|

市場調查報告書

商品編碼

1683111

汽車傳動軸市場:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Automotive Drive Shaft - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

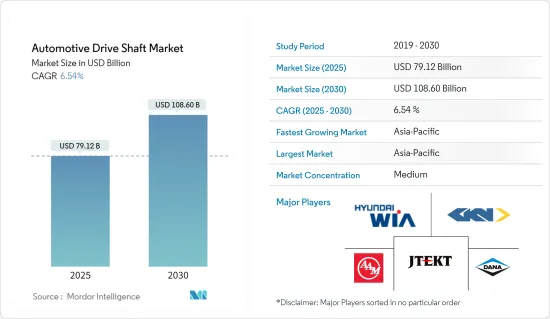

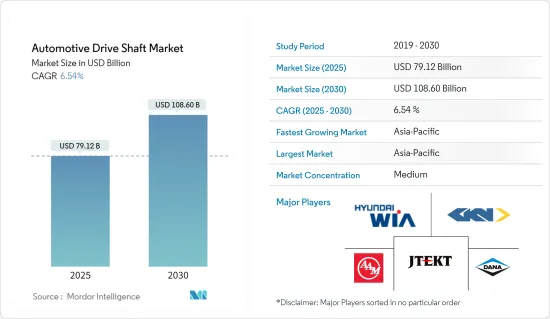

預計 2025 年汽車傳動軸市場規模為 791.2 億美元,預計到 2030 年將達到 1,086 億美元,預測期內(2025-2030 年)的複合年成長率為 6.54%。

從中期來看,隨著人口和可支配收入的增加,全球對汽車(包括乘用車和商用車)的需求預計將擴大。汽車產量和製造量的不斷成長推動了全球對傳動軸的需求。

預測期內,商用車和巴士的需求不斷成長可能會推動全球汽車的生產和銷售,有助於市場保持專注。這一趨勢主要受電動車需求不斷成長的推動。此外,汽車製造商正專注於生產最節能的電動車以滿足日益成長的需求。傳動軸製造商不斷更新其產品線以滿足不斷變化的OEM需求並增加市場佔有率。

考慮到電動車,大眾和通用汽車等主要OEM正在對新技術進行大量投資,建立供應鏈並提高電動車及其零件(如電池組和馬達)的生產能力。例如

關鍵亮點

- 2023 年 6 月,梅賽德斯-奔馳宣布將向其歐洲組裝廠投資數十億美元,以實現在本世紀末向電動車的轉變。此舉將包括生產基於新電動平台及其零件的汽車,預計將於 2025 年推出。

受輕量化零件需求增加和全輪驅動車銷售上升等趨勢的推動,汽車傳動軸市場預計未來幾年將實現成長。預計未來幾年影響整體汽車傳動軸市場成長的顯著因素之一是全球多功能車銷售的激增。亞太地區以新興經濟體為主,約佔全球汽車銷售量的一半。

預計未來幾年亞太汽車傳動軸市場將佔據最大佔有率並實現最高成長率。亞太地區的特徵是新興經濟體的存在,佔全球汽車銷售的大部分佔有率,這種趨勢在預測期內可能會持續下去。

中國、美國和挪威等國家對電動車的需求持續成長。汽車製造商計劃在未來幾年內推出更多電動車車型。大多數現有和即將推出的電動車車型都是全輪驅動 (AWD) 或後輪驅動 (FR),這可能會在預測期內產生對輕型傳動軸的需求。

汽車傳動軸的發展趨勢

乘用車佔最大市場佔有率

在汽車市場上,乘用車由於其設計時尚、尺寸大、經濟性好等特點,銷量很高。對高性能豪華 SUV 的高需求推動了這一成長。因此,許多公司都專注於推出各種新型乘用車。例如:

- 2023 年 5 月,路虎公佈了有史以來最強大、最快的量產 SUV 的細節。新款 Range 探測車 Sport SV 配備一台 5.0 升 V8 增壓引擎,可輸出 635 匹馬力。

電動車已成為汽車產業不可或缺的一部分,並為實現能源效率以及減少污染物和其他溫室氣體的排放提供了一條途徑。不斷增強的環保意識和積極主動的政府舉措是推動這一成長的關鍵因素。

根據國際能源總署(IEA)的數據,2024年第一季的電動車銷量將比2023年第一季成長約25%,其中中國佔比最大,為45%,其次是歐洲,為25%。

政府和地方的排放法規是整體電動車產業發展的主要驅動力之一。道路運輸普遍被認為是歐洲最大的空氣污染源。為了防治空氣污染,歐盟理事會通過了關於環境空氣品質評估和控制的第96/62/EC號指令,該指令設定了空氣中各種有害化合物的排放目標。車輛排放的最重要污染物是氮氧化物(NOx)和細塵(粒狀物 - PM),目前的上限均為每年 40g/m3。

歐洲已設定了 2050 年實現氣候中和的雄心勃勃的目標。為實現這一目標,歐盟委員會預計將在未來幾年內訂定幾項新法案,其中許多法案旨在提高流動性。到本世紀末,歐盟委員會的目標是讓道路上至少有 3,000 萬輛電動車。為了實現這一目標,我們需要一套政策和目標,引導國家、企業和消費者走上正確的道路。

乘用車的需求也可能增加對複雜傳動軸的需求。傳動軸製造商正在研究新材料和製造方法來生產能夠滿足這些車輛需求的傳動軸。例如,一些製造商使用碳纖維代替鋼材來減輕重量,而一些製造商則使用能夠承受高扭矩的創新複合材料。例如

- 2023 年 1 月,傳動系統零件製造商 Kalyani Mobility Drivelines (KMD) 推出了一系列適用於電動車和其他專用車輛的等速 (CV) 傳動軸。

由於這些因素以及電動和混合動力汽車市場的擴大,汽車傳動軸市場預計將繼續成長和發展。

預計亞太地區將佔據主要市場佔有率

中國和印度是亞太地區汽車製造業突出的國家。這些國家擁有大量汽車製造商,這可能在預測期內為市場創造有利可圖的機會。

該地區的政府已經推出了一系列獎勵計劃來促進汽車銷售。它還提供購買電動車的補貼,以鼓勵該地區汽車產業的擴張。例如:

- 隨著乘用車銷售量和產量的增加,印度汽車業逐年呈指數級成長。例如,與上年度相比,預計 2022-23 年乘用車銷量將從 1,467,039 輛增至 1,747,376 輛,而多功能車銷量將從 1,489,219 輛增至 2,003,718 輛,可從 1,489,219 輛增至 2,003,718 輛,可從 1,489,219 輛增至 2,003,718 輛,可從 1,489,219 輛增至 2,003,718 輛,為 2,6100 廂式銷售量為 2,13100 2,001600 廂型車。

受中產階級可支配收入不斷增加的推動,印度經濟正在擴張。這對汽車需求產生了正面影響。由於印度的生產成本低廉,過去五年汽車產量激增。隨著汽車製造業的崛起,汽車感測器市場也日益受到關注。

印度城市的車輛持有比歐盟國家和美國的車輛數量年輕得多,後兩國的平均車齡分別為 8 年和 11 年。

主要汽車零件製造商正在全部區域擴大生產設施並推出新產品。預計這些汽車零件製造商將在預測期內見證市場的顯著成長。例如,KYB Corporation(KYB)宣布計劃在2023年3月之前開發用於電動車(EV)中eAxle驅動馬達系統的電動油泵。該公司還宣布計劃製造用於eAxles潤滑和冷卻的油泵,並將其作為電氣化時代的新業務進行開發。

因此,考慮到所有這些市場發展和趨勢,預計亞太汽車傳動軸市場在預測期內將顯著成長。

汽車傳動軸產業概況

汽車傳動軸市場由全球性和地區性企業整合和主導。這些公司正在採取新產品發布、聯盟和合併等策略來保持其在市場中的地位。例如

- 2023 年 9 月,JTEKT North America 以 JTEKT Automotive Systems、Koyo Bearings 和 Toyoda Machine Tools 品牌生產了廣泛的產品。透過增加七條新機器生產線、兩條新組裝和一條內部加工零件的附加工序,JTEKT 北美公司擴大了其前驅動軸的生產能力。

市場的主要企業包括 GKN PLC(Melrose Industries PLC)、Yamada Manufacturing、American Axle & Manufacturing Inc.、JTEKT Corporation 和 Dana Incorporated。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 政府加大力度促銷

- 市場限制

- 傳動軸維護成本高

- 波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

5. 市場區隔(市場規模-美元)

- 依設計類型

- 中空軸

- 實心軸

- 按職位類型

- 後軸

- 前軸

- 按車型

- 搭乘用車

- 商用車

- 按分銷管道

- OEM

- 售後市場

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 其他

- 南美洲

- 中東和非洲

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- GKN PLC(Melrose Industries PLC)

- JTEKT Corporation

- Dana Holding Corporation

- Hyundai Wia Corporation

- Nexteer Automotive Group Ltd

- Showa Corporation

- Yamada Manufacturing Co. Ltd

- American Axle & Manufacturing Co. Ltd

- Wanxiang Qianchao Co. Ltd

- NTN Corporation

第7章 市場機會與未來趨勢

The Automotive Drive Shaft Market size is estimated at USD 79.12 billion in 2025, and is expected to reach USD 108.60 billion by 2030, at a CAGR of 6.54% during the forecast period (2025-2030).

Over the medium term, with the rising population and disposable income, the demand for automobiles, such as passenger cars and commercial vehicles, is expected to grow worldwide. The increasing production and manufacturing of automobiles are fueling the demand for drive shafts globally.

The market will likely be the focus of attention during the forecast period, driven by the growing demand for commercial vehicles and buses, both of which are expected to drive global vehicle production and sales. This trend is primarily due to the growing demand for electric vehicles. In addition, automakers are putting all their efforts into making the most energy-efficient electric vehicles as their demand grows. Driveshaft manufacturers are updating their product lines to meet the constantly shifting needs of OEMs and expand their market share.

Considering the future of electric vehicles, the major OEM companies, including Volkswagen and General Motors, are investing majorly in new technology, establishing supply chains, and increasing the production capacity of EVs and their components, such as battery packs and motors. For instance:

Key Highlights

- In June 2023, Mercedes-Benz announced an investment of billions in its European assembly plants to equip them for the shift to electric cars by the end of the decade. This move involves the production of vehicles on the new electric platforms and their components to be introduced in 2025.

The automotive drive shaft market is anticipated to grow in the coming years, driven by trends such as the rising demand for lightweight components and the increasing sales of all-wheel-drive vehicles. One notable factor that is anticipated to impact the overall growth of the automotive drive shaft market in the coming years is the sharp increase in utility vehicle sales worldwide. Asia-Pacific is distinguished by the presence of emerging economies and accounts for about half of global vehicle sales.

The Asia-Pacific automotive drive shaft market is expected to hold the largest share and register the highest growth rate in the coming years. Asia-Pacific is characterized by the presence of emerging economies and accounts for a major share of global vehicle sales, which may continue over the forecast period.

Countries such as China, the United States, and Norway are continuing to see stronger demand for electric vehicles. Automakers are planning to launch more EV models in the coming years. The majority of the present and upcoming EV models are all-wheel drives (AWD) or rear-wheel drives (RWD), which may generate the demand for lightweight drive shafts during the forecast period.

Automotive Drive Shaft Market Trends

Passenger Cars Hold the Highest Share in the Market

Passenger car sales are high in the automotive market due to features such as stylish design, size, and economic value. High demand for luxury SUVs with high performance propels this growth. Therefore, many companies are focusing on the launch of various new passenger car models. For instance:

- In May 2023, Land Rover released details about its most powerful and fastest production SUV yet. The new Range Rover Sport SV packs 635 hp with a supercharged 5-liter V8 engine.

Electric vehicles have become an integral part of the automotive industry, and they represent a pathway toward achieving energy efficiency, along with reduced emissions of pollutants and other greenhouse gases. The growing environmental concerns and favorable government initiatives are the major factors driving this growth.

According to the International Energy Agency, in Q1 2024, electric car sales grew by around 25% compared to Q1 2023, with China holding the largest share of 45%, followed by Europe with 25%.

Emission laws at the governmental and regional levels have been one of the key causes propelling the EV industry in general. Road transport is commonly acknowledged as the single-largest source of air pollution in Europe. To combat air pollution, the EU Council adopted "Directive 96/62/EC on ambient air quality assessment and management," which establishes emission targets for various harmful compounds in the atmosphere. The most important pollutants produced by cars are nitrogen oxides (NOx) and fine dust (particulate matter - PM), both of which are now capped at 40 g/ m3 per year.

Europe has set a lofty target of being climate-neutral by 2050. The European Commission plans to publish several new legislative proposals over the next few years to meet this goal, many of which are aimed at improving mobility. By the end of this decade, the European Commission aims to have at least 30 million electric vehicles on the road, a tremendous increase from the current 1.4 million EVs on European roads. To achieve this aim, a set of policies and targets must be in place to guide states, businesses, and consumers on the correct path.

The demand for passenger cars may also boost the demand for sophisticated drive shafts. Manufacturers of drive shafts are researching novel materials and manufacturing procedures to build drive shafts that can handle the requirements of these vehicles. Some producers, for example, use carbon fiber instead of steel to minimize weight, while others use innovative composite materials that can withstand high torque levels. For instance:

- In January 2023, Kalyani Mobility Drivelines (KMD), a manufacturer of driveline components, introduced a lineup of constant-velocity (CV) driveshafts for EVs and other specialty vehicles.

Owing to such factors and the expansion of the electric and hybrid vehicle market, the automotive drive shaft market will likely continue to grow and evolve.

Asia-Pacific is Expected to Hold a Significant Share in the Market

China and India are the prominent countries in terms of vehicle manufacturing in Asia-Pacific. The countries have a major presence of automotive manufacturers, which may create lucrative opportunities for the market during the forecast period.

The governments in the region have introduced many incentive plans to bolster auto sales. They are also offering subsidies on the purchase of electric vehicles to encourage the expansion of the region's automotive industry. For instance:

- With the growing sales and production of passenger cars, the Indian automotive industry has been witnessing exponential growth Y-o-Y. For instance, sales of passenger cars increased from 14,67,039 to 17,47,376 units, utility vehicles from 14,89,219 to 20,03,718 units, and vans from 1,13,265 to 1,39,020 units in FY 2022-23 compared to the previous financial year.

The Indian economy is expanding as there is a rise in the disposable income of middle-income consumers. This factor, in turn, has a favorable impact on the demand for automobiles. Vehicle manufacturing has increased rapidly over the last five years due to the country's cheap production costs. The automotive sensor market is gaining traction as vehicle manufacturing increases.

The vehicular fleet in Indian cities is much younger than in EU nations and the United States, where the average age of cars is eight years and 11 years, respectively.

Major automotive component manufacturers are expanding their manufacturing facilities and introducing new products across the region. They are expected to witness major growth in the market during the forecast period. For example, KYB Corporation (KYB) announced plans to develop electric oil pumps for eAxle drive motor systems in electric vehicles (EVs) by March 2023. The company also announced plans to build oil pumps for lubricating and cooling eAxles and develop them as a new business for the era of electrification.

Thus, considering such developments and trends in the market, the Asia-Pacific automotive drive shaft market is expected to have significant growth during the forecast period.

Automotive Drive Shaft Industry Overview

The automotive drive shaft market is consolidated and led by global and regionally established players. These companies adopt strategies such as new product launches, collaborations, and mergers to sustain their market positions. For instance:

- In September 2023, JTEKT North America manufactured a broad range of products under the JTEKT Automotive Systems, Koyo Bearings, and Toyoda Machine Tools brands. By adding seven new machine lines, two new assembly lines, and additional processes to machine components internally, JTEKT North America expanded its capability to produce front drive shafts.

Some of the major players in the market include GKN PLC (Melrose Industries PLC), Yamada Manufacturing Co. Ltd, American Axle & Manufacturing Inc., JTEKT Corporation, and Dana Incorporated.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Government Policies to Promote EV Sales

- 4.2 Market Restraints

- 4.2.1 High Cost of Maintenance Related to Drive Shafts

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Design Type

- 5.1.1 Hollow Shaft

- 5.1.2 Solid Shaft

- 5.2 By Position Type

- 5.2.1 Rear Axle

- 5.2.2 Front Axle

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 GKN PLC (Melrose Industries PLC)

- 6.2.2 JTEKT Corporation

- 6.2.3 Dana Holding Corporation

- 6.2.4 Hyundai Wia Corporation

- 6.2.5 Nexteer Automotive Group Ltd

- 6.2.6 Showa Corporation

- 6.2.7 Yamada Manufacturing Co. Ltd

- 6.2.8 American Axle & Manufacturing Co. Ltd

- 6.2.9 Wanxiang Qianchao Co. Ltd

- 6.2.10 NTN Corporation