|

市場調查報告書

商品編碼

1683094

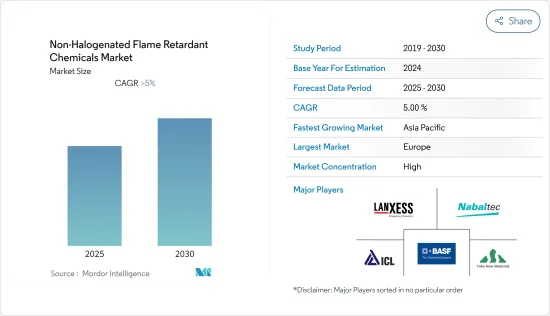

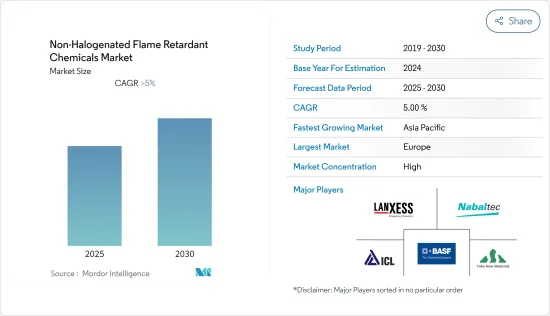

非鹵化阻燃劑市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Non-Halogenated Flame Retardant Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預測期內,非鹵阻燃劑市場預計將以超過 5% 的複合年成長率成長

關鍵亮點

- 預計在預測期內,對阻燃劑(尤其是溴化阻燃劑)的環境和健康問題也將推動市場發展。

- 禁止使用鹵素阻燃劑的更嚴格的立法似乎是未來的機會。

- 預計歐洲將在全球市場佔據主導地位。不過,預計亞太地區在預測期內的成長速度最快。

無鹵阻燃劑的市場趨勢

建築業的需求不斷成長

- 家庭火災是造成人員傷亡的主要原因之一。由於嚴格的消防安全法規,建築材料和產品中使用非鹵阻燃劑的主要原因是。在建築物中,阻燃劑主要用於結構隔熱材料。住宅和其他建築物中使用隔熱材料來保持舒適的溫度並節省能源。

- 主要隔熱材料包括聚苯乙烯泡沫板和硬質聚氨酯泡棉板。此外,非鹵化阻燃劑在聚烯泡沫中有著廣泛的應用。聚烯泡沫主要用於建築物的暖通空調應用、隔音和管道隔熱材料。

- 在全球範圍內,各種防火標準正在推動無鹵阻燃劑市場的發展。由於對使用阻燃劑的環境問題的日益關注,非鹵化阻燃劑的應用顯著增加。

- 磷基阻燃劑是主要用於聚氨酯發泡體,尤其是液體材料的非鹵素阻燃劑。硬質聚氨酯泡沫中使用的阻燃劑有三種形式:添加型液體阻燃劑、反應型液體阻燃劑和固體阻燃劑。

- 全球建築業正在健康成長,亞太地區和中東及北非地區由於市場機會眾多、住宅需求不斷增加以及人口不斷成長,對建築業的投資巨大。

- 因此,預計所有上述因素都將在預測期內推動對非鹵阻燃劑的需求。

歐洲主導市場

- 預計歐洲將主導全球市場。德國經濟是歐洲最大、世界第五大經濟體。

- 德國的電子產業規模位居歐洲第一、世界第五。電氣和電子產業佔德國工業總產值的 10% 以上,佔國內生產總值) 的 3% 左右。此外,電氣和電子產業佔德國總直接投資的23%左右。

- 德國汽車工業佔德國工業總收益的20%左右。德國約佔歐洲乘用車產量的30%。全球前100家汽車供應商中有16家位於德國。

- 德國擁有世界一流的研發基礎設施和完整的產業價值鏈整合,汽車產業環境十分完善。這使得公司能夠開發和採用最尖端科技。德國也擁有歐洲最多的OEM工廠,41個組裝和引擎生產廠佔歐洲汽車總產量的三分之一。

- 過去二十年,德國航太業經歷了長足的發展。德國聯邦經濟和能源部將航太工業列為德國的重點產業,具有高成長率和強大的工業核心。

- 由於上述所有因素,預計預測期內該地區的非鹵化阻燃劑市場將會成長。

無鹵阻燃劑產業概況

全球非鹵阻燃化學品市場正在整合,五大主要企業佔據全球市場的巨大佔有率。主要企業包括 Nabaltec AG、Huber Engineered Materials、 BASF SE、ICL 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 關於溴化阻燃劑和其他阻燃劑的環境和健康問題

- 亞太地區基礎建設活動活性化

- 消費性電子電氣製造業成長

- 限制因素

- 氫氧化物不適合高溫應用

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 原料分析

- 監理政策分析

第5章 市場區隔

- 類型

- 無機

- 氫氧化鋁

- 氫氧化鎂

- 硼化合物

- 磷光

- 氮化合物

- 其他

- 無機

- 最終用戶產業

- 電氣和電子

- 建築和施工

- 運輸

- 紡織品和家具

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率/排名分析

- 主要企業策略

- 公司簡介

- Apexical Inc.

- BASF SE

- Clariant

- Daihachi Chemical Industry Co. Ltd

- DIC Corporation

- Eti Maden

- Huber Engineered Materials

- ICL

- Italmatch Chemicals SpA

- Jiangsu Jacques Technology Co. Ltd

- LANXESS

- MPI Chemie BV

- Nabaltec AG

- Nippon Carbide Indestries Co. Inc.(Sanwa Chemical Industry Co. Ltd)

- NYACOL Nano Technologies Inc.

- Rin Kagaku Kogyo Co. Ltd

- Shandong Brother Sci. &Tech. Co. Ltd

- Thor

- TOR Minerals

第7章 市場機會與未來趨勢

- 禁止鹵素阻燃劑的立法日益增多

- 積極研發無鹵阻燃劑

簡介目錄

Product Code: 47876

The Non-Halogenated Flame Retardant Chemicals Market is expected to register a CAGR of greater than 5% during the forecast period.

Key Highlights

- Environmental and health concerns regarding brominated and other flame retardants are also expected to drive the market during the forecast period.

- Increasing legislation banning of halogenated flame retardants is likely to act as an opportunity in the future.

- Europe is expected to dominate the market across the globe. While, Asia-Pacific region is likley to witness the fastest growth during the forecast period.

Non-Halogenated Flame Retardants Chemicals Market Trends

Increasing Demand from the Buildings and Construction Industry

- Household fires are one of the primarily causes for the loss of human life. Non-halogenated flame retardants are used in building materials and products, primarily due to strict fire safety regulations. In buildings, flame retardants are majorly used in structural insulation. Insulations are used in homes and other buildings, in order to maintain comfortable temperature, while conserving energy.

- The major insulation materials include polystyrene foam boards and rigid polyurethane foam panels. Moreover, non-halogenated flame retardants find major applications in polyolefin foams. They are used in buildings, primarily in the HVAC applications, such as sound insulation and thermal insulation for pipes.

- Globally, various fire standards are driving the market for non-halogenated flame retardants. With the increasing environment concerns related to the use of flame retardants, the applications for non-halogenated flame retardants have been increasing significantly.

- Phosphorus-based flame retardants are mostly used non-halogenated flame retardants in polyurethane foams, especially in liquid substances. The flame retardants used for rigid PU foams are available in three forms, such as additive liquid flame retardants, reactive liquid flame retardants, and solid flame retardants.

- The global construction industry is growing at a healthy rate, where the Asia-Pacific and Middle East & African regions are witnessing huge investment in the construction sector due to numerous market opportunities available in these markets, along with the increasing demand for residential houses and the growing population.

- Thus, all the aforementioned factors are expected to drive the demand for non-halogenated flame retardant chemicals, during the forecast period.

Europe to Dominate the Market

- Europe region is expected to dominate the global market. The German economy is the largest in Europe, and fifth in the world.

- The German electronic industry is the Europe's biggest, and the fifth largest worldwide. The electrical and electronics industry accounted for more than 10% of the total German industrial production and about 3% of the country's gross domestic product (GDP). Moreover, the electrical and electronics industry accounted for around 23% of the entire FDI of the country.

- The German automotive industry accounted for approximately 20% of the total revenue of the German industries. Germany accounted for approximately 30% of the total passenger cars manufactured in the European region. Sixteen of the world's 100 top automotive suppliers are based in Germany.

- The country's world-class R&D infrastructure and complete industry value chain integration create a well-established automotive environment. This enables companies to develop and adopt cutting-edge technologies. The country also has the largest number of OEM plants in Europe, with 41 assembly and engine production plants that contribute to one third of the total automobile production in Europe.

- The German aerospace industry witnessed a substantial growth over the past two decades. The Federal Ministry of Economic Affairs and Energy lists aerospace as a key industry in Germany, with high growth rates and a strong industrial core.

- Owing to all the aforementioned factors, the maret for non-halogenated flame retardant chemicals is projected to grow in the region during the forecast period.

Non-Halogenated Flame Retardants Chemicals Industry Overview

The global non-halogenated flame retardant chemicals market is consolidated in nature, with the top five players accounting for a significant share in the global market. The major companies include Nabaltec AG, Huber Engineered Materials, BASF SE, and ICL, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Environmental and Health Concerns Regarding Brominated and Other Flame Retardants

- 4.1.2 Increasing Infrastructure Activities in Asia-Pacific

- 4.1.3 Rising Consumer Electrical and Electronic Goods Manufacturing

- 4.2 Restraints

- 4.2.1 Non-suitability of Hydroxides to High Temperature Applications

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Raw Material Analysis

- 4.6 Regulatory Policy Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Inorganic

- 5.1.1.1 Aluminum Hydroxide

- 5.1.1.2 Magnesium Hydroxide

- 5.1.1.3 Boron Compounds

- 5.1.2 Phosphorus

- 5.1.3 Nitrogen

- 5.1.4 Other Types

- 5.1.1 Inorganic

- 5.2 End-user Industry

- 5.2.1 Electrical and Electronics

- 5.2.2 Buildings and Construction

- 5.2.3 Transportation

- 5.2.4 Textiles and Furniture

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Apexical Inc.

- 6.4.2 BASF SE

- 6.4.3 Clariant

- 6.4.4 Daihachi Chemical Industry Co. Ltd

- 6.4.5 DIC Corporation

- 6.4.6 Eti Maden

- 6.4.7 Huber Engineered Materials

- 6.4.8 ICL

- 6.4.9 Italmatch Chemicals SpA

- 6.4.10 Jiangsu Jacques Technology Co. Ltd

- 6.4.11 LANXESS

- 6.4.12 MPI Chemie BV

- 6.4.13 Nabaltec AG

- 6.4.14 Nippon Carbide Indestries Co. Inc. (Sanwa Chemical Industry Co. Ltd)

- 6.4.15 NYACOL Nano Technologies Inc.

- 6.4.16 Rin Kagaku Kogyo Co. Ltd

- 6.4.17 Shandong Brother Sci. &Tech. Co. Ltd

- 6.4.18 Thor

- 6.4.19 TOR Minerals

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Legislation Banning of Halogenated Flame Retardants

- 7.2 Active R&D in Non-halogenated Flame Retardants

02-2729-4219

+886-2-2729-4219