|

市場調查報告書

商品編碼

1683196

電信電源系統:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Telecom Power Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

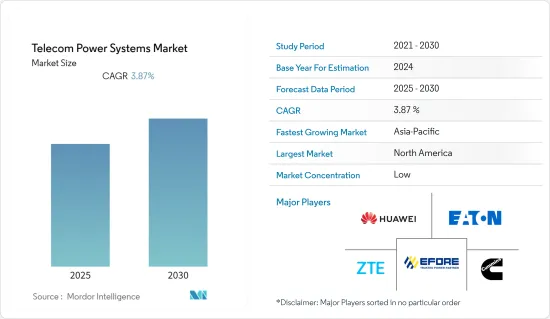

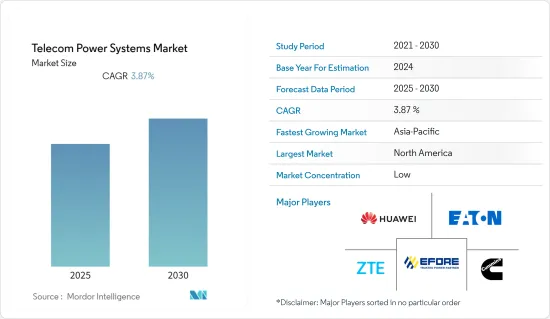

預計預測期內電信電源系統市場複合年成長率為 3.87%。

主要亮點

- 通訊電源系統由整流器、電池和電源系統控制器組成,確保電網電力中斷或波動時的通訊服務。電信電力系統市場主要受世界各地區更多塔的安裝所推動。這背後有多種因素,包括技術的變化。

- 隨著 4G 和 5G 等新興技術的推出,市場對塔式安裝的需求不斷增加。然而,各地區的4G和5G技術覆蓋率相對較低,迫使電信業者安裝更多的訊號塔來適應語音和資料流量的成長。隨著科技的進步,人們對速度的需求也不斷增加。最初,由於覆蓋範圍不足,速度不一致,但這種情況正在改變。

- 利用太陽能是一種可靠的方式,可以為主要電網以外的偏遠地區的通訊系統供電,例如無法到達的山頂或無法建造新輸電線路的廣闊濕地。這種發展可能成為該市場的未來趨勢。

- 停電是採用現代接取技術的一個主要障礙,尤其是在新興經濟體。這項問題令世界各地的服務提供者、基地台營運商和所有者感到沮喪。根據 GSMA 的最新研究,到 2025 年,中東和北非地區的 5G 連線數將超過 5,000 萬個,屆時該地區約 30% 的人口將被 5G 網路覆蓋。

- 此外,由於技術進步和成本下降,通訊系統的再生能源來源最近變得越來越受歡迎。風能和太陽能等可再生資源可提供有用的能源,降低系統基礎設施運作的整體成本,並減少碳排放。

新冠疫情也導致寬頻流量增加,促使通訊業推出多項基礎設施擴建計畫。據電訊(ITU)稱,由於新冠疫情導致的流量增加,導致容量擴張(即營運和維護CAPEX)帶來的資本支出(CAPEX)加速。資本支出的增加導致對新電力系統的需求。

電信電源系統的市場趨勢

5G接入應用將佔據較大市場佔有率

- 5G 是一種最新的無線寬頻技術,被稱為第五代無線技術。企業的目標是將位元率達到下行鏈路的峰值資料速率達到 100MB/s 到 20GB/s。但300MB/s的速率尚未投入實用化。 5G 採用 450 MHz 至 6 GHz 的 6 GHz 以下頻譜和 24 GHz 至 52 GHz 的毫米波頻率。

- 在短時間內如此迅速地採用 5G 可以成為研究市場的主要驅動力,因為它將鼓勵部署更多的行動通訊基地台。此類基礎設施改善並不只發生在該地區的少數國家,而是在許多國家。

- 隨著全球資料流量的增加,許多企業可能會採用5G連接來確保業務效率並最大限度地減少與業務違規相關的損失。 5G網路將支援一系列技術,包括物聯網(IoT)和可以在農業領域獨立運作的戶外機器人。

- DongAh Elecomm 為快速發展和多功能的通訊業提供整流器和熱插拔電源模組、電源架和能源系統。 DongAh Elecomm 的電力支援韓國三大服務供應商的 4G/LTE小型基地台部署:韓國電信、SK 電信和 LGU+,這三家公司在三年內已在韓國各地部署了超過 30 萬個小型基地台系統。

- 愛立信表示,全球行動資料流程量總量將持續成長,預計到 2024年終將達到每月 131 Exabyte。這意味著 2018 年至 2024 年的複合年成長率為 30%。該公司預測,到 2024 年 5G 網路將承載所有行動資料流量的 35%。

在預測期內,電信電源系統市場可能會受到建設 5G 技術在企業中使用所需的基礎設施的投資所驅動。

北美佔據主要市場佔有率

- 北美是大多數新技術最早部署的地區之一,通訊技術也不例外。北美94%的人擁有行動電話。

- 愛立信預計,到2025年終5G行動電話用戶數將達到3.18億,相當於北美所有行動電話用戶的80%以上。這可能會推動對電信電源系統的需求。

- 因此,為了滿足未來 5G 服務在容量、覆蓋範圍和效率方面的需求,美國網路營運商正在對其網路進行投資,以最低的每位元成本獲得最佳效能。這是透過利用網路功能虛擬(NFV) 和軟體定義網路 (SDN) 等新技術來實現的,從而使網路盡可能高效。

這些技術被擴大採用的原因可能是通訊電源系統市場的發展,因為這些技術進步會提高最終用戶的網路速度,而這是透過使用更高的頻率實現的。頻率越高,網路覆蓋範圍越小。這意味著必須安裝更多的行動訊號塔來覆蓋所有客戶,最終推動通訊電源系統市場的發展。

通訊電源系統產業概況

由於4G LTE 系統的出現,電信電源系統市場變得分散。預計未來參與者數量將進一步增加,市場競爭將更加激烈。主要參與者包括伊頓公司、華為技術有限公司和康明斯公司。

2022年5月,華為宣布推出新一代電源解決方案PowerPOD 3.0。我們採用創新融合架構,採用業界超高密度UPS5000-H,提高單櫃功率密度,並改善電源系統空間佈局。

2022年5月,愛立信宣布德國電信5G網路試驗進展順利。這可能是透過使用可再生能源和平衡供需使行動站點運作更加永續的一大步。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響

第5章 市場動態

- 市場促進因素

- 塔架安裝需求不斷增加

- 電訊採用混合電源系統

- 市場限制

- 實施和營運成本高

第6章 技術簡介

- 電源

- 轉換器

- 整流器

- 控制和監控組件

- 內閣

- 電池管理工具

第7章 市場區隔

- 按輸出範圍

- 低的

- 中等的

- 高的

- 按最終用戶應用

- 使用權

- 核

- 捷運

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第8章 競爭格局

- 公司簡介

- Eaton Corporation

- Huawei Technologies Co.

- Cummins Inc.

- ZTE Corporation

- Efore Group

- Eltek AS

- Delta Group

- Alpha Technologies

- ABB Group

- Schneider Electric

第9章投資分析

第10章 市場機會與未來趨勢

The Telecom Power Systems Market is expected to register a CAGR of 3.87% during the forecast period.

Key Highlights

- Telecom power systems comprise rectifiers, batteries, and a power system controller, and they secure telecommunication services in case of grid power interruptions and fluctuations. The telecom power systems market has been mostly driven by the fact that more towers are being put up in different parts of the world. This is due to a number of factors, including changing technologies.

- The increasing need for tower installations is driving the market as the following technologies, such as 4G and 5G, are being deployed. Still, the coverage is relatively lower for 4G and 5G technologies in various regions, so telecom companies need to set up more towers to handle the growing voice and data traffic. As technology improves, so does people's need for speed. At first, speed would vary because there wasn't enough coverage, but that's changing now.

- Using solar energy is a steady method of providing electrical power to telecommunication systems in remote places beyond the main electricity grid, for instance, on mountaintops and vast swamps where power is unavailable or it is impractical to install new power lines. This deployment may become a future trend in this market.

- Power outages, especially in developing economies, have been a major roadblock to adopting the latest access technologies. This problem has irritated service providers, cell site operators, and owners all over the world. A new GSMA study says that there could be more than 50 million 5G connections in the MENA region by 2025 and that about 30% of the region's population will be covered by 5G networks by that time.

- Additionally, renewable energy sources for remote telecommunication systems have become more popular recently due to technological advancements and lower costs. Renewable resources, like the wind and the sun, provide useful energy, lower the overall costs of running the system's infrastructure, and leave less of a carbon footprint.

The COVID-19 pandemic also led to the growth of broadband traffic, leading to several infrastructure expansion plans by the telecom industry. According to the International Telecommunication Union (ITU), the increase in traffic due to the COVID-19 pandemic resulted in an acceleration of capital expenditure (CAPEX) via the expansion of capacity (i.e., operations and maintenance CAPEX). The increased capital expenditure has led to a need for new power systems.

Telecom Power Systems Market Trends

Access Application in 5G Holds the Significant Share in the Market

- 5G is a recent wireless broadband technology and is marketed as the fifth generation of radio technologies. There is a target for the firms for the bit rate to have peak data rates of 100 MB/s up to 20 GB/s in the downlink. However, 300 MB/s rates have yet to be achieved in practical implementations. 5G employs a sub-6 GHz spectrum ranging from 450 MHz to 6 GHz as well as mmWave frequencies ranging from 24 GHz to 52 GHz.

- This increasing penetration of 5G in such a short span of time can be a major driver for the market studied, as this will fuel the deployment of more cell sites. This improvement in infrastructure isn't just happening in a few countries in the area; it's happening in many.

- With increasing data traffic globally, 5G connectivity will be incorporated in many enterprises to ensure operational efficiency and minimize losses associated with operational breaches. The 5G network will support a variety of technologies, including the Internet of Things (IoT), outdoor robots that can function independently in the agriculture sector, etc.

- DongAh Elecomm supplies rectifier and hot-swap power supply modules, power shelves, and energy systems for the fast-developing and multi-functionalized communications industry. DongAh Elecomm's power is behind the 4G/LTE small cell deployment for South Korea's three major service providers: Korea Telecom, SK Telecom, and LGU+, which deployed more than 300,000 small cell systems across the Republic of Korea over three years.

- According to Ericsson, total mobile data traffic may continue to increase globally and is predicted to reach 131 exabytes per month by the end of 2024. This implies a 30% compound annual growth rate between 2018 and 2024. By 2024, the firm expects that 5G networks will carry 35% of total mobile data traffic.

During the forecast period, the market for telecom power systems is likely to be driven by investments in building the infrastructure needed for 5G technology to be used in the business world.

North America Account for Significant Market Share

- North America has been one of the first places to use most new technologies, and telecom technologies are no exception. In North America, 94% of people have a mobile phone.

- Ericsson says that by the end of 2025, there will be 318 million 5G mobile subscriptions, which is more than 80% of all mobile subscriptions in North America. This may increase the demand for telecom power systems.

- So, to meet the needs of future 5G services in terms of capacity, coverage, and efficiency, network operators in the United States are investing in their networks to get the best performance at the lowest cost per bit. They are doing this by using new technologies like network function virtualization (NFV) and software-defined networking (SDN) to make their networks as efficient as possible.

The rationale behind the increasing adoption of these technologies can be a driving factor for the telecom power systems market, as advancements in these technologies bring increased internet speeds for end users, which are achieved by the use of higher frequencies. When higher frequencies are used, network coverage gets smaller. This means that more mobile towers need to be set up to cover all customers, which will eventually drive the telecom power systems market.

Telecom Power Systems Industry Overview

The telecom power systems market is fragmented with the advent of 4G LTE systems. There will be more players added, which will increase the market's competition. Key players are Eaton Corporation, Huawei Technologies Co., and Cummins Inc.

In May 2022, Huawei announced the launch of a new generation of power supply solutions, PowerPOD 3.0. By using an innovative converged architecture and the industry's ultra-high-density UPS5000-H, the power density per cabinet is increased, and the space layout of the power supply system is improved.

In May 2022, Ericsson announced that a trial of Deutsche Telekom's 5G-enabled network had gone well. This could be a big step toward making mobile site operations more sustainable by using renewable energy and balancing supply and demand.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Tower Installations

- 5.1.2 Adoption of Hybrid Power System in Telecom

- 5.2 Market Restraints

- 5.2.1 High Deployment and Operational Cost

6 TECHNOLOGY SNAPSHOT

- 6.1 Power Supply

- 6.2 Converters

- 6.3 Rectifiers

- 6.4 Control and Monitoring Assemblies

- 6.5 Cabinetry

- 6.6 Battery Management Tools

7 MARKET SEGMENTATION

- 7.1 By Power Range

- 7.1.1 Low

- 7.1.2 Medium

- 7.1.3 High

- 7.2 By End-user Application

- 7.2.1 Access

- 7.2.2 Core

- 7.2.3 Metro

- 7.3 By Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia Pacific

- 7.3.4 Latin America

- 7.3.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Eaton Corporation

- 8.1.2 Huawei Technologies Co.

- 8.1.3 Cummins Inc.

- 8.1.4 ZTE Corporation

- 8.1.5 Efore Group

- 8.1.6 Eltek AS

- 8.1.7 Delta Group

- 8.1.8 Alpha Technologies

- 8.1.9 ABB Group

- 8.1.10 Schneider Electric