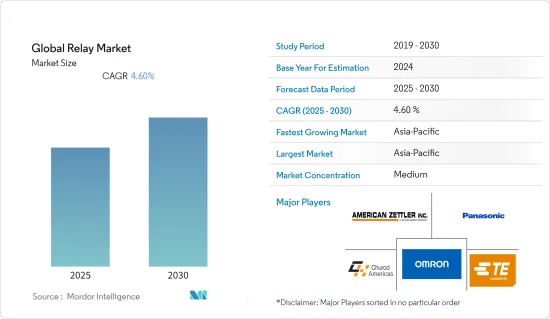

全球繼電器市場競爭較激烈,主要參與者包括 TE Connectivity、American Zettler、Churod Electronics、Omron 和 Panasonic。從市場佔有率來看,目前很少大型企業佔據市場主導地位。然而,創新和技術進步正在推動許多公司透過有機和無機成長策略來增加其市場佔有率並探索新市場。

- 2021 年 12 月,TE Connectivity 從 Phoenix Contact 收購了窄型安全繼電器(NSR) 技術。透過此次技術收購,TE Connectivity 將涉足 NSR繼電器的製造和銷售。

- 2021 年 11 月,Pickering Electronics Ltd. 宣佈在 Productronica 2021 上推出其新型 100HV 系列高壓磁簧繼電器。 Pickering磁簧繼電器可承受 1kV 至 15kV 的電壓,並可輕鬆在高達 50W 的功率下從 500V 切換到 12.5kV。該繼電器非常適合混合訊號半導體測試儀、背板測試儀、高階電纜測試儀、電動汽車、醫療用電子設備、大物理、太陽能、線上測試設備和高壓設備。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況(繼電器的現況、繼電器的優點、KPI 分析)

- 技術趨勢/進步

- COVID-19 對市場的影響

- 產業吸引力-波特五力分析

- 消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 新進入者的威脅

- 競爭對手之間的競爭

- 定價分析

第5章 市場動態

- 市場促進因素

- 增加對再生能源來源的投資

- 電動和混合動力汽車對繼電器的需求不斷增加

- 市場挑戰

- 原物料價格波動

第6章 市場細分

- 依產品類型

- 電子機械

- 固態

- 按最終用戶應用

- 航太、國防和軍事

- 車

- 通訊

- 能源和電力

- 產業

- 其他最終用戶應用程式

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 亞洲

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- American Zettler

- Churod Electronics

- Omron Corporation

- Panasonic Corporation

- Circuit Interruption Technology, Inc.

- Fujitsu Limited

- Song Chuan Group Company

- KEMET Corporation

- Phoenix Contact

- TE Connectivity

第8章投資分析

第9章 市場機會與未來趨勢

The Global Relay Market is expected to register a CAGR of 4.60% during the forecast period.

Key Highlights

- The rise in power consumption, growing adoption of electric vehicles, implementation of smart power grids, and increasing adoption of vehicular safety technology are some major factors expected to drive the relay market. However, volatility in raw material prices is one of the major factors that may hamper the growth of the relay market during the forecast period.

- Developing and developed countries worldwide are significantly investing in the construction of smart power grids, which is anticipated to propel the market for relays in the future. For instance, in July 2021, GridWise Alliance announced a USD 5 billion funding to revamp the US's transmission and distribution infrastructure with smart sensors, controls, and storage.

- Smart grids are advanced electric power grid infrastructures for enhanced reliability and efficiency and work with automated control, modern communications infrastructure, high-power converters, modern energy management techniques, and sensing and metering technologies.

- The demand for relays in an automated power grid is huge as they can support monitoring transformers and protect from transformer overload, overexcitation, and through-fault, as well as standard protection functions including overcurrent, differential, and earth faults.

- The emergence of COVID-19 adversely impacted the global relay market. The massive downturn in the industries that have been major end-users of the different types of relays impacted the decline in the relay market at a global level. Also, the pandemic brought key projects in the renewable resources sector to a standstill due to the lockdowns imposed in many countries to control the spread of the disease in 2020 and early 2021.

- Although, the industries across various parts of the world are opening back, easing the supply chain constraints. However, the disruptions caused by the pandemic are expected to have their impact felt at least for a short period.

Relay Market Trends

Growing Adoption of Relays in Automotive Industry

- The automotive industry is transitioning from hardware- to software-enabled vehicles, and the average software and electronics content per vehicle is increasing rapidly. Electronics often enable the integration of new functions and features into the car. Thus, electronics is increasing penetration into major applications, including powertrain, safety management, body, and convenience or infotainment.

- In addition, passenger safety is another factor driving the adoption of automated automobile systems. The installation of safety features and systems in vehicles has greatly aided in reducing the number of accidents and fatalities on the road over the past few decades.

- The rapidly growing use of electric components in current and upcoming vehicles is consistently propelling the need for manufacturing reliable and standardized components for efficient, safe, and secure switching of electric loads. These factors are currently driving the market growth.

- The relays for automotive applications are engineered for direct current (DC) voltages in passenger comfort and infotainment systems and managing power levels in harsh environments. The relays are utilized in almost all harnesses and box modules throughout a vehicle, comprising the car's rear and front area, body control, passenger and engine areas, powertrain, and door, seat, roof, and fan modules.

- Additionally, the demand for advanced relays with lightweight and high-performance characteristics is compelling manufacturers to invest in producing more solid-state relays, compared to traditional heavy electromechanical relays, owing to the growing demand for hybrid and electric vehicles around the world. This, in turn, will boost market growth in the future.

Asia-Pacific to Register a Significant Market Share During the Forecast Period

- Asia-Pacific is anticipated to hold a substantial market share during the forecast period. The growth of the relay market in the Asia Pacific is owing to the rising renewable energy capacity addition. Also, the increased grid infrastructure activities and emphasis on substation automation under IEC 61850 standard are anticipated to propel the market in the Asia Pacific during the forecast period.

- The advent of renewable energy generation across the region provides opportunities for relay manufacturers as it is utilized for many applications, such as offering a very big contact gap, powerful switching competencies, and many others in this sector. Apart from this, the government and various regional companies have invested strongly in developing this sector.

- Further, the Chinese government's programs, such as the Made in China 2025 plan, promote the use of R&D in factory automation and technologies and its investments. Also, as most of the automation equipment is imported from Germany and Japan, the 'Made in China' initiative aims to expand the country's domestic production of automation hardware and equipment. Initiatives by the government in the automation sector will drive the studied market.

- Moreover, increasing investments, manufacturing capacity, and sales of automotive vehicles considerably will drive the relay market shortly. In addition, stricter emission regulations by governments are propelling automakers across the region to invest in electric vehicles. Various automakers are therefore significantly investing in developing and launching new electric vehicles. For instance, in December 2021, South Korea's Hyundai Motor Co unveiled its plan to invest 40 billion rupees (USD 530 million) in launching six electric vehicles in India by 2028. The rising investment in electric vehicles is expected to further boost the demand for relays.

- Furthermore, in February 2022, Hyundai Mobis, the auto parts producing unit of Hyundai Motor Group, unveiled its plan to spend up to USD 6.72 billion in the next three years to strengthen auto chips, mobility, and other fields as its future growth drivers.

- Thus, owing to the factors mentioned above, the revenue share from the Asia Pacific is anticipated to grow faster than the other geographical regions during the forecast period.

Relay Industry Overview

The Global Relay Market is moderately competitive and consists of several major players such as TE Connectivity, American Zettler, Churod Electronics, Omron, Panasonic, etc. In terms of market share, few major players currently dominate the market. However, with innovations and technological advancements, many companies are increasing their market presence through organic and inorganic growth strategies and tapping new markets. Some of the recent developments in the market are:

- In December 2021, TE Connectivity acquired narrow safety relay (NSR) technology from Phoenix Contact. TE Connectivity will be involved in manufacturing and marketing NSR relays through this technology acquisition.

- In November 2021, Pickering Electronics Ltd. presented high voltage reed relays comprising the newly released Series 100HV at Productronica 2021. Pickering's reed relays can stand off from 1kVto 15kV and facilitate switching from 500V to 12.5kV at up to 50W. The relays are best suitable for mixed-signal semiconductor testers, backplane testers, high-end cable testers, electric vehicles, medical electronics, big physics, solar energy, in-circuit test equipment, and high voltage instrumentation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview (Current Scenario of Relay, Benefits of a Relay and KPI Analysis)

- 4.2 Technological Trends/Advancements

- 4.3 Impact of COVID-19 on the Market

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of Substitute

- 4.4.4 Threat of New Entrants

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Pricing Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Investments in Renewable Energy Sources

- 5.1.2 Increasing Demand for Relays in Electric and Hybrid Vehicles

- 5.2 Market Challenges

- 5.2.1 Volatility in Raw Material Prices

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Electromechanical

- 6.1.2 Solid State

- 6.2 By End-user Application

- 6.2.1 Aerospace, Defense and Military

- 6.2.2 Automotive

- 6.2.3 Communications

- 6.2.4 Energy and Power

- 6.2.5 Industrial

- 6.2.6 Other End-user Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 American Zettler

- 7.1.2 Churod Electronics

- 7.1.3 Omron Corporation

- 7.1.4 Panasonic Corporation

- 7.1.5 Circuit Interruption Technology, Inc.

- 7.1.6 Fujitsu Limited

- 7.1.7 Song Chuan Group Company

- 7.1.8 KEMET Corporation

- 7.1.9 Phoenix Contact

- 7.1.10 TE Connectivity