|

市場調查報告書

商品編碼

1683126

冷凍乾燥設備和服務:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Lyophilization Equipment And Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

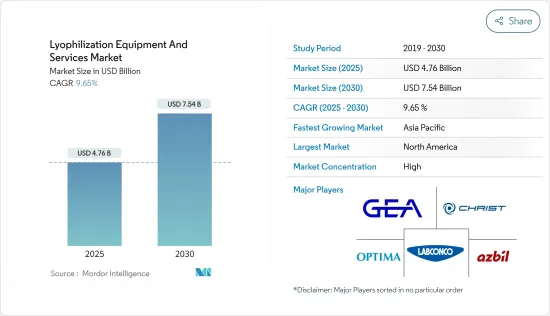

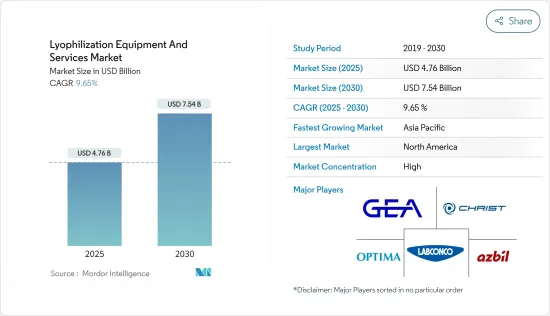

冷凍乾燥設備和服務市場規模預計在 2025 年為 47.6 億美元,預計到 2030 年將達到 75.4 億美元,預測期內(2025-2030 年)的複合年成長率為 9.65%。

大趨勢推動市場成長在製藥、生物技術和食品加工行業的主要大趨勢的推動下,冷凍乾燥設備和服務市場正在經歷顯著成長。這些促進因素包括對生物製藥日益成長的需求、向個人化醫療的轉變以及消費者對保存期限較長的簡便食品日益成長的偏好。這些行業中冷凍乾燥技術的日益廣泛應用加上技術的進步推動了這些趨勢,刺激了創新和市場擴張。

冷凍乾燥產品的需求不斷增加:冷凍乾燥產品的需求正在迅速增加,尤其是在製藥和生物技術領域。冷凍乾燥可以延長保存期限、提高穩定性和易用性,這對於現代藥物開發至關重要。這一趨勢對於注射生物製藥來說尤其重要,因為它在慢性病管理中發揮著越來越重要的作用。此外,冷凍乾燥產品無需低溫運輸物流,降低了運輸和儲存成本,使其成為全球醫療保健領域的寶貴解決方案。

冷凍乾燥技術的進步:冷凍乾燥技術的創新正在透過提高效率、擴充性和安全性來改變市場。與傳統的批量方法相比,連續冷凍乾燥製程可以提高產量並降低營業成本。無菌冷凍乾燥技術採用先進的隔離系統,進一步提高了藥品和生技藥品的無菌性,並最大限度地降低了污染風險。這項技術進步對於需要精確控制和無菌的產業尤其重要。

擴大應用和工業應用:雖然傳統上專注於製藥和食品加工,但冷凍乾燥在化妝品、營養保健品和工業酵素領域找到了新的應用。在化妝品產業,冷凍乾燥可增強活性成分的穩定性和功效,並延長產品的保存期限。在膳食補充劑行業,它有助於保持維生素和礦物質的完整性,滿足消費者對高品質膳食補充劑的需求。冷凍乾燥技術在這些領域的擴展表明了其對整個行業日益成長的重要性。

持續創新和客製化:客製化冷凍乾燥解決方案以滿足特定行業需求的趨勢日益成長。製造商正在改進冷凍乾燥機的設計,以整合先進的自動化和能源效率等功能。用於個人化醫療和生技藥品等小眾應用的專用設備的開發也在增加。隨著企業尋求解決敏感材料和小批量生產帶來的獨特挑戰,這種客製化和持續創新的需求正在塑造市場的未來。

冷凍乾燥設備和服務的市場趨勢

乾燥機類型細分:主導冷凍乾燥設備市場

細分市場概況:乾燥機類型包括托盤式、歧管式和旋轉式冷凍乾燥機,佔約 45% 的市佔率。每種乾燥機類型都可以滿足特定的行業需求,從製藥製造到食品加工。冷凍乾燥設備在保存精細材料方面發揮著至關重要的作用,並且在許多不同領域已成為不可或缺的設備。現代冷凍乾燥機的多功能性和效率凸顯了其優越性,確保了其在冷凍乾燥設備市場繼續佔據主導地位。

成長動力與未來預期:對冷凍乾燥產品的需求不斷增加,推動了乾燥機類型的成長。冷凍乾燥技術的進步提高了冷凍乾燥機的效率,在滿足複雜製藥和生物技術產品的保存需求方面發揮關鍵作用。隨著生物製藥和個人化醫療變得越來越普遍,這一趨勢預計將持續下去,進一步推動對先進冷凍乾燥設備的需求。

競爭策略與未來顛覆:公司正專注於增強冷凍乾燥機的功能,例如節能設計、提高自動化程度以及整合物聯網以實現即時流程監控。在技術創新的推動下,製造商正在開發可用於廣泛應用的緊湊型、多功能乾燥機。然而,新的乾燥技術或監管變化等潛在干擾可能會威脅傳統冷凍乾燥方法的主導地位,因此需要企業保持靈活性。

亞太地區:冷凍乾燥市場成長的中心

區域成長動力:亞太地區正成為冷凍乾燥設備和服務成長最快的市場,預計 2024 年至 2029 年的複合年成長率為 10%。在製藥和生物技術等行業的快速應用推動下,該市場預計到 2029 年將超過 22 億美元。該地區的成長將受到中國和印度等國家的推動,這些國家正在大力投資國內製藥生產和研究能力。

促進因素和市場預期:中國和印度分別以 10.2% 和 11% 的成長率引領成長。推動這一成長的因素包括藥品生產的擴大、生物技術研究的增加以及對優質食品的需求的增加。此外,政府推動本地製造業的舉措和中階對優質醫療產品日益成長的需求也是推動該地區市場擴張的關鍵因素。

策略挑戰與潛在干擾:為了抓住亞太地區的成長機會,公司正在建立本地製造工廠,與地區參與者夥伴關係,並客製化產品以滿足當地的監管要求。然而,各國經濟發展和技術採用水準不同,帶來了挑戰。公司需要製定特定地點的策略來保持競爭力,並應對法律規範的變化和本地競爭對手的崛起等潛在干擾。

冷凍乾燥設備和服務業概況

主導市場格局的全球參與者:全球冷凍乾燥設備和服務市場由擁有豐富專業知識的領先跨國公司主導。 GEA 集團、Optima Packaging Group 和 Martin Christ Gefriertrocknungsanlagen GmbH 等市場領導憑藉對研發的持續投入、全面的產品系列和全球影響力,保持了相當的市場佔有率。這些公司正專注於創新以保持競爭力。

市場領導利用技術專長:主要企業透過整合自動化、物聯網和連續處理技術來推動市場創新。例如,GEA 集團在研發方面的大量投資(佔銷售額的 2.3%)凸顯了該產業對冷凍乾燥技術進步的承諾。這些公司還透過提供一系列服務(例如維護和流程最佳化)來增強其價值提案並加強客戶關係。

未來市場成功的策略:未來的成功將取決於連續處理和自動化的進步,以及滿足對生技藥品和個人化藥物日益成長的需求的能力。例如,BioPharma Group 用於小規模生產的新型 GMP 冷凍乾燥設施證明了個人化醫療中細分能力的重要性。此外,我們與生技和製藥公司的策略合作對於在不斷變化的環境中保持競爭力至關重要。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 凍乾產品需求不斷增加

- 冷凍乾燥技術的進步

- 市場限制

- 製藥和生物技術行業擴大使用替代乾燥技術

- 冷凍乾燥設備的安裝和維護成本高

- 波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

5. 市場區隔(市場規模-美元)

- 按方式

- 乾燥機類型

- 托盤式冷凍乾燥機

- 歧管式凍乾機

- 旋轉冷凍乾燥機

- 其他產品

- 配件

- 真空系統

- CIP 系統

- 乾燥室

- 其他配件

- 服務

- 乾燥機類型

- 按應用

- 食品加工和包裝

- 製藥和生物技術製造

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東和非洲

- GCC

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭格局

- 公司簡介

- AZBIL KIMMON CO., LTD.(AzbilTelstar, SLU)

- GEA Group Aktiengesellschaft

- Labconco Corporation

- Martin Christ Gefriertrocknungsanlagen GmbH

- Millrock Technology Inc

- Optima Packaging Group GmbH

- ATS(SP Industries)

- Tofflon Science and Technology Co. Ltd

- Lyophilization Technology Inc.

第7章 市場機會與未來趨勢

The Lyophilization Equipment And Services Market size is estimated at USD 4.76 billion in 2025, and is expected to reach USD 7.54 billion by 2030, at a CAGR of 9.65% during the forecast period (2025-2030).

Megatrends Driving Market Growth: The Lyophilization Equipment and Services Market is experiencing significant growth, propelled by key megatrends across pharmaceutical, biotechnology, and food processing industries. These drivers include the rising demand for biopharmaceuticals, the shift toward personalized medicine, and the growing consumer preference for convenience foods with extended shelf lives. The increasing use of lyophilization in these industries, combined with technological advancements, supports these trends, fostering innovation and market expansion.

Rising Demand for Lyophilized Products: The demand for lyophilized products has risen sharply, especially within the pharmaceutical and biotech sectors. Lyophilization offers extended shelf life, stability, and ease of use, which are critical for modern drug development. This trend is particularly relevant for injectable biopharmaceuticals, which play an increasingly prominent role in managing chronic diseases. Moreover, lyophilized products eliminate the need for cold chain logistics, reducing transportation and storage costs, making them a valuable solution in global healthcare.

Technological Advancements in Lyophilization Methods: Innovations in lyophilization technology are transforming the market, driving enhanced efficiency, scalability, and safety. Continuous freeze-drying processes, which outperform traditional batch systems, allow for greater throughput and lower operating costs. Aseptic lyophilization technologies further enhance the sterility of pharmaceuticals and biologics, incorporating advanced isolator systems to minimize contamination risks. This technological progress is particularly significant in industries requiring precise control and sterile conditions.

Expanding Applications and Industry Adoption: While traditionally dominated by pharmaceuticals and food processing, lyophilization is finding new applications in cosmetics, nutraceuticals, and industrial enzymes. In cosmetics, lyophilization enhances the stability and potency of active ingredients, extending product shelf life. In the nutraceutical industry, it helps preserve the integrity of vitamins and minerals, meeting consumer demand for high-quality health supplements. The expansion of lyophilization into these sectors indicates its growing importance across a broader range of industries.

Continuous Innovation and Customization: There is a growing trend toward customized lyophilization solutions tailored to specific industry needs. Manufacturers are enhancing freeze-dryer designs, integrating features like advanced automation and energy efficiency. The development of specialized equipment for niche applications, such as personalized medicine and biologics, is also on the rise. This demand for customization and continuous innovation is shaping the future of the market, as companies seek to meet the unique challenges posed by sensitive materials and small-batch production.

Lyophilization Equipment & Services Market Trends

Dryer Type Segment: Dominating the Lyophilization Equipment Landscape

Segment Overview: The dryer type segment, encompassing tray, manifold, and rotary freeze dryers, commands nearly 45% of the market. Each dryer type serves specific industry needs, from pharmaceutical manufacturing to food processing. Freeze-drying equipment plays a crucial role in preserving sensitive materials, making it indispensable across multiple sectors. The versatility and efficiency of modern freeze dryers underscore their dominance, ensuring their continued prominence in the lyophilization equipment market.

Growth Drivers and Future Expectations: The rise in demand for lyophilized products is fueling the growth of the dryer type segment. Advances in lyophilization technology are making freeze dryers more efficient, thus playing a critical role in meeting the preservation needs of complex pharmaceuticals and biotech products. This trend is set to continue as biopharmaceuticals and personalized medicine become more prevalent, driving further demand for sophisticated freeze-drying equipment.

Competitive Strategies and Future Disruptions: Companies are focusing on enhancing freeze dryer capabilities with energy-efficient designs, increased automation, and integration of IoT for real-time process monitoring. The drive for innovation is pushing manufacturers to create compact, versatile dryers that cater to a wide range of applications. However, potential disruptions, such as new drying technologies or regulatory changes, could challenge the dominance of traditional freeze-drying methods, requiring companies to remain agile.

Asia-Pacific: The Epicenter of Lyophilization Market Growth

Regional Growth Dynamics: The Asia-Pacific region is emerging as the fastest-growing market for lyophilization equipment and services, with a projected CAGR of 10% between 2024 and 2029. By 2029, the market is expected to exceed USD 2.2 billion, driven by rapid adoption across industries such as pharmaceuticals and biotechnology. The region's growth is led by countries like China and India, which are investing heavily in domestic pharmaceutical manufacturing and research capabilities.

Driving Forces and Market Expectations: China and India are leading the charge with growth rates of 10.2% and 11%, respectively. Factors driving this growth include expanding pharmaceutical production, increased biotech research, and rising demand for high-quality food products. Government initiatives aimed at boosting local manufacturing and the burgeoning middle class's demand for quality healthcare products are also critical drivers of market expansion in the region.

Strategic Imperatives and Potential Disruptions: To capture the growth opportunities in Asia-Pacific, companies are establishing local manufacturing plants, forming partnerships with regional players, and tailoring products to meet local regulatory requirements. However, varying levels of economic development and technology adoption across countries pose challenges. Companies need to craft region-specific strategies to remain competitive and navigate potential disruptions, such as shifting regulatory frameworks or emerging local competitors.

Lyophilization Equipment & Services Industry Overview

Global Players Dominate the Market Landscape: The global lyophilization equipment and services market is dominated by large, multinational players with specialized expertise. Market leaders such as GEA Group, Optima Packaging Group, and Martin Christ Gefriertrocknungsanlagen GmbH maintain significant market shares due to their continuous investment in R&D, comprehensive product portfolios, and global reach. These companies focus heavily on innovation to maintain their competitive edge.

Market Leaders Leverage Technological Expertise: Key players are driving market innovation by integrating automation, IoT, and continuous processing technologies. For instance, GEA Group's significant investment in R&D (2.3% of revenue) highlights the industry's commitment to advancing lyophilization technology. These companies also offer a range of services, including maintenance and process optimization, enhancing their value propositions and strengthening customer relationships.

Strategies for Future Market Success: Future success will depend on advancements in continuous processing and automation, as well as the ability to meet the growing demand for biologics and personalized medicine. For example, Biopharma Group's new GMP freeze-drying facility for small-batch production demonstrates the importance of niche capabilities in personalized medicine. Strategic collaborations with biotech and pharmaceutical firms will also be crucial for maintaining competitiveness in this evolving landscape.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Lyophilized Products

- 4.2.2 Technological Advancements in Lyophilization Methods

- 4.3 Market Restraints

- 4.3.1 Increasing Utilization of Alternative Drying Techniques in the Pharmaceutical and Biotechnology Industries

- 4.3.2 High Setup and Maintenance Cost of Freeze-Drying Equipment

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Modality

- 5.1.1 Dryer Type

- 5.1.1.1 Tray-style Freeze Dryers

- 5.1.1.2 Manifold Freeze Dryers

- 5.1.1.3 Rotary Freeze Dryers

- 5.1.1.4 Other Products

- 5.1.2 Accessories

- 5.1.2.1 Vacuum Systems

- 5.1.2.2 CIP (Clean-in-place) Systems

- 5.1.2.3 Drying Chamber

- 5.1.2.4 Other Accessories

- 5.1.3 Services

- 5.1.1 Dryer Type

- 5.2 By Application

- 5.2.1 Food Processing and Packaging

- 5.2.2 Pharmaceutical and Biotech Manufacturing

- 5.2.3 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AZBIL KIMMON CO., LTD. (AzbilTelstar, SLU)

- 6.1.2 GEA Group Aktiengesellschaft

- 6.1.3 Labconco Corporation

- 6.1.4 Martin Christ Gefriertrocknungsanlagen GmbH

- 6.1.5 Millrock Technology Inc

- 6.1.6 Optima Packaging Group GmbH

- 6.1.7 ATS (SP Industries)

- 6.1.8 Tofflon Science and Technology Co. Ltd

- 6.1.9 Lyophilization Technology Inc.

![冷凍乾燥設備和服務市場:趨勢、機會和競爭分析 [2023-2028]](/sample/img/cover/42/1342012.png)