|

市場調查報告書

商品編碼

1683119

光電產業市場 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Photonics Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

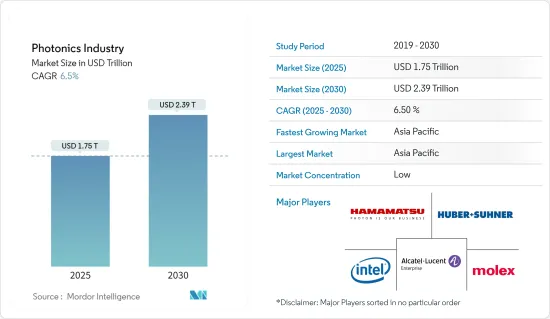

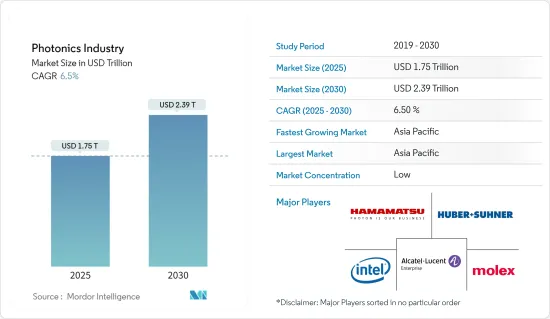

光電產業預計將從 2025 年的 1.75 兆美元成長到 2030 年的 2.39 兆美元,預測期內(2025-2030 年)的複合年成長率為 6.5%。

光電涉及輻射能(如光),其基本元素是光子和波,可以治療疾病、探勘宇宙甚至破案。光電涉及光和其他電磁輻射的產生、操縱、傳輸、檢測和利用。光電被廣泛認為是開發智慧系統的一項必不可少的技術,該系統可以在不犧牲整體系統效率的情況下高效利用能源。醫療、汽車、通訊、製造和零售等許多行業都在利用這項技術來提高效率,從而推動工業成長。這些領域的投資近年來也呈現強勁成長。

關鍵亮點

- 光電是跨多個行業的核心技術,根據行業展望,該技術的消費正在快速成長,市場正在擴展到新的垂直領域。近年來,光電在雷射雷達和積層製造領域呈現日益成長的趨勢。幾十年來,LiDAR一直被用來研究大氣中氣體和污染物的分佈。近年來,它已成為自動駕駛必不可少的技術。 LiDAR 測繪系統及其支援技術的進步正在滲透到各個垂直領域,包括航太和國防、走廊測繪和地形測量、汽車、採礦以及石油和天然氣,擴大了全球市場的覆蓋範圍。

- 在美國,Google、微軟、Facebook等大公司引領光電市場,它們需要最佳化每個資料中心的資料傳輸流程。此外,該國為技術進步和擴張提供了良好的環境。此外,美國矽光電元件產業的重要資金籌措格局正在鼓勵組織和新興企業投資於不斷擴大的光電市場。

- 此外,美國電腦協會發表的《深度學習中矽光子的調查》報導指出,深度學習在解決電腦視覺、自然語言處理和一般模式識別等領域的極其困難的問題方面表現出非凡的成功。這些成就是數十年來對更好的學習技術和更深的神經網路模型的研究以及用於訓練和執行的深度神經網路硬體平台的開發的成果。近年來,用於深度學習的 ASIC(專用積體電路)硬體加速器備受關注,因為其中許多加速器比標準 CPU 和 GPU 設計具有更高的效能和能源效率。

- 根據產業分析報告,產業需要大量的初始投資來整合這些光電技術以實現自動化目的。自動化系統的高成本與有效、強大的硬體和高效的軟體有關。自動化設備需要大量的資本投入才能實現智慧生產(安裝、設計和建造自動化系統可能要花費數百萬美元)。這導致各行各業依賴現有的低成本技術,從而難以採用。

- 產業分析報告強調,除了對光子解決方案的供應鏈和生產的直接影響外,疫情的後遺症也在影響市場成長。例如,包括美國在內的各個地區迫在眉睫的景氣衰退威脅可能會對市場成長產生不利影響,因為經濟不確定性將阻止消費者和企業在高價值產品上增加支出,這可能會影響所研究市場的成長率。

- COVID-19 疫情對整個半導體製造市場的需求和供應都產生了影響。此外,全球各地半導體工廠的停產、關閉,也加劇了供不應求的情況。其影響已在受調查的市場中反映出來。然而,許多影響都是短暫的。世界各國政府為支持汽車和半導體產業採取的預防措施有助於恢復工業成長。

光電產業趨勢

消費終端用戶產業細分市場佔據主要市場佔有率

- 光電用於多種消費設備,如條碼掃描器、DVD參與企業、電視遙控器、電視和智慧型手機。條碼掃描器常見於印表機、CD/DVD/藍光設備和遠端設備等消費性設備。條碼掃描器在物流和供應鏈管理中發揮著至關重要的作用。透過掃描產品包裝和運輸標籤上的條碼來追蹤庫存、管理存量基準並確保準確交貨。

- 基於光電的條碼掃描器用於物流應用中的包裝分類。這些掃描器有助於根據條碼資訊自動對包裹進行分類。它也廣泛用於零售環境中的銷售點交易、庫存控制和價格驗證。快速且準確地掃描產品條碼可以提高效率和客戶服務。

- 光電技術在DVD參與企業的運作中也扮演關鍵角色。 DVD參與企業在光碟機中使用光電技術,包括 CD、DVD、藍光和高清參與企業和錄影機。 DVD參與企業使用雷射在光碟上讀取和寫入資料。雷射二極體將狹窄的聚焦光束照射到光碟表面,從而實現精確的資料搜尋和記錄。參與企業是參與企業,他們使用光電技術在DVD上讀取和寫入資料。來自雷射二極體的雷射光束與凹坑相互作用並撞擊 DVD 表面,使參與企業能夠提取儲存的資訊。

- 根據美國消費者技術協會 (CTA) 和美國人口普查局的數據,美國智慧型手機銷售額預計將從 2021 年的 730 億美元增至 2022 年的 747 億美元。此外,根據 GSMA 的數據,到 2025 年,北美智慧型手機用戶數量預計將達到 3.28 億。此外,到 2025 年,北美的行動用戶數量 (86%) 和網路普及率 (80%) 可能會增加。行動電話需求的不斷成長和行業趨勢可能為所研究市場的成長提供有利的機會。

- 此外,美國人口普查局估計2022-2023年智慧型手機銷售額將達747億美元。這種放緩是由於美國智慧型手機出貨量下降所造成的。在經濟挑戰、高通膨和季節性需求疲軟的背景下,低階智慧型手機銷量下滑是導致銷量下滑的最大因素。不過,預計未來幾年這種情況將會消退。這些行業趨勢預計將對智慧型手機相機鏡頭的成長產生重大影響。

亞太地區全球市場大幅成長

- 日本是亞洲的高科技強國。全球相機產業正在快速發展,日本一直是該市場的領導者和創新者。無反光鏡混合相機、數位單眼相機和可更換鏡頭輕便型相機目前正在推動相機市場的發展,為市場研究創造了更多的機會。

- 日本有許多光電相關的大學和研究機構。例如,日本大阪大學的光子學先端研究中心(PARC)已成為日本領先的光電科學和工業研究中心。

- 由於亞太地區的經濟成長和全球市場佔有率,預計中國將在亞太國家中呈現強勁成長。中國是重要的電子產品生產國和消費國之一。該地區的製造業正在快速成長,並引進了一系列製造和通訊技術。

- 印度是世界上最大且成長最快的經濟體之一。預計不斷增強的購買力和社交媒體的影響力將推動電子產品市場的發展。政府正在做出許多努力以成為新興經濟體。印度電子和資訊技術部核准了各種數位計劃,在預測期內創造了巨大的市場成長機會。

- 韓國是該市場的主要貢獻者之一。人口成長、對矽光子產品開發的投資增加、國內外參與企業專注於開發最先進的矽光子產品、以及為提高該地區的資料傳輸速度而加強的研發活動都是推動市場成長的一些因素。

- 其他亞太市場包括印尼、新加坡和泰國。 5G、人工智慧、物聯網、虛擬實境等新技術的快速發展和商業性應用,對資料處理和資訊互動的需求日益增加。這種情況可能會促進該地區資料中心的建設,從而帶來該行業的爆炸性成長。

光電產業概況

光電行業市場高度分散,有許多大型參與者。其中主要參與者有濱松光子株式會社、英特爾公司、Polatis 公司(Huber+Suhner)、阿爾卡特朗訊公司(諾基亞公司)和 Molex 公司。市場主要參與者正在採用合作和收購等策略來加強其產品陣容並獲得永續的競爭優勢。

- 2023 年 11 月—Innolume 宣布推出具有 1W 光輸出的高功率 O 波段量子點 SOA。可用於 LiDAR、PON 和 FSO。

- 2023 年 9 月 - Ams OSRAM AG 與馬來西亞投資發展局 (MIDA) 宣布相互支持在馬來西亞繼續投資和業務擴展。透過合作協議,MIDA 表達了對 Ams OSRAM AG 在馬來西亞努力的大力支持。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 新冠肺炎疫情和其他宏觀經濟因素的後續影響將影響市場

- 技術簡介

第5章 市場動態

- 市場促進因素

- 矽基光電應用的出現

- 越來越關注高效能、環保解決方案

- 市場限制

- 光電設備的初始成本高

第6章 市場細分

- 按最終用戶產業

- 消費者

- 航太和國防

- 展示

- 太陽的

- LED 照明

- 醫療和生物測量

- 工業和製造業

- 車

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 歐洲其他地區

- 亞太地區

- 日本

- 中國

- 印度

- 台灣

- 韓國

- 其他亞太地區

- 其他

- 北美洲

第7章 競爭格局

- Vendor Positioning Analysis

- 公司簡介

- Hamamatsu Photonics KK

- Intel Corporation

- Polatis Incorporated(HUBER+SUHNER)

- Alcatel-lucent SA(Nokia Corporation)

- Molex Inc.(Koch Industries)

- Infinera Corporation

- NEC Corporation

- Innolume GmbH

- Coherent Corporation

- IPG Photonics Corporation

- AMS OSRAM AG

- Signify NV

- LEA Photonics SAS(Keopsys)

- Schott AG

- Carl Zeiss AG(Scantinel Photonics GmbH)

- Nikon Corporation

- Corning Inc.

第8章投資分析

第9章:未來市場展望

The Photonics Industry is expected to grow from USD 1.75 trillion in 2025 to USD 2.39 trillion by 2030, at a CAGR of 6.5% during the forecast period (2025-2030).

Photonics involve radiant energy (such as light), whose fundamental element is the photons and waves that can cure diseases, explore the universe, and even solve crimes. They involve the generation, manipulation, transmission, detection, and utilization of light and other forms of electromagnetic radiation. Photonics is widely regarded as a critical enabling technology for developing smart systems that efficiently use energy without sacrificing overall system efficiency. Many verticals, including healthcare, automotive, communications, manufacturing, and retail, are leveraging this technology to attain higher efficiency, driving the industry's growth. Investments from these sectors also have witnessed significant growth in recent past.

Key Highlights

- With photonics being a core technology of multiple industries, the industry outlook shows that the consumption of the technology is witnessing rapid growth, with the market expanding in new verticals. Over the past few years, there has been an increasing trend of LiDAR or additive manufacturing in photonics. LiDAR has been used to study the atmosphere's distribution of gases and contaminants for decades. In recent years, it has become a critical technology for autonomous driving. The advancements in LiDAR mapping systems and their enabling technologies have penetrated different verticals, like aerospace and defense, corridor mapping and topographical survey, automotive, mining, oil and gas, and other verticals, which are increasing the global market's scope.

- In the United States, the largest companies, such as Google, Microsoft, and Facebook, are the primary force driving the photonics market, necessitating optimizing the data transmission process for respective data centers. The country also provides a favorable environment for technological advancements and expansions. Furthermore, the significant funding landscape in the US silicon photonics devices industry has encouraged organizations and start-ups to invest in the expanding photonics market.

- Moreover, an article titled "A Survey on Silicon Photonic in Deep Learning," published by the Association of Computing Machinery stated that deep learning has led to exceptional success in solving some extremely tough problems in disciplines, including computer vision, natural language processing, and general pattern recognition. These achievements are the product of decades of research into better training methodology and deeper neural network models, as well as developments in deep neural network hardware platforms for training and execution. Many application-specific integrated circuit (ASIC) hardware accelerators for deep learning have received attention in recent years due to their improved performance and energy efficiency over standard CPU and GPU designs.

- According to this industry analysis report, the industries require a high level of initial investment to integrate such photonics technology for automation purposes. The high cost of automated systems is concerned with effective and robust hardware and efficient software. Automation equipment requires high capital investment to invest in smart production (an automated system can cost millions of dollars to install, design, and fabricate). Thus, industries rely on the existing technologies available at a lower price, ultimately challenging adoption.

- Apart from the direct impact evident in the supply chains and production of photonic solutions, the aftereffects of the pandemic are also impacting the growth of the market, as highlighted in the industry analysis report. For instance, the ongoing threat of recession looming over various regions, including the United States, may negatively influence the market's growth, as the economic uncertainty will prevent consumers and businesses from spending more on high-value products, which may impact the growth rate of the market studied.

- The COVID-19 pandemic influenced the overall semiconductor manufacturing market from the demand and supply sides. In addition, the global lockdowns and closure of semiconductor plants also fueled the supply shortage. The effects were also reflected in the market studied. However, many of these effects were short-term. Precautions by governments worldwide to support the automotive and semiconductor sectors helped revive the industry's growth.

Photonics Industry Trends

Consumer End-user Industry Segment Holds Significant Market Share

- Photonics are utilized in several consumer devices like barcode scanners, DVD players, TV remote controls, televisions, smartphones, etc. Barcode scanners are commonly used in consumer equipment like printers, CD/DVD/Blu-ray devices, and remote devices. Barcode scanners play a crucial role in logistics and supply chain management. They are used for scanning barcodes on product packages and shipping labels to track inventory, manage stock levels, and ensure accurate delivery.

- Photonics-based barcode scanners are used for package sorting in logistics applications. These scanners help automate sorting packages based on their barcode information. They are also extensively used in retail environments, including point-of-sale transactions, inventory management, and price verification. They enable quick and accurate scanning of product barcodes, improving efficiency and customer service.

- Photonics technology also plays a crucial role in the functioning of DVD players. DVD players utilize photonics technology in their optical disc drives, including CD, DVD, Blu-ray, and HD (high-definition) players and recorders. DVD players use lasers for reading and writing data on optical discs. The laser diode emits a focused, narrow beam of light that can be directed onto the surface of the disc, allowing for precise data retrieval and recording. DVD players are optical disc players that rely on photonics technology to read and write data on DVDs. The laser beam emitted by the laser diode interacts with the pits and lands on the DVD's surface, allowing the player to retrieve the stored information.

- According to the Consumer Technology Association (CTA) and the US Census Bureau, the sales value of smartphones sold in the United States was expected to increase from USD 73 billion in 2021 to USD 74.7 billion in 2022. Additionally, according to GSMA, in North America, the number of smartphone subscribers is expected to reach 328 million by 2025. Moreover, by 2025, North America may witness an increase in the penetration rates of mobile subscribers (86%) and the Internet (80%). The increasing demand and industry trends for mobile phones are likely to offer lucrative opportunities for the growth of the market studied.

- Moreover, the US Census Bureau estimated the smartphone sales value to be USD 74.7 billion during 2022-2023. This sluggish growth is an outcome of declined smartphone shipments in the United States. Low-end smartphone sales declines were the most significant contributing factor to the downturn amid economic challenges, high inflation, and poor seasonal demand. However, this is expected to end in the coming years. These industry trends are expected to impact smartphone camera lens growth significantly.

Asia-Pacific to Register Major Growth in the Global Market

- Japan is a high-tech powerhouse economy in Asia. The global camera industry is rapidly evolving, and Japan is a consistent leader and innovator in the market. Mirror-less hybrid cameras, DSLRs, and compact interchangeable-lens cameras now drive the camera market, further creating opportunities for the market studied.

- The country has many universities and institutes related to photonics. For instance, the Photonics Advanced Research Center (PARC) at Osaka University in Japan has emerged as a leading scientific and industrial research center for Japan's photonics.

- China is expected to exhibit a significant growth rate among countries in Asia-Pacific, owing to the region's growing economy and the global electronics market share. China is one of the prominent electronics producers and consumers. The manufacturing industry is rapidly growing in the region and witnessing the deployment of various manufacturing and telecommunications technologies, which is expected to aid the market's growth.

- India is one of the largest and fastest-growing economies in the world. The growing purchasing power and the rising influence of social media are expected to drive the market for electronic goods. The government is undertaking many initiatives to become one of the developed economies. The Ministry of Electronics and Information Technology, India, approves various digital projects, creating significant market growth opportunities over the forecast period.

- South Korea is one of the significant contributors to the market. The growing population, increasing investments toward developing silicon photonic products, international and domestic players' rising focus on developing modern silicon photonic products, and the improving R&D activities to increase the region's data transmission rate fuel the market growth.

- The countries considered part of the rest of the Asia-Pacific include Indonesia, Singapore, and Thailand. The rapid development of 5G, AI, the internet of things (IoT), virtual reality (VR), and the commercial application of such new technologies increase the demand for data processing and information interaction. This scenario may boost the construction of data centers in the region, leading to explosive industry growth.

Photonics Industry Overview

The photonics market is highly fragmented, with the presence of various major players, among which the largest companies are Hamamatsu Photonics KK, Intel Corporation, Polatis Incorporated (Huber+Suhner), Alcatel-Lucent SA (Nokia Corporation), and Molex Inc. (Koch Industries). The largest companies in the market are adopting strategies, such as partnerships and acquisitions, to enhance their product offerings and gain sustainable competitive advantage.

- November 2023 - Innolume announced the introduction of high-power O-Band quantum Dot SOA with 1W optical power. It can be used in LiDARs, PONs, and FSO.

- September 2023 - Ams OSRAM AG and the Malaysian Investment Development Authority (MIDA) announced mutual support for the continued investment and expansion in Malaysia. Through a collaborative agreement, MIDA demonstrated significant support for Ams OSRAM's initiatives in Malaysia.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products and Services

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of Silicon-based Photonics Applications

- 5.1.2 Increasing Focus on High Performance and Eco-friendly Solutions

- 5.2 Market Restraints

- 5.2.1 High Initial Cost of Photonics-enabled Devices

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Consumer

- 6.1.2 Aerospace and Defense

- 6.1.3 Display

- 6.1.4 Solar

- 6.1.5 LED Lighting

- 6.1.6 Medical and Bioinstrumentation

- 6.1.7 Industrial and Manufacturing

- 6.1.8 Automotive

- 6.1.9 Other End-user Industries

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.2.5 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 Japan

- 6.2.3.2 China

- 6.2.3.3 India

- 6.2.3.4 Taiwan

- 6.2.3.5 South Korea

- 6.2.3.6 Rest of Asia-Pacific

- 6.2.4 Rest of the World

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Positioning Analysis

- 7.2 Company Profiles

- 7.2.1 Hamamatsu Photonics KK

- 7.2.2 Intel Corporation

- 7.2.3 Polatis Incorporated (HUBER+SUHNER)

- 7.2.4 Alcatel-lucent SA (Nokia Corporation)

- 7.2.5 Molex Inc. (Koch Industries)

- 7.2.6 Infinera Corporation

- 7.2.7 NEC Corporation

- 7.2.8 Innolume GmbH

- 7.2.9 Coherent Corporation

- 7.2.10 IPG Photonics Corporation

- 7.2.11 AMS OSRAM AG

- 7.2.12 Signify NV

- 7.2.13 LEA Photonics SAS (Keopsys)

- 7.2.14 Schott AG

- 7.2.15 Carl Zeiss AG (Scantinel Photonics GmbH)

- 7.2.16 Nikon Corporation

- 7.2.17 Corning Inc.