|

市場調查報告書

商品編碼

1683202

屋頂膜:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Roofing Membranes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

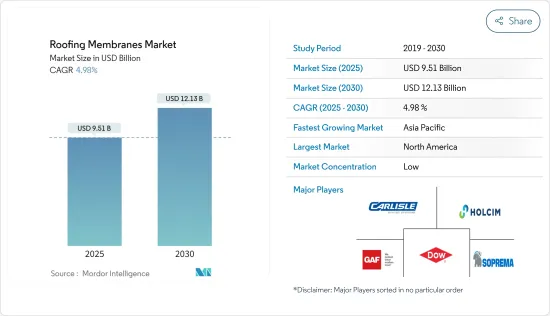

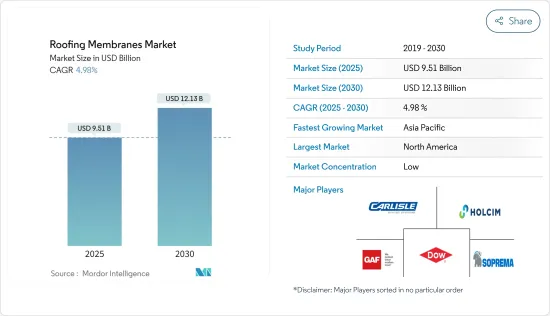

屋頂膜市場規模預計在 2025 年為 95.1 億美元,預計到 2030 年將達到 121.3 億美元,預測期內(2025-2030 年)的複合年成長率為 4.98%。

關鍵亮點

- 建築計劃中輕量材料的採用越來越多以及建設活動的活性化是推動屋頂膜市場成長的關鍵因素。

- 然而,原料價格的波動和嚴格的法規和標準可能會阻礙市場成長。

- 在預測期內,對節能屋頂膜的需求不斷成長和技術進步可能為市場提供有利的成長機會。

- 由於建設活動的活性化,北美佔據了屋頂膜市場的主導地位。

屋頂膜市場趨勢

商業領域佔據市場主導地位

- 屋頂膜廣泛應用於業務用途,其需求主要受到全球蓬勃發展的商業建築業的推動。這些薄膜在商業建築中充當重要的防水屏障,保護建築物免受環境因素的影響並保持屋頂系統的完整性。

- 這些薄膜的強度、耐用性和不透水性使其成為商業屋頂應用的首選。

- 這些薄膜用於工廠、火車站、機場、公司總部、購物中心、劇院、學校和醫院等商業領域。

- 亞太地區在商業建築領域佔據主導地位。受政府大力發展舉措的推動,尤其是印度和中國政府,該地區近期對辦公空間的需求激增。

- 根據國家統計局資料,2022年,中國全年商業營業用地開工面積約8155萬平方公尺,較上年的14,105萬平方公尺有所下降。此外,2023年終商品房待售占地面積為6.7295億平方公尺,與前一年同期比較成長19%。

- 在印度,Infosys Pocharam 辦公園區的建設預計將於 2023 年第三季開始,並於 2027 年第三季末完工,占地面積的辦公園區擴建。

- 在中東,政府為加強商業部門發展而推出的多項舉措,如沙烏地阿拉伯2030願景和阿布達比2030經濟願景,預計將大幅促進屋頂膜的消費。

- 預計各種飯店建築計劃將進一步推動對屋頂膜的需求。例如,隨著旅遊業的復甦,萬豪國際集團計劃在越南頂級旅遊目的地(包括河內、胡志明市、峴港和富國島)開設 20 家豪華酒店和度假村。

- 安納塔拉酒店、度假村和水療中心透露了在巴西開設新度假村的計劃,該度假村預計將於 2025 年開業。安納塔拉瑪穆卡博度假村擁有 116 間客房、套房和泳池別墅。

- 隨著商業建築建設的增加,預計未來幾年對商業屋頂膜的需求將會成長。

北美可望主導市場

- 北美佔據全球市場的最大佔有率。在美國、加拿大和墨西哥等國家,更輕、更快捷的建築技術的採用正在推動對屋頂膜的需求激增。

- 美國擁有世界上最大的建築業之一。根據美國人口普查局預測,2023年美國建築總價值將達到19.78兆美元,較2022年成長7%。截至2024年2月,獲準建造的私人住宅數量達到151.8萬套,較2023年同期成長2.4%。

- 隨著美國多個新的商業建築計劃的建設,對屋頂膜的需求預計將進一步增加。例如,2024 年 1 月,印第安納州政府與 Meta Platforms Inc. 合作在印第安納州建造一個價值 8 億美元的新資料中心園區。該計劃預計於 2026 年完工,並將在 River Ridge 商業中心建造一個 70 萬平方英尺的設施。

- 加拿大統計局的數據顯示,建築業總投資成長了 1.7%,從 2023 年 10 月的 19.446 兆美元增至 2023 年 11 月的 19.767 兆美元。同期住宅建築投資成長 2.2% 至 137 億美元,非住宅建築投資成長 0.6% 至 60 億美元。

- 2023年,墨西哥國際貿易署報告稱,墨西哥建築業的價值顯著成長。整個產業價值將從 2022 年的 1,028.8 億美元增至 2023 年的 1,205.8 億美元。特別是基礎設施產業,其價值預計將從 2022 年的 388.3 億美元飆升至 2023 年的 461 億美元左右。建築和基礎設施領域的這些上升趨勢將在未來幾年推動墨西哥所研究市場的需求。

- 因此,預計預測期內建築市場的有利條件和輕量材料的日益採用將增加北美對屋頂膜的需求。

屋頂膜產業概況

屋頂膜市場比較分散。主要參與企業(不分先後順序)包括 Carlisle SynTec Systems、Sika AG、HOLCIM、GAF Inc. 和 Saint-Gobain。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 計劃中擴大採用輕量材料

- 建設活動增加

- 其他促進因素

- 市場限制

- 原物料價格波動

- 嚴格的法規和標準

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(以金額為準的市場規模)

- 依產品類型

- 熱塑性聚烯(TPO)

- 三元乙丙橡膠(EPDM)

- 聚氯乙烯(PVC)

- 改質瀝青(Modbit)

- 其他

- 按安裝類型

- 機械附著力

- 全黏性

- 安定器

- 其他安裝類型

- 按應用

- 住宅

- 商業設施

- 設施

- 基礎設施

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Carlisle SynTec Systems

- Dow

- GAF Inc.

- Henry Company

- HOLCIM

- IB Roof Systems

- IKO Polymeric

- Johns Manville

- Kingspan Group

- Owens Corning

- Polygomma

- Sika AG

- Siplast Inc.

- SOPREMA

第7章 市場機會與未來趨勢

- 節能屋頂膜的需求不斷成長

- 技術進步

- 其他機會

簡介目錄

Product Code: 64123

The Roofing Membranes Market size is estimated at USD 9.51 billion in 2025, and is expected to reach USD 12.13 billion by 2030, at a CAGR of 4.98% during the forecast period (2025-2030).

Key Highlights

- The rising adoption of lightweight materials in construction projects and increasing construction activities are the major factors driving the growth of the roofing membranes market.

- However, fluctuating raw material prices and stringent regulations and standards are likely to hinder the growth of the market.

- Nevertheless, the increasing demand for energy-efficient roofing membranes and advancements in technology are likely to create lucrative growth opportunities for the market during the forecast period.

- North America dominates the roofing membranes market owing to the growing construction activities in the region.

Roofing Membranes Market Trends

Commercial Segment to Dominate the Market

- Roofing membranes are widely utilized in commercial applications, and their demand is largely fueled by a surge in global commercial construction. These membranes serve as a vital waterproof barrier in commercial buildings, shielding them from environmental elements and upholding the roofing system's integrity.

- Due to their strength, durability, and impermeability to water, these membranes have become the preferred choice for commercial roofing applications.

- These membranes are used in commercial areas, such as factories, railway stations, airports, company headquarters, shopping centers, theaters, schools, and hospitals.

- Asia-Pacific is a dominant player in the commercial construction arena. The region recently witnessed a boom in office space demand, particularly in India and China, driven by proactive government development initiatives.

- As per the data from the National Bureau of Statistics of China, in 2022, the annual starting construction of commercial properties in China amounted to around 81.55 million square meters, down from 141.05 million square meters from the previous year. Furthermore, at the end of 2023, the floor space of commercial buildings for sale was 672.95 million square meters, up by 19% over the previous year.

- In India, the construction of Infosys Pocharam Office Campus, which includes the expansion of an office campus with a floor area of 761,804 square meters, was initiated in the third quarter of 2023, and it is likely to be completed by the end of Q3 2027.

- In the Middle East, several government initiatives to bolster the development of the commercial sector, such as Saudi Arabia Vision 2030 and Abu Dhabi Economic Vision 2030, are likely to substantially drive the consumption of roofing membranes.

- Various hotel construction projects are expected to further propel the demand for roofing membranes. For instance, as the tourism industry rebounds, Marriott International Inc. is set to unveil 20 luxury hotels and resorts across Vietnam's prime tourist spots, including Hanoi, Ho Chi Minh City, Da Nang, and Phu Quoc Island.

- Anantara Hotels, Resorts, and Spas revealed plans for a new resort in Brazil, slated to debut in 2025. Anantara Mamucabo will feature 116 guest rooms, suites, and pool villas.

- Given the growth in commercial construction activities, the demand for roofing membranes in commercial applications is poised for growth in the coming years.

North America Expected to Dominate the Market

- North America holds the largest share of the global market. Countries like the United States, Canada, and Mexico have seen a surge in demand for roofing membranes, driven by the adoption of lightweight and swift construction techniques.

- The United States boasts one of the world's largest construction industries. According to the United States Census Bureau, in 2023, the nation's construction value hit USD 19.78 trillion, marking a robust 7% increase from 2022. By February 2024, the number of privately owned housing units authorized by building permits reached 1,518,000, showing a 2.4% uptick from the same period in 2023.

- Several new commercial construction projects are under construction in the United States, which are likely to increase the demand for roofing membranes further. For instance, in January 2024, the government of Indiana and Meta Platforms Inc. partnered to construct a new USD 800 million data center campus in Hoosier State. The project, which is likely to be completed by the year 2026, is a 700,000-square-foot facility at the River Ridge Commerce Center.

- Statistics Canada reported a 1.7% increase in total investment in building construction, climbing from USD 19,446 billion in October 2023 to USD 19,767 billion in November 2023. In the same period, residential spending saw a 2.2% growth, hitting USD 13.7 billion, while non-residential spending rose by 0.6% to USD 6.0 billion.

- In 2023, Mexico's construction industry, as reported by the International Trade Administration, saw a notable uptick in value. The industry's overall worth climbed to USD 120.58 billion, up from USD 102.88 billion in 2022. Specifically, the infrastructure segment surged to about USD 46.10 billion in 2023, a significant rise from USD 38.83 billion in 2022. These upward trajectories in both the construction and infrastructure sectors are poised to fuel the demand for the market studied in Mexico in the coming years.

- Hence, due to such positive factors in the construction market and the growing adoption of lightweight materials, the demand for roofing membranes is projected to increase in North America during the forecast period.

Roofing Membranes Industry Overview

The roofing membrane market is fragmented in nature. The major players (not in any particular order) include Carlisle SynTec Systems, Sika AG, HOLCIM, GAF Inc., and Saint-Gobain.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Adoption of Lightweight Materials in Construction Projects

- 4.1.2 Increasing Construction Activities

- 4.1.3 Other Drivers

- 4.2 Market Restraints

- 4.2.1 Fluctuating Raw Materials Prices

- 4.2.2 Stringent Regulations and Standards

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 By Product Type

- 5.1.1 Thermoplastic Polyolefin (TPO)

- 5.1.2 Ethylene Propylene Diene Monomer (EPDM)

- 5.1.3 Poly Vinyl Chloride (PVC)

- 5.1.4 Modified Bitumen (Mod-Bit)

- 5.1.5 Other Product Type

- 5.2 By Installation Type

- 5.2.1 Mechanically Attached

- 5.2.2 Fully Adhered

- 5.2.3 Ballasted

- 5.2.4 Other Installation Types

- 5.3 By Application

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Institutional

- 5.3.4 Infrastructural

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Carlisle SynTec Systems

- 6.4.2 Dow

- 6.4.3 GAF Inc.

- 6.4.4 Henry Company

- 6.4.5 HOLCIM

- 6.4.6 IB Roof Systems

- 6.4.7 IKO Polymeric

- 6.4.8 Johns Manville

- 6.4.9 Kingspan Group

- 6.4.10 Owens Corning

- 6.4.11 Polygomma

- 6.4.12 Sika AG

- 6.4.13 Siplast Inc.

- 6.4.14 SOPREMA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Energy-efficient Roofing Membranes

- 7.2 Advancements in Technology

- 7.3 Other Opportunities

02-2729-4219

+886-2-2729-4219

![TPO屋頂膜市場:市場規模、趨勢、成長分析 [2024-2030]](/sample/img/cover/42/1496975.png)

![PVC 屋頂膜市場:市場規模、趨勢、成長分析 [2024-2030]](/sample/img/cover/42/1496974.png)