|

市場調查報告書

商品編碼

1651042

海上管道 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Offshore Pipeline - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

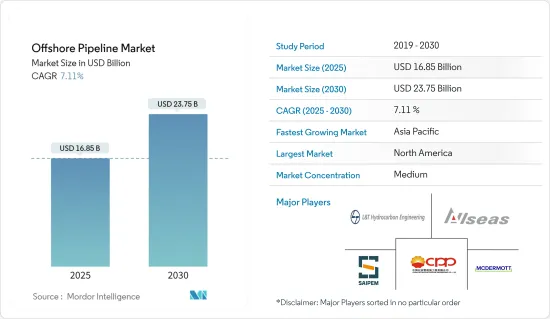

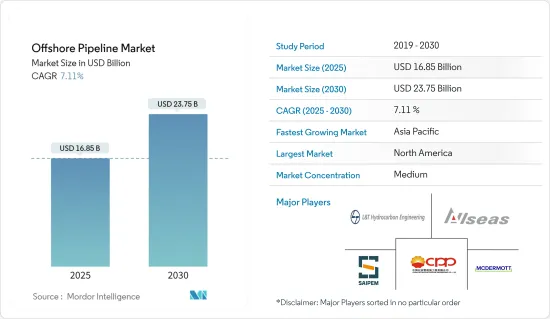

預計 2025 年海上管道市場規模為 168.5 億美元,到 2030 年預計將達到 237.5 億美元,預測期內(2025-2030 年)的複合年成長率為 7.11%。

從長遠來看,預測期內預計推動市場發展的因素包括:原油和天然氣需求不斷增加(尤其是亞太地區的需求),以及對石油和天然氣探勘的安全性、經濟性和可靠連通性的日益重視。

另一方面,預計建築、深水挑戰和高昂建築成本等技術挑戰將抑制市場成長。

預計在預測期內,透過歐洲和亞太地區的海底(海上)管道進口的石油和天然氣將增加為海上管道市場創造龐大的商機。

由於海上探勘活動的活性化,以美國和加拿大為首的北美很可能在預測期內主導海上管道市場。

海上管道市場趨勢

天然氣產業可望強勁成長

- 天然氣需求的不斷成長推動了新天然氣田的發現和使用海底管線進行簡單、低成本的天然氣出口運輸的採用,預計這將推動海上管道市場的發展。

- 2022年全球天然氣產量為40,438億立方公尺。北美地區天然氣產量居世界首位,約12,039億立方米,其次是中東和非洲,產量為9,703億立方米。預計這將在預測期內推動海上管道市場的發展。

- 2022年9月,德國EUROPIPE公司訂單北美公司TC Energy(TCE)的墨西哥灣酵母門戶管線計劃的管線供應合約。 TCE 正在與墨西哥國有電力公司聯邦電力委員會 (CFE) 合作建造一條價值 45 億美元的海上天然氣管道,以確保墨西哥東南部的電力供應。該計劃於八月底被訂單了 Salzgitter Mannesmann 與 Aktien-Gesellschaft der Dillinger Huttenwerke 的合資企業 EUROPIPE。計劃範圍為供應265,000噸(365公里)防腐塗層管道。

- 此外,2023 年 1 月,埃尼報告稱,在位於埃及近海東地中海納爾吉斯油田的納爾吉斯 1 號探勘井發現了新的重大天然氣。 Nargis-1 井的鑽探水深為 1,014 英尺(309 公尺),並遇到了約 200 英尺(61 公尺)厚的中新世和漸新世含氣砂岩。可以利用埃尼現有的設施來開發這項發現。

- 此外,最近一波成本削減和重大技術突破使得許多石油和天然氣探勘和生產公司能夠向永續深水和超深水開發領域拓展。

- 因此,預計不久的將來海上管道市場將迅速擴張。鑑於上述情況,預計預測期內天然氣產業將快速成長。

北美可望主導市場

- 預計預測期內北美將主導全球海上管道市場。該地區的幾個國家正在尋求投資海上石油和天然氣探勘。預計預測期內美國和加拿大等國家的石油和天然氣管道基礎設施將保持運作。

- 由於墨西哥灣活動增多,美國海上管道市場預計將大幅擴張。計劃中的新天然氣生產計劃預計將大幅擴大該地區的海底管線網路。

- 例如,2023 年 1 月,總部位於休士頓的 Talos Energy 在美國墨西哥灣的兩個深水發現中發現了商業數量的石油和天然氣,並計劃將其開發為 Ram Powell張力腳平臺(TLP) 的海底回接裝置。據美國稱,在 Lime Rock 和 Venice 主要目標區分別發現了 78 英尺和 72 英尺的產油層。

- 截至 2021 年 12 月,TC Energy Corp. 和墨西哥國有電力公司 Comision Federal de Electricidad (CFE) 正在就建設一條新的海上天然氣管道進行談判,以向尤卡坦半島供應天然氣,該半島因國內生產停滯而面臨長期天然氣短缺。此外,Sempra 每年 325 萬噸的 Energia Costa Azul (ECA) 液化天然氣 (LNG) 第一期終端於 2021 年做出了最終投資決定。預計該線將於 2024 年投入營運。

- 此外,預計未來幾年技術進步將為加拿大的管道業務帶來穩定強勁的成長。加拿大石油和天然氣產業認為管道是滿足高價值終端用戶市場能源需求最安全、最可靠、最具成本效益的方式。

- 因此,由於對石油和天然氣計劃的投資增加,預計預測期內北美將成為海上管道市場的領先地區。

海上管道產業概況

海上管道市場適度細分。市場的主要企業(不分先後順序)包括 Saipem SpA、L&T Hydrocarbon Engineering Limited、McDermott International Ltd.、Allseas Group SA 和中國石油管道工程公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 至2029年的市場規模及需求預測(單位:美元)

- 截至2029年全球原油歷史趨勢及產量預測(單位:百萬桶/日)

- 布蘭特原油與亨利港現貨價格(截至 2023 年)

- 至 2029 年世界天然氣產量的歷史趨勢和預測(單位:十億立方英尺/天)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 石油和天然氣需求不斷增加

- 越來越重視石油和天然氣探勘的安全性、經濟性和可靠的連接性

- 限制因素

- 建設技術難題、深水難題、建造成本高

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 產品類型

- 油

- 氣體

- 2029 年市場規模與需求預測(按地區)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 挪威

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 伊朗

- 卡達

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Saipem SpA

- L&T Hydrocarbon Engineering Limited

- McDermott International Ltd.

- Allseas Group SA

- Bourbon Corporation SA

- Enbridge Inc.

- Subsea 7 SA

- Genesis Energy LP

- China Petroleum Pipeline Engineering Co. Ltd.

- Atteris LLC

- 市場排名/佔有率分析

第7章 市場機會與未來趨勢

- 透過海底(近海)管道增加歐洲-亞太地區石油和天然氣進口

The Offshore Pipeline Market size is estimated at USD 16.85 billion in 2025, and is expected to reach USD 23.75 billion by 2030, at a CAGR of 7.11% during the forecast period (2025-2030).

Over the long term, factors such as increasing demand for crude oil and natural gas, especially from the Asia-Pacific region, and growing emphasis on safe, economic, and reliable connectivity for oil and gas exploration are expected to drive the market during the forecast period.

On the other hand, technical challenges like construction, deep-water challenges, and high construction costs are expected to restrain market growth.

Nevertheless, increasing oil and gas imports in the European and Asia-Pacific regions through subsea (offshore) pipelines are expected to create huge opportunities for the offshore pipeline market during the forecast period.

North America, led by the United States and Canada, would likely dominate the offshore pipeline market during the forecast period due to the increased offshore exploration activities.

Offshore Pipeline Market Trends

The Gas Segment is Expected to Witness Significant Growth

- The rising demand for natural gas has resulted in the discovery of new gas fields as well as the adoption of simple and low-cost transportation of natural gas exports via subsea (offshore) pipelines, which are anticipated to drive the offshore pipeline market.

- Global natural gas production was recorded at 4043.8 billion cubic meters in 2022. North America is the leading natural gas producer, accounting for about 1203.9 billion cubic meters, followed by the Middle East and Africa with 970.3 billion cubic meters. This is expected to drive the offshore pipeline market during the forecast period.

- In September 2022, EUROPIPE, located in Germany, was awarded by North American TC Energy (TCE) a contract to supply pipe for the Southeast Gateway Pipeline project in the Gulf of Mexico. TCE is constructing the USD 4.5 billion offshore gas pipeline in collaboration with the Mexican state-owned power utility Comision Federal de Electricidad (CFE) to ensure southeastern Mexico's electricity supply. The project was awarded to EUROPIPE, a joint company of Salzgitter Mannesmann and Aktien-Gesellschaft der Dillinger Huttenwerke, at the end of August. The project's scope involves supplying 265,000 metric tons of pipe (365 kilometers) with anti-corrosion coating.

- Additionally, in January 2023, Eni reported a significant new gas discovery at the Nargis-1 exploration well in the Nargis Offshore Area Concession off the coast of Egypt in the Eastern Mediterranean Sea. The Nargis-1 well was drilled in 1,014 feet (309 m) of water and encountered roughly 200 net feet (61 m) of Miocene and Oligocene gas-bearing sandstones. The discovery can be developed by taking advantage of Eni's current facilities.

- Furthermore, recent waves of cost reductions and key technological breakthroughs have allowed many oil and gas exploration and production companies to diversify into sustainable deepwater and ultra-deepwater developments.

- As a result, the offshore pipeline market is anticipated to expand rapidly in the near future. As a result of the preceding, the gas segment is anticipated to grow at a rapid pace during the forecast period.

North America is Expected to Dominate the Market

- During the forecast period, North America is anticipated to dominate the global offshore pipeline market. Several countries in the area are attempting to invest in offshore oil and gas exploration. During the forecast period, oil and gas pipeline infrastructure in countries such as the United States and Canada is anticipated to remain fully operational.

- With increased activity in the Gulf of Mexico, the offshore pipeline market in the United States is anticipated to expand significantly. The forthcoming new gas production projects are expected to significantly expand the region's subsea pipeline network.

- For instance, in January 2023, Talos Energy, headquartered in Houston, discovered commercial quantities of oil and natural gas in two deepwater discoveries in the United States Gulf of Mexico, which it intends to develop as subsea tie-backs to its Ram Powell tension-leg platform (TLP). According to the US player, 78 feet and 72 feet of net pay zone thickness were discovered in the main targets at Lime Rock and Venice, respectively, with excellent geologic qualities.

- As of December 2021, TC Energy Corp. and Mexican state power utility Comision Federal de Electricidad (CFE) were in talks to build a new offshore gas pipeline to supply the Yucatan Peninsula, which has faced chronic gas shortages due to stagnant domestic production. Also, Sempra's 3.25 million metric tons/year (mmty) Energia Costa Azul (ECA) liquefied natural gas (LNG) Phase 1 terminal reached a final investment decision in 2021. It is expected to start operation by 2024.

- Furthermore, technological advancements are anticipated to drive stable and robust growth in the Canadian pipeline business over the next several years. Pipelines are regarded as the safest, most dependable, and most cost-effective way of meeting the energy needs of high-value end-user markets in the Canadian oil and gas sector.

- As a result, North America is anticipated to be the major region in the offshore pipeline market during the forecast period, owing to increased investment in oil and gas projects.

Offshore Pipeline Industry Overview

The offshore pipeline market is moderately fragmented. Some of the major players in the market (in no particular order) include Saipem SpA, L&T Hydrocarbon Engineering Limited, McDermott International Ltd., Allseas Group SA, and China Petroleum Pipeline Engineering Co. Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Crude Oil Historic Trend and Production Forecast in million barrels per day, Global, until 2029

- 4.4 Brent Crude Oil and Henry Hub Spot Prices, until 2023

- 4.5 Natural Gas Historic Trend and Production Forecast in billion cubic feet per day (bcf/d), Global, until 2029

- 4.6 Recent Trends and Developments

- 4.7 Government Policies and Regulations

- 4.8 Market Dynamics

- 4.8.1 Drivers

- 4.8.1.1 Increasing Demand for Crude Oil and Natural Gas

- 4.8.1.2 Growing Emphasis on Safe, Economic, and Reliable Connectivity for Oil and Gas Exploration

- 4.8.2 Restraints

- 4.8.2.1 Technical Challenges Like Construction, Deep-Water Challenges, and High Construction Costs

- 4.8.1 Drivers

- 4.9 Supply Chain Analysis

- 4.10 Porter's Five Forces Analysis

- 4.10.1 Bargaining Power of Suppliers

- 4.10.2 Bargaining Power of Consumers

- 4.10.3 Threat of New Entrants

- 4.10.4 Threat of Substitute Products and Services

- 4.10.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Oil

- 5.1.2 Gas

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2029 (for regions only)})

- 5.2.1 North America

- 5.2.1.1 United States of America

- 5.2.1.2 Canada

- 5.2.1.3 Rest of the North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Norway

- 5.2.2.6 Rest of the Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 South Korea

- 5.2.3.4 Rest of the Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of the South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Iran

- 5.2.5.2 Qatar

- 5.2.5.3 Saudi Arabia

- 5.2.5.4 United Arab Emirates

- 5.2.5.5 Rest of the Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Saipem SpA

- 6.3.2 L&T Hydrocarbon Engineering Limited

- 6.3.3 McDermott International Ltd.

- 6.3.4 Allseas Group SA

- 6.3.5 Bourbon Corporation SA

- 6.3.6 Enbridge Inc.

- 6.3.7 Subsea 7 SA

- 6.3.8 Genesis Energy LP

- 6.3.9 China Petroleum Pipeline Engineering Co. Ltd.

- 6.3.10 Atteris LLC

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Oil and Gas Imports in the European and Asia-Pacific Regions Through Subsea (offshore) Pipelines