|

市場調查報告書

商品編碼

1683223

消費者生物辨識市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Consumer Biometrics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

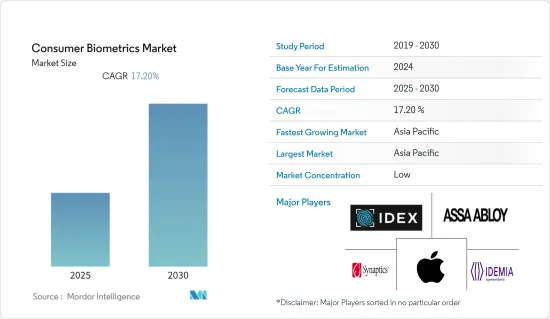

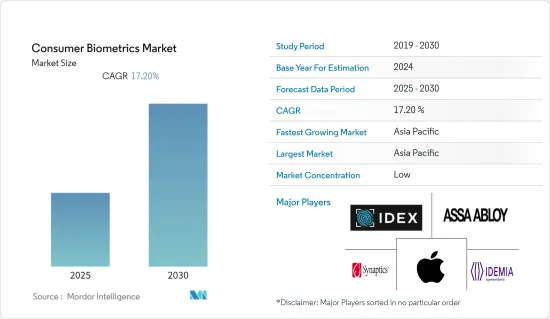

預測期內,消費者生物辨識市場預計複合年成長率為 17.2%

關鍵亮點

- 連接性和數位化的增強增加了客戶與設備和服務的互動,並對驗證其存取權限提出了更高的要求。人們對複雜生物辨識安全需求的認知不斷提高,生物辨識技術在家用電子電器產品中的應用日益廣泛,以提升客戶體驗,以及技術進步預計將在預測期內推動市場成長。

- 網際網路的快速普及和行動裝置的增加正在推動行動付款的成長。預計未來幾年這種付款方式將顯著成長。

- 例如,根據GSMA的預測,到2025年,北美的智慧型手機用戶數量將達到3.28億。此外,到2025年,該地區的行動用戶(86%)和網路普及率(80%)的成長率可能位居全球第二。此外,根據 GSMA 的預測,到 2025 年,歐洲的網路普及率(82%)和智慧型手機普及率(88%)將位居世界最高。

- 配備指紋感應器的智慧型手機的普及率不斷提高是推動指紋感應器成長的重要因素之一。根據瑞士信貸報告顯示,2018年全球配備指紋感應器的智慧型手機出貨量達10.82億台。

消費者生物辨識市場趨勢

指紋認證模組佔大部分佔有率

- 用於指紋生物識別的設備為使用者提供了嵌入式生物識別的更大便利性、可用性和可及性。由於對存取控制的生物識別技術的需求不斷增加、對更好的安全性的需求以及消費者對具有個性化體驗的新技術的偏好發生變化,預計在預測期內對消費者身份驗證的指紋感測模組的需求將大幅成長。

- 其中,智慧型手機在過去五年中見證了該技術的成長趨勢。該技術用於促進線上交易、身份驗證和許多其他服務。

- 根據 Verizium 對 1,000 名美國成年人進行的一項調查,了解消費者對生物識別的態度,指紋是行動電話上最受歡迎的生物識別方式,佔 63%。其他形式的識別排名明顯較低,包括臉部辨識(14%)、傳統密碼和密碼(8%)和語音辨識(2%)。

- 受訪的市場見證了智慧型手機的各種技術突破,從獨立指紋掃描器到顯示器指紋掃描器。中國智慧型手機品牌 Vivo 率先實現顯示器指紋辨識。從配備 TouchID電容式的 iPhone 5S 發布開始,許多下一代智慧型手機將採用多種生物識別選項,用戶可以根據不同目的進行設定。

亞太地區是成長最快的市場

- 亞太地區是所有地區中人口最多的地區。在城市人口不斷成長和購買力不斷增強的推動下,亞太地區預計將成為消費者生物辨識技術最大且成長最快的市場之一。

- 華為、蘋果、三星、小米和聯想等主要智慧型手機公司都在中國設有製造地。隨著智慧型手機銷量持續成長,預計該國對智慧型手機中嵌入的指紋感應器的需求將會成長。

- 為了尋求市場成長機會,該地區的公司正在生產生物識別感測器。例如,2019 年 12 月,中國感測器製造商匯頂科技 (Goodix) 將其最新的超薄光學顯示器指紋感應器整合到 Oneplus 7T pro 5G Mclaren 中,推出了該感應器。

- 該地區的汽車公司正在積極投資將消費者生物識別解決方案整合到即將推出的汽車中。例如,小鵬汽車已推出內建車把指紋感知器的P7車型。

消費者生物辨識產業概況

消費者生物辨識技術市場的供應商正在採取積極的定價策略來增加市場競爭。許多公司透過推出新產品和解決方案以及進行策略併購來擴大其市場佔有率。例如,2019 年 6 月,Assa Abloy 收購了英國大型護照製造商 De La Rue 的國際身分證解決方案業務。 De La Rue 的國際身分識別解決方案業務將成為該公司的策略性技術補充。

- 2020 年 2 月 - 匯頂科技開發創新的指紋認證解決方案,為領先的 5G 旗艦設備提供支持,並在華為 Mate Xs 和 Realme X50 Pro 5G 上實現雙重商業化。這些創新提高了公司的定位。

- 2020 年 1 月 - Next Biometrics Group SA 在印度訂單UIDAI 和 STQC 認證指紋生物辨識讀取器訂單,價值 75 萬美元。客戶提供20%預付款,第一位客戶正在運送途中。該訂單眼映了對生物識別解決方案日益成長的需求,主要與印度政府的 Aadhaar 計劃有關,並繼續為 NEXT 提供擴大其在不斷成長的印度市場的佔有率的機會。

- 2019 年 11 月 - Synaptics Inc. 宣布進軍汽車領域,推出汽車產業的指紋辨識生物辨識技術。該公司計劃在2020年上半年將這些解決方案推廣到全球市場。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 採用市場促進因素與限制因素

- 市場促進因素

- 擴大生物辨識技術的應用

- 生物辨識技術進步

- 市場限制

- 資料安全和隱私問題

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

第5章 市場區隔

- 透過感測模組

- 指紋認證

- 臉部辨識

- 眼睛/虹膜辨識

- 按最終用戶

- 車

- 智慧型手機/平板電腦

- 個人電腦/筆記型電腦

- 穿戴式裝置

- 物聯網設備

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- Apple Inc.

- Shenzhen Goodix Technology Co. Ltd

- IDEX Biometrics ASA

- Infineon Technologies

- Princeton Identity

- Egis Technologies Inc.

- Qualcomm Incorporated

- STMicroelectronics NV

- ON Semiconductor

- Assa Abloy AB

- Synaptics Inc.

- NEXT Biometrics Group ASA

- LG Innotek Co. Ltd

- Knowles Electronics LLC

- Omnivision Technologies

- Precise Biometrics AB

- Idemia France SAS

第7章投資分析

第8章 市場機會與未來趨勢

The Consumer Biometrics Market is expected to register a CAGR of 17.2% during the forecast period.

Key Highlights

- The increasing connectivity and digitization have increased customer interactions with devices and services, which is further demanding identity authentication for access. The increasing awareness of the need for sophisticated biometric security, widening the scope of applications of biometrics technology in consumer electronics, to improve customer experiences, and technological advancements are expected to drive the growth of the market over the forecast period.

- The rapid proliferation of the internet and the growth of mobile devices has led to increased payments through mobile. This mode of payment is anticipated to experience significant growth over the next few years.

- For instance, according to GSMA, the number of smartphone subscribers in North America is expected to reach 328 million by 2025. Moreover, by 2025, the region is likely to witness an increase in the penetration rates of mobile subscribers (86%) and the internet (80%), the second-highest in the world. Additionally, according to GSMA, by 2025, Europe is estimated to have the highest rate of penetration of the internet (82%) and smartphones (88%).

- The increasing penetration of smartphones, which are equipped with fingerprint sensors, is among the prominent driver for the growth of fingerprint sensors. According to the Credit Suisse report, in 2018, the shipment of smartphones with fingerprint sensors worldwide stood at 1,082 million units.

Consumer Biometrics Market Trends

Fingerprint Sensing Modules to Hold the Major Share

- Devices used for fingerprint biometrics provide the users with increased convenience, availability, and reachability of embedded biometrics. The demand for fingerprint sensing modules for consumer authentication is expected to witness significant growth over the forecast period on account of the increasing demand for biometric technology for access management, need for better security, and change in consumer preference for new technologies with a personalized experience.

- Smartphones, in that row, have witnessed an increasingly growing trend in this technology over the past five years. This technology has been leveraged to facilitate online transactions, authentication, and many other services.

- A survey conducted on 1,000 US adults by Veridium to understand biometric consumer sentiment indicated that their most preferred form of biometric identification on their phones is the fingerprint, at 63%. Other forms of identification are ranked way below, such as facial recognition (14%), traditional passwords and PINs (8%), and voice recognition (2%).

- The market studied has seen various technological developments in smartphones from a separate fingerprint scanner to an in-display fingerprint scanner. Vivo, a Chinese Smartphone brand, was the first to implement in-display fingerprint. Starting with the launch of the iPhone 5S, which had a TouchID capacitive technology, many other next-generation smartphones have incorporated multiple biometric options that users can set for different purposes.

Asia-Pacific to be the Largest and Fastest Growing Market

- Asia-Pacific has the largest population of all the regions. With an increase in the urban population and increased purchasing power, Asia-Pacific is expected to be one of the largest and fastest growing markets for consumer biometrics.

- Major smartphone companies, including Huawei, Apple, Samsung, Xiaomi, and Lenovo has its manufacturing facilities in China. With the continuous increase in smartphone sales, the demand for fingerprint sensors to be embedded into smartphones is expected to increase in the country.

- Seeking the growing opportunities in the market, the companies in the region are manufacturing biometric sensors. For instance, in December 2019, Chinese sensor manufacturer Goodix introduced its latest ultra-thin optical in-display fingerprint sensor by integrating it in Oneplus 7T pro 5G Mclaren.

- Automotive companies in the region are actively investing in integrating consumer biometric solutions in their upcoming vehicles. For instance, Xiaopeng Motors has introduced its P7 model, which has an embedded fingerprint sensor in the handlebar.

Consumer Biometrics Industry Overview

The providers of consumer biometrics market are adopting an aggressive pricing strategy to gain a competitive edge in the market. Many companies are increasing their market presence by introducing new products or solutions or by entering into strategic mergers and acquisitions. For Instance, in June 2019, Assa Abloy signed acquired the international identity solutions business of De La Rue, a leading passport manufacturer based in the United Kingdom. De La Rues International Identity Solutions business is a strategic technological addition to the company.

- February 2020 - Goodix has developed some innovative fingerprint solutions, which will power up advanced 5G flagship experiences with dual commercialization, which are Huawei Mate Xs, and Realme X50 Pro 5G. These innovations will result in better positioning of the company.

- January 2020 -Next Biometrics Group SA received an order for UIDAI and STQC certified fingerprint biometric readers in India, with a value of USD 750,000. The customer provided a 20% upfront payment, and the first readers are in transit. The purchase order reflects the increased demand for biometric solutions, primarily those related to the Indian Government's Aadhaar program, which continues to provide NEXT with opportunities to expand its share in the growing Indian market.

- November 2019 - Synaptics Inc. announced its expansion into the automotive segment, with the launch of its fingerprint biometrics for the automotive industry. The company is expected to roll out these solutions to the global market in the first half of 2020.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Widening Applications of Biometrics

- 4.3.2 Technological Advancements in Biometrics

- 4.4 Market Restraints

- 4.4.1 Data Security and Privacy Concerns

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Industry Value Chain Analysis

5 MARKET SEGMENTATION

- 5.1 By Sensing Module

- 5.1.1 Fingerprint

- 5.1.2 Face Recognition

- 5.1.3 Eye/Iris Recognition

- 5.2 By End Users

- 5.2.1 Automotive

- 5.2.2 Smartphone/Tablet

- 5.2.3 Pc/Laptop

- 5.2.4 Wearables

- 5.2.5 IoT Devices

- 5.2.6 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Apple Inc.

- 6.1.2 Shenzhen Goodix Technology Co. Ltd

- 6.1.3 IDEX Biometrics ASA

- 6.1.4 Infineon Technologies

- 6.1.5 Princeton Identity

- 6.1.6 Egis Technologies Inc.

- 6.1.7 Qualcomm Incorporated

- 6.1.8 STMicroelectronics NV

- 6.1.9 ON Semiconductor

- 6.1.10 Assa Abloy AB

- 6.1.11 Synaptics Inc.

- 6.1.12 NEXT Biometrics Group ASA

- 6.1.13 LG Innotek Co. Ltd

- 6.1.14 Knowles Electronics LLC

- 6.1.15 Omnivision Technologies

- 6.1.16 Precise Biometrics AB

- 6.1.17 Idemia France SAS