|

市場調查報告書

商品編碼

1651060

蒸氣渦輪MRO-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Steam Turbine MRO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

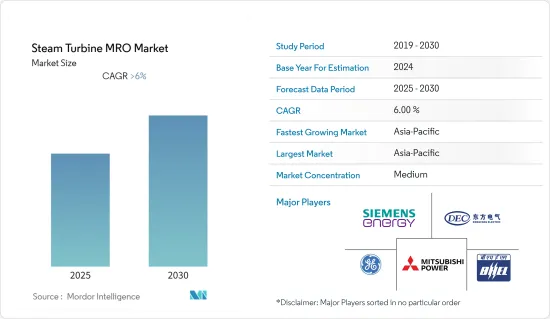

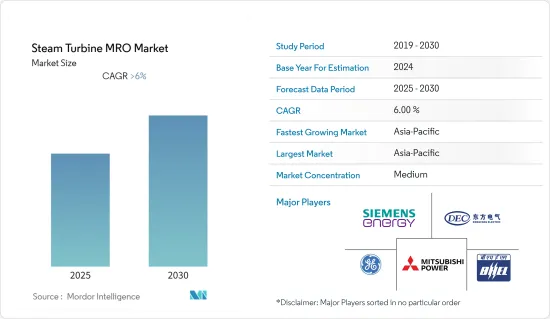

預測期內,蒸氣渦輪MRO 市場預計將以超過 6% 的複合年成長率成長

關鍵亮點

- 從中期來看,即將建成的天然氣複合迴圈和燃煤發電廠預計將引領市場。

- 然而,預計預測期內可再生能源的不斷增加的應用將阻礙市場的成長。

- 一種以釷為主要燃料的新型火力發電廠正在研究中。釷產生的廢棄物比鈾少,而且價格更便宜,更為豐富,因此該領域的進步可能帶來火力發電廠的復興。因此,預計這將為蒸氣渦輪服務供應商進入該市場創造重大機會。

- 預計亞太地區將主導市場,大部分需求來自中國和印度等國家。

蒸氣渦輪MRO 市場趨勢

維修部門顯著成長

- 為了確保電力設備正常運轉,公司和發電廠營運商需要進行定期維護服務,包括檢查、零件更換、診斷和維修。從而提高了運作性能,確保了設備的長期穩定運作。

- 許多公用事業公司和獨立電力生產商都簽署了長期服務協議 (LTSA) 來滿足其工廠的需求。這些合約涵蓋了廣泛的服務範圍,包括車隊管理、庫存管理、維護、維修和大修,以及燃氣渦輪機的日常技術支援。

- 由於其無污染燃料特性,幾乎所有主要國家對其的需求都在增加。然而,僅僅部署燃氣渦輪機並不能保證長期運作的靈活性,這正是 MRO 服務發揮作用的地方。因此,許多國家在工廠啟動時或運作一定時期後開始採用維護服務。

- 根據全球能源監測數據顯示,截至2022年,美國燃氣發電廠總數為987座,俄羅斯為177座,中國(當地)為163座。

- 蒸氣渦輪用於各種規模的多種應用中,以驅動泵浦、壓縮機和發電機等設備。定期預防性維護對於確保可靠、高效的運作至關重要。法國一家發電廠聘請蘇爾壽對其渦輪機和連接變速箱和泵浦進行大修,使大規模停電變得更具成本效益和更易於管理。

- 許多國家都希望利用天然氣發電,並即將關閉燃煤發電廠。例如,在美國,截至 2021 年,正在新開發容量約 3,230 萬千瓦的天然氣發電廠,目標是在 2025 年投入運作。其中,在建1420萬千瓦,前期建設340萬千瓦,待授權1470萬千瓦。越來越多的天然氣發電廠需要蒸氣渦輪將蒸氣的熱能轉換為機械能。蒸氣渦輪需要定期維護以提高其效率,這將推動市場成長。

- 由於上述情況和最近的發展,維護部門預計將在未來幾年引領蒸氣渦輪MRO 市場。

亞太地區可望主導市場

- 亞太地區是蒸氣渦輪最大的市場,預計未來幾年對維護、維修、大修和其他服務的需求將很高。

- 隨著全球人均用電量的不斷增加,以及孟加拉 Hurrahri燃煤發電廠和印度 Patratu 超級電廠等燃煤發電廠的規劃,蒸氣渦輪MRO 服務在不久的將來可能會繼續成長。

- 渦輪機製造商建議使用者在前兩年每三個月檢查一次渦輪機,之後每年檢查一次。此類合約有助於降低整體成本,並透過使用性能更好的零件來提高燃氣渦輪機的功率。預計這將導致對維護、修理和大修服務的需求增加。

- 中國廣泛使用蒸氣渦輪,正在建造世界上數量最多的火力發電廠。為滿足電力需求,阜陽電廠、華電萊州電廠等超超臨界燃煤電廠正在興建中。

- 截至 2021 年,日本約有 22 座燃煤電廠在建,其中包括常陸那珂共同發電電廠和名平電廠等預計供電量超過 1,000 兆瓦的電廠,而且這些電廠很可能在不久的將來進行維護和維修。

- 預計預測期內亞太地區將引領蒸氣渦輪維護、維修和大修 (MRO) 市場。這是由於上述和最近的變化。

蒸氣渦輪MRO 產業概況

蒸氣渦輪MRO 市場有適度細分。市場的主要企業(不分先後順序)包括西門子能源股份公司、通用電氣公司、東方汽輪機股份有限公司、印度重型電氣有限公司和三菱電力亞太私人有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2028 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

第 5 章 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第6章 市場細分

- 服務類型

- 維護

- 維修

- 大修

- 備用零件

- 服務供應商類型

- OEM

- 獨立服務供應商

- 內部

- 最終用戶產業

- 力量

- 石油和天然氣

- 其他

- 植物燃料

- 煤炭

- 天然氣

- 核能

- 容量

- 300MW以下

- 300~599MW

- 超過600MW

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 北美洲

第7章 競爭格局

- 合併、收購、合作及合資

- 主要企業策略

- 公司簡介

- Siemens Energy AG

- General Electric Company

- Dongfang Turbine Company Limited

- Bharat Heavy Electricals Limited

- Mitsubishi Power Asia Pacific Pte. Ltd.

- Shanghai Electric

- Harbin Electric Company Limited

- EllIoTt Group

第8章 市場機會與未來趨勢

簡介目錄

Product Code: 500047

The Steam Turbine MRO Market is expected to register a CAGR of greater than 6% during the forecast period.

Key Highlights

- Over the medium term, the market is expected to be driven by upcoming natural gas combined-cycle plants and thermal coal plants.

- On the other hand, increasing adoption of renewable energy is expected to hinder market growth during the forecast period.

- Nevertheless, a new thermal plant is under study that uses thorium as its primary fuel. The progress in this field can lead to a renaissance in thermal power plants as thorium creates much less waste, is cheaper, and is more abundant than uranium. This, in turn, is expected to create a significant opportunity for steam turbine service providers to tap into this market.

- Asia-Pacific is expected to dominate the market, with most of the demand coming from countries such as China and India.

Steam Turbine MRO Market Trends

Maintenance Segment to Witness Significant Growth

- To make sure that power equipment works well, companies and power plant operators must do regular maintenance services like inspections, part replacements, diagnosis, and repairs.This improves operational performance and ensures the long-term, stable operation of the facility.

- A lot of power companies and independent power producers sign long-term service agreements (LTSAs) to meet the needs of their plants. These agreements cover a wide range of services, including fleet management, inventory management, maintenance, repair, and overhaul, as well as day-to-day technical support for gas turbines.

- Due to the properties of clean fuel, its demand is growing in almost every major country. However, only deploying gas turbines does not guarantee any flexibility in operations for the long term, and here, MRO services come into the picture. Thus, many countries have started using maintenance services, either at the beginning of the plant's operation or after crossing a specific period.

- According to the Global Energy Monitor, as of 2022, the total number of gas power stations includes the United States with 987, Russia with 177, and China (Mainland) with 163 power plants.

- Going ahead, steam turbines are used in many applications on various scales to drive equipment such as pumps, compressors, and generators. Periodic, preventive maintenance is crucial to ensuring reliable and efficient operation. For a power generation site in France, a significant outage was made more cost-effective and easier to manage by using Sulzer to deliver a major overhaul on the turbine and the gearbox and pump connected to it.

- Many countries look forward to generating electricity from natural gas and are on the verge of closing coal-fired power plants. For example, in the U.S., as of 2021, around 32.3 GW of new natural gas-fired power plants were in advanced stages of development and were set to start up in 2025. Out of these, 14.2 GW are under construction, 3.4 GW are in pre-construction, and 14.7 GW have a status of advanced permitting. The growing natural gas power plants will require steam turbines to convert the heat energy of steam into mechanical energy. Since the steam turbine requires maintenance regularly to offer efficiency, this culminates in the market's growth.

- Due to what has been said above and what has happened recently, the maintenance segment is expected to lead the steam turbine MRO market over the next few years.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is the biggest market for steam turbines, and over the next few years, there will be a lot of demand for services like maintenance, repair, and overhauling.

- As the amount of electricity used per person around the world goes up, planned thermal plants like the Phulari Coal Powered Plant in Bangladesh and the Patratu Super-Thermal Power Plant (coal) in India are likely to keep steam turbine MRO services growing in the near future.

- Manufacturers of turbines recommend that users check the turbines every three months for the first two years, and then every year after that.Such agreements help bring down overall costs and make gas turbines more powerful by using parts with better performance.This is expected to increase the demand for maintenance, repair, and overhaul services.

- China, which uses a lot of steam turbines, is building the most thermal power plants of any country in the world. Ultra-supercritical coal plants like Fuyang Power Station and Huadian Laizhou Power Station are being built to match the electricity demand.

- As of 2021, around 22 coal-powered plants were under construction in Japan, including power plants like Hitachinaka Kyodo power plant and Nakoso power plant, which are expected to provide more than 1000 MW of electricity and are likely to get maintained and repaired in the near future, which in turn culminates in the growth of the market.

- Asia-Pacific is expected to lead the market for steam turbine maintenance, repair, and overhaul (MRO) during the forecast period. This is because of the things mentioned above and the recent changes.

Steam Turbine MRO Industry Overview

The steam turbine MRO market is moderately fragmented. Some of the key players in the market (in particular order) include Siemens Energy AG, General Electric Company, Dongfang Turbine Company Limited, Bharat Heavy Electricals Limited, and Mitsubishi Power Asia Pacific Pte. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

5 Porter's Five Forces Analysis

- 5.1 Bargaining Power of Suppliers

- 5.2 Bargaining Power of Consumers

- 5.3 Threat of New Entrants

- 5.4 Threat of Substitute Products and Services

- 5.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 Type of Service

- 6.1.1 Maintenance

- 6.1.2 Repair

- 6.1.3 Overhaul

- 6.1.4 Spare Parts

- 6.2 Type of Service Provider

- 6.2.1 Original Equipment Manufacturers

- 6.2.2 Independent Service Providers

- 6.2.3 In-House

- 6.3 End-User Industry

- 6.3.1 Power

- 6.3.2 Oil & Gas

- 6.3.3 Other End-User Industries

- 6.4 Plant Fuel

- 6.4.1 Coal

- 6.4.2 Natural Gas

- 6.4.3 Nuclear

- 6.5 Capacity

- 6.5.1 less than 300 MW

- 6.5.2 300 MW to 599 MW

- 6.5.3 600 MW and above

- 6.6 Geography

- 6.6.1 North America

- 6.6.1.1 United States of America

- 6.6.1.2 Canada

- 6.6.1.3 Rest of North America

- 6.6.2 Europe

- 6.6.2.1 Germany

- 6.6.2.2 United Kingdom

- 6.6.2.3 France

- 6.6.2.4 Italy

- 6.6.2.5 Rest of Europe

- 6.6.3 Asia-Pacific

- 6.6.3.1 China

- 6.6.3.2 India

- 6.6.3.3 Japan

- 6.6.3.4 Rest of Asia-Pacific

- 6.6.4 South America

- 6.6.4.1 Brazil

- 6.6.4.2 Argentina

- 6.6.4.3 Rest of South America

- 6.6.5 Middle-East and Africa

- 6.6.5.1 Saudi Arabia

- 6.6.5.2 United Arab Emirates

- 6.6.5.3 South Africa

- 6.6.5.4 Rest of Middle East & Africa

- 6.6.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Mergers, Acquisitions, Collaboration, and Joint Ventures

- 7.2 Strategies Adopted by Key Players

- 7.3 Company Profiles

- 7.3.1 Siemens Energy AG

- 7.3.2 General Electric Company

- 7.3.3 Dongfang Turbine Company Limited

- 7.3.4 Bharat Heavy Electricals Limited

- 7.3.5 Mitsubishi Power Asia Pacific Pte. Ltd.

- 7.3.6 Shanghai Electric

- 7.3.7 Harbin Electric Company Limited

- 7.3.8 Elliott Group

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219