|

市場調查報告書

商品編碼

1683210

衛星天線:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Satellite Antenna - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

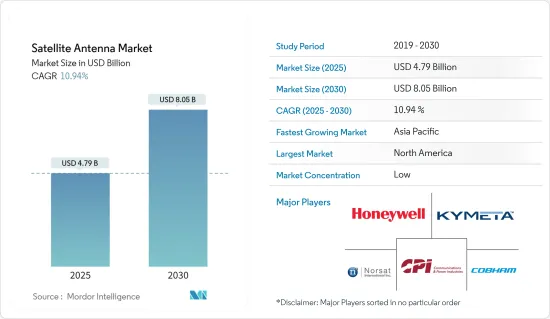

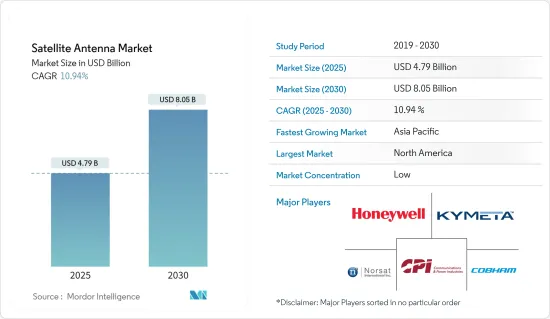

衛星天線市場規模預計在 2025 年為 47.9 億美元,預計到 2030 年將達到 80.5 億美元,預測期內(2025-2030 年)的複合年成長率為 10.94%。

過去幾年來,邊防安全、海上攔截和行動通訊等關鍵領域對增強通訊能力的需求顯著成長,衛星天線系統已成為不可或缺的解決方案。

主要亮點

- 對於寬頻通訊的需求不斷成長,並且不一定特定於地點。這項需求包括在船舶、飛機和車輛上工作的使用者(包括緊急應變人員)的連接需求,既有固定的,也有主動的。這三個不同的平台需要沿途保持持續的連接,而這些平台經常經過大城市服務不足的地區和人口密度較低的地區。

- 太空探勘任務數量的增加、小型衛星的廣泛應用、投資的增加以及對衛星輔助軍事系統的需求的不斷成長,正在推動所研究市場的擴張。例如,2023年3月,加拿大聯邦預算宣布撥款25億美元,支持其太空領導地位。其中包括五年內撥款 1.5 億美元支持加拿大先進的太空產業,並透過月球探勘加速器計畫 (LEAP) 加速新技術的發展。

- 此外, Ku波段天線重量輕,比其他波段更適合太空計劃。太空衛星天線擴大用於遙測、GPS(全球定位系統)、UHF(超高頻)和FTS(飛行終止系統)等應用。

- 據憂思科學家聯盟稱,截至 2022 年 4 月 30 日,美國共有 3,433 顆運行中的衛星繞地球運行。這是目前單一國家持有衛星數量最多的國家,僅次於中國的541顆衛星。此外,根據《喬納森的太空報告》,預計 2022 年將有 6,905 顆活躍衛星繞地球運行,比 2021 年增加 2,105 顆。預計如此龐大的衛星數量將為研究市場提供成長機會。

- 衛星天線會隨著時間的推移而劣化或錯位,導致訊號遺失、干擾和效能不佳等問題。需要定期維護和調整以確保高效率的訊號傳輸和接收。然而,維護衛星天線,特別是地球靜止軌道上的衛星天線,成本高昂,後勤挑戰大,可能會影響市場擴張。解決這些挑戰的方法是開發更耐用、更可靠的天線技術和加強維護程序。

- 疫情過後,多個行業都在投資各種策略發展,以獲得市場佔有率並滿足當前市場的需求。例如,2023 年 4 月,專門從事國防、國家安全和通訊解決方案的技術公司 Kratos Defense &Security Solutions, Inc. 宣布推出 OpenEdgeTM 2500 數位化儀,該數位化儀專為幫助衛星天線製造商數位化其產品而設計。當整合到天線中時,這種緊湊型數位化儀可以有效地將射頻 (RF) 訊號轉換為可用於現代軟體定義通訊網路的網際網路通訊協定(IP)資料流。

衛星天線市場趨勢

太空應用預計將佔據較大的市場佔有率

- 全球太空產業正在經歷顯著的成長和技術進步,導致全球對衛星天線的需求不斷增加。

- 衛星通訊服務需求的不斷成長是推動衛星天線需求的主要因素。隨著全球連通性的擴大,對天線的需求也日益成長,以促進衛星和地面站之間的通訊。

- 此外,小型化和降低成本的進步使得小型衛星(包括立方衛星和奈米衛星)越來越受歡迎。這些小型衛星通常需要更小、更緊湊的天線,這推動了對專門的小型化天線解決方案的需求。

- 包括 SpaceX 和 OneWeb 在內的多家開發商正在開發衛星星系,以在全球範圍內提供寬頻通訊。根據國際電信聯盟統計,上年度活躍的行動寬頻用戶數約為69億,而固定寬頻用戶數約14億。

- 包括印度在內的多個國家的政府已著手進行太空改革,鼓勵、支持和規範進入太空,並為新興企業和私人公司提供增加全球市場佔有率的機會,從而增加對衛星天線的需求。

- 因此,全球太空產業對衛星天線的需求增加是由衛星通訊服務的擴展、衛星技術的進步以及高頻寬應用的成長所推動的,並且預計在預測期內將繼續成長。

北美佔據主要市場佔有率

- 美國擴大使用衛星天線為傳統地面基礎設施有限或無法使用的偏遠和服務不足地區提供寬頻網路存取。衛星網路服務為農村地區的連結和保障提供了有效的解決方案。此外,對可靠的遠距通訊和廣播服務的需求不斷成長,推動了該國衛星天線的採用。

- 此外,在陸地上使用衛星天線的主要原因之一是為農村和偏遠地區提供寬頻網路連線。在許多農村地區,光纖電纜或傳統寬頻網路等地面基礎設施可能在經濟上不可行或從地理上難以部署,從而極大地推動了市場成長。

- 加拿大地廣人稀,傳統寬頻基礎設施的部署十分困難。衛星天線為偏遠和服務不足的地區提供高速網路存取提供了有效的解決方案,促進了該國衛星天線的發展。

- 加拿大在透過衛星影像進行地球觀測方面具有重要地位。此外,衛星天線通常安裝在住宅,特別是地面寬頻選擇有限的農村和偏遠地區。

- 重要的本地企業也在進行投資、與其他企業合併以及投資新計畫,以擴大消費群並更好地滿足各種用途的需求。因此,隨著夥伴關係關係、併購和投資的持續進行,預計預測期內衛星天線的採用率將大幅增加。

衛星天線產業概況

衛星天線市場競爭激烈,有許多大型參與者,其中幾個全球和區域參與者在爭奪關注。該市場對於新參與企業的進入門檻較高,影響了市場吸引力的機會。許多用戶選擇年度合約或租賃服務來降低成本。最近,越來越多的公司選擇提供更好頻寬的天線來適應各種應用。這導致衛星天線的需求增加。許多提供該產品的公司都是市場的主要參與者,例如Honeywell、哈里斯和三菱。創新提供了永續的競爭優勢。由於多家公司都將這個市場視為一個有利可圖的機會,預計企業集中度在預測期內將出現溫和成長。總體而言,競爭對手之間的敵意預計會很高。

2023 年 6 月,歐瑞康積層製造與空中巴士簽署了一份價值 380 萬歐元(418 萬美元)的衛星天線群積層製造合約。這些部件將用於一系列被送入軌道的通訊。作為新契約的一部分,歐瑞康 AM 將使用雷射粉末層熔合技術 3D 列印尺寸約為 400 x 400 x 400 毫米的鋁天線叢集。

2023 年 2 月,MDA 與阿根廷國家電信業者簽署了新契約,為 ARSAT-SG1 衛星提供Ka波段多波束天線,該衛星為全國以及玻利維亞、巴拉圭和智利提供高速網際網路和數位視訊和語音服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 產業影響評估

第5章 市場動態

- 市場促進因素

- 增加太空探勘計劃

- 小型衛星的採用率不斷提高

- 市場限制

- 解決訊號傳輸問題的維護

第6章 市場細分

- 按頻段

- C波段

- K/KU/KA 頻段

- 短L波段

- X波段

- VHF 和 UHF 頻段

- 其他頻段

- 依天線類型

- 指向平板天線

- 拋物面天線

- 喇叭天線

- 玻璃纖維增強塑膠天線

- 鐵模天線

- 其他天線類型

- 按應用

- 宇宙

- 土地

- 海上

- 飛機

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 世界其他地區(拉丁美洲及中東及非洲)

- 北美洲

第7章 競爭格局

- 公司簡介

- Honeywell International Inc.

- CPI International Inc.

- Kymeta Corporation

- Norsat International Inc.

- COBHAM LIMITED(AI Convoy(Luxembourg)Sa rl)

- L3harris Technologies Inc.

- Viasat Inc.

- Airbus DS Government Solutions Inc.(Airbus SE)

- Macdonald, Dettwiler and Associates Ltd(Maxar Technologies)

- Gilat Satellite Networks Ltd

第8章投資分析

第9章 市場機會與未來趨勢

The Satellite Antenna Market size is estimated at USD 4.79 billion in 2025, and is expected to reach USD 8.05 billion by 2030, at a CAGR of 10.94% during the forecast period (2025-2030).

As the demand for enhanced communication capabilities has grown significantly over the past few years in vital domains, including border security, marine interdiction, and mobile telecom, satellite antenna systems have emerged as essential solutions.

Key Highlights

- The demand for broadband communications continues to rise and is not necessarily location-specific. This demand includes the need for connection for users functioning on ships, planes, and vehicles (including first responders) that are both fixed and active. These three distinct platforms require constant connectivity along their routes, frequently passing through unserved sections of major metropolitan cities and less heavily populated regions.

- The growing number of space exploration missions, the proliferation of small satellites, rising investments, and expanding demand for satellite-assisted military systems are facilitating the expansion of the market studied. For instance, in March 2023, funding of USD 2.5 billion was announced as part of the federal budget to support Canadian leadership in space, including USD 150 million over five years for the Lunar Exploration Accelerator Program (LEAP) to support Canada's advanced space industry and help accelerate the development of new technologies.

- Furthermore, due to the lightweight profile of the Ku band antennas, their application in space-bound projects is significantly higher than other bands. The satellite antennas deployed in space are being increasingly used for applications in telemetry, GPS (global positioning system), UHF (ultra-high frequency), FTS (flight termination system), etc.

- According to the Union of Concerned Scientists, as of April 30, 2022, the United States had 3,433 operational artificial satellites circling the Earth. It is the number of satellites a single country has to date, with China accounting for only 541. Furthermore, according to Jonathan's Space Report, an estimated 6,905 active satellites circled the Earth in 2022, an increase of 2,105 active satellites from 2021. Such a huge number of satellites is anticipated to provide opportunities for the growth of the market studied.

- Satellite antennas can get degraded or out of alignment over time, which can cause problems, including signal loss, interference, or poor performance. Regular maintenance and adjustment are required to guarantee efficient signal transmission and reception. However, maintaining satellite antennas, particularly those in geostationary orbit, may be expensive and logistically challenging, affecting market expansion. The solution to these difficulties is creating more durable and dependable antenna technology and enhancing maintenance procedures.

- Post-pandemic, several industries are investing in various strategic developments to gain market share and keep them updated with the current requirements in the market. For instance, in April 2023, the launch of the OpenEdgeTM 2500 digitizer, designed expressly to assist satellite antenna manufacturers in digitally enabling their products, was announced by Kratos Defence & Security Solutions, Inc., a technology firm specializing in defense, national security, and communications solutions. When incorporated into any antenna, the compact digitizer efficiently transforms radio frequency (RF) signals into Internet protocol (IP) data streams that may be used in contemporary software-defined communications networks.

Satellite Antenna Market Trends

Space Application is Expected to Hold Significant Market Share

- The global space industry has been experiencing significant growth and technological advancements, contributing to the increasing demand for satellite antennas worldwide.

- The growing demand for satellite-based communication services is a primary factor driving demand for satellite antennas in the market. With the expansion of global connectivity, there is an increasing need for antennas to facilitate communication between satellites and ground stations.

- In addition, miniaturization and cost reduction advancements are leading to the proliferation of small satellites, including CubeSats and nanosatellites. These small satellites often require smaller, more compact antennas, increasing demand for specialized miniaturized antenna solutions.

- Several players, such as SpaceX, OneWeb, and others, are developing plans for satellite constellations to provide global broadband coverage. ITU said there were around 1.4 billion fixed broadband subscriptions in the previous year, whereas active mobile broadband subscriptions were about 6.9 billion.

- The governments of several countries, such as India, have started space sector reforms to encourage, support, regulate, and provide startups and private companies an opportunity to engage in space operations to grow their market share globally, resulting in increased demand for satellite antennas.

- Thus, increasing demand for satellite antennas in the global space industry is driven by the expansion of satellite communication services, advancements in satellite technology, and growth in high bandwidth applications and is projected to continue during the forecast period.

North America to Hold Significant Market Share

- Satellite antennas are increasingly used in the United States to provide broadband internet access in remote and underserved areas where traditional terrestrial infrastructure is limited or unavailable. Satellite internet services offer a viable solution for bridging and ensuring connectivity in rural regions. Moreover, a surge in the need for reliable long-distance communication and broadcasting services drives the adoption of satellite antennas within the country.

- Moreover, one of the prime reasons for using satellite antennas on land is to provide broadband internet connectivity to rural and remote areas. In many rural regions, terrestrial infrastructure such as fiber optic cables or traditional broadband networks may not be economically feasible or geographically challenging to deploy, driving the market's growth significantly.

- Canada is known for its vast and sparsely populated regions, making it challenging to deploy traditional broadband infrastructure. Satellite antennas provide an effective solution for delivering high-speed internet access to remote and underserved areas, contributing to the growth of satellite antennas in the country.

- Canada has a strong presence in Earth observation through satellite imagery. Moreover, satellite antennas are often installed in residential areas, particularly in rural and remote regions with limited terrestrial broadband options.

- Significant regional companies are also investing, merging with other businesses, and investing in new projects to increase their consumer base and better meet their demands across various applications. Hence, with ongoing partnerships and collaborations, mergers and acquisitions, and investments, the adoption of satellite antennas is expected to increase significantly during the forecast period.

Satellite Antenna Industry Overview

The Satellite Antenna market comprises several global and regional players vying for attention in a highly competitive market space due to the presence of many large players. The market poses high barriers to entry for new players, impacting the opportunities to gain traction. Many users opt for annual contracts or lease-based services to cut their costs. Of late, companies have also been opting for antennas that provide better frequency bands for various applications. This has led to an increase in the demand for satellite antennas. Most companies providing the product are major players in the market, such as Honeywell Inc., Harris, Mitsubishi, etc. Innovation brings about a sustainable and competitive advantage. The firm concentration ratio is expected to record moderate growth during the forecast period because several companies consider this market a lucrative opportunity. Overall, the competitive rivalry is expected to be high.

In June 2023, Oerlikon AM and Airbus signed a EUR 3.8 million (USD 4.18 million) contract for the additive manufacture of satellite antenna clusters. These components would be used in a series of communication satellites put into orbit. As part of this new contract, Oerlikon AM would 3D print aluminum antenna clusters that measure approximately 400 x 400 x 400 mm using laser powder bed fusion technology.

In February 2023, MDA secured a new contract with Argentina's National Telecommunications Company to supply Ka-band multi-beam antennas for its ARSAT-SG1 satellite which provides high-speed internet and digital video and voice services across the country and to Bolivia, Paraguay, and Chile.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Space Exploration Projects

- 5.1.2 Increasing Adoption of Small Satellites

- 5.2 Market Restraints

- 5.2.1 Maintenance for Addressing Poor Transmission of Signals

6 MARKET SEGMENTATION

- 6.1 By Frequency Band

- 6.1.1 C Band

- 6.1.2 K/KU/KA Band

- 6.1.3 S and L Band

- 6.1.4 X Band

- 6.1.5 VHF and UHF Band

- 6.1.6 Other Frequency Bands

- 6.2 By Antenna Type

- 6.2.1 Flat Panel Antenna

- 6.2.2 Parabolic Reflector Antenna

- 6.2.3 Horn Antenna

- 6.2.4 Fiberglass Reinforced Plastic Antenna

- 6.2.5 Iron Antenna with Mold Stamping

- 6.2.6 Other Antenna Types

- 6.3 By Application

- 6.3.1 Space

- 6.3.2 Land

- 6.3.3 Maritime

- 6.3.4 Airborne

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 South Korea

- 6.4.3.5 Rest of Asia-Pacific

- 6.4.4 Rest of the World (Latin America and Middle East and Africa)

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 CPI International Inc.

- 7.1.3 Kymeta Corporation

- 7.1.4 Norsat International Inc.

- 7.1.5 COBHAM LIMITED (AI Convoy (Luxembourg) S.a r.l.)

- 7.1.6 L3harris Technologies Inc.

- 7.1.7 Viasat Inc.

- 7.1.8 Airbus DS Government Solutions Inc. (Airbus SE)

- 7.1.9 Macdonald, Dettwiler and Associates Ltd (Maxar Technologies)

- 7.1.10 Gilat Satellite Networks Ltd