|

市場調查報告書

商品編碼

1683217

半導體雷射器市場 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Semiconductor Laser - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

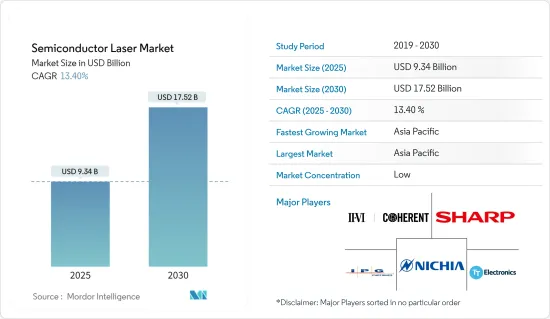

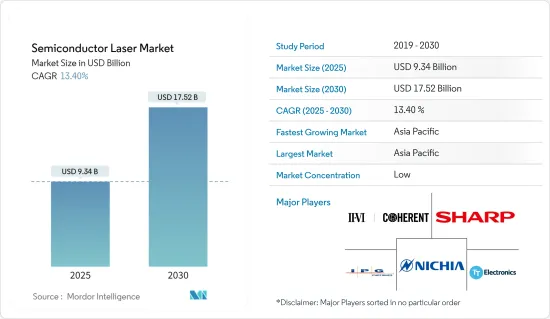

預計到 2025 年半導體雷射器市場規模將達到 93.4 億美元,到 2030 年將達到 175.2 億美元,預測期內(2025-2030 年)的複合年成長率為 13.4%。

關鍵亮點

- 半導體雷射器,也稱為雷射二極體或二極體雷射器,是一種使用半導體材料作為活性介質的雷射。它是半導體 pn 接面二極體大分類的子集。半導體雷射通常很小,大約只有一粒鹽的大小。半導體雷射是固體雷射器,在導帶中載子密度較高的條件下,透過帶間躍遷中的受激發射實現光放大。

- 半導體雷射的運行原理涉及將電荷載子(電子和電洞)注入半導體材料內形成的 p-n 接面。當在雷射二極體上施加正向電偏壓時,電荷載子從 p-n 接面的另一側注入耗盡區。電荷載流子的注入導致了粒子數反轉,其中更多的電子佔據較高的能階而不是較低的能階。當導帶中的電子與價能帶中的電洞重新結合時,透過受激發射就會發射出光子,從而產生雷射。

- 半導體雷射具有多種優點,使其廣泛應用於各個行業。半導體雷射比常見的照明技術消耗更少的功率,並且更節能。使用壽命長,適合長期使用。二極體雷射體積小、重量輕,易於操作並可整合到各種各樣的系統中。半導體雷射價格相對低廉,因此日常使用具有較高的成本效益。而且,雖然設計在小範圍內看起來很複雜,但操作起來卻很容易。

- 半導體雷射應用需求不斷成長的主要促進因素之一是對資料傳輸的需求不斷增加。數位化和物聯網 (IoT) 正在產生更多的資料,這反過來又要求更快的資料傳輸。這將為專門生產光纖通訊產品的元件製造商創造巨大的機會。

- 光纖雷射是固體雷射器,透過受雷射發射產生高強度雷射光束。雷射利用光纖作為增益介質或雷射放大源。光纖雷射的核心由摻雜鉺、釹或鐿等稀土元素的特殊設計的光纖組成。這些摻雜劑決定了雷射器運作所需的能量水平。光纖被包層包圍,包層的作用是限制和引導纖芯內的光。

- 半導體雷射器使用的關鍵因素之一是可靠性。為了獲得穩定的輸出,需要恆定的溫度和恆定的電流。缺乏對電路的控制可能會導致產品故障並破壞使用該產品的設備。

半導體雷射器市場趨勢

預計通訊領域將佔據主要市場佔有率

- 半導體雷射在現代通訊系統中發揮著至關重要的作用,能夠實現遠距、高速、可靠的資料傳輸。在全球半導體雷射器市場分析中,按應用細分,通訊行業佔據了全球市場的大部分佔有率。全球半導體雷射產業的發展主要得益於其在光纖通訊的廣泛應用。雷射二極體已成為寬頻通訊網路中的關鍵組件。

- 半導體雷射器具有體積小(長度0.2~1mm)、直接調變可達10~40GHz、功耗低、單波長光、高功率可達1W等多種優異性能,成為光纖通訊系統中標準的光纖傳輸。

- 半導體雷射是一種利用半導體作為介質來放大訊號的固體雷射。如今,基於光纖的通訊網路最受歡迎,每個光鏈路中都內建有半導體雷射。半導體雷射已成為快速商業化的通訊和資料通訊產業的基礎支柱。

- 垂直共振腔面射型雷射(VCSEL) 是資料中心和高效能運算 (HPC) 中基於多模光纖 (MMF) 的光鏈路的主要光源。通訊系統的最新設計旨在使 VCSE 半導體雷射器更加節能,並在室溫下維持高調變位元率,而無需在高溫下調整操作參數。

- 根據 IOP Conf 發表的一篇論文,量子點等奈米結構半導體雷射在通訊領域,尤其是光纖通訊發揮關鍵作用,而這得益於先進技術和高光增益的需求。系列:材料科學與工程。

- 此外,5G和6G通訊網路將促進不同端點以高速、低延遲通訊的方式互聯互通。這些關鍵應用的通用要求是能夠以超快的速度執行複雜任務的雷射光源,實現寬頻、安全和節能的通訊。各國正採取各種舉措,加速部署5G和6G通訊。根據 OpenSignal 的數據顯示,波多黎各在 2023 年 5G 可用性排名中名列前茅,5G 行動裝置用戶在調查期間 48.4% 的時間能夠連接到 5G 服務。緊隨波多黎各之後的是韓國和科威特,5G可用性分別為42.9%和39.4%。

亞太地區:可望大幅成長

- 日本、中國、韓國和印度等國家的通訊業的快速成長預計將推動亞太雷射市場的發展。通訊網路營運商正在為所有通訊應用部署光纖,包括城際、城內、FTTx 和行動蜂窩系統。除了企業外,中國政府部門也在部署光纖系統來支援電網、高速公路、鐵路、管道、機場、資料中心和許多其他應用,這推動研究市場的成長。

- 人工智慧、5G、物聯網、虛擬實境等新技術的快速發展和商業性應用,帶動資料處理和資訊互動的需求日益增加,有望加速本地區資料中心的建設,帶來產業爆發式成長。

- 隨著網路流量呈指數級成長,降低資料通訊中的能耗對於永續性至關重要。半導體雷射體積小、每位元消費量低,在實現短距離光互連的能源效率方面發揮關鍵作用。

- 此外,該地區電子工業的興起和消費設備產量的增加也加速了對半導體雷射的需求。此外,中國、台灣、韓國、日本等國家是蘋果、一加、Vivo、三星等智慧型手機製造商的所在地,這些地區的半導體製造商製造半導體雷射以滿足這些製造商的需求。

- 此外,亞太地區政府的有利舉措和投資正在刺激該地區的製造業成長和工業化,從而促進市場成長。 2022年2月,印度政府發布了積層製造(或3D列印)國家戰略,鼓勵學術界、政府和工業界之間的合作,將印度打造為3D列印設計、開發和部署的全球中心。

- 中國是全球最大的半導體生產國之一,正在穩步投資其半導體產業,目標是到 2035 年實現市場完全自給自足。同樣,2021 年 11 月,東京批准了一項 7,740 億日圓(49.3 億美元)的半導體投資計劃,其中包括為台灣半導體製造核准(TSMC) 在熊本縣的新代工廠提供 4000 億日元(25.5 億美元)的補貼。這些投資為市場成長提供了積極的前景。

- 由於人工智慧、機器學習、擴增實境和虛擬實境等雲端應用的快速普及,資料中心流量正在快速成長,推動著創新研究市場的發展。據 Cloud Scene 稱,資料中心的主要市場包括中國、日本、澳洲、印度和新加坡。據Clouscene稱,截至2023年9月,中國擁有448個資料中心,比亞太地區任何其他國家或地區都多。截至當月,中國資料中心數量排名世界第四。

半導體雷射器市場概況

半導體雷射器市場高度細分,主要參與者包括相干公司、夏普公司、日亞化學公司、IPG Photonics 公司和 TT Electronics。市場參與企業正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2023年11月-ROHM開發高功率雷射二極體RLD90QZW8。非常適合需要距離測量和空間識別的工業設備和消費應用。

- 2023 年 9 月 - IPG Photonics Corporation 在密西根州諾維舉行的電池展上宣布推出具有最高單模芯功率的新型雙束雷射。此雷射器使電池焊接比以往更快、更高效,以更低的核心功率提供兩倍的無飛濺焊接速度。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 新冠肺炎疫情及其他宏觀經濟因素對市場的影響

- 技術簡介

第5章 市場動態

- 市場促進因素

- 半導體雷射應用普及

- 光纖雷射器市場成長

- 與其他光源相比,半導體雷射更受青睞

- 市場問題

- 可靠性和測試困難

第6章 市場細分

- 按波長

- 紅外線雷射

- 紅色雷射

- 綠色雷射

- 藍光雷射

- 紫外線雷射

- 按類型

- EEL(邊射型雷射)

- VCSEL(垂直共振腔面射型雷射)

- 量子級聯雷射

- 光纖雷射

- 其他

- 按應用

- 用於通訊

- 醫療

- 軍事和國防

- 工業的

- 測量感測器

- 車

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- Vendor Positioning Analysis

- 公司簡介

- Coherent Inc

- Sharp Corporation

- Nichia Corporation

- IPG Photonics Corporation

- TT Electronics

- Sumitomo Electric Industries, Ltd.

- Sheaumann Laser, Inc.

- Newport Corporation(mks Instruments, Inc.)

- Panasonic Industry Co., Ltd

- Rohm Company Limited

- Hamamatsu Photonics KK

- Jenoptik Laser GMBH

- TRUmpF Group

- ams OSRAM AG

- Lumentum Holdings Inc.

第8章投資分析

第9章:市場的未來

The Semiconductor Laser Market size is estimated at USD 9.34 billion in 2025, and is expected to reach USD 17.52 billion by 2030, at a CAGR of 13.4% during the forecast period (2025-2030).

Key Highlights

- A semiconductor laser, also known as a laser diode and diode laser, is a type of laser that utilizes a semiconductor material as its active medium. It is a subset of the larger classification of semiconductor pn junction diodes. Semiconductor lasers are typically small, often about the size of a grain of salt. They are solid-state lasers based on semiconductor gain media, where optical amplification is achieved through stimulated emission at an interband transition under conditions of high carrier density in the conduction band.

- The working principle of a semiconductor laser involves the injection of charge carriers (electrons and holes) into a pn junction formed within the semiconductor material. When a forward electrical bias is applied across the laser diode, charge carriers are injected from opposite sides of the pn junction into the depletion region. This injection of charge carriers creates a population inversion, where more electrons occupy the higher energy levels than the lower energy levels. When the electrons in the conduction band recombine with holes in the valence band, they emit photons through stimulated emission, resulting in the generation of laser light.

- Semiconductor lasers offer several advantages that make them widely used in various industries. Semiconductor lasers consume less power compared to typical lighting techniques, making them more energy-efficient. They have a long operational life, making them suitable for long-term use. Semiconductor lasers are small and lightweight, making them easy to handle and integrate into different systems. Semiconductor lasers are relatively inexpensive, making them cost-effective for everyday use. They are also simple to operate, even though their design may seem complex on a small scale.

- One of the key drivers of the rise in demand for semiconductor laser applications is the rising demand for data transfer speed. As more data is created through digitalization and the internet of Things (IoT), there is a need for faster data transfers. This presents a sizeable opportunity for the component for the component manufacturers that specialize in optical communication products.

- A fiber laser is a solid-state laser that generates a high-intensity laser beam through stimulated emission. The laser utilizes an optical fiber as the gain medium or the source of laser light amplification. The core of a fiber laser consists of a specially designed optical fiber, often doped with rare-earth elements such as erbium, neodymium, or ytterbium. These dopants provide the necessary energy levels for the laser to operate. The fiber is surrounded by a cladding layer that helps confine and guide the light within the core.

- One of the crucial factors for the usage of the semiconductor laser is reliability. The products require constant temperature and constant current to ensure stable output power. Any lack of control of the electric circuit can cause the product to malfunction and hamper the device in which it is used.

Semiconductor Laser Market Trends

Communication Segment is Expected to Hold Significant Market Share

- Semiconductor lasers play a crucial role in modern communication systems, enabling high-speed data transmission over long distances with reliable performance. The communication industry dominates the global semiconductor laser market analysis categorized by applications, accounting for most of the global market. The global semiconductor laser industry has been primarily driven by the high applicability rate in optical communication. Laser diodes have evolved into an important component of broadband communication networks.

- Semiconductor lasers work as standard light transmitters in optical-fiber communication systems, owing to their small size of 0.2-1 mm length as well as their diverse excellent performances such as the capability of direct modulation up to 10-40 GHz, low-power consumption, single wavelength light, and high output power up to 1 W.

- Semiconductor lasers are a specific type of solid-state laser utilizing semiconductors as an active medium to amplify signals. Recently, fiber optics-based telecommunication networks have been the most preferred choice, with every optical link equipped with semiconductor lasers inside. Semiconductor lasers have served as the backbone for rapidly commercializing telecommunications and Datacom industries.

- Vertical-cavity surface-emitting Lasers (VCSELs) are the primary optical sources for optical links based on multimode fiber (MMF) in data centers and high-performance computers (HPCs). Recent designs in telecommunication systems aim to enhance VCSE semiconductor lasers to be more energy-efficient and capable of sustaining high modulation bit rates at room temperature without requiring adjustments to the operating parameters, even at elevated temperatures.

- Nanostructured Semiconductor lasers such as quantum dots have been highly preferred for optical telecommunication devices in recent times, as per the article published in IOP Conf. Series: Materials Science and Engineering, Quantum dot lasers play an important role in the telecommunication sector, especially in optical communication, driven by the demand for advanced technology and high optical gain.

- Moreover, in 5G and 6G telecommunication networks, swift and low-latency communications facilitate the interconnection of diverse endpoints. A common requirement in these critical applications is a laser source to execute intricate tasks at ultra-fast speeds, enabling broadband, secure, and energy-efficient communications. Countries are taking various initiatives to boost the deployment of 5G and 6G communication. According to OpenSignal, Puerto Rico led a 2023 ranking of 5G availability, with users of 5G handsets able to spend 48.4 percent of the surveyed period connected to a 5G service. Puerto Rico was followed by South Korea and Kuwait, with 5G availabilities of 42.9 and 39.4 percent, respectively.

Asia-Pacific Expected to Witness Major Growth

- The exponential growth in the communication industry in countries such as Japan, China, South Korea, and India is anticipated to drive the laser market in the Asia-Pacific region. Telecom network operators have installed fiber for all telecom applications, including inter-city, intra-city, FTTx, and mobile cellular systems. Apart from enterprises, the Chinese government authorities also install fiber systems to support the electric power grid, highways, railways, pipelines, airports, data centers, and many other applications, which drive the growth of the studied market.

- With the rapid development of AI, 5G, the Internet of Things, virtual reality, and the commercial application of these new technologies, the demand for data processing and information interaction is growing, which is expected to speed up the construction of data centers in the region and lead to the explosive growth of the industry.

- As internet traffic grows exponentially, reducing the energy consumption in data communications is crucial for sustainability. With their smaller size and lower energy consumption per bit, semiconductor lasers play a significant role in achieving energy efficiency in short-distance optical interconnects.

- Moreover, the flourishing electronics industry in this region and the increased production of consumer devices are accelerating the demand for semiconductor lasers as they are used for several manufacturing processes. Additionally, countries like China, Taiwan, Korea, and Japan are home to smartphone manufacturers such as Apple, Oneplus, Vivo, and Samsung, which makes semiconductor manufacturers around these regions produce semiconductor lasers that cater to the demands of these manufacturers.

- Also, favorable government initiatives and investments in Asia-Pacific promote the growth of the manufacturing sector and industrialization in the region, which drives the market's growth. In February 2022, the government of India released a national strategy for additive manufacturing (or 3D printing) to encourage collaboration between academia, government, and industry to make India a global hub for the design, development, and deployment of 3D printing.

- China is one of the largest producers of semiconductors in the world, and the country is making steady investments in the industry as it has set a target to become fully self-sufficient in the semiconductor market by 2035. Similarly, Tokyo approved a JPY 774 billion (USD 4.93 billion) package for semiconductor investments in November 2021, including a JPY 400 billion (USD 2.55 billion) subsidy for Taiwan Semiconductor Manufacturing Company's (TSMC) new foundry in Kumamoto prefecture. Such investments are creating a positive outlook for market growth.

- Datacenter traffic is rapidly increasing, owing to the rapid adoption of cloud applications, such as artificial intelligence, machine learning, augmented reality, and virtual reality, driving the market studied with innovations. According to Cloud Scene, some of the top markets in data centers include China, Japan, Australia, India, and Singapore. According to Clouscene, as of September 2023, there were 448 data centers in China, the most of any country or territory in the Asia-Pacific region. China had the fourth-highest number of data centers worldwide as of that month.

Semiconductor Laser Market Overview

The Semiconductor Laser market is highly fragmented, with the presence of major players like Coherent Corporation, Sharp Corporation, Nichia Corporation, IPG Photonics Corporation, and TT Electronics. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- November 2023 - ROHM developed a high-power laser diode, the RLD90QZW8. It is ideal for industrial equipment and consumer applications requiring distance measurement and spatial recognition.

- September 2023 - IPG Photonics Corporation announced the launch of a New Dual-Beam Laser with the Highest Single-Mode Core Power at The Battery Show in Novi, Michigan. It offers unprecedented speed and productivity improvements for battery welding with spatter-free welding speeds up to 2X faster than possible with lower core powers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 and Other Macroeconomic Factors on the Market

- 4.5 Tech Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Proliferation of Semiconductor Laser Applications

- 5.1.2 Growth in the Fiber Laser Market

- 5.1.3 Preference for Semiconductor Lasers Over Other Light Sources

- 5.2 Market Challenges

- 5.2.1 Difficulties Regarding Reliability and Testing

6 MARKET SEGMENTATION

- 6.1 By Wavelength

- 6.1.1 Infrared Lasers

- 6.1.2 Red Lasers

- 6.1.3 Green Lasers

- 6.1.4 Blue lasers

- 6.1.5 Ultraviolet Lasers

- 6.2 By Type

- 6.2.1 EEL (Edge-emitting Laser)

- 6.2.2 VCSEL (Vertical-cavity Surface-emitting Laser)

- 6.2.3 Quantum Cascade Laser

- 6.2.4 Fiber Laser

- 6.2.5 Other Types

- 6.3 By Application

- 6.3.1 Communication

- 6.3.2 Medical

- 6.3.3 Military and Defense

- 6.3.4 Industrial

- 6.3.5 Instrumentation and Sensor

- 6.3.6 Automotive

- 6.3.7 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Positioning Analysis

- 7.2 Company Profiles

- 7.2.1 Coherent Inc

- 7.2.2 Sharp Corporation

- 7.2.3 Nichia Corporation

- 7.2.4 IPG Photonics Corporation

- 7.2.5 TT Electronics

- 7.2.6 Sumitomo Electric Industries, Ltd.

- 7.2.7 Sheaumann Laser, Inc.

- 7.2.8 Newport Corporation (mks Instruments, Inc.)

- 7.2.9 Panasonic Industry Co., Ltd

- 7.2.10 Rohm Company Limited

- 7.2.11 Hamamatsu Photonics K.K

- 7.2.12 Jenoptik Laser GMBH

- 7.2.13 TRUmpF Group

- 7.2.14 ams OSRAM AG

- 7.2.15 Lumentum Holdings Inc.