|

市場調查報告書

商品編碼

1651052

歐洲停車場:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Europe Car Parking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

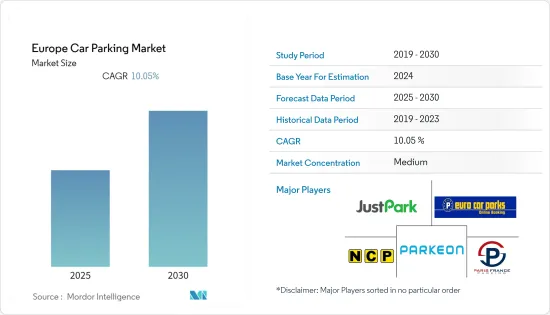

預測期內,歐洲停車市場預計將以 10.05% 的複合年成長率成長。

主要亮點

- 預計整個歐洲的停車費將大幅上漲。駕駛者支付停車費的意願大幅提升,但同時,平均停車時間卻減少了。從歷史上看,停車費的上漲速度遠高於通貨膨脹率。例如,在德國,短期停車場的停車費在五年內平均上漲了2.9%。英國成長了 3.6%,挪威成長了 4.6%。

- 該市場還受益於技術改進以及地方政府和技術供應商之間的合作。例如,2019年9月,P2P汽車租賃公司、機場汽車共享經濟的先驅Car & Away透露,它已從英國私人投資者那裡籌集了350萬英鎊的資金。這項投資預計將有助於該公司擴大在英國的業務,並進一步實現打造全球最聰明的P2P(P2P) 汽車共享社群的目標。

- 由於新冠疫情導致停車場關閉,歐洲停車場業務受到嚴重打擊。需求下降是由於交通堵塞緩解和汽車銷售下降等因素造成的。不過,一旦解除封鎖,需求預計會增加,而且由於對公共交通安全的擔憂,汽車銷售預計也會上升。疫情過後,停車管理可能會進一步發展,並更加重視人身安全、資訊安全和人們的福祉。

歐洲停車市場的趨勢

技術進步推動市場成長

- 車輛、基礎設施和公共交通正在迅速與智慧技術結合,以提高機動性和安全性。道路上安裝了感測器,可以追蹤沿路汽車和行動電話的資料,從而了解交通流模式、道路封閉、道路工程、道路狀況等。

- 物聯網 (IoT)、停車感測器和電子付款方式等技術進步也支持了市場的成長。公司希望透過提供更好的客戶體驗和便利的停車服務來獲得競爭優勢。利用即時資料和分析,企業可以分配停車位、控制存取權限並減少管理停車開銷。

- 此外,停車管理讓顧客感到安心,因為路邊停車並不是最安全的選擇。然而,停車場管理仍然可以增加顧客數量和顧客的停留時間。

- 此外,透過最佳化可用的停車位,停車管理技術有助於提高整體收益。同時,其在降低整體營運支出(OPEX)和資本支出(CAPEX)方面發揮關鍵作用。世界各國政府都在努力為其民眾提供充足的停車位,以緩解交通擁擠。

汽車購買量增加

- 儘管過去幾個月歐洲新車註冊量整體成長率持續下降,但新車購買量仍然相當強勁。根據JATO Dynamics對歐洲27個市場的統計,2021年3月歐洲(包括歐盟、歐洲自由貿易聯盟國家和英國)新車註冊量為1,116,419輛,較去年同期下降19%。儘管 2020 年 3 月至 2019 年 3 月期間註冊量增加了 33%,但市場仍未能恢復到疫情前的水平,比 2019 年 3 月低了 37%。

- 2022年3月,歐洲新乘用車註冊量下降了五分之一,而2022年第一季近期汽車銷量下降了11%,至1985年以來的最低水準。 2022年3月,電動車在歐洲的市佔率增加,再次超過柴油車。 2022年3月,特斯拉Model 3是歐洲最暢銷的轎車和最暢銷的電池電動車,標緻208是第一季歐洲最受歡迎的汽車。

歐洲停車產業概況

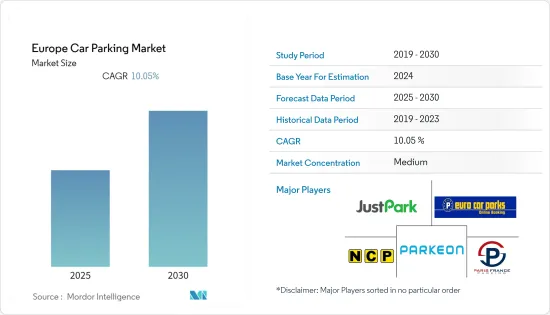

歐洲停車市場相當分散,許多參與者佔據相當大的市場佔有率。停車市場的知名參與者包括 JustPark、Parkeon SA、Park Rite 和 Urbiotica。

- 2021 年 9 月-JustPark 和 Octopus Energy 建立充電夥伴關係。目的是為缺乏家庭停車場或充電設施的英國車隊駕駛提供更好的都市區充電機會——這是電動車普及的一大障礙。

- 2020 年 6 月,Urbiotica 宣布收購 Worldsensing 的停車管理解決方案 Fastprk。 Fastprk 的加入完善了 Urbiotica 的智慧停車解決方案產品組合,鞏固了其在該領域的領導地位,並藉助 Fastprk 技術提供的互補雙重檢測和 LoRa通訊協定開闢了新的市場機會。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業相關人員分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者和消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 國內付款環境的演變

- 與日本無現金交易擴張相關的主要市場趨勢

- COVID-19 對該國付款市場的影響

第5章 市場動態

- 市場促進因素

- 汽車數量的穩定成長引發了人們對停車位安全的擔憂

- 技術進步以及理事會和技術提供者之間的持續合作

- 市場挑戰

- 成本和基礎設施問題

- 歐洲停車產業的主要法規和標準

- 關鍵用案例和使用案例分析

- 歐洲停車產業主要人口趨勢與模式分析

- 歐洲現金替代與汽車購買量成長分析

第6章 市場細分

- 按應用領域

- 停車場營運商/停車場管理公司

- 基礎設施提供者(硬體和軟體)

- P2P 停車應用程式提供者

- 按國家

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲國家

第7章 競爭格局

- 公司簡介

- JustPark

- Euro Car Parks Limited

- National Car Parks Limited(NCP)

- NSL Limited, a Marston Holdings Company

- ParkingEye Ltd

- Parkeon SA

- Indigo Group

- Paris France Parking

- Park Rite

- RFC

- IPairc

- Munster Car Park Services Ltd

- Nationwide Controlled Parking Systems

- Tazbell

- Urbiotica

第8章投資分析

第9章:未來市場展望

簡介目錄

Product Code: 91163

The Europe Car Parking Market is expected to register a CAGR of 10.05% during the forecast period.

Key Highlights

- It is expected to see significant growth in prices/parking charges across all European countries. The willingness of car users to pay for parking is increasing significantly - while the average duration of use is decreasing. In the past, parking charges have increased at a rate well above the inflation rate. For example, in Germany, parking charges for short-stay car parks increased by an average of 2.9 % in five years. In the UK, they increased by 3.6 %, and in Norway by 4.6%.

- The market also benefits from technological improvements and collaborations between local governments and technology suppliers. For example, in September 2019, Car & Away, the peer-to-peer car rental company and pioneer of the airport-based car-sharing economy, revealed that it had raised GBP 3.5 million in capital from private investors in the United Kingdom. This investment is expected to help the company expand in the United Kingdom and, further, it's objective to build the world's smartest peer-to-peer (P2P) car-sharing community.

- The European car parking business has been harmed as a result of the lockdown imposed due to the spread of the coronavirus. Reduced demand is due to a sharp reduction in traffic congestion and a decrease in car sales, among other factors. However, after the lockdown is lifted, demand is projected to rise, and vehicle sales are expected to increase due to concerns about public transportation safety. Post-pandemic car parking management will likely grow, focusing more on physical safety, information security, and people's perceived well-being.

Europe Car Parking Market Trends

Technological Advancements to Boost the Market Growth

- Vehicles, infrastructure, and public transportation are rapidly linked with smart technology to improve mobility and safety. Streets are equipped with sensors that track data on the roads and through cars and mobile phones to acquire insight into traffic flow patterns, roadblocks, roadwork, and road conditions, among other things.

- Technological advancements such as the Internet of Things (IoT), parking sensors, and electronic payment methods also support the market's growth. Firms are trying to deliver an enhanced customer experience and offer hassle-free parking that can help them gain a competitive advantage over others. With the help of real-time data and analytics, organizations can allocate spaces, provide access control, and reduce administrative overhead spent on parking.

- Additionally, car parking management gives customers a sense of security as parking on the street is not considered the safest option. Still, with the car parking management, there can be an increase in the number of customers and the time they spend at any outlet.

- Furthermore, by optimizing vacant parking spaces, parking management technologies assist in raising overall revenue. Simultaneously, they play a critical role in lowering overall operational and capital expenditures (OPEX and CAPEX) (CAPEX). All governments worldwide attempt to reduce traffic congestion by providing enough parking spots for their population.

Increase in purchase of Cars

- Though the overall growth rate of new car registrations has kept declining over the past few months in Europe, there is a significant number of new purchases. Total new passenger vehicle registrations in Europe (including the EU, EFTA, and the UK) were down 19% in March 2021, according to JATO Dynamics statistics for 27 European markets, with 1,116,419 new passenger cars registered. While registrations grew by 33% from March 2020 to March 2019, the market has failed to return to pre-pandemic levels, falling 37% short of March 2019.

- In March 2022, new passenger vehicle registrations in Europe fell by a fifth, with recent automobile sales falling 11% in the first quarter of 2022 to the lowest levels since 1985. EVs increased market share in Europe in March 2022, outselling diesel vehicles once more. In March 2022, the Tesla Model 3 was Europe's best-selling car model and best-selling battery-electric vehicle, but the Peugeot 208 was Europe's favorite automobile during the first quarter.

Europe Car Parking Industry Overview

The Europe Car Parking Market is moderately fragmented, with many players accounting for significant amounts of shares in the market. Some of the prominent companies in the car parking market are JustPark, Parkeon S.A, Park Rite, Urbiotica, and others.

- September 2021 - JustPark and Octopus Energy launch charging cooperation. They aim to help provide better urban charging opportunities for fleet drivers in the UK who do not have access to their parking and charging opportunities at home, which is suspected to be a large hurdle for EV adoption.

- In June 2020, Urbiotica announced the acquisition of Fastprk, a parking management solution from Worldsensing. The addition of Fastprk completes Urbiotica's portfolio of smart parking solutions, strengthening its leadership position in the sector and opening up new opportunities to penetrate new markets due to the complementarity that Fastprk's technology offers with its dual detection and LoRa communication protocol.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness-Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Evolution of the payments landscape in the country

- 4.5 Key market trends pertaining to the growth of cashless transaction in the country

- 4.6 Impact of COVID-19 on the payments market in the country

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Steady rise in vehicles leading to concerns over availability of parking space

- 5.1.2 Technological advancements and ongoing collaborations between local councils and technology providers

- 5.2 Market Challenges

- 5.2.1 Cost & Infrastructural Concerns

- 5.3 Key Regulations and Standards in the Europe Car Parking Industry

- 5.4 Analysis of major case studies and use-cases

- 5.5 Analysis of key demographic trends and patterns related to car parking industry in Europe

- 5.6 Analysis of cash displacement and rise of purchase of vehicles in Europe

6 Market Segmentation

- 6.1 By Application Area

- 6.1.1 Parking Operators/Parking Management Companies

- 6.1.2 Infrastructure Providers (Hardware & Software)

- 6.1.3 P2P Parking Apps Provider

- 6.2 By Country

- 6.2.1 UK

- 6.2.2 Germany

- 6.2.3 France

- 6.2.4 Italy

- 6.2.5 Rest of Europe

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 JustPark

- 7.1.2 Euro Car Parks Limited

- 7.1.3 National Car Parks Limited (NCP)

- 7.1.4 NSL Limited, a Marston Holdings Company

- 7.1.5 ParkingEye Ltd

- 7.1.6 Parkeon S.A

- 7.1.7 Indigo Group

- 7.1.8 Paris France Parking

- 7.1.9 Park Rite

- 7.1.10 RFC

- 7.1.11 IPairc

- 7.1.12 Munster Car Park Services Ltd

- 7.1.13 Nationwide Controlled Parking Systems

- 7.1.14 Tazbell

- 7.1.15 Urbiotica

8 Investment Analysis

9 Future Outlook of the Market

02-2729-4219

+886-2-2729-4219