|

市場調查報告書

商品編碼

1651032

中東和非洲 AMH:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)MEA AMH - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

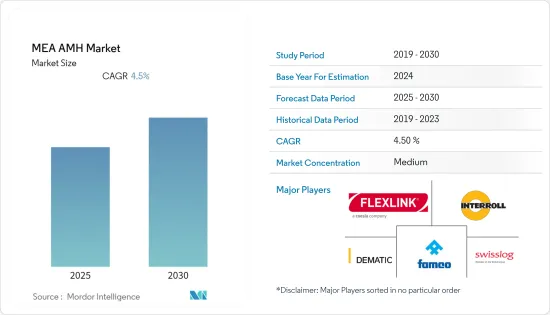

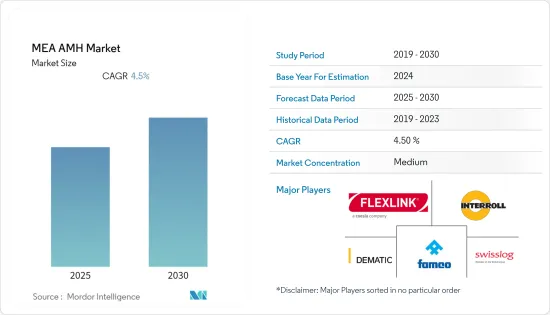

預測期內,中東和非洲的 AMH 市場預計將達到 4.5% 的複合年成長率

關鍵亮點

- 對大幅降低營運成本和提高倉庫效率的需求不斷成長,支援了該地區 AMH 系統和機器人的部署。例如,AutoStore 使用機器人和箱子快速完成小零件訂單,並且比市場上任何其他自動化系統更好地利用可用空間。

- 據 Swisslog Middle East 稱,阿拉伯聯合大公國和世界各地的多家企業都從物流自動化中受益匪淺。中東地區電子商務、零售、食品飲料、製藥等產業對自動化物流解決方案的需求日益成長。

- 改善非洲內部貿易還可以減少在國內和跨境運輸商品和服務所需的成本和時間,從而提高南非的營商便利度。隨著政府和當地企業對開發當地市場的興趣日益濃厚,DHL 等全球參與企業也正在試驗。在預測期內,預計將有更多的物流參與企業進入該國市場,從而增加對 AMH 解決方案的需求。

- 自動化是任何行業的關鍵驅動力,包括電子商務。根據杜拜工商會的報告,受新冠疫情主導的數位轉型影響,2020年阿拉伯聯合大公國零售電商市場規模達39億美元,與前一年同期比較增53%。

中東和非洲 AMH 市場趨勢

零售業將經歷顯著成長

- 零售業是中東和非洲對 AMH(AMH)解決方案需求的最大貢獻者之一。 AMH 在該地區近 25% 的收益來自該部門。

- 該地區零售業的成長主要受兩個因素主導:電子商務行業的快速成長以及旅遊和酒店服務投資的增加。

- 大多數中東國家都依賴石油和天然氣產業,因此正在採取必要措施增加非石油收入來源。這一趨勢在沙烏地阿拉伯和阿拉伯聯合大公國尤為明顯,這兩個國家正在大力投資建立經濟特區,發展製造業和旅遊業。

- 隨著旅遊業的投資吸引了越來越多的外國遊客,洲際酒店集團、萬豪酒店、雅高酒店和希爾頓等公司也不斷擴張。在電子商務領域,由於非海灣合作理事會國家的需求增加,海灣合作理事會國家正在發展成為轉運供應商。這導致該地區倉儲設施數量的增加,從而增加了對 AMH(自動化物料輸送)設備的需求。

南非佔有主要佔有率

- 南非是非洲大陸最大的經濟體。南非的 GDP 價值佔全球經濟的近 0.6%,2020 年價值超過 3,700 億美元。

- 儘管非洲對外貿易存在順差,但非洲內部貿易仍較低。隨著非洲國家採取更加開放的政策並投資於基礎設施,預計非洲內部貿易勢頭將增強,當地分銷管道將得到加強。

- 南非擁有完善的物流網路,是電子商務產業一個前景光明的平台。據估計,該國超過 50% 的人口可以上網,該地區約有 8,300 萬名網路消費者。旅遊業也是該地區對 AMH 設備需求增加的主要驅動力,影響周邊的零售和食品飲料場所。

- 食品和飲料行業是該國 AMH 設備的最大消費者,其中自動輸送機是最暢銷的設備類型。許多專用輸送機適用於維持需求的溫度而不污染產品,已成為全國許多食品加工單位的關鍵效率因素。

中東和非洲 AMH 產業概況

中東和非洲 AMH 市場本質上較為穩固且競爭適中。產品推出、高額研發投入、夥伴關係和收購等是國內公司為在不斷成長的市場中保持競爭力而採取的主要成長策略。

- 2020 年 11 月 - 總部位於阿拉伯聯合大公國的倉庫自動化領導者 ACME Intralog 將在中東地區及其他地區進行大規模擴張,並決定在未來兩年內投資 3000 萬迪拉姆,以加強其在阿拉伯聯合大公國的研發和製造設施。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- COVID-19 對市場的影響

- 市場促進因素

- 技術進步不斷推動市場成長

- 工業 4.0 投資推動自動化和物料輸送需求

- 電子商務快速成長

- 市場限制

- 初期成本高

- 技術純熟勞工短缺

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 產品類型

- 硬體

- 軟體

- 服務

- 設備類型

- 移動機器人

- 自動導引運輸車(AGV)

- 自動堆高機

- 汽車牽引車/曳引機/拖曳船

- 單元貨載

- 組裝

- 特殊用途

- 自主移動機器人(AMR)

- 雷射導引車

- 自動儲存和搜尋系統 (ASRS)

- 固定巷道(堆垛機高機+穿梭車系統)

- 旋轉木馬(水平旋轉木馬+垂直旋轉木馬)

- 垂直升降模組

- 自動輸送機

- 腰帶

- 滾筒

- 調色盤

- 開賣

- 堆垛機

- 常規型(高電位+低電位)

- 機器人

- 分類系統

- 移動機器人

- 垂直最終用戶

- 飛機場

- 車

- 飲食

- 零售/倉儲/配送中心/物流中心

- 一般製造業

- 藥品

- 郵政和小包裹

- 其他

- 國家

- 南非

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 以色列

第6章 競爭格局

- 公司簡介

- FlexLink Systems Inc.

- Swisslog Middle East LLC

- Famco

- Dematic Corporation

- Stor-Mat Systems LLC

- Interroll Group

第7章投資分析

第 8 章:市場的未來

簡介目錄

Product Code: 57316

The MEA AMH Market is expected to register a CAGR of 4.5% during the forecast period.

Key Highlights

- The growing demand for reducing operational costs significantly and boosting efficiency in the warehouses has supported the deployment of automated material handling systems and robots in the region. For instance, AutoStore uses robots and bins to process small parts orders quickly and provides better use of available space than any other automated system in the market.

- According to Swisslog Middle East, several companies in the UAE and globally have benefitted immensely from logistics automation. There is an increasing demand for automated logistics solutions in industries ranging from e-commerce and retail to F&B and pharma in the Middle East.

- Improvements in intra-Africa trade may also ease business in South Africa, by reducing the costs and time required to move goods and services within countries and across borders. With the increasing interest of the government and local players to develop the local market, global players like DHL are experimenting. Over the forecast period, the country is expected to draw more logistics players into the market, increasing the demand for AMH solutions in the country.

- Automation is a crucial driver for the full spectrum of industries, including e-commerce. According to the Dubai Chamber of Commerce and Industry report, the UAE retail e-commerce market reached USD 3.9 billion in 2020, representing 53% YOY driven by the Covid-19-led digital shift, while e-commerce accounted for an 8% share of the retail market during the same year.

Middle East and Africa Automated Material Handling Market Trends

Retail Sector to Witness Significant Growth

- The retail sector is one of the most significant contributors to the demand for automated material handling (AMH) solutions in the Middle East & African region. Almost 25% of the revenue obtained for AMH in the region was sourced from this sector.

- The growth of the retail segment in the region was primarily governed by two factors, rapid growth in the e-commerce segment and increasing investments in tourism and hospitality services.

- As most Middle Eastern countries depend on the oil and gas sector, they are taking the necessary steps to increase their non-oil revenue streams. This trend is evident in Saudi Arabia and the United Arab Emirates, which are investing heavily in special economic zones for the manufacturing sector and tourism development.

- Companies like IHG, Marriott, Accor Hotels, and Hilton are continuously expanding, as the investments in tourism are fetching more international tourists. In the e-commerce sector, with increasing demand from countries outside GCC, the GCC countries are evolving as redistributors. This increases the number of warehouse establishments in the region, leading to growth in demand for automated material handling (AMH) equipment.

South Africa to Hold Major Share

- South Africa is the largest economy in the African continent. The GDP value of South Africa represented nearly 0.6% of the world economy and was valued more than USD 370 billion in 2020.

- Although Africa has surplus trade overseas, intra-African trade remains low. The adoption of more open policies and investments in infrastructure by the African countries is expected to build momentum for intra-African trade, strengthening the local distribution channels.

- With its well-built logistics networks in the region, South Africa is a promising platform for the e-commerce industry. More than 50% of the population in the country is estimated to have internet access, which accounts for around 83 million online shoppers in the region. Tourism is another primary driver for the increase in the demand for AMH equipment in the region, with its impact on the surrounding retail and food and beverage establishments.

- As the food and beverage industry is the country's largest consumer of AMH equipment, automated conveyors are the top-grossing equipment type. Many special purpose conveyors suitable for sustaining severe temperatures without contaminating the product are key efficiency factors to many food processing units in the country.

Middle East and Africa Automated Material Handling Industry Overview

The Middle East & Africa automated material handling market is consolidated and moderately competitive in nature. Product launches, high expense on research and development, partnerships and acquisitions, etc., are the prime growth strategies adopted by the companies in the country to sustain the growing competition.

- November 2020 - UAE-based warehouse automation major ACME Intralog is set to embark on a major expansion both within and outside the Middle East region and has decided to invest AED 30 million over the next two years to beef up its research and development and manufacturing facilities in the UAE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Impact of Covid-19 on the Market

- 4.3 Market Drivers

- 4.3.1 Increasing technological advancements aiding market growth

- 4.3.2 Industry 4.0 investments driving the demand for automation and material handling

- 4.3.3 Rapid growth of e-commerce

- 4.4 Market Restraints

- 4.4.1 High Initial Costs

- 4.4.2 Unavailability for skilled workforce

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 Equipment Type

- 5.2.1 Mobile Robots

- 5.2.1.1 Automated Guided Vehicle (AGV)

- 5.2.1.1.1 Automated Forklift

- 5.2.1.1.2 Automated Tow/Tractor/Tug

- 5.2.1.1.3 Unit Load

- 5.2.1.1.4 Assembly Line

- 5.2.1.1.5 Special Purpose

- 5.2.1.2 Autonomous Mobile Robots (AMR)

- 5.2.1.3 Laser Guided Vehicle

- 5.2.2 Automated Storage and Retrieval System (ASRS)

- 5.2.2.1 Fixed Aisle (Stacker Crane + Shuttle System)

- 5.2.2.2 Carousel (Horizontal Carousel + Vertical Carousel)

- 5.2.2.3 Vertical Lift Module

- 5.2.3 Automated Conveyor

- 5.2.3.1 Belt

- 5.2.3.2 Roller

- 5.2.3.3 Pallet

- 5.2.3.4 Overhead

- 5.2.4 Palletizer

- 5.2.4.1 Conventional (High Level + Low Level)

- 5.2.4.2 Robotic

- 5.2.5 Sortation System

- 5.2.1 Mobile Robots

- 5.3 End-user Vertical

- 5.3.1 Airport

- 5.3.2 Automotive

- 5.3.3 Food and Beverage

- 5.3.4 Retail/Warehousing/ Distribution Centers/Logistic Centers

- 5.3.5 General Manufacturing

- 5.3.6 Pharmaceuticals

- 5.3.7 Post and Parcel

- 5.3.8 Other End Users

- 5.4 Country

- 5.4.1 South Africa

- 5.4.2 UAE

- 5.4.3 Saudi Arabia

- 5.4.4 Israel

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 FlexLink Systems Inc.

- 6.1.2 Swisslog Middle East LLC

- 6.1.3 Famco

- 6.1.4 Dematic Corporation

- 6.1.5 Stor-Mat Systems LLC

- 6.1.6 Interroll Group

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219