|

市場調查報告書

商品編碼

1683129

亞太矽砂市場:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Asia-Pacific Silica Sand - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

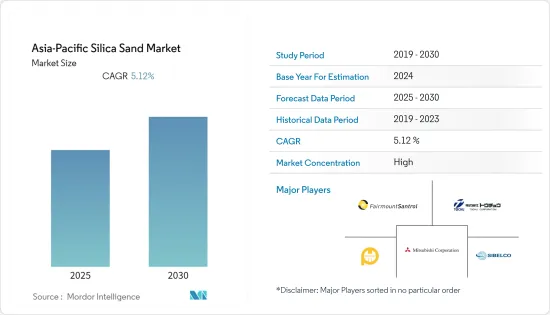

預測期內,亞太地區矽砂市場預計將以 5.12% 的複合年成長率成長。

新冠疫情導致全國範圍的封鎖、製造活動和供應鏈的中斷以及全球範圍內的生產停頓,對 2020 年的市場產生了負面影響。不過,情況在 2021 年開始好轉,市場的成長軌跡得以恢復。

關鍵亮點

- 持續的經濟成長導致鑄造業建設和使用增加是推動市場發展的關鍵因素。

- 預計非法採砂和無砂建築產品的開發將阻礙市場的成長。

- 預計水處理產業的應用開發以及牙科和生物技術領域的沙基治療方法開發將成為預測期內探索的市場機會。

亞太矽砂市場趨勢

玻璃產業需求不斷成長

- 玻璃製造業是亞太地區矽砂市場最大的終端用戶產業之一。

- 矽砂是玻璃製造業不可或缺的原料,佔玻璃製造業原料的50%以上。該材料用於各種玻璃材料,包括容器、平板玻璃、特殊玻璃和玻璃纖維。

- 在玻璃製造的應用領域中,容器子子區隔佔消費量最大,其次是平板玻璃和玻璃纖維子區隔。

- 預計該應用領域的市場將極大地受益於亞洲新興經濟體(尤其是印度和中國)快速成長的汽車和建築行業對平板玻璃和玻璃纖維日益成長的需求。

- 根據國家統計局的數據,中國的建築業規模是全世界最大的。根據住宅及城鄉建設部預測,2025年,中國建築業佔GDP的比重預計仍將維持在6%左右。

- 預計中國的人口趨勢將有利於住宅和商業建設活動。人口不斷成長引發了公共和私營部門對經濟適用住宅群的投資。中國政府已採取舉措,向40個重點城市贈送650萬套政府補貼租賃住宅,可容納約1,300萬人居住。

- 此外,韓國、日本等已開發國家在電子領域對特種玻璃的廣泛使用享有盛譽,預計將進一步推動玻璃製造業的成長。

- 預計所有上述因素都將在預測期內推動市場成長。

印度預計成長最快

- 印度礦業部將沙子與大理石、黏土等列為小礦物。小礦物約佔印度採礦業總量的 12%。

- 印度矽砂用途廣泛,如鑄造廠的玻璃形成、化學生產、建築和油漆。

- 無論從收益或市場成長潛力來看,印度都是全球建築市場領先的國家之一。印度是世界第十大經濟體,以購買力平價計算位居世界第三。

- 這導致對商業建築、購物中心、競技場、高層建築、酒店等的需求增加,增加了印度對矽砂的需求。

- 印度建築業是該國最大的產業之一,佔該國GDP的很大一部分。印度的目標是到2025年實現5兆美元的經濟成長。因此,基礎設施建設將發揮關鍵作用。印度政府已推出國家基礎設施管道(NIP)以及「印度製造」和生產掛鉤激勵(PLI)計劃等舉措,以促進基礎設施產業的發展。從歷史上看,該國 80% 以上的基礎設施支出用於資金籌措交通、電力、水利和灌溉。

- 無論從收益或市場成長潛力來看,印度都是全球建築市場領先的國家之一。印度是世界第十大經濟體,以購買力平價計算位居世界第三。預計到 2030年終,中國的房地產行業規模將達到 1 兆美元,不斷成長的城市人口將帶來對額外 2,500 萬套住房的需求。

- 由於建築業和鑄造業的成長,印度矽砂市場預計將出現健康成長。

亞太石英砂產業概況

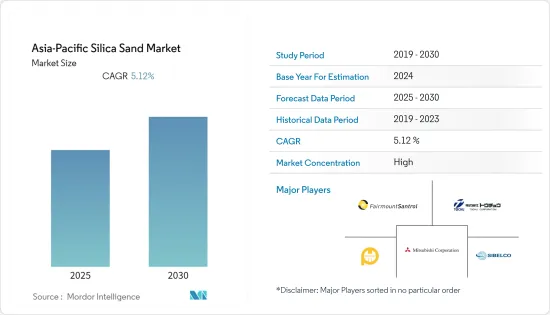

亞太地區矽砂市場部分整合。主要企業包括三菱商事株式會社、東忠商事株式會社、Sibelco、PUM GROUP 和 Fairmount Santrol。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 由於經濟持續成長,建築業增加

- 在鑄造業的應用日益廣泛

- 其他促進因素

- 限制因素

- 非法採砂

- 開發無砂建築產品

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(市場規模(基於數量))

- 最終用戶產業

- 玻璃製造

- 鑄件

- 化學製造

- 建造

- 油漆和塗料

- 陶瓷和耐火材料

- 濾

- 石油和天然氣回收

- 其他

- 地區

- 中國

- 印度

- 日本

- 韓國

- 印尼

- 泰國

- 馬來西亞

- 新加坡

- 菲律賓

- 越南

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Chongqing Changjiang River Moulding Material(Group)Co. Ltd.

- Fairmount Santrol

- Mitsubishi Corporation

- Mangal Minerals

- PUM GROUP

- JFE MINERAL Co., LTD.

- Raghav Productivity Enhancers Limited

- Sibelco

- Shivam Chemicals

- TOCHU CORPORATION

- Xinyi Golden Ruite Quartz Materials Co. Ltd.

第7章 市場機會與未來趨勢

- 在水處理產業的應用日益廣泛

- 牙科和生物技術領域的沙基治療發展

The Asia-Pacific Silica Sand Market is expected to register a CAGR of 5.12% during the forecast period.

Due to the COVID-19 outbreak, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory.

Key Highlights

- The major factor driving the market studied is consistent economic growth leading to increased construction and use in the foundry industry.

- Illegal mining of sand and the development of sand-free construction products are expected to hinder the market's growth.

- Increasing application in the water treatment Industry and the development of sand-based treatments in dentistry and biotechnology are expected to act as opportunities for the market studied in the forecast period.

Asia-Pacific Silica Sand Market Trends

Increasing Demand from the Glass Industry

- The glass manufacturing industry was one of the largest end-user industries of the Asia-Pacific silica sand market.

- Silica sand is an inevitable part of the glass manufacturing industry and accounts for more than 50% of the raw materials used. The material is used in various glass materials, including containers, flat and specialty glass, and fiberglass.

- The container sub-segment accounted for the largest consumption in the glass manufacturing application segment and was followed by the flat glass and the fiberglass sub-segments.

- The market in this application segment is expected to benefit heavily from the increasing demand for flat glass and fiberglass from the rapidly growing automotive and construction sectors in the emerging economies in Asia, especially India and China.

- China's construction sector is the largest industry in the world and according to the National Bureau of Statistics. As per the forecast given by the Ministry of Housing and Urban-Rural Development, China's construction sector is expected to maintain a 6% share of the country's GDP going into 2025.

- The country's demographics are expected to favor housing and commercial construction activities. The growing population has triggered public and private sector investments in affordable residential colonies. China's government has taken the initiative to gift 40 critical cities with 6.5 million government-subsidized rental homes that are supposed to accommodate around 13 million people.

- Moreover, the use of specialty glass in the reputable electronics sector in developed countries such as South Korea and Japan is expected to aid further the growth of the glass manufacturing industry, which in turn, may increase the demand for silica sand in the region.

- All the factors as mentioned above are expected to drive the market growth during the forecast period.

India is expected to Witness the Fastest Growth

- The Indian Ministry of Mines has classified sand as a minor mineral along with marble, clay, and others. The minor minerals account for about 12% of the entire mining industry in India.

- Silica sand in India is used for various applications, such as glass formation in foundries, chemical production, construction, paints, etc.

- India is one of the major countries in the global construction market, both in terms of revenue and market growth potential. India represents the tenth-largest economy in the world and the third-largest in purchasing power parity.

- This has increased demand for commercial buildings, shopping malls, arenas, high-rise buildings, and hotels, boosting the demand for silica sand in India.

- India's construction sector is one of the largest industries in the country, contributing a significant share of its GDP. India aims to achieve a goal of a USD 5 trillion economy by 2025. As a result, infrastructure development will play a critical role. The government has launched the National Infrastructure Pipeline (NIP) along with other initiatives such as the Make in India and Production-Linked Incentives (PLI) schemes to boost the growth of the infrastructure sector. Historically, more than 80% of the nation's infrastructure spending has been spent on funding transportation, power, water, and irrigation.

- India is one of the major countries in the global construction market, both in terms of revenue and market growth potential. India represents the tenth-largest economy in the world and the third-largest in purchasing power parity. The real estate industry in the country is anticipated to reach USD 1 trillion by the end of 2030, with the rising urban population expected to create additional demand for 25 million additional residential units.

- India's silica sand market is expected to grow at a healthy rate because of the growing construction and foundry industry.

Asia-Pacific Silica Sand Industry Overview

The Asia-Pacific silica sand market is partially consolidated in nature. The major companies include Mitsubishi Corporation, TOCHU CORPORATION, Sibelco, PUM GROUP, and Fairmount Santrol, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Consistent Economic Growth Leading to Increase in Construction

- 4.1.2 Increasing Use in the Foundry Industry

- 4.1.3 Others Drivers

- 4.2 Restraints

- 4.2.1 Illegal Mining of Sand

- 4.2.2 Development of Sand-free Construction Products

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 End User Industry

- 5.1.1 Glass Manufacturing

- 5.1.2 Foundry

- 5.1.3 Chemical Production

- 5.1.4 Construction

- 5.1.5 Paints and Coatings

- 5.1.6 Ceramics and Refractories

- 5.1.7 Filtration

- 5.1.8 Oil and Gas Recovery

- 5.1.9 Other End User Industries

- 5.2 Geography

- 5.2.1 China

- 5.2.2 India

- 5.2.3 Japan

- 5.2.4 South Korea

- 5.2.5 Indonesia

- 5.2.6 Thailand

- 5.2.7 Malaysia

- 5.2.8 Singapore

- 5.2.9 Philippines

- 5.2.10 Vietnam

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chongqing Changjiang River Moulding Material (Group) Co. Ltd.

- 6.4.2 Fairmount Santrol

- 6.4.3 Mitsubishi Corporation

- 6.4.4 Mangal Minerals

- 6.4.5 PUM GROUP

- 6.4.6 JFE MINERAL Co., LTD.

- 6.4.7 Raghav Productivity Enhancers Limited

- 6.4.8 Sibelco

- 6.4.9 Shivam Chemicals

- 6.4.10 TOCHU CORPORATION

- 6.4.11 Xinyi Golden Ruite Quartz Materials Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Application in the Water Treatment Industry

- 7.2 Development of Sand based Treatments in Dentistry and Biotechnology