|

市場調查報告書

商品編碼

1651058

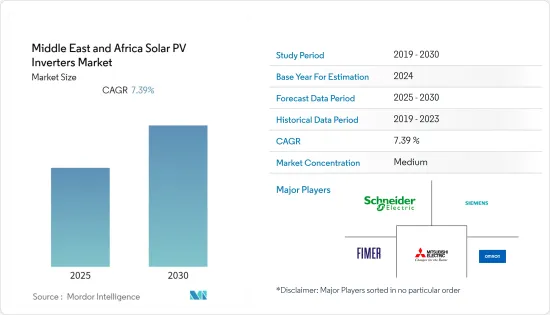

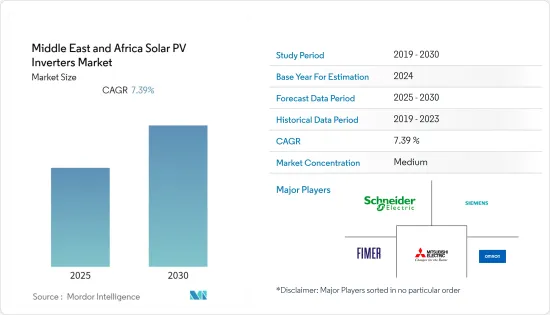

中東和非洲太陽能逆變器市場:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Middle East and Africa Solar PV Inverters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預計預測期內中東和非洲太陽能逆變器市場的複合年成長率將達到 7.39%。

2020年,新冠疫情並未對市場產生重大影響。目前市場已恢復至疫情前的水準。

主要亮點

- 從長遠來看,隨著對太陽能的需求不斷增加以及投資和雄心勃勃的太陽能目標,太陽能逆變器市場預計將蓬勃發展。

- 然而,預計串列型逆變器缺乏擴充性等技術缺陷將在預測期內阻礙太陽能光電逆變器的成長。

- 技術進步和產品創新可能會在未來幾年為市場成長創造機會。

- 預計阿拉伯聯合大公國將佔太陽能需求的大部分,並有望在預測期內成為最大的市場。

中東和非洲太陽能逆變器市場趨勢

集中式逆變器市場預計將佔據市場主導地位

- 關鍵的電網饋線是中央逆變器。它常用於額定輸出功率超過100kWp的太陽能發電系統。通常使用落地式或地面式逆變器將從太陽能電池陣列收集的直流電轉換為交流電,以用於並聯型。這些設備可在室內或室外使用,容量範圍從約 50kW 到 1MW。

- 而且集中式逆變器的逆變器數量較少,也較容易管理。此逆變器整合度高、功率密度高、成本低、保護功能齊全,電站安全性高。

- 中央逆變器用於公共事業規模的應用,因此必須產生與其所使用的電網相同的電壓和頻率。由於世界各地的電網標準不同,允許製造商自訂這些參數以滿足相數的特定要求,而生產的集中式逆變器大部分都是三相逆變器。

- 例如,2022 年 6 月,1.5 吉瓦太陽能發電廠 Sdea 太陽能發電計劃預計將成為世界上最大的單一合約太陽能發電設施之一,並為 185,000 戶家庭生產足夠的電力,同時每年減少排放約 290 萬噸。輸電、逆變器和輸電變電站也將成為計劃的一部分。

- 2021年中東地區太陽能發電總量為15.2兆瓦時,年增率為20.4%。由於中央逆變器用於將太陽能轉換為可用電能,隨著即將到來的公共事業規模計劃和太陽能發電的增加,中央逆變器部分預計將在預測期內主導市場成長。

阿拉伯聯合大公國可能會主導該市場。

- 阿拉伯聯合大公國是主要的石油和天然氣生產國,但過去幾年也實施了多個大型可再生能源計劃。因此,阿拉伯聯合大公國正在引領該地區向可再生能源,特別是太陽能領域的轉型。阿拉伯聯合大公國在全國實施可再生能源計劃方面一直處於領先地位。

- 例如,阿拉伯聯合大公國正在阿布達比建造全球最大的太陽能發電廠,這將使阿布達比的太陽能發電能力提升至約3.2千兆瓦。該太陽能發電廠將全部區域約16萬戶家庭提供電力。

- 此外,阿拉伯聯合大公國2050能源策略的目標是到2050年將清潔能源在該國整體能源結構中的佔比提高到50%,從而節省整體能源成本約1,900億美元。這為預測期內的太陽能逆變器市場創造了巨大的商機。

- 2021年,阿拉伯聯合大公國的太陽能發電總量約為5.1兆瓦時。憑藉13%的年成長率和未來的戰略計劃,太陽能發電工程的成長預計將在預測期內推動光伏逆變器市場的發展。

中東和非洲光伏逆變器產業概況

太陽能逆變器市場中等分散。市場的主要企業(不分先後順序)包括 FIMER SpA、施耐德電氣 SE、西門子股份公司、三菱電機和OMRON。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按逆變器類型

- 集中式逆變器

- 串列型逆變器

- 微型逆變器

- 按應用

- 住宅

- 商業和工業(C&I)

- 公共事業規模

- 按地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 以色列

- 其他中東和非洲地區

第6章 競爭格局

- 合併和收購

- 主要企業策略

- 公司簡介

- Omron Corporation

- Mitsubishi Electric Corporation

- FIMER SpA

- Siemens AG

- Schneider Electric SE

- Delta Energy Systems Inc.

- Huawei Technologies Co. Ltd

- Enphase Energy Inc.

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 93273

The Middle East and Africa Solar PV Inverters Market is expected to register a CAGR of 7.39% during the forecast period.

The COVID-19 pandemic didn't significantly impact the market in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, the market for solar PV inverters is anticipated to develop, along with investments and ambitious solar energy targets, due to the rising demand for solar electricity.

- On the other hand, technological drawback, such as the lack of expandability of string inverters, is expected to hamper the growth of solar PV inverters during the forecast period.

- Technological advancement and product innovation are likely to create opportunities for the market to grow in the upcoming years.

- United Arab Emirates is expected to be the largest market during the forecast period, with the majority of the demand for solar energy.

MEA Solar PV Inverters Market Trends

Central Inverters Segment is Expected to Dominate the Market.

- A significant grid feeder is a central inverter. It is frequently employed in solar photovoltaic systems with rated outputs of more than 100 kWp. DC power gathered from a solar array is often converted into AC power for grid connection using floor or ground-mounted inverters. These gadgets can be employed indoors or outdoors and have capacities ranging from about 50kW to 1MW.

- Moreover, a central inverter has less number of inverters, which is easy to manage. The inverter has high integration, high power density, low cost, complete protection functions, and high power station safety.

- As central inverters are used for utility-scale applications, they should produce the same voltage and frequency as that of the electric grid where they are used. As there are a lot of different electric grid standards worldwide, manufacturers are allowed to customize these parameters to match the specific requirements in terms of the number of phases; most central inverters manufactured are three-phase inverters.

- For instance, In June 2022, the Sudair Solar Power project, a 1.5GW photovoltaic (PV) solar farm, was anticipated to be one of the most extensive single-contracted solar PV facilities in the world, producing enough electricity to run 185,000 homes while reducing annual emissions by around 2.9 million tonnes. Transformers, inverters, and an electrical transmission substation will be part of the project.

- In 2021, the total Middle East solar generation accounted for 15.2 terawatt-hours with an annual growth rate of 20.4%; solar generation is expected to grow in the future. As the central inverters are used to convert solar energy into usable electricity, thus with the upcoming utility-scale projects and increasing solar generation the central inverters segment is expected to dominate the market growth during the forecast period.

United Arab Emirates Likely to Dominate the Market.

- United Arab Emirates is a major oil and gas producer, but it has undertaken several sizable renewable energy projects over the past several years. As a result, the nation is leading the region's transition to renewable energy, especially in the solar sector. It has become one of the leaders in executing renewable energy projects around the nation.

- For instance, United Arab Emirates is building the world's largest solar power plant in Abu Dhabi, which will increase Abu Dhabi's solar power capacity to approximately 3.2 gigawatts. This solar power plant will provide electricity to approximately 160,000 households across the region.

- Moreover, the 'UAE Energy Strategy 2050' targets to increase the contribution of clean energy to the overall national energy mix of the country to 50% by 2050, resulting in savings of approximately USD 190 billion of the overall energy costs. This provides significant opportunities for the solar PV inverters market in the forecast period.

- In 2021, United Arab Emirates' total solar generation was around 5.1 terawatt-hours. With an annual growth rate of 13 % and upcoming strategic plans, solar photovoltaic projects are expected to grow, which, in turn, is expected to drive the PV inverters market in the forecast period.

MEA Solar PV Inverters Industry Overview

The solar PV inverters market is moderately fragmented. Some of the major players in the market (in no particular order) include FIMER SpA, Schneider Electric SE, Siemens AG, Mitsubishi Electric Corporation, and Omron Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD Billion Till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Inverter Type

- 5.1.1 Central Inverters

- 5.1.2 String Inverters

- 5.1.3 Micro Inverters

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial (C&I)

- 5.2.3 Utility-scale

- 5.3 By Geography

- 5.3.1 UAE

- 5.3.2 Saudi Arabia

- 5.3.3 Israel

- 5.3.4 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Omron Corporation

- 6.3.2 Mitsubishi Electric Corporation

- 6.3.3 FIMER SpA

- 6.3.4 Siemens AG

- 6.3.5 Schneider Electric SE

- 6.3.6 Delta Energy Systems Inc.

- 6.3.7 Huawei Technologies Co. Ltd

- 6.3.8 Enphase Energy Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219