|

市場調查報告書

商品編碼

1683181

策略性礦物材料市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Strategic Mineral Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

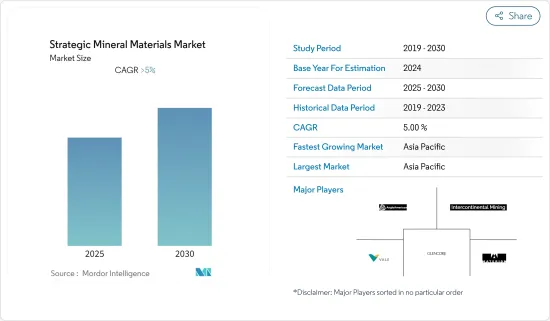

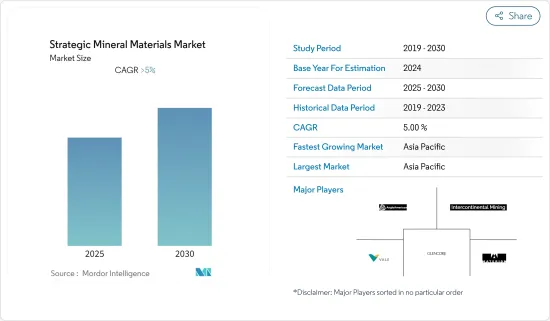

預測期內,策略性礦產市場預計將以超過 5% 的複合年成長率成長

關鍵亮點

- 然而,COVID-19 疫情的影響和對採礦作業日益成長的環境擔憂預計將阻礙市場成長。

- 各種策略性礦產的使用基礎不斷增加預計將成為未來的一個機會。

- 亞太地區佔據市場主導地位,其中中國是最大的消費國,其次是印度、韓國和日本。

戰略礦物材料市場趨勢

鋼鐵應用佔鈮市場主導地位

- 一般來說,鋼的性能取決於鋼的碳、錳、磷、矽、合金元素和細合金元素等化學成分以及加工條件。一般來說,提高鋼強度最簡單的方法就是增加碳含量。然而,這會對其他所需性能(如可焊性、韌性和成形性)產生不利影響。

- 但由於鈮與碳的親和性較大,能形成碳化物和碳氮化物,因此,常以鈮鐵的形式添加到鋼和不銹鋼中,以保持平衡的性能。最終的產品被稱為微合金鋼,通常含有約0.1%重量的鈮,通常與鈦和/或釩結合。

- 在 HSLA 鋼中,鈮通常佔合金總量的不到 0.1%,但其作為結晶細化劑的作用卻有很大不同,可提高鋼的強度、可焊性、延展性和韌性。低等級鋼的強度來自於結晶尺寸,而高等級鋼的強度來自於結晶晶粒尺寸和沈澱硬化的結合。

- 低等級鋼的強度來自於結晶尺寸,而高級鋼的強度來自於結晶尺寸和沈澱硬化的結合。由於鈮和鈦與碳、氮等間隙元素結合,因此這些鋼被描述為無間隙鋼。

- 然而,最好的結果通常是透過結合利用協同優勢的精細合金來實現的。例如,在「暴露」的無機鋼汽車部件上將鈮與鈦結合使用,這對於出色的表面品質至關重要。

- 大多數現代 HSLA 鋼都屬於這個「低碳」類別。全球範圍內,90%的鈮產品用於鋼鐵業。

- 鈮在高強度低合金(HSLA)鋼中的最大用途是汽車、石油管線和建築。 HSLA 鋼也用於核子反應爐(與鋯合金製成核心元件)、風力發電機、鐵路軌道和造船。 HSLA 鋼消耗了每年鈮產量的約 90%。

- 鈮鐵是鋼鐵業應用最廣泛的產品,主要用於管道、汽車、結構鋼和不銹鋼四個領域。在管道產業方面,中國的應用與全球其他地區類似,但在汽車用鋼、結構鋼和不銹鋼產業的應用有很大差異。

亞太地區佔市場主導地位

亞太地區佔據全球市場主導地位。中國、印度、韓國和日本等國家正經歷各種礦物在各種用途上的加速利用,預測期內該市場可能會顯著成長。由於印度和中國等國家的高需求,亞太地區的電氣和電子產業(包括半導體和通訊)近年來發展迅速。由於電子產業創新、技術進步和研發活動的快速發展,對最新電子產品的需求很高。專門生產高階產品的製造工廠和研發中心的數量也在增加。航太是戰略礦物材料的另一個主要終端用戶產業。隨著全球對飛機的需求不斷增加,航太業正在尋求實施創新解決方案來縮短生產時間並降低成本。因此,預測期內上述因素將加速戰略礦物材料在各種應用上的使用。然而,由於該地區目前的 COVID-19 疫情可能繼續影響經濟表現和需求,因此整個 2020 年的需求可能仍會受到影響。

策略性礦產和材料產業概況

全球策略性礦物材料市場本質上是分散的,因為有許多公司經營各種礦物。市場上一些知名的公司包括洲際礦業、淡水河谷、英美資源集團、嘉能可、CBMM 和 Materion Corporation。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 各終端用戶產業的需求不斷增加

- 其他促進因素

- 限制因素

- 新冠肺炎疫情的影響

- 採礦作業的環境問題日益嚴重

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 礦物

- 銻

- 阻燃劑

- 電池

- 陶瓷和玻璃

- 催化劑

- 合金

- 重晶石

- 石油和天然氣

- 其他用途(油漆、化學品製造等)

- 鈹

- 電子產品

- 航太

- 車

- 能源

- 其他

- 鈷

- 電池

- 高溫合金

- 硬質合金和鑽石工具

- 催化劑

- 其他

- 螢石

- 化學品

- 鋼

- 鋁

- 水泥

- 其他

- 鎵

- 積體電路

- 雷射二極體

- 受光元件

- 太陽能電池

- 其他

- 鎗

- 光纖

- 紅外線光學

- 催化劑

- 電氣和太陽能設備

- 其他

- 銦

- 平板顯示器和觸控螢幕

- 低熔點合金和焊料

- 半導體

- 透明熱反射器

- 其他

- 錳

- 鑄造合金

- 包裝

- 運輸

- 建築學

- 其他

- 鈮

- 鋼

- 高溫合金

- 超導磁鐵

- 電容器

- 玻璃

- 其他

- 鉑族元素

- 自催化

- 珠寶飾品

- 電氣和電子

- 化學

- 其他

- 稀土

- 催化劑

- 電池

- 磁性合金

- 冶金

- 其他

- 鉭

- 電子產品

- 醫療

- 航太

- 車

- 其他

- 銻

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率/排名分析

- 主要企業策略

- 公司簡介

- Anglo American plc

- CBMM

- Glencore

- Indium Corporation

- Intercontinental Mining

- Materion Corporation

- South32

- Vale

- WARRIOR GOLD INC.

第7章 市場機會與未來趨勢

- 擴大各種礦物質的用途

The Strategic Mineral Materials Market is expected to register a CAGR of greater than 5% during the forecast period.

Key Highlights

- On the flipside, the impact of COVID-19 pandemic and increasing environmental concerns regarding mining operations is expected to hinder the growth of the market.

- Increasing application base for various strategic minerals is projected to act as an opportunity in the future.

- Asia-Pacific dominated the market with the largest consumption coming from China, followed by India, South Korea, and Japan.

Strategic Mineral Materials Market Trends

Steel Application to Dominate the Niobium Segment

- In general, the properties of steel depend on its chemical composition concerning carbon, manganese, phosphorus, silicon, alloying and micro-alloying elements, and processing conditions. Generally, the easiest way to increase the strength of steel is improving its carbon content. But this adversely affects other necessary properties, such as weldability, toughness, and formability.

- However, niobium has a high affinity for carbon, forming carbides and carbon nitrides, therefore, it is often added to steel and stainless steel in the form of ferro-niobium to maintain a balanced package of properties, the carbon and niobium levels being carefully matched with processing conditions to achieve the desired properties. The result, known as a micro-alloyed steel product, typically contains around 0.1% niobium by weight, often in conjunction with titanium and vanadium.

- In HSLA steel niobium is often less than 0.1% of the total alloy, but its role as a grain refiner makes a significant difference by increasing strength, weldability, ductility, and toughness of the steel. Strength is generated by grain refinement for the lower grades and a combination of grain refinement and precipitation hardening for the higher grades.

- Strength is generated by grain refinement for the lower grades and a combination of grain refinement and precipitation hardening for the higher grades. These steels are described as interstitial-free, since niobium and titanium fix interstitial elements, like carbon and nitrogen.

- However, the best results are usually achieved with a combination of micro alloys that exploit synergistic benefits. An example of this is the use of niobium and titanium together in 'exposed' interstitial-free steel automobile parts where superior surface quality is essential.

- Most modern HSLA steels fall into this 'low carbon' category. Globally, 90% of the niobium products are used in the steel industry.

- The largest use for niobium in high-strength and low-alloy (HSLA) steel is for automobiles, oil pipelines, and construction. HSLA steels are also used in nuclear reactors (alloyed with zirconium to make core elements), wind turbines, railroad tracks, and in ship building. HSLA steels consume approximately 90% of the annual niobium production.

- Ferro niobium is the most widely used product in the steel industry, which is mainly applied in four fields of the pipeline, automobile, structure, and stainless steel. As for the pipeline industry, the application in China is in line with that in the other parts of the world, but the difference is significant in the application in automotive steel, structural steel, and stainless steel industries.

Asia-Pacific to Dominate the Market

Asia-Pacific dominated the global market. With accelerating usage of various minerals in different applications in countries, such as China, India, South Korea, and Japan, the market studied is likley to witness significant growth during the forecast period. The Asia-Pacific electrical and electronics industry (including semiconductors and telecommunications) grew rapidly in the recent past, owing to the high demand from countries, like India and China. There is a high demand for modern electronic products, due to the rapid pace of innovation, the advancement of technology, and R&D activities in the electronics industry. There is a growth in the number of manufacturing plants and development centers, focusing on high-end products. Aerospace is the another major end-user industry for strategic mineral materials. The demand for aircraft is increasing across the world, and the aerospace industry is aiming to introduce innovative solutions to improve the manufacturing time and save costs. Therefore, the aforementioned factors are accelerating the usage of strategic mineral materials from various applications during the forecast period. However, the demand is likely to be affected during 2020 as well, as economic performance and demand are likely to remain affected by the current COVID-19 pandemic in the region.

Strategic Mineral Materials Industry Overview

The global strategic mineral materials market is fragmented in nature with the presence of numerous players for different minerals. The prominent companies in the market includes Intercontinental Mining, Vale, Anglo American plc, Glencore, CBMM, and Materion Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Various End-user Industries

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Impact of COVID-19 Pandemic

- 4.2.2 Growing Environmental Concerns over Mining Operations

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Mineral

- 5.1.1 Antimony

- 5.1.1.1 Flame Retardants

- 5.1.1.2 Batteries

- 5.1.1.3 Ceramics and Glass

- 5.1.1.4 Catalyst

- 5.1.1.5 Alloys

- 5.1.2 Barite

- 5.1.2.1 Oil and Gas

- 5.1.2.2 Other Applications (paints, chemical manufacturing and others)

- 5.1.3 Beryllium

- 5.1.3.1 Electronics

- 5.1.3.2 Aerospace

- 5.1.3.3 Automotive

- 5.1.3.4 Energy

- 5.1.3.5 Other Applications

- 5.1.4 Cobalt

- 5.1.4.1 Batteries

- 5.1.4.2 Superalloys

- 5.1.4.3 Cemented Carbides and Diamond Tools

- 5.1.4.4 Catalysts

- 5.1.4.5 Other Applications

- 5.1.5 Fluorspar

- 5.1.5.1 Chemicals

- 5.1.5.2 Steel

- 5.1.5.3 Aluminum

- 5.1.5.4 Cement

- 5.1.5.5 Other Applications

- 5.1.6 Gallium

- 5.1.6.1 Integrated Circuits

- 5.1.6.2 Laser diodes

- 5.1.6.3 Photodetectors

- 5.1.6.4 Solar Cells

- 5.1.6.5 Other Applications

- 5.1.7 Germanium

- 5.1.7.1 Fiber Optics

- 5.1.7.2 Infrared Optics

- 5.1.7.3 Catalyst

- 5.1.7.4 Electrical and Solar Equipment

- 5.1.7.5 Other Applications

- 5.1.8 Indium

- 5.1.8.1 Flat-Panel Display Screens and Touchscreens

- 5.1.8.2 Low Melting Alloys and Solders

- 5.1.8.3 Semiconductors

- 5.1.8.4 Transparent Heat Reflectors

- 5.1.8.5 Other Applications

- 5.1.9 Manganese

- 5.1.9.1 Casting Alloys

- 5.1.9.2 Packaging

- 5.1.9.3 Transportation

- 5.1.9.4 Construction

- 5.1.9.5 Other Applications

- 5.1.10 Niobium

- 5.1.10.1 Steel

- 5.1.10.2 Super Alloys

- 5.1.10.3 Superconducting Magnets

- 5.1.10.4 Capacitors

- 5.1.10.5 Glass

- 5.1.10.6 Other Applications

- 5.1.11 Platinum Group Elements

- 5.1.11.1 Autocatalyst

- 5.1.11.2 Jewelry

- 5.1.11.3 Electrical & Electronics

- 5.1.11.4 Chemical

- 5.1.11.5 Other Applications

- 5.1.12 Rare Earth Elements

- 5.1.12.1 Catalyst

- 5.1.12.2 Batteries

- 5.1.12.3 Magnetic Alloys

- 5.1.12.4 Metallurgy

- 5.1.12.5 Other Applications

- 5.1.13 Tantalum

- 5.1.13.1 Electronics

- 5.1.13.2 Medical

- 5.1.13.3 Aerospace

- 5.1.13.4 Automotive

- 5.1.13.5 Other Applications

- 5.1.1 Antimony

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 ASEAN Countries

- 5.2.1.6 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Spain

- 5.2.3.6 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations and Agreements

- 6.2 Market Share/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anglo American plc

- 6.4.2 CBMM

- 6.4.3 Glencore

- 6.4.4 Indium Corporation

- 6.4.5 Intercontinental Mining

- 6.4.6 Materion Corporation

- 6.4.7 South32

- 6.4.8 Vale

- 6.4.9 WARRIOR GOLD INC.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Application base of Various Minerals